Imagine the market as a busy hospital emergency room. If you charge in haphazardly, you'll end up bewildered. If you wait for the right window when the team is ready and the pathway is clear, you can operate with precision.

ICT "killzone" periods refer to those intervals during the trading day when liquidity, institutional involvement, and more accurate price movements coincide. Learn to recognise them and you'll stop fighting the market and start trading with its rhythm.

Below is an easy, beginner-friendly guide to ICT killzones: what they are, when they happen (including the latest 2025 timing conventions and DST caveats), why they matter, how different sessions behave, and practical, risk-aware ways to use them.

What "ICT Killzone" Actually Means

"ICT" stands for Inner Circle Trader, a trading methodology popularised by Michael J. Huddleston. The ICT killzone refers to a particular timeframe within a trading session, usually lasting two to three hours, when institutional activity and volatility peak.

Traders using the ICT approach focus on these windows because price action tends to be cleaner (trend moves, authentic breakouts, good liquidity), making high-probability setups more common.

What Are the Four Primary ICT Killzone Times?

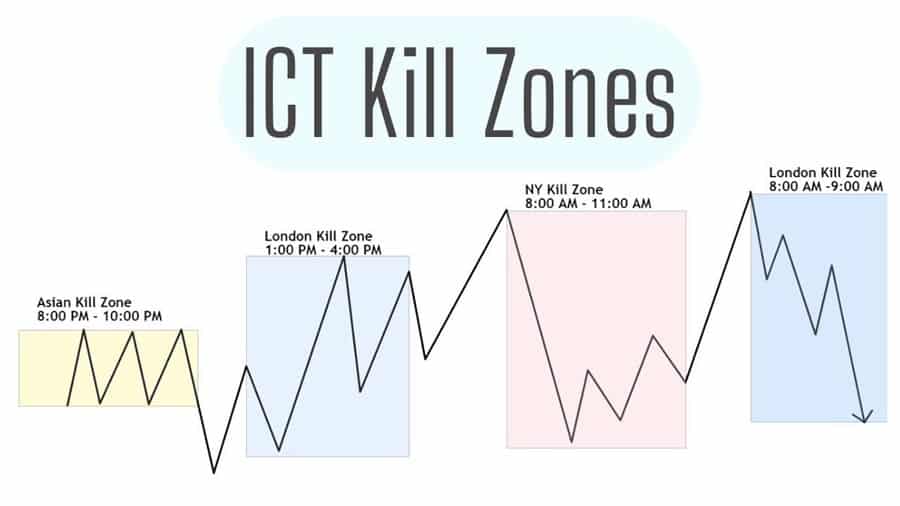

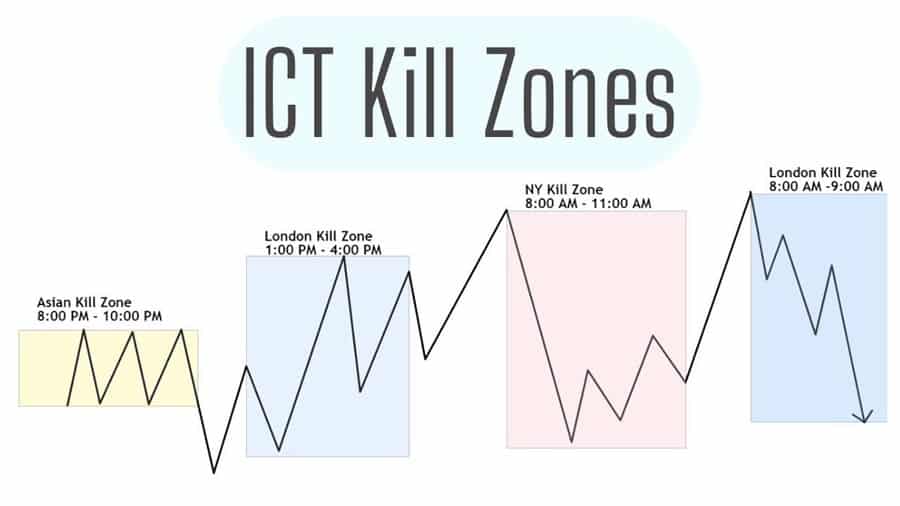

Most ICT practitioners pay attention to four main killzones tied to the global market opening and closing:

Asian (Tokyo) Killzone: the Asian session's main activity.

London (European) Killzone: the London open period is often highly liquid.

New York (US) Killzone: the US open and early session overlap with London.

London Close Killzone: late European session when desks square positions.

These time windows are where "smart money" is often active and where meaningful directional moves can begin.

ICT Killzones Times Session-by-Session Explained

| Killzone |

Typical NY (ET) Window |

Equivalent UTC (standard) |

Notes |

| Asian (Tokyo) Killzone |

7:00–9:00 PM ET (19:00–21:00) |

00:00–02:00 UTC (next day) |

Active pairs: JPY, AUD, NZD; lower liquidity than London/NY. |

| London (Open) Killzone |

2:00–5:00 AM ET (02:00–05:00) |

07:00–10:00 UTC |

The classic ICT London window: increased volume as London desks start. |

| New York (Open) Killzone |

8:00–11:00 AM ET (08:00–11:00) |

12:00–15:00 UTC |

Overlap with London (partly) — heavy USD-related moves. |

| London Close Killzone |

11:00 AM–1:00 PM ET (11:00–13:00) |

15:00–17:00 UTC |

Position-squaring before European close; good for reversals/scalps. |

Times above are given in New York local time (Eastern Time) and UTC, and include the usual ICT killzones used by many traders. Always check whether New York is on EST or EDT (Daylight Saving) when converting to your time zone.

1. Asian (Tokyo) Killzone: Quiet but Strategic

The Asian killzone typically displays reduced volatility relative to European and US sessions.

Yet, it's essential for range strategies, carry trades, and setups on AUD/JPY, NZD pairs, or the early continuation of overnight movements. Expect thinner depth and more chop; targets are usually modest.

2. London (Open) Killzone: The "Engine Room"

London's open is the heavy lifter. As European banks and funds engage, the London killzone (typically 02:00–05:00 ET) offers genuine liquidity and more robust breakouts on EUR, GBP, and key crosses.

Many ICT setups (order blocks, breaker blocks, OTE entries) are defined around this period.

3. New York (Open) Killzone: The decisive mover

New York's morning session (roughly 08:00–11:00 ET) frequently produces the day's largest directional moves, especially when combined with London overlap.

USD-linked pairs, futures, and indices respond to US data, employment reports, and institutional reallocation; this is where significant trend days often begin.

4. London Close Killzone: Position Flushes & Reversals

As European desks square up, the London close zone can create late reversals and quick scalping possibilities.

Traders use this window to capture the "end-of-day" liquidity and often to manage or hedge positions ahead of the US close.

Why ICT Killzones Work for Traders?

Killzones focus on liquidity, institutional movement and news response. That combination tends to produce these effects:

In short, you get higher probability setups with clearer risk management, provided you trade correctly and avoid over-leveraging.

How Traders Use Killzones: 6 Practical Approaches

Here are practical ways traders structure trades around ICT killzones.

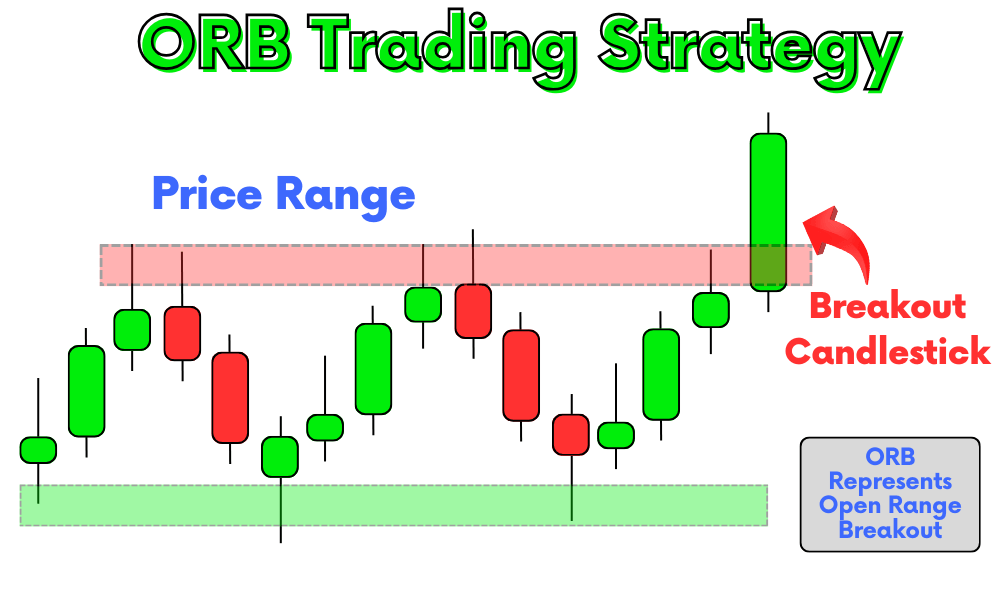

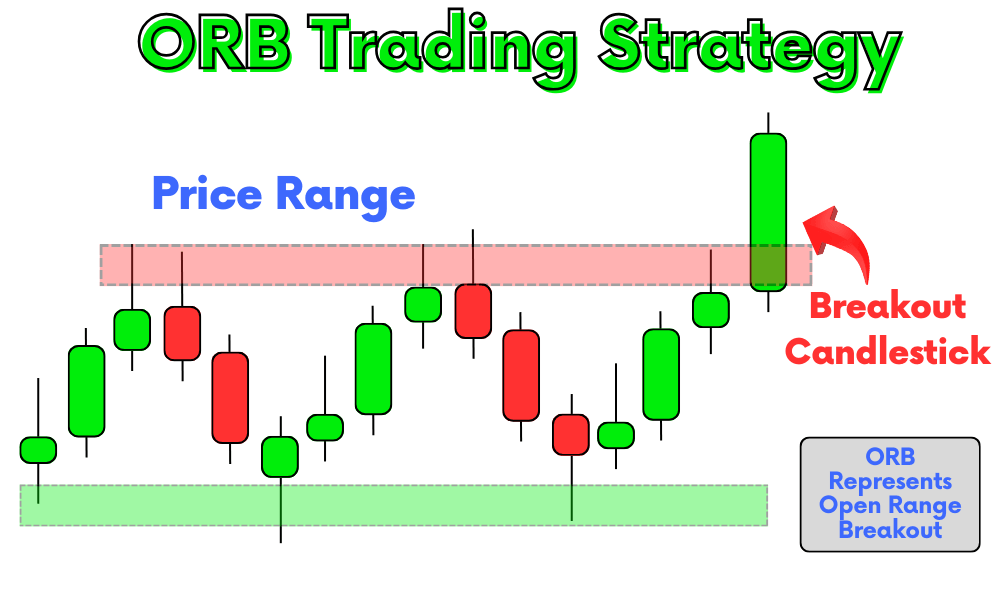

Opening-Range Breakouts: Mark the first 15–60 minutes after killzone start; trade breakouts with volume confirmation.

Liquidity Hunts: Watch for false breaks that grab stops, then fade or follow the liquidity path (common near London open).

Order Block Entries (ICT OTE): Look for optimal trade entry zones after a killzone imbalance is created.

Killzone Scalping: Small targets inside the killzone using tight stops and small sizing.

Session Fade / Reversion: Fade exaggerated moves within the killzone if institutional bias isn't confirmed.

Overlap Trades: Prioritise trades during London/New York overlaps, highest institutional participation and cleaner trends.

Are Killzones Guaranteed Success?

No. Killzones are not a shortcut to guaranteed profits. They are probability enhancers. If you apply good risk management, treat moves as expressions of institutional flow, and keep trade sizes modest, killzones can focus your effort on the market's most efficient hours.

However, be cautious of confirmation bias; observing a "killzone" doesn't guarantee every trade will succeed.

Frequently Asked Questions

Q1: Who Created ICT Killzones?

The concept is central to the Inner Circle Trader (Michael Huddleston) methodology and widely taught across his materials and community resources.

Q2: Which Pairs Are Best for the London Killzone?

EUR/USD, GBP/USD, EUR/GBP, and major EUR crosses often indicate the best action during the London open.

Q3: Are ICT Killzones Useful for Stocks or Crypto?

Yes, though crypto runs 24/7 and has different dynamics.

Conclusion

In conclusion, ICT killzones are powerful because they teach you to trade the market's timetable, not your emotions. Like the surgeon who waits for the sterile window, the disciplined trader waits for the market's cleanest hours.

Use killzones to concentrate effort on the most probable trading hours, combine them with strong risk management, and remember: consistency beats impulse.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.