The crude oil market is among the most volatile and liquid in the world, offering significant opportunities for short-term and swing traders. However, its price behaviour is influenced by a web of dynamic factors ranging from geopolitical tensions to inventory data and macroeconomic indicators. For traders who seek consistency rather than mere luck, a hybrid strategy that blends fundamental insight with technical precision offers the best of both worlds.

Supply & Demand Analysis: The Foundation of Directional Bias

No commodity is more geopolitically sensitive than oil. As such, fundamental analysis must be at the core of any Trading plan. The balance between global supply and demand dictates whether oil will trend higher or lower. Traders should closely monitor:

No commodity is more geopolitically sensitive than oil. As such, fundamental analysis must be at the core of any Trading plan. The balance between global supply and demand dictates whether oil will trend higher or lower. Traders should closely monitor:

OPEC+ production quotas: Announcements from OPEC and allied producers (especially saudi arabia and Russia) directly impact global output levels.

US inventory data: Weekly EIA and API crude oil stockpile reports often trigger sharp price movements, especially if the actual figures diverge from expectations.

Macroeconomic indicators: Global GDP forecasts, PMI figures, and industrial output data help assess demand health. A slowdown in China or the US, for example, often pressures oil prices downward.

Geopolitical developments: Conflicts in oil-producing regions (e.g. the Middle East, Venezuela) or sanctions against countries like Iran can choke supply and cause price spikes.

Keeping abreast of these elements enables traders to form a directional bias for the week or month—long if demand outpaces supply, short if the opposite holds true.

Technical Indicator Setup: Timing Entries with Precision

While fundamentals offer context, technical analysis provides execution timing. Crude oil, particularly WTI and Brent futures, responds well to a handful of reliable indicators and tools:

Moving Averages: The 20- and 50-day exponential moving averages (EMAs) are particularly helpful for identifying short- to medium-term trends. A crossover (e.g., 20 EMA above 50 EMA) suggests upward momentum.

Relative Strength Index (RSI): The RSI can signal overbought (above 70) or oversold (below 30) conditions. However, in trending markets, RSI should be used with trend filters.

Bollinger Bands: When price compresses within narrowing bands, a breakout may be imminent. A breakout above the upper band on rising volume is typically bullish.

MACD (Moving Average Convergence Divergence): When the MACD line crosses above the signal line in positive territory, it indicates bullish momentum—and vice versa.

Importantly, no single indicator should be used in isolation. Traders should wait for confluence, where multiple indicators align, before taking action.

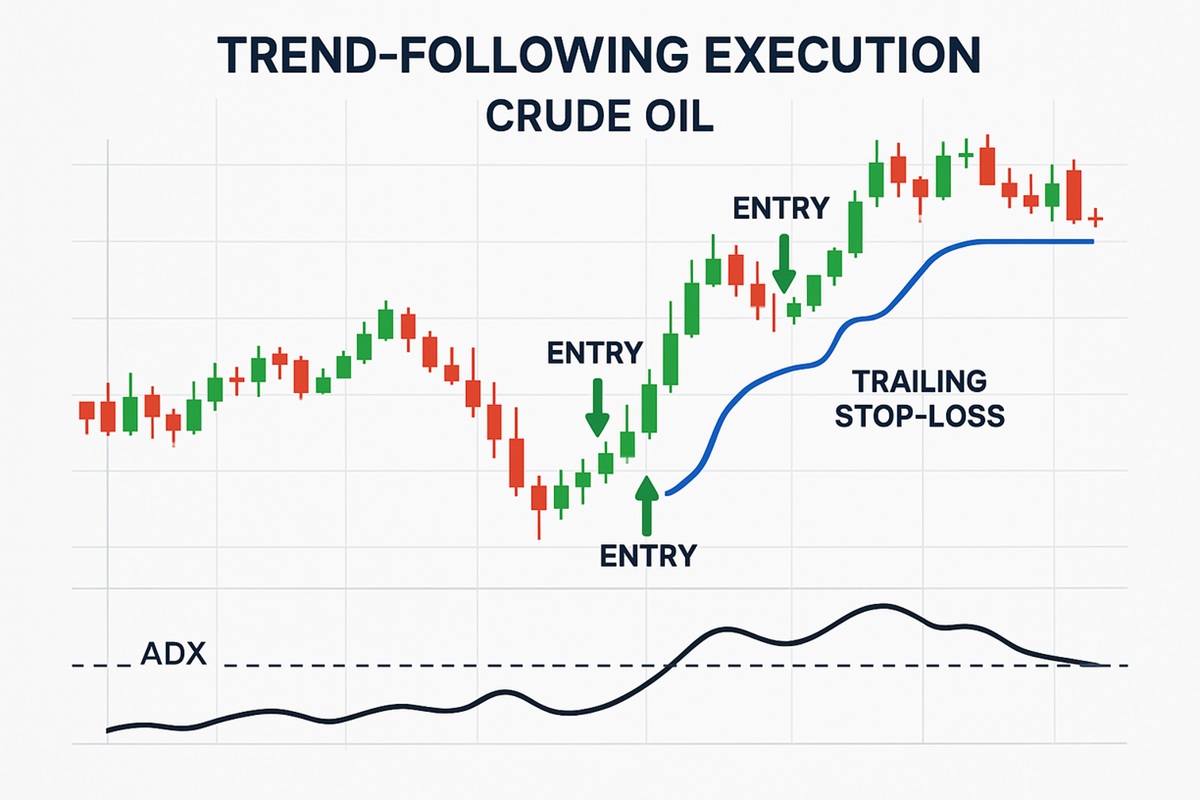

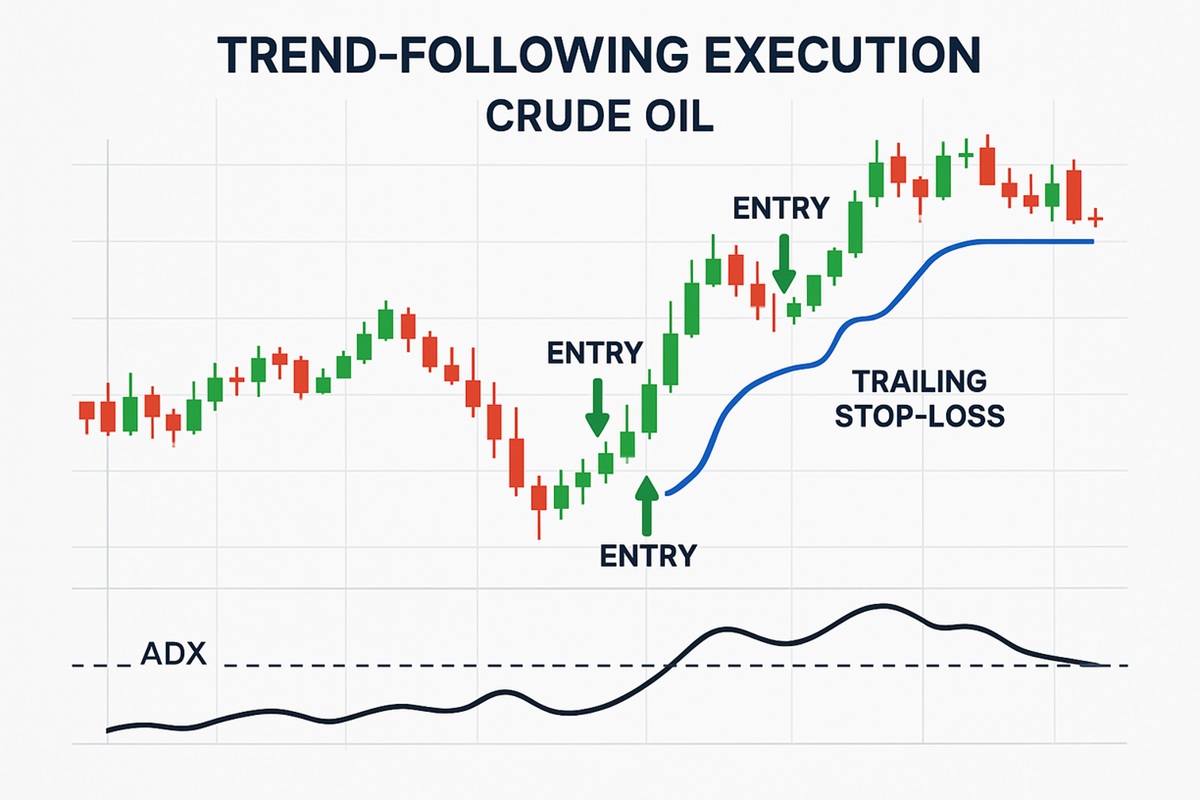

Trend‑Following Execution: Riding the Dominant Momentum

Once a directional bias and technical setup are aligned, traders can execute trend-following trades. This method aims to capture sustained moves rather than intraday fluctuations.

Once a directional bias and technical setup are aligned, traders can execute trend-following trades. This method aims to capture sustained moves rather than intraday fluctuations.

Key practices include:

Use of trailing stop-losses: As the trade moves in your favour, trailing stops allow you to lock in profits without prematurely closing the position.

ADX filter: The Average Directional Index (ADX) measures trend strength. A reading above 25 confirms that a trend is present and likely to persist.

Scaling into positions: Rather than entering a full position at once, traders can add to their trade as the trend confirms itself—especially after pullbacks to moving averages or previous support/resistance zones.

Crude oil can trend for days or weeks during macro shifts or OPEC-driven moves. The goal here is to let profits run, rather than trying to time the top or bottom.

Breakout & Range Tactics: Adapting to Market Conditions

Crude oil doesn't always trend. At times, it consolidates within well-defined ranges. Traders should adapt their tactics accordingly:

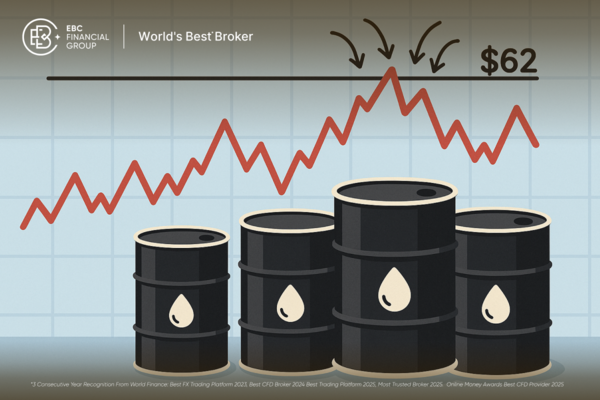

Breakout Strategy: Identify consolidation zones using horizontal resistance and support lines. A breakout on high volume with strong momentum signals a potential entry. This is especially effective around psychological levels like $70. $80. or $100.

Fakeouts and Stop Hunts: The oil market is notorious for false breakouts. Waiting for a confirmed close outside the range (especially on the 4H or daily chart) helps avoid being caught in a trap.

Range Trading: When volatility contracts and price respects a range, buying near support and selling near resistance with tight stops becomes the preferred strategy.

News Catalyst Breakouts: Pairing breakout setups with news events (like OPEC statements or inventory releases) increases the odds of sustained moves.

Traders should always know which regime the market is in—trending or ranging—and apply the appropriate method accordingly.

Risk Management & Trade Sizing: The Key to Long-Term Survival

The best strategy means nothing without proper risk management. In highly volatile markets like oil, protecting capital is essential. Consider the following rules:

Risk per trade: Limit exposure to 1–2% of total capital per trade. This prevents large drawdowns during periods of underperformance.

Stop-Loss Placement: Place stops beyond technical levels—below support or above resistance—rather than arbitrary pip counts. This gives trades room to breathe while maintaining structure.

Position Sizing: Adjust the number of contracts or lot size based on volatility and stop distance. ATR (Average True Range) can help gauge how wide stops should be.

Diversification & Hedging: If holding multiple positions, avoid overexposing to the same directional risk (e.g., long oil, long CAD, short USD). Diversify where possible or hedge accordingly.

Performance Tracking: Maintain a trading journal documenting entry/exit rationale, emotional state, market context, and outcome. Review monthly to identify strengths and weaknesses.

Risk management turns a good strategy into a sustainable one—and ultimately determines whether a trader can survive long enough to thrive.

Final Thoughts: Oil Trading Demands Both Art and Discipline

Crude oil trading is not for the faint of heart. It requires sharp analytical skills, a calm temperament, and a robust framework that blends both macro understanding and tactical precision. By applying a hybrid strategy—anchored in fundamentals but refined by technical analysis—traders can gain an edge in this high-stakes, fast-moving market.

Crude oil trading is not for the faint of heart. It requires sharp analytical skills, a calm temperament, and a robust framework that blends both macro understanding and tactical precision. By applying a hybrid strategy—anchored in fundamentals but refined by technical analysis—traders can gain an edge in this high-stakes, fast-moving market.

Yet the most important ingredient remains discipline. Even the best strategy, without emotional control and risk awareness, can quickly turn against the trader. Stay flexible, stay informed, and treat every trade as part of a larger system, not a lottery ticket.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

No commodity is more geopolitically sensitive than oil. As such, fundamental analysis must be at the core of any

No commodity is more geopolitically sensitive than oil. As such, fundamental analysis must be at the core of any  Once a directional bias and technical setup are aligned, traders can execute trend-following trades. This method aims to capture sustained moves rather than intraday fluctuations.

Once a directional bias and technical setup are aligned, traders can execute trend-following trades. This method aims to capture sustained moves rather than intraday fluctuations. Crude oil trading is not for the faint of heart. It requires sharp analytical skills, a calm temperament, and a robust framework that blends both macro understanding and tactical precision. By applying a hybrid strategy—anchored in fundamentals but refined by technical analysis—traders can gain an edge in this high-stakes, fast-moving market.

Crude oil trading is not for the faint of heart. It requires sharp analytical skills, a calm temperament, and a robust framework that blends both macro understanding and tactical precision. By applying a hybrid strategy—anchored in fundamentals but refined by technical analysis—traders can gain an edge in this high-stakes, fast-moving market.