Crude oil is one of the most actively traded commodities globally. From speculators to hedgers, traders flock to oil markets to profit from its price movements. However, one of the most critical, and often overlooked—elements of trading crude oil is calculating the correct lot size.

Trading oil CFDs, futures, or options requires understanding the actual amounts you're trading, as this can distinguish between sustainable growth and avoidable losses.

This guide breaks down everything you need to know about crude oil lot size, its calculation, and why it matters for your risk management strategy.

What Is a Lot in Crude Oil Trading?

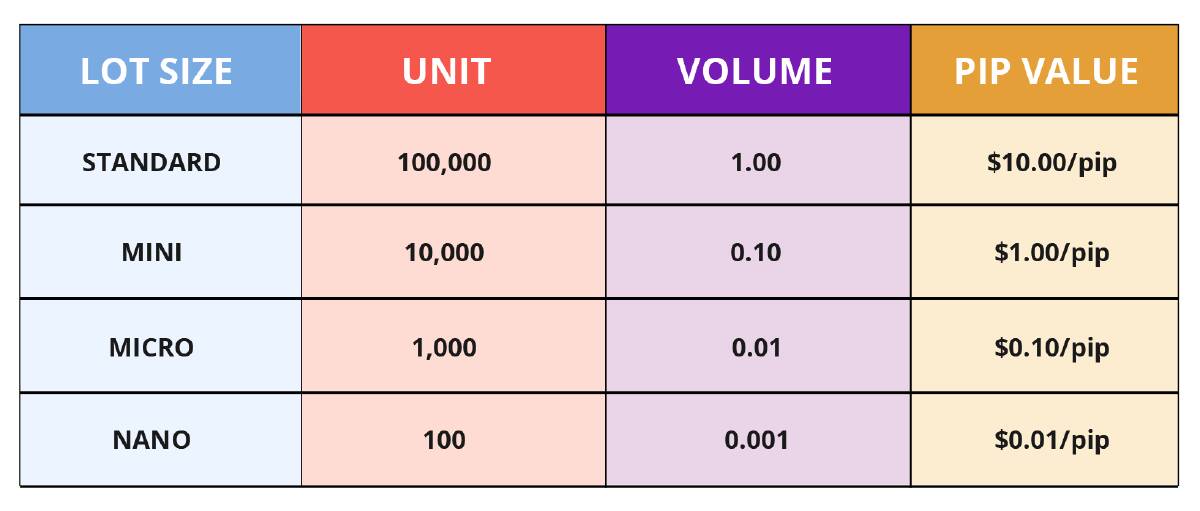

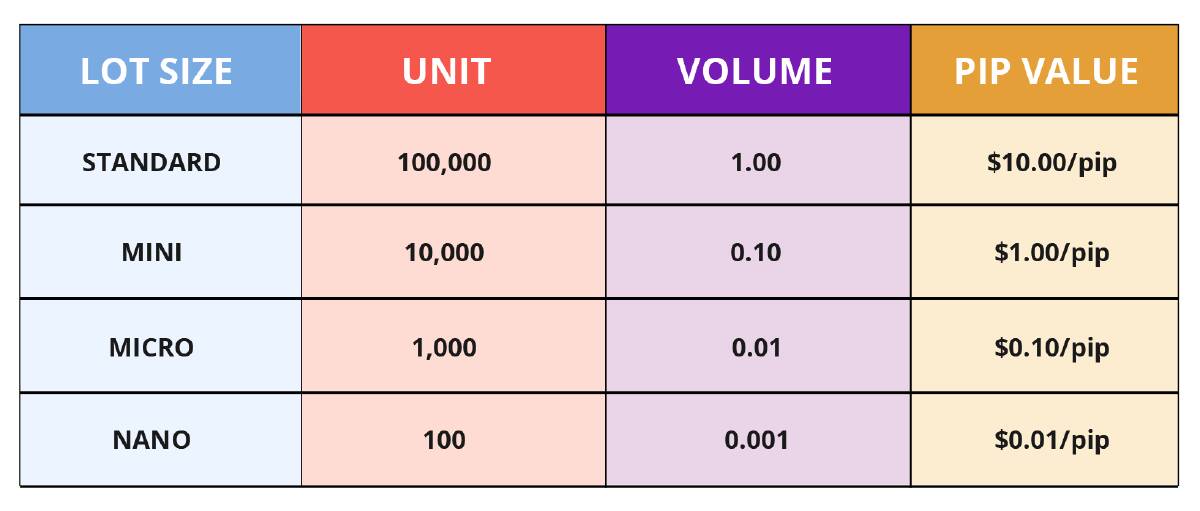

In trading terminology, a "lot" refers to a standardised quantity of the asset being traded. In crude oil trading, the lot size determines the volume of oil you are purchasing or selling in one contract.

The standard lot size for crude oil, especially when trading WTI (West Texas Intermediate) or Brent Crude, is typically 1,000 barrels per contract. However, depending on the trading platform or broker, there may also be mini lots (100 barrels) or micro lots (10 barrels), especially in CFD and retail platforms.

Understanding your lot size is crucial because it directly affects:

Your profit/loss per price movement (known as "pip" or "tick")

The required margin or capital for the trade

The total exposure you have in the market

Instruments for Trading Crude Oil

1. Crude Oil Futures

These are standardised contracts traded on exchanges. Each futures contract typically represents 1,000 barrels of crude oil.

2. Crude Oil CFDs (Contracts for Difference)

Brokers provide CFDs that enable traders to speculate on oil prices without actually possessing the underlying asset. CFD brokers may offer flexible lot sizes like:

1 lot = 100 barrels

0.1 lot = 10 barrels

0.01 lot = 1 barrel

3. ETFs and Options

While not directly traded in lot sizes like futures and CFDs, ETFs and options on oil also require understanding the equivalent exposure per unit.

How to Calculate Crude Oil Lot Size: Step-by-Step Guide

Step 1: Determine Your Account Currency

Your lot size calculation depends on whether your Trading Account is in USD, EUR, INR, or another currency. Crude oil is priced in USD globally, so if your account is in USD, calculations are simpler.

If you are utilising different currencies, you must translate your position value into your account currency.

Step 2: Identify Your Risk Per Trade

Professional risk management suggests risking 1% to 2% of your total capital on any single trade. For example, if you have $10,000 in your account and you want to risk 2%, that means:

It is the maximum you're willing to lose if the trade goes against you.

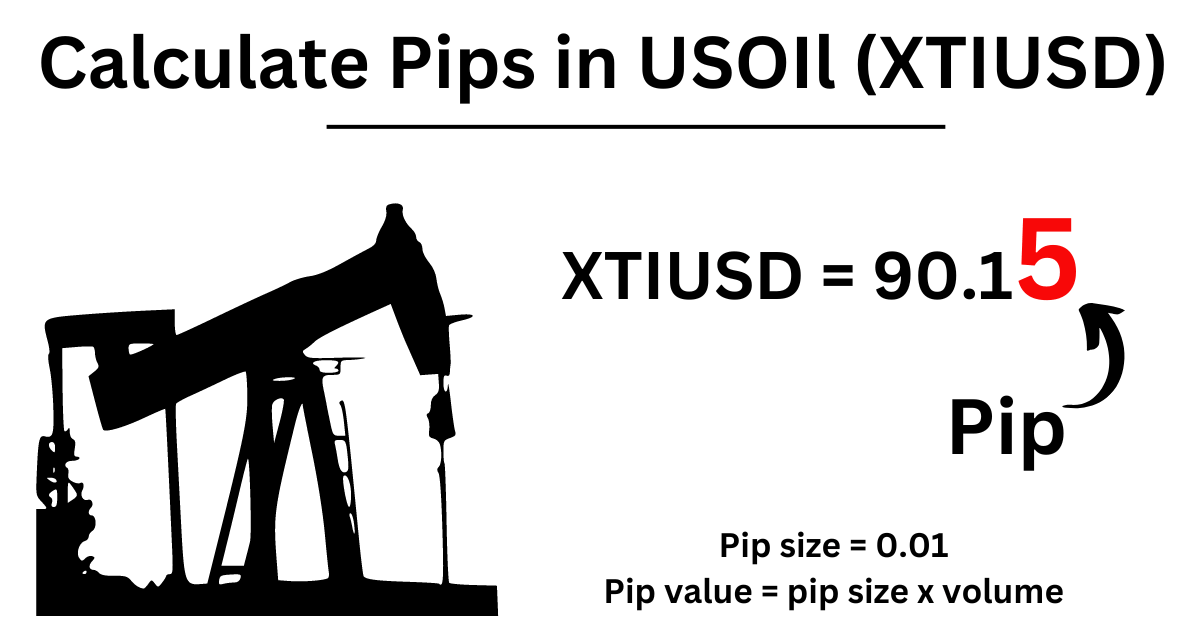

Step 3: Set Your Stop-Loss in Pips or Price Movement

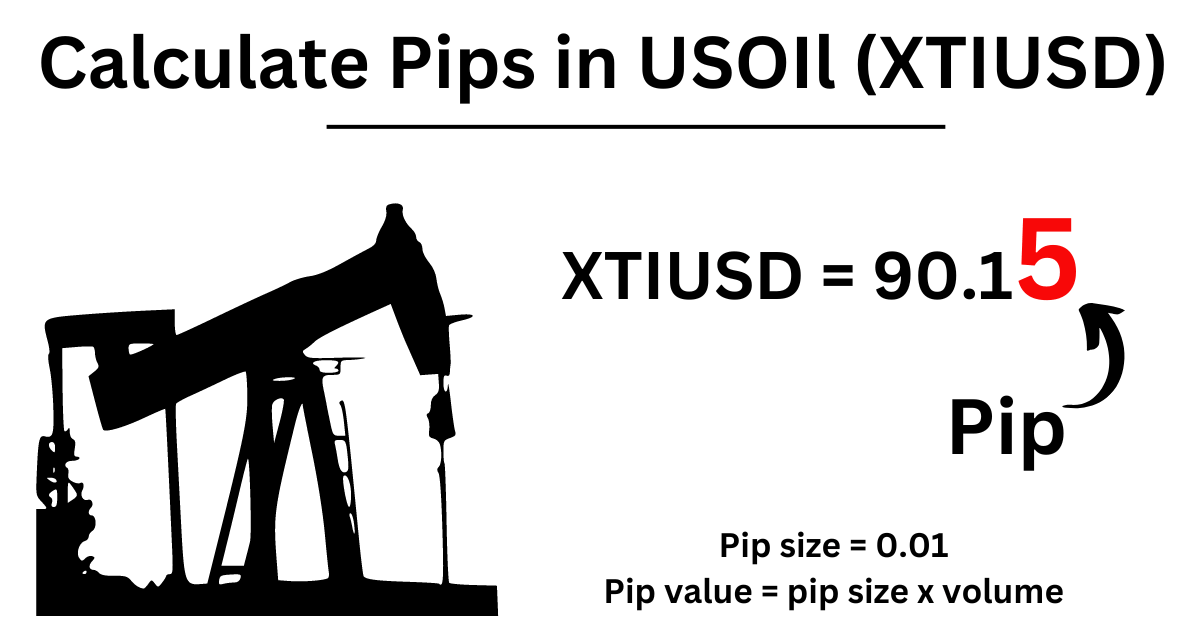

In crude oil, 1 pip (or 1 point) is equivalent to a $0.01 price change per barrel.

Let's say you're placing a stop-loss of $1.00 on a trade. If you're trading 1 barrel, a $1.00 movement would result in:

If you're trading 100 barrels (1 mini lot), the same $1.00 movement would mean:

Now, using your risk per trade from Step 2, you can determine the correct number of barrels.

Step 4: Use This Formula to Calculate Lot Size

Lot size = Risk per trade / (Stop-loss in dollars × Pip value per barrel)

Assume:

Lot size = $200 / $1.50 = ~133.33 barrels

That means you should trade 1.33 mini lots (if 1 mini lot = 100 barrels) or 13 micro lots (if 1 micro lot = 10 barrels). Round it down to 130 barrels or the closest lot size your broker allows.

Example

Let's assume:

You have a $5,000 account with a regulated broker

You want to risk 1% = $50

You set a stop-loss of $0.50

The broker's 1 CFD lot = 100 barrels

Now calculate:

That's 1 mini lot, which you can conveniently place using the broker's MT4/MT5 platform. If the broker allows micro lots, you could also trade 0.5 mini lots (50 barrels), especially if you want to be extra cautious.

Margin Requirements for Crude Oil

Margin is the amount of capital your broker requires to open a position. It depends on:

The lot size

The leverage offered

The price of oil

Formula:

If:

Then:

So you only need $80 in your account to control $8,000 worth of oil.

However, this increases risk. If oil moves against your position, losses are magnified. Always use appropriate leverage and lot size together.

Lot Size vs Crude Oil Volatility

Crude oil is known for its volatility. News events, geopolitical tensions, or OPEC meetings can cause price swings of $2 to $5 within a day.

Here's how that impacts lot size:

A $2 move on 1,000 barrels = $2,000 profit/loss

A $2 move on 100 barrels = $200 profit/loss

To manage this volatility, you might opt to decrease your position size or establish broader stop-loss thresholds with suitable lot modifications.

Never set your lot size arbitrarily; always match it with stop-loss distance and your capital.

Risk Management with Crude Oil Lot Size

One of the keys to surviving crude oil's volatility is solid risk management. It starts with choosing a lot size that aligns with your risk tolerance, account size, and stop-loss range.

Here's how good traders apply risk management:

They pre-calculate position size before placing a trade

They never exceed 2% risk per trade

They use stop-losses and avoid overleveraging

They reduce lot size in volatile sessions (e.g., OPEC meetings)

Lot size also depends on market context. In high-volatility situations, it may be advisable to halve your lot size to mitigate risk exposure.

Final Tips for Crude Oil Traders

If you're new to oil trading, lot size should be your first concern, not leverage or indicators. Here's why:

The correct lot size ensures you don't overtrade

It keeps your losses within tolerable levels

It enhances consistency by standardising your trade exposure

Many beginners fail not because of wrong market direction, but because they over-leverage and miscalculate their lot size.

Practice on a demo account first to understand how crude oil moves per lot and how your risk tolerance matches market volatility.

Conclusion

In conclusion, trading crude oil can be very lucrative, but only when handled with discipline. Understanding how to calculate crude oil lot size will empower you to control your risk, trade more confidently, and build a long-term strategy.

As you develop your Trading plan, revisit your lot size rules regularly and adjust them as your account grows and your strategy evolves. Combine this with good technical analysis, and you'll be well on your way to trading oil like a pro.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.