Thomas Bulkowski: The Man Behind the Charts

Thomas N. Bulkowski is a name that resonates with traders and analysts worldwide. Renowned for his meticulous study of chart patterns, Bulkowski has spent over four decades dissecting financial markets to uncover the statistical probabilities behind price movements.

Unlike many market commentators who rely on intuition, Bulkowski's approach is firmly grounded in empirical research, making his work a trusted resource for both beginners and professional traders.

Born with a keen analytical mind, Bulkowski dedicated much of his career to studying the intricacies of stock price behaviour. Over the years, he has meticulously compiled data from thousands of trading scenarios, transforming anecdotal knowledge into actionable insights.

His influence is particularly notable in the realm of technical analysis, where his research has become a benchmark for evaluating chart patterns.

Charting His Legacy: Major Works

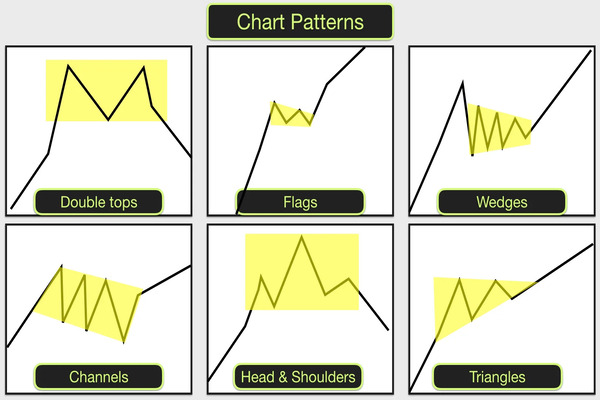

Bulkowski's literary contributions have shaped how traders approach the markets today. Among his publications, four stand out as particularly influential.

1)Encyclopedia of Chart Patterns

Often referred to as the definitive reference for chart patterns, Encyclopedia of Chart Patterns catalogues seventy-five distinct patterns, including twenty-three that were previously undocumented.

What sets this work apart is Bulkowski's commitment to statistics: each pattern is accompanied by historical performance data, failure rates, and actionable trading strategies. Traders using this book can evaluate patterns with a clear understanding of probabilities, reducing reliance on guesswork.

2)Chart Patterns: After the Buy

Unlike many trading books that focus on spotting patterns, Chart Patterns: After the Buy shifts the focus to the critical post-breakout phase. Bulkowski examines what typically happens once a breakout occurs, helping traders understand the likely price movements that follow.

Drawing on data from over 43.000 patterns, the book provides guidance on optimal exit points and follow-through strategies. This makes it an invaluable resource for traders looking to refine risk management and maximise potential returns.

3)Visual Guide to Chart Patterns

Understanding that not all traders are comfortable with statistics, Bulkowski created the Visual Guide to Chart Patterns, an accessible reference packed with clear visuals and straightforward explanations.

The guide helps traders quickly spot patterns on live charts and grasp their likely behaviour, effectively bridging the gap between theory and practical trading application.

4)Getting Started in Chart Patterns

For newcomers, Bulkowski offers Getting Started in Chart Patterns, an introductory guide that covers the basics of technical analysis. It is designed to help beginners recognise common patterns, understand their significance, and develop foundational trading strategies without being overwhelmed by complex statistics.

The Science of Patterns: Bulkowski's Methodology

What truly distinguishes Bulkowski is his empirical methodology. Unlike analysts who rely on anecdotal evidence or intuition, Bulkowski systematically collects data from thousands of historical trades, evaluating each pattern according to well-defined performance metrics.

1)Empirical Research

Bulkowski's research involves rigorous statistical analysis, assessing the likelihood of pattern success, average price targets, and typical failure points. By quantifying what historically works, he transforms chart patterns from speculative tools into evidence-based instruments.

2)Performance Metrics

Each pattern is assessed using a variety of metrics, including breakout success rate, average gain, and failure probability. These metrics allow traders to compare patterns objectively and prioritise those with higher historical reliability.

3)Trading Tactics

Bulkowski complements his research with practical trading tactics. He provides guidance on optimal entry points, stop-loss placement, and trade management.

By combining empirical data with actionable strategies, traders can approach the markets with a disciplined, systematic methodology.

Beyond the Books: Online Resources & Tools

Thomas Bulkowski has extended his influence beyond print, creating online resources that continue to support traders globally.

His website, ThePatternSite.com, serves as an encyclopaedia of chart patterns. It offers detailed statistical analysis, pattern recognition guides, and updates on market behaviour. Traders can access a wealth of information that complements his books, including case studies and pattern performance charts.

Bulkowski's Amazon author page provides a comprehensive list of his publications, offering easy access to his works and enabling readers to track new releases. His books remain widely reviewed and recommended, highlighting his authority in the field.

Through his writings and online presence, Bulkowski has cultivated a global community of traders who rely on his research for informed decision-making. From forums to trading groups, his empirical insights continue to shape trading strategies and technical analysis education.

Expert Insights: Why Bulkowski Matters Today

Even in an era of algorithmic trading and high-frequency markets, Bulkowski's work remains highly relevant. His data-driven approach ensures that traders can distinguish between high-probability patterns and statistical anomalies.

The principles Bulkowski outlines are applicable across various asset classes, including equities, commodities, and forex. His emphasis on probabilities and pattern recognition equips traders to navigate volatile and complex markets with a systematic edge.

While Bulkowski's analysis is comprehensive, some critics argue that historical patterns may not always predict future performance, particularly in markets influenced by algorithmic trading or macroeconomic interventions.

Traders are advised to combine his insights with current market context for the most effective strategy.

FAQ: Unlocking Bulkowski's Trading Wisdom

Q1: What is the Encyclopedia of Chart Patterns?

It is Bulkowski's comprehensive reference book cataloguing seventy-five chart patterns, complete with performance statistics, failure rates, and trading tactics.

Q2: How does Bulkowski's approach differ from other technical analysts?

Bulkowski prioritises empirical research, relying on statistical analysis of historical data rather than anecdotal observation or intuition.

Q3: Are his strategies suitable for all market conditions?

While historically grounded, traders should adapt Bulkowski's strategies to contemporary market conditions, considering factors such as volatility, liquidity, and macroeconomic events.

Q4: Where can I access Bulkowski's resources?

His official website, ThePatternSite.com, provides comprehensive pattern analysis, trading guides, and links to his books and updates.

Closing Thoughts: Trading with Data, Not Guesswork

Thomas Bulkowski's contribution to technical analysis cannot be overstated. By transforming chart patterns into a quantifiable, empirical science, he empowers traders to make informed decisions rooted in statistical evidence.

His books, online resources, and ongoing research offer invaluable guidance for anyone seeking to approach the markets systematically.

Ultimately, Bulkowski reminds traders that success is less about luck and more about discipline, preparation, and understanding probabilities. In a world of speculation and noise, his work stands as a beacon for data-driven trading and evidence-based analysis.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.