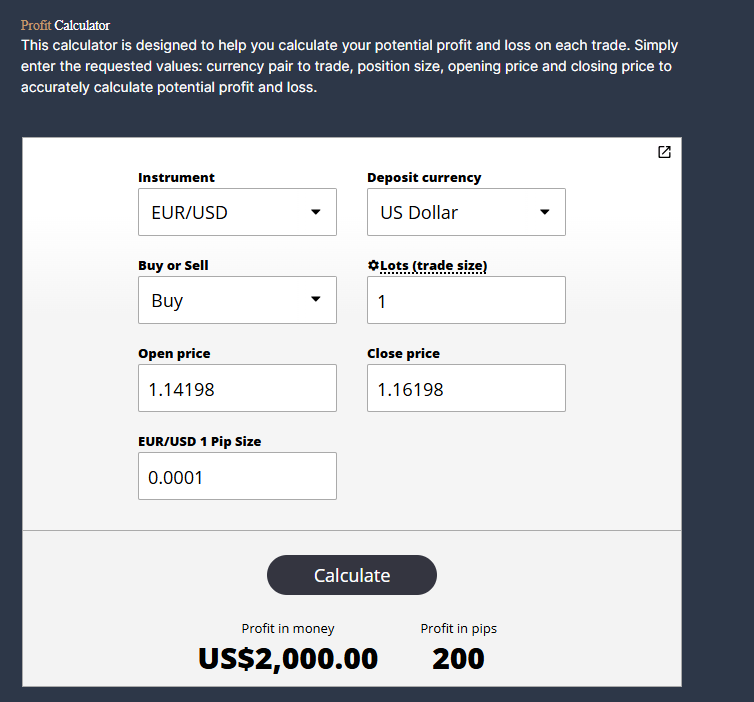

In forex trading, where precision and timing are everything, using the right tools can make a measurable difference. One such tool is the profit calculator forex traders turn to for fast, reliable insights into potential trade outcomes.

While often overlooked by beginners, this tool provides vital information that helps both novice and experienced traders understand their potential gains or losses before they open a position.

Rather than relying on rough estimates or emotional decisions, the profit calculator forex traders use takes all key trade parameters into account. This includes entry price, exit price, trade volume, and the currency pair being traded. With this data, it delivers an instant and accurate picture of possible profit or loss—empowering smarter and more disciplined trading.

What Is a Profit Calculator Forex Tool?

A profit calculator forex traders use is a digital tool, often embedded into trading platforms or available as a standalone website feature. It is designed to estimate how much a trader stands to gain or lose from a given trade, based on specific inputs.

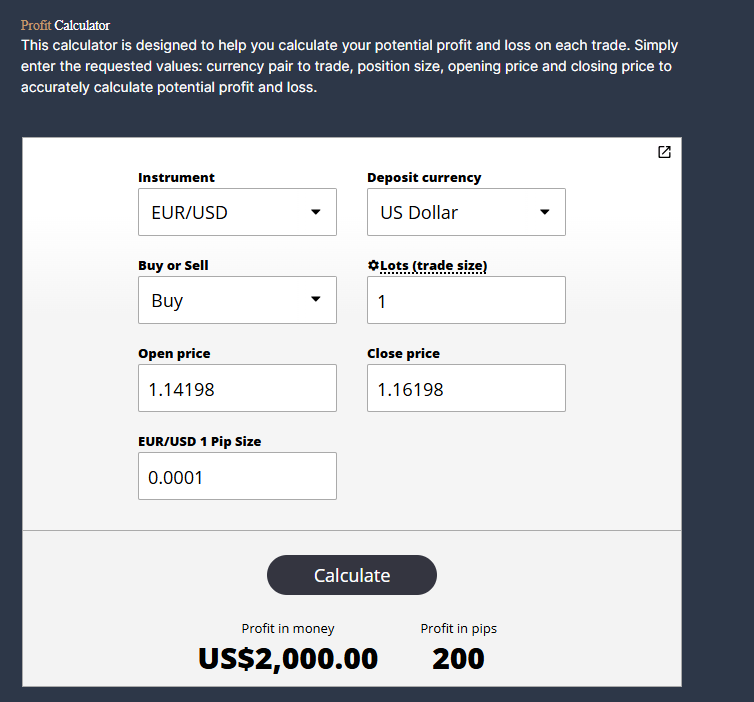

These tools typically ask for the trading pair, entry and exit price, trade size (usually in lots or units), and account currency. Once the information is entered, the calculator runs the numbers based on pip value and the relevant exchange rate. The result is a monetary figure showing the profit or loss the trader can expect if the trade plays out as defined.

This calculation is especially useful when planning stop-loss and take-profit levels. It turns abstract risk into a tangible figure, making it easier for traders to stick to their strategies.

The Key Role of Accuracy in Trade Planning

One of the greatest advantages of using a profit calculator forex traders often cite is its accuracy. Without such a tool, a trader might miscalculate the potential risk or reward, especially when dealing with different lot sizes or exotic currency pairs.

Even minor misjudgements in pip value or trade volume can lead to major differences in outcomes. By providing a precise breakdown, a profit calculator ensures that traders are not flying blind. This accuracy is essential when trying to maintain consistent position sizing, which is a core principle in risk management.

Traders who skip this step often find themselves taking on more risk than they realise, especially in volatile markets. A profit calculator helps correct that by exposing the true scale of each position.

Common Mistakes Without a Profit Calculator Forex Tool

Many traders make decisions based on assumptions, rough estimations, or past experiences. This approach might work in calm markets, but it often leads to errors during high volatility or when trading larger lot sizes. Without a profit calculator forex trades can quickly spiral out of control if the trader hasn't fully considered the pip value or leverage.

Some of the most common mistakes include entering trades with incorrect lot sizes, misjudging the financial impact of a stop-loss level, or ignoring currency conversion rates. These mistakes may not always result in a loss, but they do weaken the trader's overall risk control.

By contrast, using a profit calculator before each trade promotes greater discipline and reduces the chances of emotional or impulsive decision-making.

When and How to Use a Profit Calculator Forex Traders

The profit calculator forex traders trust is best used before entering any trade. This is the moment when planning matters most. The calculator helps you evaluate the potential reward versus risk, and whether the setup aligns with your trading strategy.

To use it effectively, you should have your intended entry and exit points already mapped out. Next, you enter the lot size and ensure that your account currency is correctly selected. The calculator will show you not just the pip value, but the monetary impact of your trade, both in profit and in potential loss.

Some calculators even offer extra features such as spread cost inclusion or margin requirement estimates. These details help form a complete picture, allowing you to see whether the trade is worth taking based on your rules and goals.

Strategy Alignment

One of the overlooked strengths of the profit calculator forex traders use is how it helps align trades with broader strategy goals. For instance, if a trader uses a 2:1 reward-to-risk ratio, they can instantly see whether a planned trade meets this criterion before committing any capital.

This is especially helpful for traders who use automated systems, fixed position sizing models, or who trade in fast-moving sessions like the London open. With the calculator, there's no need to stop and manually run complex equations. The result is faster decisions without sacrificing accuracy.

When used consistently, the profit calculator becomes a bridge between strategy and execution. It ensures that traders are not straying from their own rules, even during times of market excitement or stress.

Myths About the Profit Calculator Forex Tools

One common myth is that only new traders need such a tool. In truth, many professionals use it regularly to confirm trade parameters. Another myth is that a profit calculator is only useful for large accounts. However, even micro account holders benefit from knowing their exact exposure.

Some traders wrongly assume that their trading platform's interface already includes this functionality in the position window. While many platforms do offer real-time profit and loss during a trade, that information only becomes available after the trade is placed. A profit calculator, on the other hand, is used beforehand—when it matters most.

Dismissing it as unnecessary can lead to avoidable losses and missed opportunities to refine trading discipline.

Final Thoughts

While the profit calculator forex traders rely on may seem like a small component of the broader trading toolkit, its importance should not be underestimated. It is a tool that empowers planning, removes guesswork, and supports consistent strategy execution.

Whether you are trading manually or following a system, incorporating a profit calculator into your routine helps build good habits. It ensures that every trade has a clear risk-reward profile and that decisions are based on facts, not assumptions.

Ultimately, the truth about profit calculator forex tools is that they offer clarity in a market where uncertainty is the norm. For that reason alone, they deserve a permanent spot in every trader's process.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.