Steve Nison's Japanese Candlestick Charting Techniques revolutionised Western trading by introducing a visually intuitive way to analyse market trends and investor psychology. Rooted in centuries of Japanese trading experience, the book provides essential knowledge for both novice and experienced traders who want to understand market reversals, continuations, and price behaviour.

Introduction to Japanese Candlestick Charting Techniques

Japanese Candlestick Charting Techniques begins by explaining the fundamentals of candlestick charts, which display the relationship between open, high, low, and close prices over a given period. Unlike traditional bar charts, candlestick charts provide immediate visual insight into market sentiment. Nison emphasises that understanding these charts is the first step in anticipating price movements.

The book also introduces key candlestick patterns, including reversal, continuation, and indecision patterns, demonstrating how they reflect market psychology and can guide trading decisions. By using Japanese Candlestick Charting Techniques, traders gain an analytical edge that goes beyond simple trend-following.

Reversal Patterns in Japanese Candlestick Charting Techniques

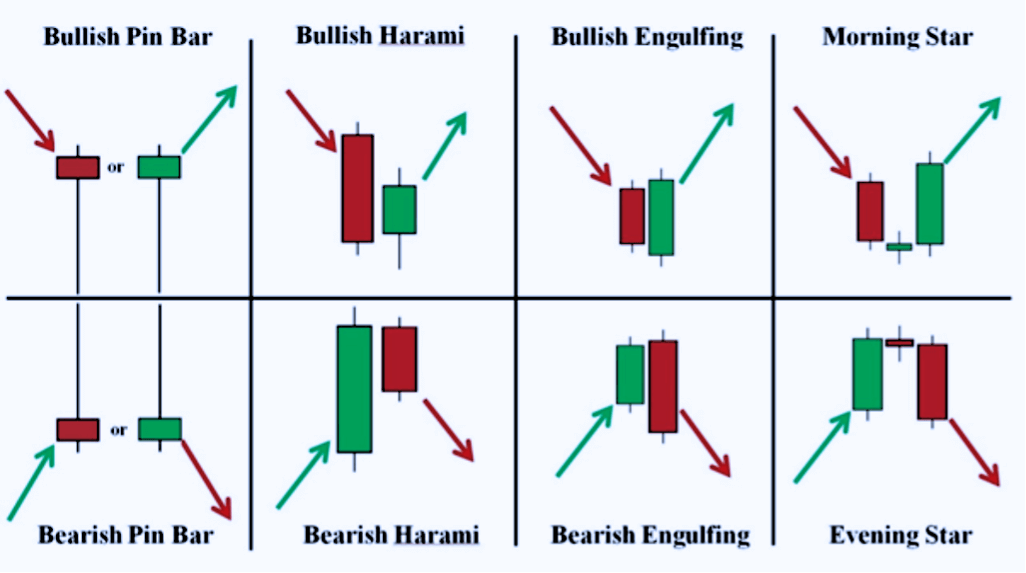

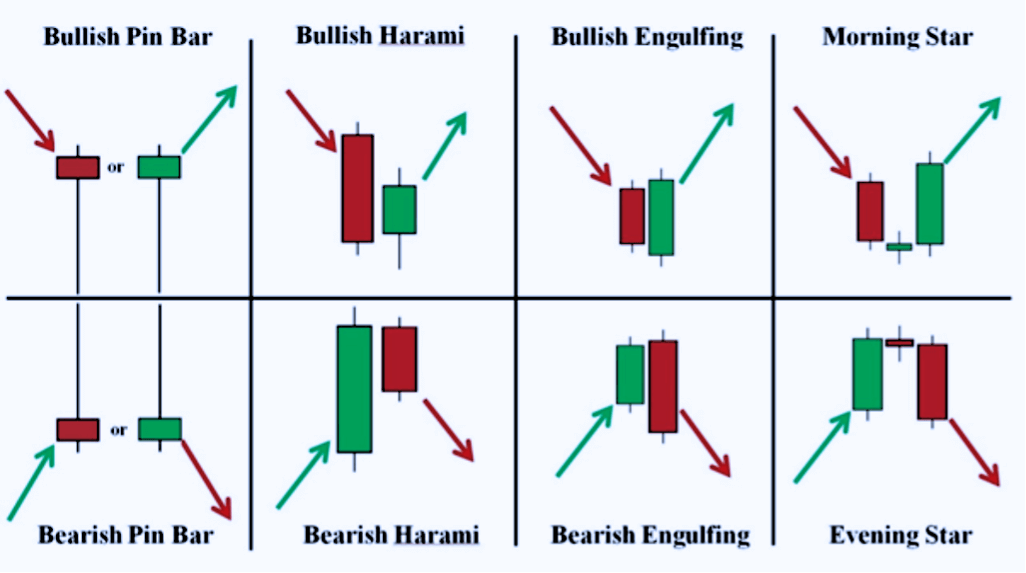

A significant portion of Japanese Candlestick Charting Techniques focuses on reversal patterns, which indicate potential changes in market direction. Nison details both bullish and bearish patterns:

Bullish Patterns: Hammer, Inverted Hammer, Morning Star, Piercing Line, and Bullish Engulfing. These patterns suggest opportunities to enter long positions after a downtrend.

Bearish Patterns: Hanging Man, Shooting Star, Evening Star, Dark Cloud Cover, and Bearish Engulfing. Recognising these signals can help traders anticipate market downturns.

By studying these patterns in Japanese Candlestick Charting Techniques, traders can identify trend reversals earlier and adjust their strategies accordingly.

Continuation Patterns in Japanese Candlestick Charting Techniques

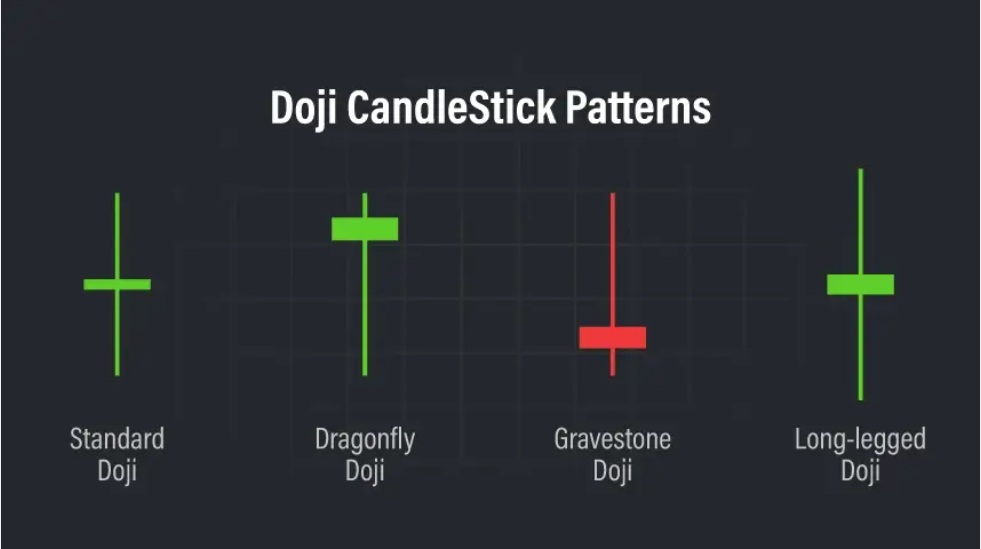

In addition to reversals, Japanese Candlestick Charting Techniques explains continuation patterns that signal the persistence of a current trend. Key patterns include:

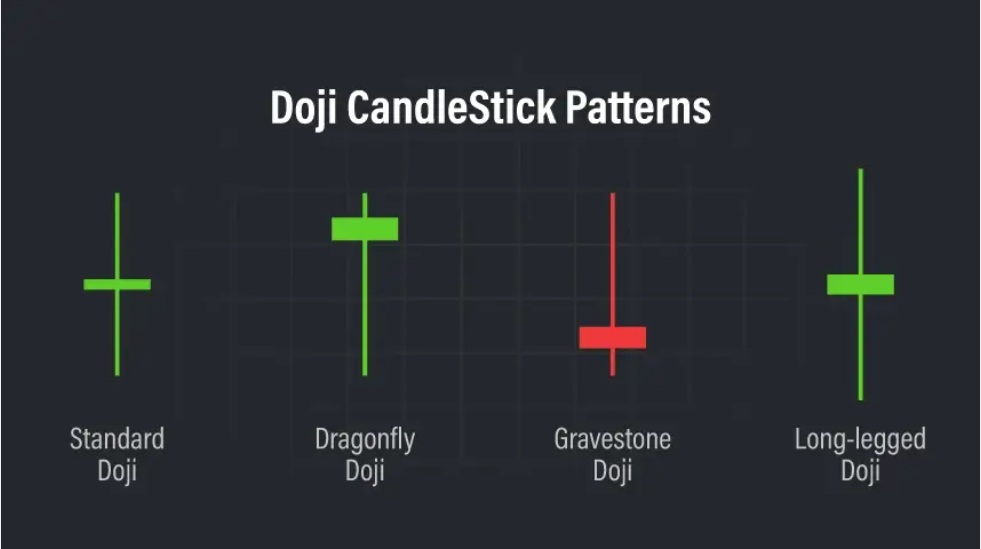

Doji Candles: Including Long-Legged, Gravestone, Dragonfly, and Four-Price Doji. These often indicate market indecision before a continuation or reversal.

Nison's text emphasises that mastering these patterns allows traders to stay aligned with market trends and manage trades more effectively.

Advanced Candlestick Patterns in Japanese Candlestick Charting Techniques

Japanese Candlestick Charting Techniques also explores advanced patterns that provide deeper insight into price movements. These include:

By understanding these advanced patterns, traders can anticipate market behaviour with greater confidence, as highlighted throughout Japanese Candlestick Charting Techniques.

Applying Japanese Candlestick Charting Techniques in Trading

One of the greatest strengths of Nison's Japanese Candlestick Charting Techniques is its practical application. The book explains how to integrate candlestick patterns with other technical tools like moving averages, RSI, and MACD to improve trade accuracy.

Traders are guided on how to develop actionable strategies:

Setting entry and exit points based on pattern confirmations

Using volume and other indicators to validate signals

Implementing effective risk management and position sizing

The book also includes case studies demonstrating how candlestick patterns have historically predicted price movements, allowing readers to apply the techniques to real-world scenarios.

Conclusion

Steve Nison's Japanese Candlestick Charting Techniques remains a cornerstone of modern technical analysis. By mastering the candlestick patterns and methods presented in the book, traders can better understand market psychology, anticipate trend reversals, and make informed trading decisions.

Whether used alone or in combination with other technical tools, Japanese Candlestick Charting Techniques provides a timeless framework for navigating the financial markets with confidence.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.