Important Clarification: The official currency of South Korea is the Korean Won (KRW), not the Korean Yen. However, many traders and search users commonly use the term "Korean Yen" when searching for information about trading the Korean currency against the US Dollar.

This confusion often stems from:

-

Regional familiarity with the Japanese Yen, leading to the assumption that neighbouring Asian countries use similar currency names

-

Search habits where users type "Korean Yen" when looking for Korean currency information

Casual conversation where the terms are sometimes used interchangeably, despite being technically incorrect

For clarity throughout this article: When we refer to "Korean Yen to USD" trading, we are discussing the Korean Won (KRW) to US Dollar (USD) currency pair. The Korean Won is South Korea's official currency, introduced in 1962, and is subdivided into 100 jeon (though jeon coins are no longer in circulation).

Professional traders should always use the correct terminology:

-

Correct: KRW/USD, Korean Won to USD, Won-Dollar

Incorrect: Korean Yen, KRY/USD

Now that we've clarified the currency terminology, let's dive into the comprehensive trading strategies for the KRW/USD pair.

Understanding the KRW/USD Currency Pair

The Korean Won to US Dollar exchange rate reflects the economic relationship between South Korea's export-driven economy and the world's largest financial market. As Asia's fourth-largest economy, South Korea's currency movements are influenced by several key factors that professional traders monitor closely.

Understanding these fundamentals is crucial for developing a successful trading approach. The Won's performance often mirrors broader Asian market sentiment, making it an excellent barometer for regional economic health.

Key Economic Drivers

Export Performance: South Korea's economy heavily relies on exports, particularly technology, automobiles, and petrochemicals. When global demand for Korean goods increases, the Won typically strengthens against the Dollar. Major exporters like Samsung, Hyundai, and LG significantly influence currency movements through their quarterly earnings and guidance.

Interest Rate Differentials: The Bank of Korea's monetary policy decisions directly impact KRW/USD movements. Higher Korean interest rates generally attract foreign investment, strengthening the Won. Monitor the central bank's policy meetings and statements for early signals of rate changes.

Geopolitical Factors: Political tensions on the Korean Peninsula can create volatility in the Won, presenting both opportunities and risks for traders. North Korean missile tests or diplomatic developments often trigger immediate market reactions.

Global Risk Sentiment: During periods of market uncertainty, investors often flee to safe-haven currencies like the USD, weakening the Won. This flight-to-quality phenomenon makes the pair particularly sensitive to global economic events.

Professional Trading Strategies

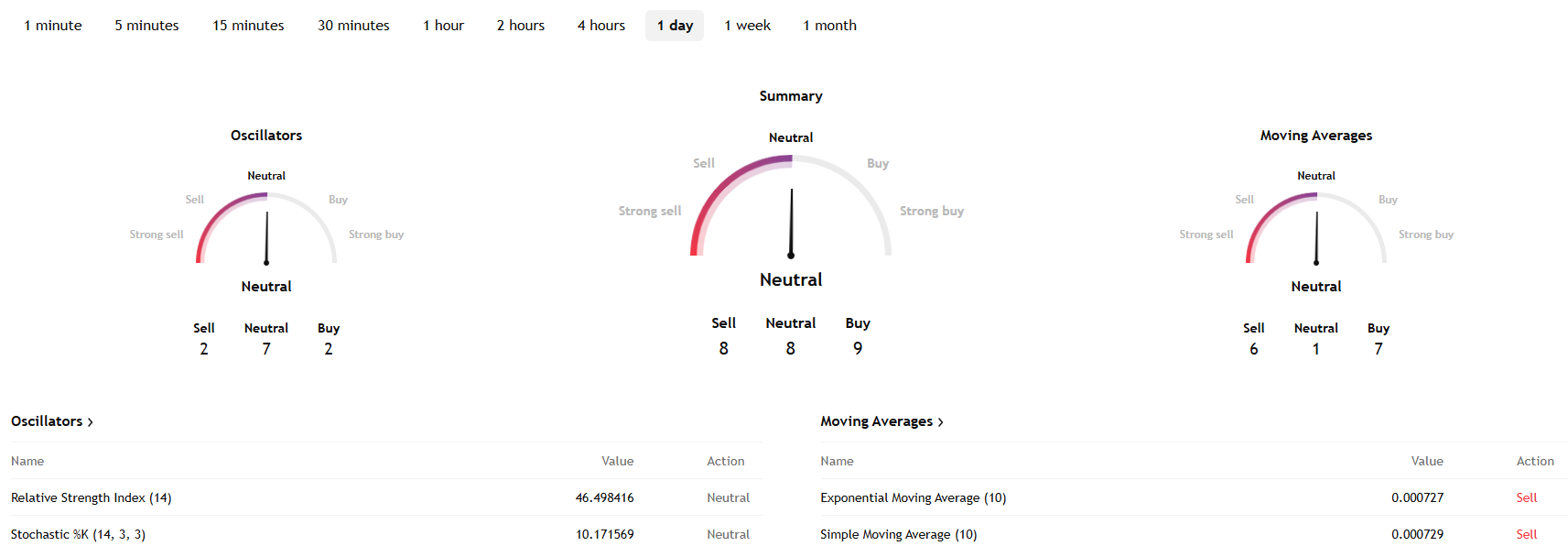

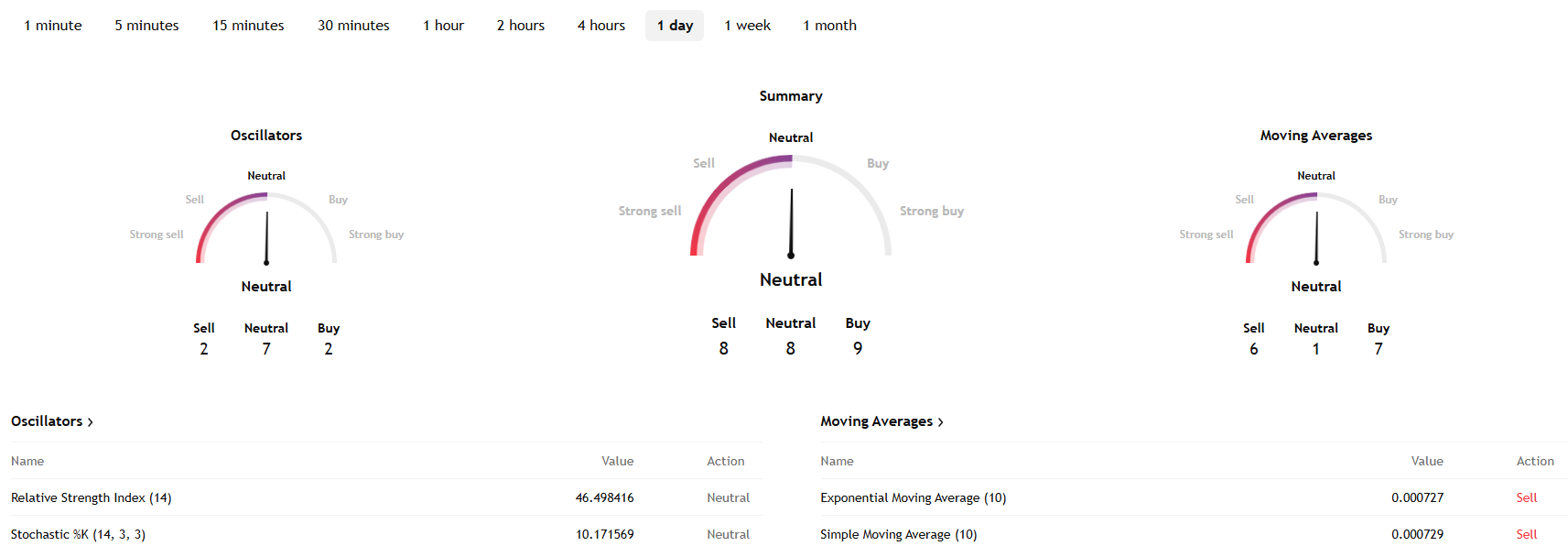

1. Technical Analysis Approach

Support and Resistance Levels: Identify key price levels where the KRW/USD has historically reversed. These levels often act as psychological barriers for traders. Use weekly and monthly charts to identify major levels, then drill down to daily charts for precise entry points.

Moving Averages: Use the 20-day and 50-day moving averages to identify trend direction. When the 20-day crosses above the 50-day, it often signals a bullish trend for the Won. The 200-day moving average serves as a long-term trend indicator.

RSI Indicators: The Relative Strength Index helps identify overbought (above 70) and oversold (below 30) conditions, providing entry and exit signals. Combine RSI with price action for higher probability trades.

Bollinger Bands: These help identify volatility expansion and contraction periods, crucial for timing entries in the KRW/USD pair which can experience sudden moves.

2. Fundamental Analysis Strategy

Economic Calendar Monitoring: Track South Korean GDP releases, inflation data, and employment figures. Strong economic data typically supports Won strength. Pay particular attention to manufacturing PMI and export data, as these directly impact currency valuation.

Central Bank Communications: Follow Bank of Korea statements and Federal Reserve announcements, as policy divergence creates trading opportunities. Governor speeches and meeting minutes often provide forward guidance.

Trade Balance Reports: South Korea's trade surplus or deficit significantly impacts Won valuation, making these reports crucial for fundamental traders. Monthly trade data releases can trigger substantial price movements.

Corporate Earnings Impact: Major Korean conglomerates' earnings reports can influence Won sentiment, particularly during quarterly reporting seasons when repatriation flows increase.

3. News-Based Trading

Technology Sector Performance: Samsung and other Korean tech giants' earnings can influence Won sentiment, particularly during quarterly reporting seasons. Monitor semiconductor industry trends as they heavily impact Korean exports.

Commodity Price Movements: As an oil importer, South Korea's currency often weakens when crude oil prices rise, creating predictable trading patterns. Track Brent crude and WTI prices for correlation opportunities.

China Economic Data: Given China's role as South Korea's largest trading partner, Chinese economic releases significantly impact the Won. Monitor Chinese PMI, GDP, and trade data.

Risk Management Essentials

Position Sizing

Never risk more than 2% of your trading capital on a single KRW/USD trade. This conservative approach protects your account during unexpected market movements. Calculate position sizes based on your stop-loss distance and account balance.

Use the formula: Position Size = (Account Balance × Risk Percentage) ÷ Stop Loss Distance

Stop-Loss Placement

Set stop-losses at logical technical levels, typically 1-2% below your entry point for long positions. Avoid placing stops at round numbers where many other traders might have similar orders. Consider using trailing stops to lock in profits as trades move in your favour.

Take-Profit Targets

Establish profit targets at key resistance levels or use a risk-reward ratio of at least 1:2. This means if you're risking 50 pips, aim for a minimum 100-pip profit. Scale out of positions by taking partial profits at multiple levels.

Correlation Risk Management

Monitor correlations with other Asian currencies and equity markets. High correlation periods require reduced position sizes to avoid overexposure to regional risk factors.

Market Timing and Sessions

Asian Trading Session

The KRW/USD pair is most active during Asian trading hours (23:00-08:00 GMT), when Korean markets are open and liquidity is highest. This session offers the tightest spreads and most reliable price action for the pair.

Economic Release Times

Korean economic data typically releases at 23:00 GMT, creating immediate volatility. Position yourself before these announcements or wait for the initial reaction to subside. Major releases can cause 100+ pip moves within minutes.

Seasonal Patterns

The Won often strengthens in Q4 due to year-end repatriation flows from Korean exporters, whilst Q1 can see weakness due to dividend payments to foreign investors. These seasonal patterns provide additional trading opportunities for patient traders.

Holiday Considerations

Korean national holidays can significantly reduce liquidity and increase volatility. Plan your trading calendar around major Korean holidays like Chuseok and Lunar New Year.

Advanced Trading Techniques

Carry Trade Opportunities

When Korean interest rates exceed US rates, consider carry trades where you buy KRW and sell USD to earn the interest differential. Monitor central bank policies closely for changes that could reverse these opportunities.

Correlation Trading

The Won often correlates with other Asian currencies like the Japanese Yen and Chinese Yuan. Use these relationships to confirm trade signals or hedge positions. During risk-off periods, these correlations typically strengthen.

Options Strategies

Consider using currency options to limit downside risk whilst maintaining upside potential, particularly around major economic announcements. Protective puts can safeguard long Won positions during uncertain periods.

Arbitrage Opportunities

Monitor price differences between onshore (KRW) and offshore (NDF) markets for potential arbitrage opportunities, though these typically require significant capital and sophisticated execution.

Common Pitfalls to Avoid

Overleverage

The KRW/USD can experience sudden volatility due to geopolitical events. Excessive leverage can quickly wipe out accounts during these periods. Stick to conservative leverage ratios, especially when trading around news events.

Ignoring Market Sentiment

Don't trade against strong market sentiment without compelling technical or fundamental reasons. The crowd is often right in the short term, and fighting major trends can be costly.

Poor Timing

Avoid trading during low-liquidity periods when spreads widen and price movements become erratic. Early Monday morning and late Friday sessions often present challenging trading conditions.

Neglecting Geopolitical Risks

Korean Won trading requires constant awareness of geopolitical developments. Sudden escalations in regional tensions can override technical and fundamental analysis.

Technology and Tools

Trading Platforms

Use professional platforms offering real-time KRW/USD quotes, advanced charting tools, and economic calendars. Ensure your platform provides access to Korean market hours and local news feeds.

Mobile Trading

Ensure your trading platform offers mobile access for managing positions when away from your computer, particularly important given Asian market hours. Test mobile execution speed and reliability before relying on it for active trading.

Automated Alerts

Set price alerts for key technical levels and economic announcement times to never miss trading opportunities. Configure alerts for correlation breakdowns and unusual volume spikes.

Research Tools

Utilise economic calendars, central bank communication trackers, and correlation matrices to enhance your analysis. Bloomberg, Reuters, and Korean financial news sources provide essential market intelligence.

Conclusion

The Korean Won to USD currency pair offers excellent opportunities for disciplined traders who understand the underlying economic dynamics and employ proper risk management. Success requires patience, continuous learning, and strict adherence to your Trading plan.

By implementing these professional strategies and maintaining disciplined risk management, you can develop a profitable approach to trading this dynamic Asian currency pair.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.