Platinum and gold are two of the world's most coveted precious metals, often compared for their rarity, industrial uses, and investment appeal. Investors and collectors alike frequently ask: Is platinum more expensive than gold today?

In 2025, the answer is clear—gold remains significantly more expensive than platinum. Here's why, plus a look at the latest prices, historical trends, and the key factors that drive their values.

Current Prices: Gold vs. Platinum in 2025

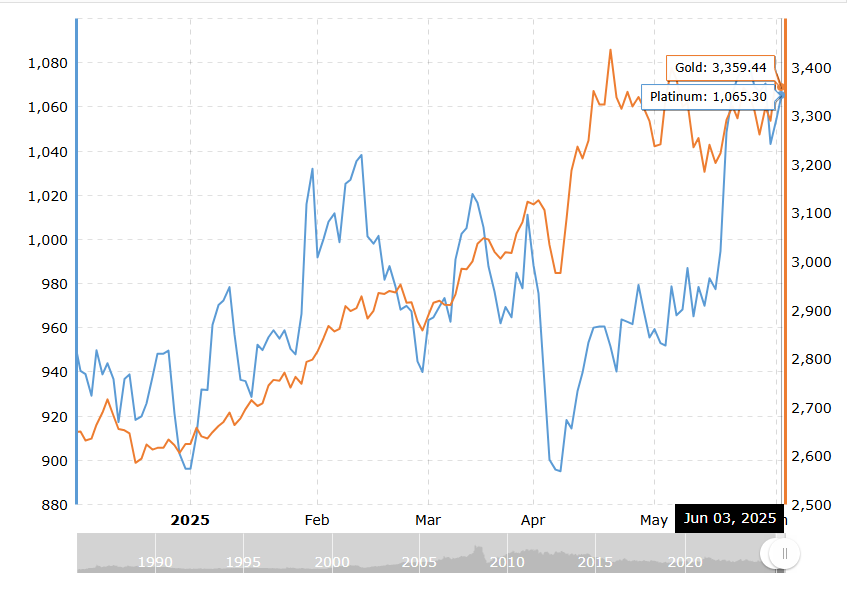

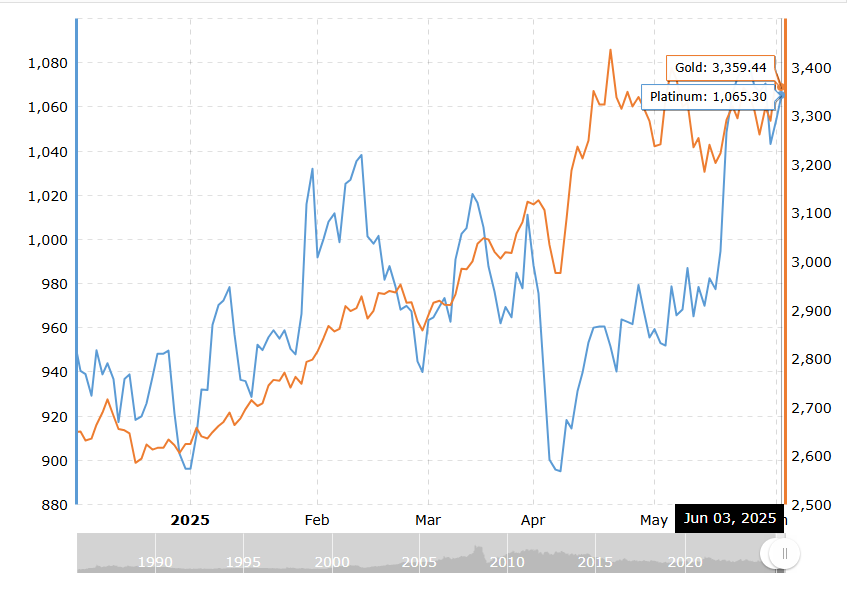

As of late May 2025, gold is trading at approximately $3,360 per troy ounce, while platinum is around $1,070 per troy ounce. This means gold is currently more than three times as expensive as platinum. The gold-to-platinum price ratio stands at 3.26, indicating that one ounce of gold is worth over three ounces of platinum.

This price gap is not new. Gold has consistently outpaced platinum in value since the mid-2010s, despite platinum's greater rarity in the Earth's crust and its vital industrial uses.

Historical Trends: When Was Platinum More Expensive?

Historically, platinum was often more expensive than gold. For much of the 20th century and into the early 2000s, platinum commanded a premium due to its scarcity and its critical role in industrial applications, especially catalytic converters for vehicles. The last time platinum traded above gold was in mid-2014.

Since then, the tables have turned. Gold's price has surged, particularly during periods of economic uncertainty, while platinum has experienced more volatility, largely due to fluctuations in industrial demand and changes in automotive technology.

What Drives the Price of Platinum?

Platinum's value is heavily influenced by industrial demand, especially from the automotive sector, which uses platinum in catalytic converters to reduce vehicle emissions. When the global economy is strong and car production is high, platinum prices tend to rise. Conversely, during economic downturns or when demand for diesel vehicles drops, platinum prices can fall sharply.

Other factors influencing platinum's price include:

Supply constraints: Over 70% of platinum production is concentrated in south africa, making the market sensitive to supply disruptions.

Jewellery and investment demand: Platinum is popular in luxury jewellery, particularly in Asia, and also sees demand from investors seeking diversification.

Technological shifts: The rise of electric vehicles, which do not use catalytic converters, has dampened long-term demand for platinum in the auto industry.

What Drives the Price of Gold?

Gold's value is less tied to industrial use and more to its status as a safe-haven asset. During times of inflation, recession, or geopolitical uncertainty, investors flock to gold for stability and wealth preservation. Central banks also hold significant gold reserves, further supporting its value.

Key drivers for gold include:

Safe-haven demand: Gold thrives during market volatility and economic crises.

Central bank purchases: Ongoing buying by central banks, especially in emerging markets, has boosted gold prices to record highs in 2025.

Limited supply growth: While gold is more abundant than platinum, new discoveries and mining output have remained relatively stable, supporting long-term value.

Why Is Gold More Expensive Than Platinum in 2025?

Several factors explain why gold is currently more expensive than platinum:

Higher investment demand: Gold's role as a hedge against uncertainty has driven strong investor demand, pushing prices to record highs in 2025.

Industrial volatility: Platinum's price is more volatile due to its reliance on industrial cycles, especially in the automotive sector.

Safe-haven status: Gold's reputation as the ultimate store of value makes it the preferred choice during global instability, further widening the price gap.

Will Platinum Ever Be More Expensive Than Gold Again?

While platinum has been cheaper than gold for over a decade, market dynamics can shift. If industrial demand for platinum surges—perhaps due to new technologies or stricter emissions regulations—its price could rise relative to gold.

However, as long as gold remains the preferred safe-haven asset, it is likely to command a higher price in times of uncertainty.

Conclusion

As of 2025, platinum is not more expensive than gold. Gold's price is driven by its safe-haven appeal, central bank demand, and historical significance, while platinum's value depends on industrial trends and supply constraints.

Investors should consider these factors, along with their own risk tolerance and market outlook, when deciding between these two precious metals.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.