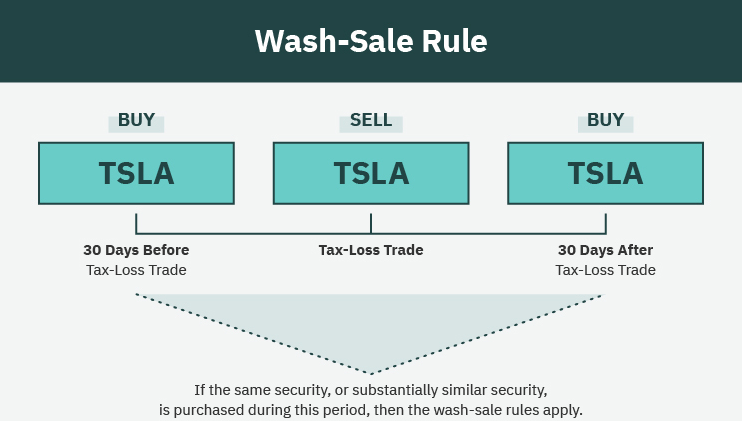

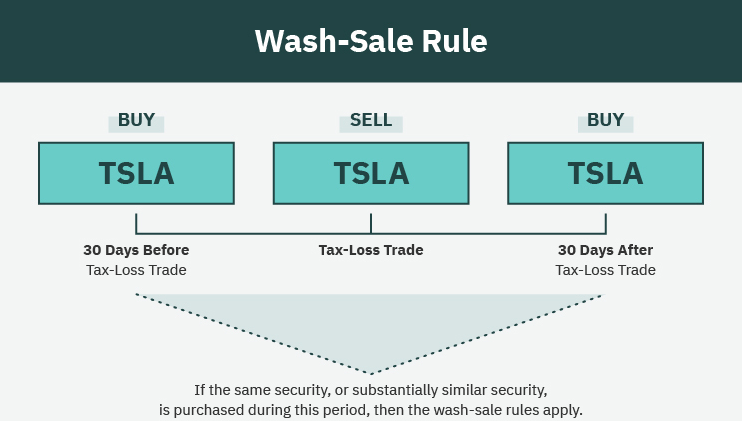

If you are new to investing or reviewing your portfolio for tax season, you may have come across the term and wondered — what is a wash sale? A wash sale occurs when an investor sells a security at a loss and then repurchases the same or a substantially identical security within 30 days before or after the sale.

While this might seem like a strategy to lock in losses for tax purposes while maintaining a similar market position, tax authorities have rules to prevent this practice from giving you an unfair tax advantage.

Understanding what is a wash sale is important because triggering one can affect your capital gains tax calculations and disallow certain losses you might expect to deduct.

Why Wash Sales Matter

To fully grasp what is a wash sale, it's important to understand the intent behind the tax rule. In many tax jurisdictions, including the United States and several other developed markets, investors can offset gains with losses to reduce their overall tax liability. This is known as tax-loss harvesting.

However, without a rule against wash sales, an investor could sell a stock at a loss and then immediately buy it back, effectively creating a paper loss without changing their market exposure. That's why tax regulators consider this a loophole and have put rules in place to block it.

In simple terms, when you're figuring out what is a wash sale, think of it as a disallowed tax loss triggered by buying back into the same investment too quickly after selling it at a loss.

How the 30-Day Rule Works

Central to understanding what is a wash sale is the “30-day rule.” This rule applies to the period both before and after the sale of the security.

If you sell a stock at a loss and then repurchase the same or a substantially identical stock — or even a call option or fund — within 30 calendar days, your loss is not allowed for tax deduction purposes.

What is a wash sale in this context? It's any transaction that fails to meet the required time gap, regardless of your intent. The rule is applied automatically by tax software and brokerage platforms, so it's not something investors can bypass through timing tricks or technicalities.

What Happens to the Disallowed Loss?

A common follow-up to what is a wash sale is: what happens to the loss that gets disallowed?

Fortunately, the loss is not completely gone. Instead, it is added to the cost basis of the newly purchased security. This means the disallowed loss is deferred rather than cancelled outright. When you eventually sell the repurchased asset (outside of a wash sale window), the deferred loss will adjust your capital gain or loss at that time.

This adjustment ensures that investors still receive the tax benefit eventually — just not at the time of the wash sale.

What Is a Wash Sale Example?

Let's break down what is a wash sale with a basic example:

Suppose you buy 100 shares of XYZ Ltd at £50 per share. A few months later, the price drops to £40, and you sell all your shares, realising a £1,000 loss. Five days later, you buy the same 100 shares of XYZ Ltd again at £42. Because you repurchased the same security within 30 days, this transaction qualifies as a wash sale.

Your £1,000 loss will not be deductible in that tax year. Instead, it will be added to the cost basis of your new shares, which would now be £5,200 (£4,200 purchase + £1,000 disallowed loss). When you sell those shares later, the adjusted basis will ensure the tax treatment reflects the true economic outcome.

What Counts as “Substantially Identical”?

Another aspect of what is a wash sale involves understanding what counts as “substantially identical.” While it's clear that buying the exact same stock qualifies, investors often face ambiguity with related securities.

For example, mutual funds and ETFs that track the same index might be considered substantially identical, depending on how closely their holdings overlap. Call options on the same security are also included in the wash sale rule. In some cases, even different share classes of the same company could qualify.

When trying to navigate what is a wash sale, it's always better to err on the side of caution or consult a financial adviser for clarity.

Are Wash Sales the Same in Every Country?

Wash sale rules can vary significantly depending on your jurisdiction. While the concept is widely recognised, the specifics of what is a wash sale — such as the look-back period, applicable securities, and tax treatment — may differ.

For example, in the United Kingdom, capital gains tax applies differently, and there is no identical “wash sale rule” like the one used in the US. Instead, rules like the 30-day “bed and breakfasting” regulation apply, which achieves a similar effect by matching disposals and acquisitions within a 30-day window.

So when researching what is a wash sale, be sure to check how the rules apply based on where you are filing your taxes.

How to Avoid Triggering a Wash Sale

If you want to take advantage of tax-loss harvesting without triggering a wash sale, the key is careful timing and asset selection. You can:

Wait at least 31 days before repurchasing the same security.

Consider buying a similar but not substantially identical investment to maintain exposure.

Use tax planning software or broker-provided reports to track previous trades and spot wash sale risks.

Being strategic in how you manage your trades can help you stay compliant while optimising your tax outcomes. Understanding what is a wash sale allows you to approach your trades with greater clarity and avoid surprises come tax time.

Final Thoughts

For many investors, particularly those actively trading or rebalancing portfolios near tax deadlines, knowing what is a wash sale is critical. It's not just a technicality — it directly affects your taxable gains and the value of your investment strategy.

The rule is designed to prevent short-term loss harvesting while maintaining market positions, but it does offer deferred benefits through cost basis adjustments. By understanding the conditions that create a wash sale and planning your trades accordingly, you can reduce tax friction and make more informed financial decisions.

Whether you are a casual investor or an experienced trader, learning what is a wash sale and how to avoid it is one of the simplest ways to stay tax-efficient and legally compliant.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.