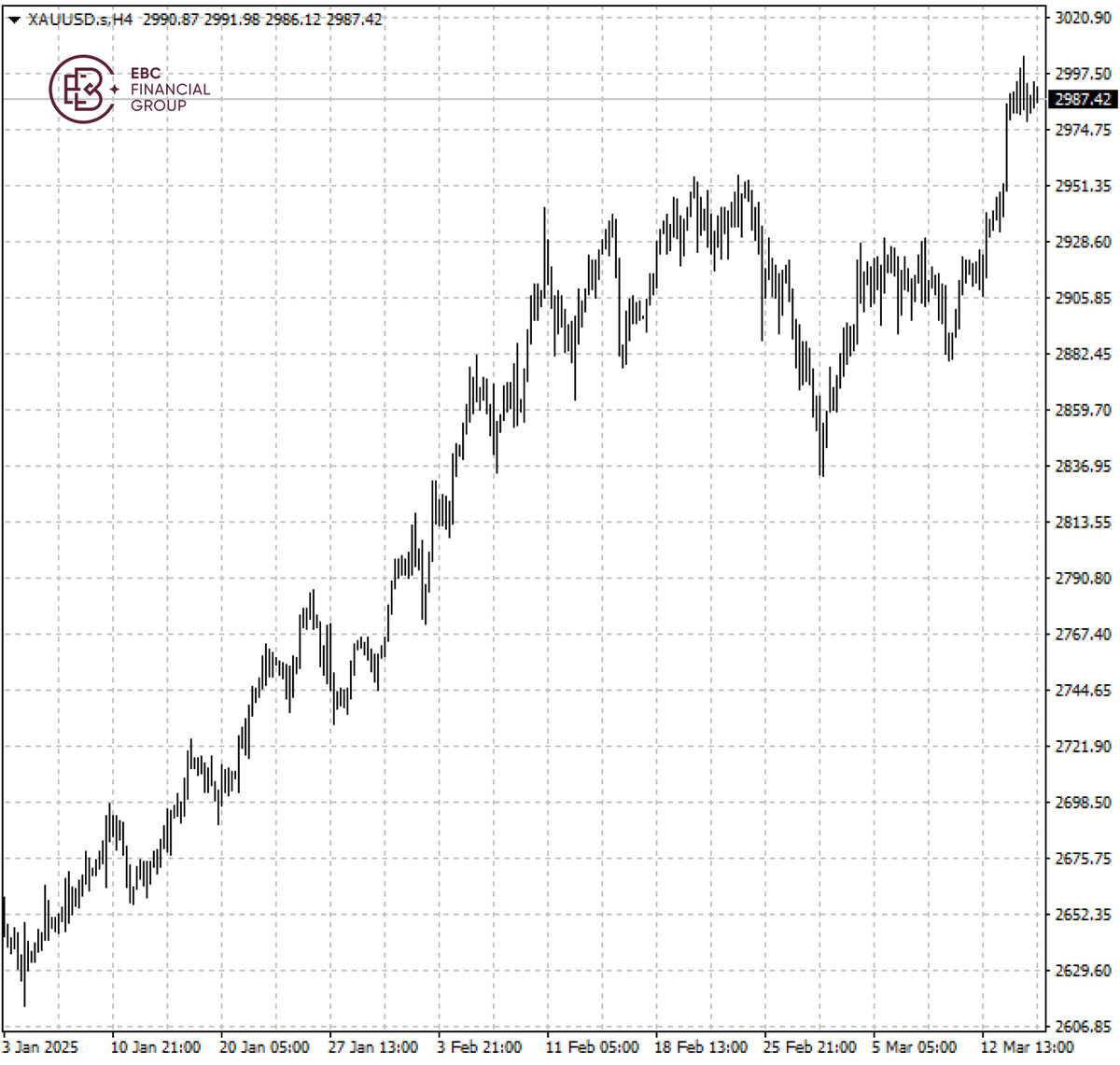

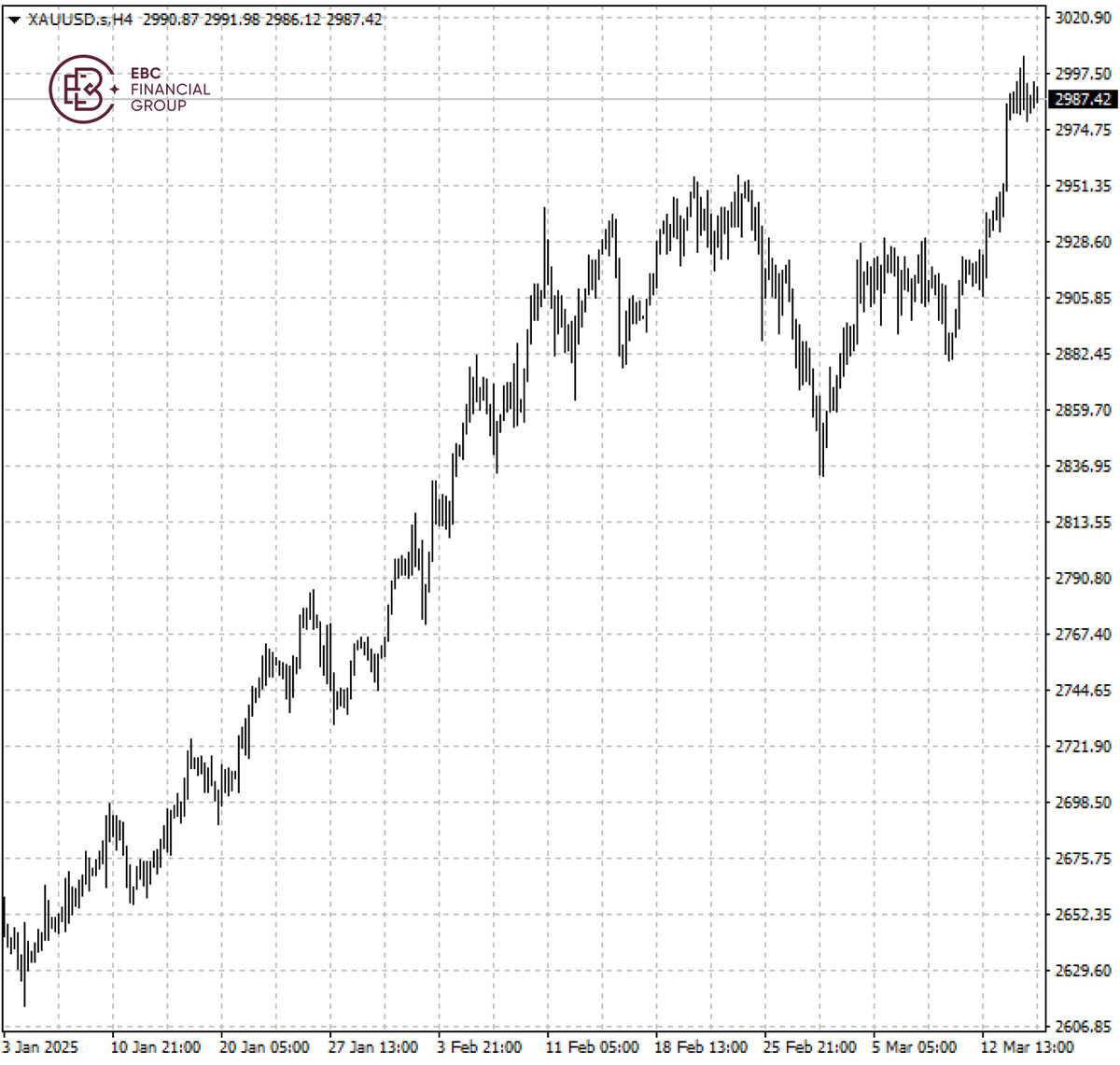

Gold steadied below $3,000 on Monday after hitting a fresh record high last

week. Goldman Sachs said in a note there was upside risk to its $3,100 end-2025

base case scenario.

Traditionally viewed as a safe store of value during geopolitical turmoil,

bullion has risen around 14% so far this year, driven in part by concerns over

the impact of Trump's tariffs and a selloff in stock markets.

The metal has also been supported by central bank demand, with the PBOC

building its bullion reserves for a fourth straight month in February. Trump has

ramped up tariffs on imports of Chinse goods.

The European Commission said that it will impose counter tariffs on €26

billion worth of US goods from next month, marking a flare-up in global trade

war.

Trump is expected to speak with Putin this week on ways to end the three-year

war in Ukraine, US envoy Steve Witkoff told CNN on Sunday after returning from

what he described as a "positive" meeting in Moscow.

Kremlin set out tough conditions for the potential truce. A license allowing

US energy transactions with Russian financial institutions expired last week,

according to the Trump administration.

Bullion was facing strong resistance at the psychological level, so we see

consolidation in the short term. A push below $2,980 could expose $2,960.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.