Investment planning is the disciplined process of setting financial goals and building a strategy to achieve them over time. It goes beyond simply choosing investments; it involves understanding your risk tolerance, planning for life stages, and adapting to changing financial environments.

Today, with global markets shifting and innovative assets emerging, robust investment planning can help individuals, from young professionals to retirees, build, preserve, and grow their wealth.

This guide explains investment planning, outlining essential principles and linking practical, clear, and future-oriented strategies for various life stages.

What Is Investment Planning?

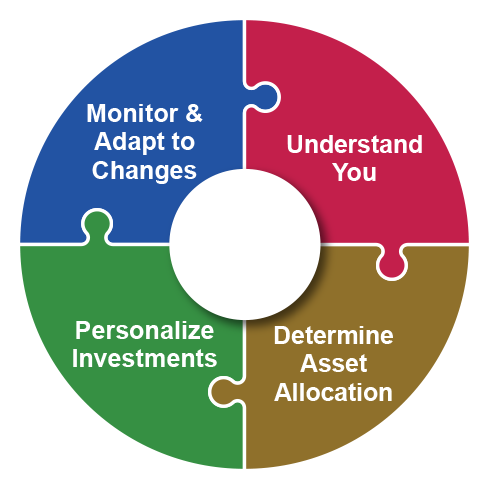

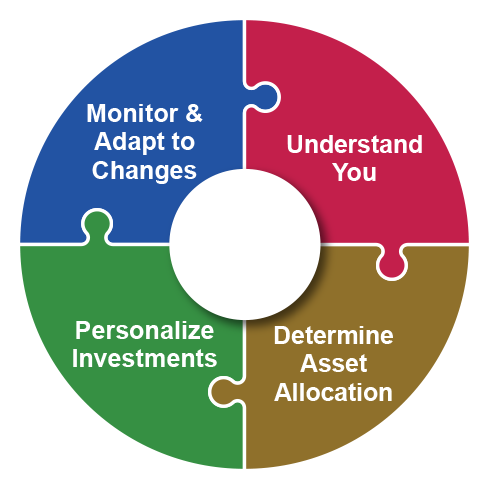

Investment planning begins with assessing your financial condition, including income, savings, debts, and expenses. This foundation sets realistic goals—whether buying a home, funding education, or securing retirement. Equally important is mapping out a timeline and understanding how much you'll need to invest regularly to achieve those goals.

Risk tolerance and liquidity needs inform your strategy, helping you decide how much to allocate to equities, fixed income, or alternative assets.

Finally, the plan should guide monitoring and rebalancing to stay on course as circumstances evolve.

Core Components of Investment Planning

An effective investment plan consists of several intertwined components:

1) Goal Setting:

Define what matters most—travel, education, retirement, or leaving a legacy—and attach dollar amounts and timelines to each goal.

2) Risk Profiling:

Understand your comfort with volatility. Are you willing to ride 30% equity drawdowns, or do you prefer smoother returns?

3) Asset Allocation:

Diversify across asset classes—stocks, bonds, real estate, cash, and possibly alternatives like ETFs, commodities, or private assets.

4) Investment Selection:

Within each asset class, choose suitable instruments—U.S. large-cap stocks, emerging-market ETFs, investment-grade bonds, or even crypto exposure for the adventurous.

5) Tax and Fee Awareness:

Use tax-advantaged vehicles wisely—such as retirement accounts or education savings plans—and minimise expenses by utilising low-cost funds and avoiding unnecessary trading.

6) Monitoring and Rebalancing:

Market swings mean your portfolio drifts from its original allocation over time. Consistent portfolio assessments—monthly or quarterly—enable you to adjust by divesting from outperforming asset classes and reallocating to underperforming ones, preparing for the upcoming cycle.

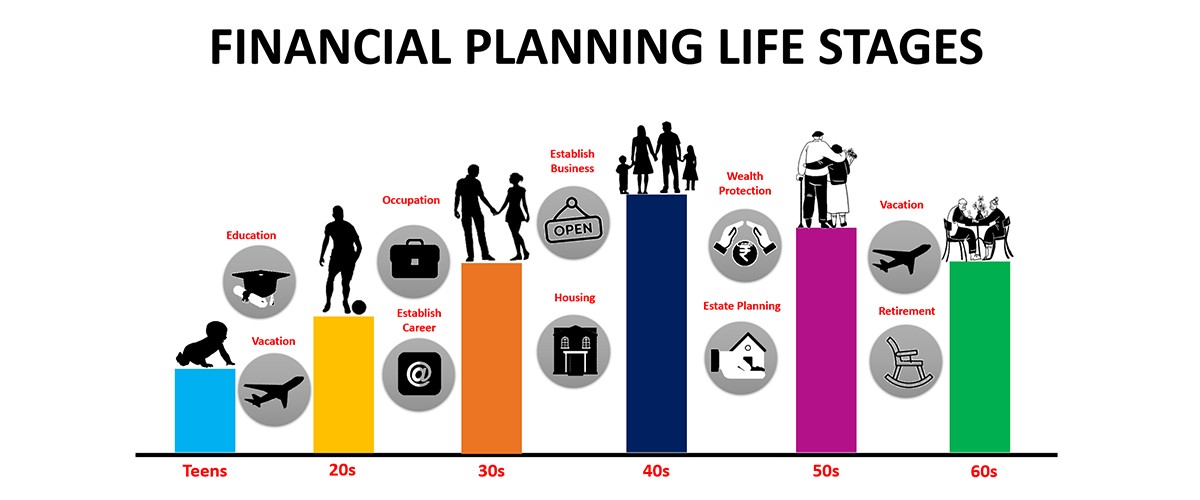

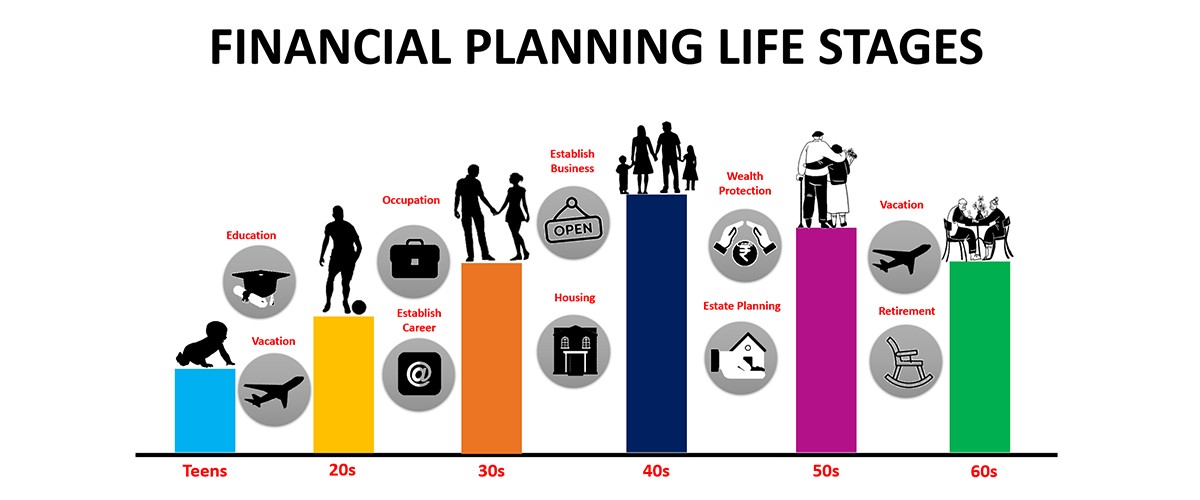

Investment Planning Strategies for Every Stage

Young Professionals (Ages 20–35)

During the initial stages of a career, time serves as the best asset for an investor, making it essential to maximise equity exposure. With decades of compounding ahead, younger individuals can afford to take calculated risks to secure greater long-term rewards.

Growth-oriented investment plans typically include diversified equity ETFs, a small allocation to high-volatility assets, and increasing retirement contributions. Establishing emergency savings early is vital, and employing dollar-cost averaging for investments helps mitigate market volatility as savings and salaries grow.

For those with an entrepreneurial spirit, consider small allocations to private equity, peer-to-peer lending, or fractional real estate. Financial planning tools can also simplify the goal-setting process, setting clear targets such as buying a first home by age 30 or accumulating six months' expenses in liquid investments before attempting longer-term investments.

Mid-Career Adults (Ages 35–50)

Mid-career professionals often juggle multiple financial priorities: raising children, saving for college, paying a mortgage, and planning for retirement. As obligations grow, so does the need for balance, diversification, and capital preservation.

A balanced approach combines equities with fixed income—30–50% bonds, supplemented by dividend-paying stocks or ETFs to provide income and hedge equity volatility.

Midlife investors may also explore sector-specific strategies, such as healthcare or real estate investment trusts (REITs), as their goals diversify and horizons remain substantial.

Pre-Retirees and Retirees (Ages 50–70+)

As retirement approaches, priorities shift decisively toward capital preservation, income, and tax planning. A traditional allocation might consist of 40% bonds, 40% equities, and 20% income-producing assets, depending on risk tolerance.

Retirees ought to pay more attention to stable income by utilising annuities, bonds, dividend ETFs, or reverse mortgages. A bucketed strategy (short-term needs, intermediate income, long-term growth) can provide security and development.

Lastly, tax planning becomes essential: Roth conversions, required minimum distribution strategies, and charitable gifting can help manage tax burdens.

Advanced Asset Allocation Strategies

For seasoned investors, investment planning may incorporate dynamic strategies like factor investing, income layering, or tactical allocation.

Factor-based instruments (value, momentum, quality) allow customisation within equities. Alternative assets add diversification: private equity, hedge funds, gold, or cryptocurrencies gain little correlation to traditional markets.

For tactical shifts, investors may adopt a core-satellite model. A core portfolio of diversified ETFs provides the foundation, while satellite allocations are in short-term high-volatility assets. Risk overlays, such as protective puts or volatility-hedged options, can limit drawdowns in volatile regimes.

Final Tips: Stay Committed and Monitor Your Plan

A successful plan needs attention. Quarterly check-ups of portfolio alignment, goal progress, and tax changes are valuable. Rebalancing—divesting from outperformers while acquiring underperformers—aligns risk with your goals, avoiding excessive concentration in a single asset class.

Life transitions such as having a baby, purchasing a house, job changes, and health issues require plan shifts. Significant market events might necessitate temporary portfolio evaluations to verify the strategy's effectiveness.

Finally, enjoy the process. Investment planning isn't about hitting one grand finale—it's a lifelong journey of achieving goals, making mistakes, and periodic adjustments in reaction to new life phases.

Conclusion

In conclusion, investment planning is both an art and a science. It hinges on clearly defined goals, asset diversification, risk discipline, and continual adaptation to life's evolving chapters.

At every stage, from starting careers to enjoying retirement—tailored strategies guide investors toward success. By combining proven frameworks, behavioural self-awareness, and adaptive techniques, planning builds more than wealth; it fosters confidence, resilience, and peace of mind in an uncertain world.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.