Bill Lipschutz is one of the most remarkable currency traders in modern finance, celebrated for turning a modest inheritance into hundreds of millions through disciplined strategy and psychological mastery.

Known as the "Sultan of Currencies," he built his reputation at Salomon Brothers in the 1980s, where his deep understanding of risk, sentiment, and market behaviour made him a legend in the world of forex trading.

This article will break down his background, core trading principles, mindset, strategic insights, operational framework, common pitfalls and why his lessons remain relevant today.

The Background of Bill Lipschutz: From Student Trader to FX Legend

Bill Lipschutz was born in Farmingdale, New York, in 1956. He studied at Cornell University, earning a Bachelor of Fine Arts in Architectural Design and then an MBA in Finance.

His initial trading journey began when he inherited around USD 12.000 in stocks while still a student. He managed to grow it to approximately USD 250.000 through aggressive trading before suffering a large loss that wiped most of it out.

In 1982 he joined Salomon Brothers as part of their newly‑formed Foreign Exchange Department, and by 1988 he was Director and Global Head of FX Options. In 1989 he became Managing Director and Global Head of Foreign Exchange.

By the mid‑1980s, he was reportedly generating upwards of USD 300 million per year for Salomon's proprietary FX desk.

In 1995 he co‑founded Hathersage Capital Management, a hedge fund specialising in G10 currencies, where he currently serves as Principal and Director of Portfolio Management.

His rise from student trader to one of the most respected currency‑traders sets the stage for his philosophies.

Core Principle: Risk Control & Position Sizing in Bill Lipschutz's Trading

At the heart of Bill Lipschutz's trading philosophy lies risk control and position sizing, more so than predicting the market's direction. He often emphasises that being right less than half the time can still yield profits if losses are small and winners large.

| Principle |

Description |

Example / Notes |

| Time as a risk factor |

Longer trades hold exposure for more time → more uncertainty |

Lipschutz stresses that if you don't know when you will be right, you probably will be wrong. |

| Reward to risk ratio |

Seek favourable payout compared to potential loss |

One source lists ideal ~3:1 ratio. |

| Position scaling / size |

Limiting trade size to manageable fraction of capital, adjusting as market moves |

Helps prevent catastrophic drawdowns even if many trades lose |

His view is that you must manage risk first, profit second. He once said: "The key to successful trading is to focus on risk control, not on making money."

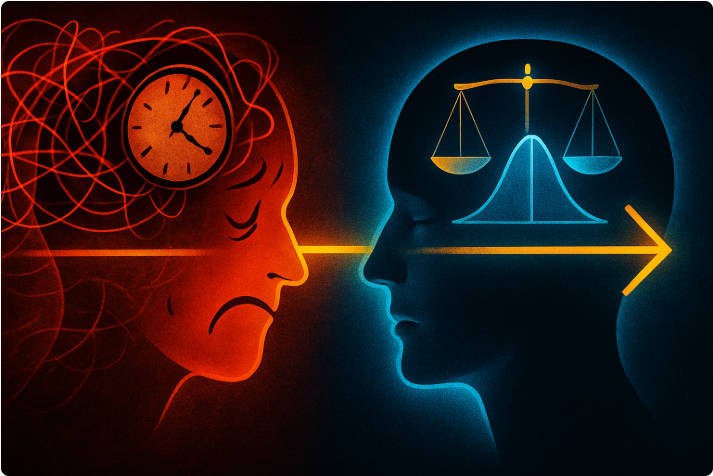

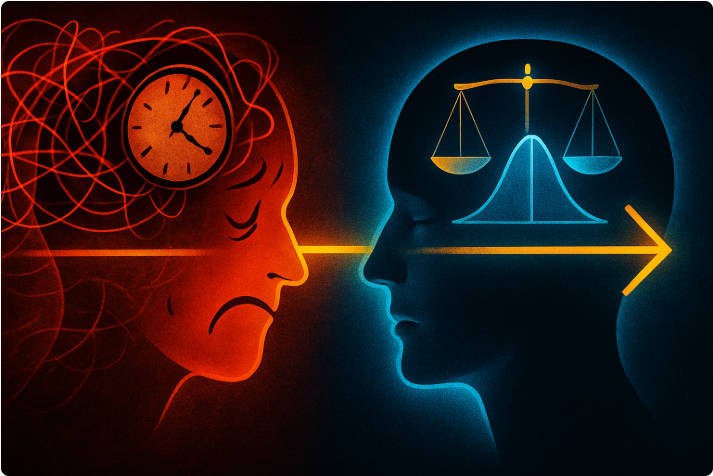

Psychology & Mindset: How Bill Lipschutz Approaches the Game

Bill Lipschutz places enormous emphasis on psychology. He views trading as a game of probabilities rather than certainties. In one interview he stated:

Key mindset features:

Accepting losses as part of the process. He argues that many traders fail because they cannot tolerate the pain of being wrong.

Maintaining discipline, staying focused and avoiding emotional decisions.

Concentrating on quality of trades, not quantity. He urges waiting for when the odds are significantly in your favour.

| Attribute |

Good Trader (Lipschutz‑style) |

Less Successful Trader |

| Risk management |

Strict |

Lax |

| Loss attitude |

Learns and moves on |

Angst, paralysis |

| Emotional state |

Calm and consistent |

Reactive, erratic |

| Trade volume |

Fewer, high‐conviction |

Many, lower conviction |

He believes that your psychological capital is as real as your financial capital. By preserving emotional discipline, you preserve the ability to trade well.

Strategic Insight: Market Forces, Timing & Macro Awareness

Unlike purely technical traders, Bill Lipschutz combines deep macroeconomic insight with execution discipline. He studies political events, interest rate shifts, currency flows and the broader context before acting.

Although he uses technical levels for entries and exits, his directional bias is shaped by fundamentals.

Some strategic themes:

Recognise when an opportunity is rare and large enough to commit capital. He once executed a trade buying a mis‑priced British bond with a sterling redemption option exploited via forward FX markets.

Stay aware of "outside forces" — markets are influenced by more than charts. Major macro events may invert trends quickly.

Trade fewer but higher quality ideas. His focus: "you must be willing to allow your profits to run and your losses to cut short."

Bill Lipschutz's Operational Framework: Practical Steps for Traders

Bringing his principles into operational form, here is how one might model a Bill Lipschutz‑inspired trading plan:

1. Preparation & Research

Review macroeconomic calendar, currency flows and geopolitical risk

Identify markets where fundamentals are diverging

2. Entry Criteria & Position Sizing

Choose setups where reward: risk is favourable (e.g., 3:1 or better)

Limit risk per trade (for example ≤ 2 % of trading capital)

3. Execution & Monitoring

Use technical levels for entry and stop‐loss

Scale in if the position proves correct, scale out if adverse moves persist

4. Exit Strategy

5. Post‑Trade Review

Journal trade: what went right/wrong, what improved

Review drawdowns, win/loss size, expectancy

Applying this systematically helps align your process with the mindset and strategy of Bill Lipschutz.

Common Mistakes Traders Make That Bill Lipschutz Avoided

By contrasting what many traders do wrong against Lipschutz's approach, the path becomes clearer:

Over‑trading / Too many correlated positions → He concentrated on fewer, distinct trades.

Focusing on being right rather than managing risk → He emphasises that you don't need to be right most of the time, just survive and thrive when you are.

Ignoring macro or "outside forces" → He consistently monitors macro shifts and acknowledges their impact.

Letting losses escalate or revenge trade → He advises absorbing losses, not quickly jumping back in emotionally.

Legacy & Relevance: Why Bill Lipschutz's Lessons Still Matter

Bill Lipschutz's teaching is less about a specific system and more about a trading mindset, process, and discipline. His legacy persists because the core truths of risk control, psychology and strategic thinking remain valid regardless of market era.

Even in hectic modern markets, his insistence on evaluating when to be in the market and how big to be in a trade applies directly. His story—from modest inheritance to multi‑million‑dollar FX profits—serves as a blueprint for traders serious about long‑term survival and success.

Implementation Checklist: "Trade Like Bill Lipschutz"

Use the following checklist to embed his principles into your routine:

Define your maximum risk per trade (e.g., 1‑2 % of capital)

Seek trades with favourable reward: risk ratio (aim ≥ 3:1)

Limit number of open positions; avoid over‑diversification that dilutes edge

Always ask: “What outside forces could derail this?”

Journal every trade: entry reason, size, risk, exit outcome

Review monthly: win/loss ratio, expectancy, drawdown, psychological reactions

Frequently Asked Questions

Q1: Who is Bill Lipschutz?

A: Bill Lipschutz is a veteran currency trader who began trading equities while at Cornell University, turned a modest inheritance into sizable profits, then joined Salomon Brothers' FX desk and later founded Hathersage Capital Management, specialising in G10 currencies.

Q2: What makes Bill Lipschutz's trading approach unique?

A: His approach is rooted in controlling risk first, recognising time as a risk factor, scaling positions, and maintaining psychological discipline. He emphasises that you don't need to be right often—as long as you manage losses and let winners run.

Q3: What are some of Bill Lipschutz's famous quotes?

A: For instance: "If most traders would learn to sit on their hands 50 percent of the time, they would make a lot more money." Also: "I don't think you can consistently be a winning trader if you're banking on being right more than 50 percent of the time."

Q4: What is the significance of "time as a risk factor" in his framework?

A: Bill Lipschutz points out that the longer a trade stays open, the greater the exposure to unpredictable "outside forces" (macro events, news flow) and thus greater risk. Therefore, he favours favourable reward‑to‑risk ratios and sizing to account for time held.

Q5: Does Bill Lipschutz use a purely technical or purely fundamental approach?

A: He blends both. While he is fundamentally oriented—focusing on macroeconomic, geopolitical and currency‑flow forces—he also uses key technical levels for entries/exits and position management.

Q6: What are the common mistakes Bill Lipschutz warns against?

A: Among the mistakes: over‑trading, ignoring risk/size, failing to acknowledge outside forces, letting losses affect confidence, not waiting for high‑conviction setups.

Q7: How can traders apply Bill Lipschutz's lessons today?

A: By adopting key habits: define risk per trade (e.g., ≤ 2 % of capital), look for strong reward:risk (3:1 or more), restrict number of open positions, monitor macro context, journal trades, and review performance regularly. These operational steps echo Lipschutz's framework.

Q8: What is Bill Lipschutz's legacy in the trading community?

A: His legacy lies in showing that excellence in trading stems not from always being right, but from good process, strong risk controls, mental discipline, and strategic awareness. His story also offers inspiration for long‑term growth rather than quick wins.

Conclusion

In reviewing Bill Lipschutz's trading journey and framework we see three pillars: risk control, psychological discipline and strategic insight. He teaches that the winning trade is not the one that makes you right, but the one that keeps your capital intact and multiplies when the edge is clear.

By shifting your focus from "how many trades can I win" to "can I manage risk, wait for the right opportunity and execute with discipline", you start thinking like Bill Lipschutz. The next step is action: pick one principle above, apply it tomorrow, review it a week later, and iterate.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.