The Legacy of Steve Nison in Technical Analysis

Steve Nison is widely regarded as the figure who transformed the Western world's understanding of Japanese candlestick charting. Before his work in the late 1980s and early 1990s, candlestick patterns were scarcely known outside Japan. His books, Japanese Candlestick Charting Techniques and Beyond Candlesticks, not only introduced these charts to traders but also demonstrated how they could be used in combination with Western technical tools.

His contribution was more than a simple translation of a Japanese method. Nison provided context, interpretation, and integration, making candlesticks a cornerstone of modern trading. Today, almost every charting platform includes candlestick views by default—a testament to his influence.

From Rice Markets to Wall Street: The Story of Candlesticks

The roots of candlestick charting can be traced back to 18th-century Japanese rice traders, most notably Munehisa Homma, who observed the psychology of buyers and sellers through price movements. These early traders developed visual patterns to represent emotion, momentum, and reversals in the market.

Nison's brilliance lay in recognising that these centuries-old techniques were timeless. Whether tracking rice contracts in Osaka or equity indices in New York, candlesticks captured the universal rhythm of human behaviour in markets. By bridging East and West, he revived an ancient technique and demonstrated its relevance in an era of electronic trading.

Steve Nison and the Power of Market Context

One of Nison's most consistent lessons is that no candlestick pattern should ever be read in isolation. A hammer or engulfing candle may suggest a reversal, but without an understanding of the broader market trend, the pattern may mislead.

This is where moving averages play a crucial role. Moving averages smooth price action, filtering out noise and providing a clear sense of direction. For Nison, they offered the necessary backdrop against which candlesticks could be accurately interpreted. A bullish engulfing candle that appears above a rising average carries a very different weight than the same candle in a falling market.

The Disparity Index: Steve Nison's Moving Average Innovation

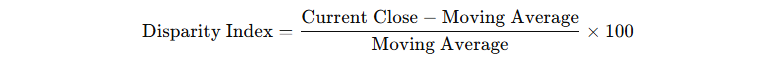

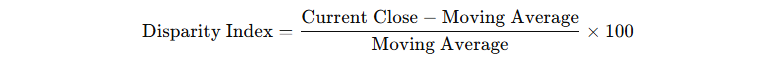

Among Nison's contributions, the Disparity Index stands out as a distinctive tool. Introduced in Beyond Candlesticks, the index measures the percentage difference between the current closing price and a selected moving average.

The formula is straightforward:

This indicator highlights how far price has strayed from its average, offering a visual measure of momentum and potential extremes. When prices are far above the average, the market may be overbought; when far below, it may be oversold.

By combining the Disparity Index with candlestick signals, traders gain a sharper sense of timing. For instance, if a hammer candle forms while the Disparity Index is at a deeply negative reading, the likelihood of a reversal is considerably strengthened.

Beyond the Average: How Traders Use SMA, EMA, and WMA

In his writings, Nison did not promote a single "best" moving average but explored the uses of different types:

Simple Moving Average (SMA): Each data point is weighted equally, providing a broad view of trend.

Weighted Moving Average (WMA): Gives more emphasis to recent data, making it more responsive to current shifts.

Exponential Moving Average (EMA): Prioritises the most recent prices, often favoured by short-term traders for its sensitivity.

Nison explained that these averages were not predictive devices but supportive tools. Their value lies in confirming what the candlesticks suggest, rather than forecasting independently.

Steve Nison on Confirmation vs Prediction

A hallmark of Nison's philosophy is his insistence on confirmation. He warned traders against relying on any one tool to predict price movements. A moving average cross or a candlestick pattern on its own might be tempting, but true reliability comes when tools are used together.

For example, a doji at the peak of a rally may indicate indecision. If this occurs at a point where the price is significantly stretched above an exponential moving average, the case for a reversal strengthens. In this way, moving averages act as a filter, validating candlestick insights rather than competing with them.

Blending East and West: Nison's Lasting Contribution

Steve Nison's work is often described as a bridge between traditions. By merging Japanese candlestick techniques with Western indicators such as moving averages, oscillators, and support/resistance frameworks, he created a holistic approach.

This blend has become so standard that many traders today forget its origins. The marriage of a centuries-old Japanese visual tool with modern Western mathematics represents a synthesis of culture, history, and technology.

Applying Steve Nison's Wisdom in Today's Markets

Although Nison's books were published decades ago, his insights remain highly relevant. Modern markets are faster, more algorithm-driven, and more global than ever. Yet the core principles of discipline, context, and confirmation still apply.

In algorithmic systems, moving averages are often coded into trading strategies as filters for entry and exit signals. Incorporating candlestick logic, as Nison encouraged, can enrich these models by adding a layer of psychological context. For discretionary traders, the lesson is equally clear: candlesticks show intent, moving averages show trend, and together they form a more complete picture.

Final Thoughts: The Timeless Guidance of Steve Nison

Steve Nison's legacy lies in more than his introduction of candlesticks. It lies in his philosophy of integration—never taking signals at face value, always seeking confirmation, and respecting the interplay between price and context.

By linking candlesticks to moving averages, particularly through his Disparity Index, Nison gave traders tools that transcend timeframes and asset classes. Whether in equities, commodities, or currencies, his principles remind us that markets are a blend of numbers and psychology.

For traders today, the message remains timeless: respect the past, use the tools of the present, and never stop seeking balance between insight and confirmation.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.