LQD ETF at a Glance

The iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) is among the most prominent exchange-traded funds (ETFs) focused on U.S. investment-grade corporate bonds. Launched in 2002 by iShares, a leading provider of ETFs, LQD aims to provide investors with broad exposure to high-quality corporate debt, offering both income generation and diversification benefits within the fixed-income landscape.

The fund serves as an accessible vehicle for investors seeking regular income while mitigating some of the volatility associated with equities. By pooling capital across a diversified portfolio of bonds, LQD allows individual investors to participate in the corporate credit market without needing to directly manage a large selection of individual bonds. In essence, LQD acts as a bridge between the traditional bond market and the convenience of a traded security, providing liquidity, transparency, and ease of access.

Fund Composition and Methodology

LQD tracks the Markit iBoxx USD Liquid Investment Grade Index, which represents the performance of U.S. dollar-denominated, investment-grade corporate bonds. The ETF focuses on bonds rated BBB or higher by major credit rating agencies, reflecting a relatively low credit risk compared to high-yield alternatives.

The fund holds bonds across a broad range of sectors, with substantial allocations to financials, industrials, and utilities, reflecting the composition of the U.S. corporate bond market. Sector weighting is regularly adjusted to mirror the underlying index, ensuring the ETF accurately reflects market trends.

In terms of maturity distribution, LQD generally invests in bonds with medium- to long-term maturities, often ranging from 1 to 30 years, with a significant proportion in the 5–10 year segment. This structure provides a balance between yield and interest rate sensitivity, offering investors the potential for stable income while maintaining reasonable exposure to duration risk.

The ETF uses a passive management strategy, replicating the index either through full replication or sampling methods, depending on market liquidity and efficiency. Rebalancing occurs periodically to maintain alignment with the index, including adjustments for new bond issues, maturities, and corporate events such as credit rating changes.

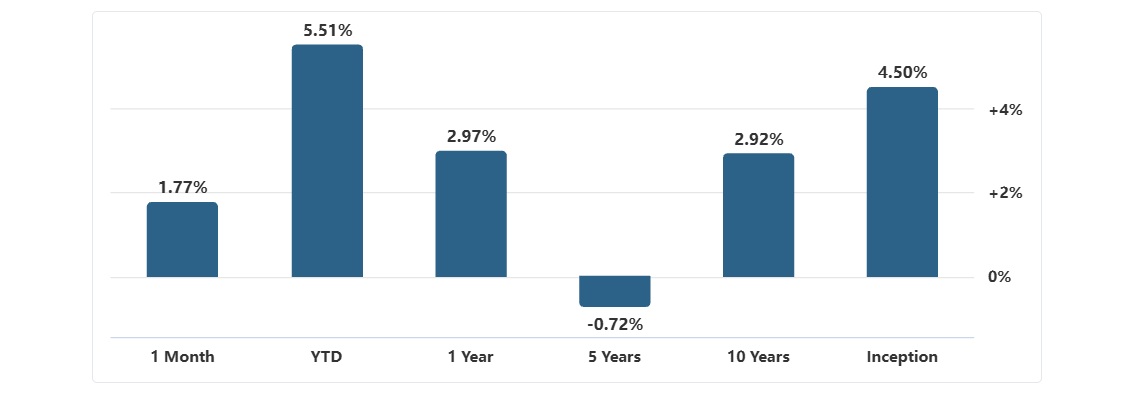

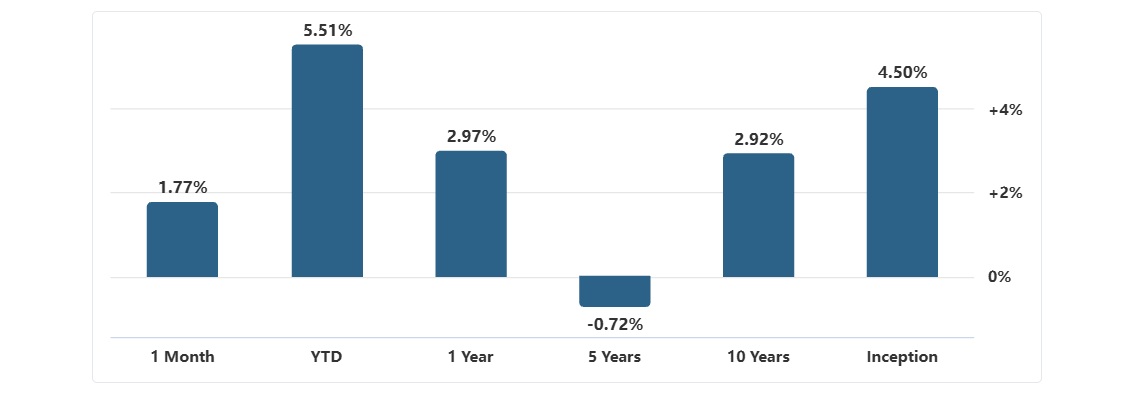

Historical Performance and Yield Characteristics

Historically, LQD has demonstrated a steady income profile with moderate capital appreciation. Over the past decade, the ETF has delivered average annualised returns in the 4–6% range, depending on prevailing interest rates and market conditions.

The yield-to-maturity (YTM) has historically hovered around 3–5%, providing investors with consistent coupon payments derived from high-quality corporate bonds. During periods of declining interest rates, LQD has generally benefited from price appreciation, as the value of fixed-rate bonds rises. Conversely, rising rates can result in short-term capital declines, although the income component partially offsets these fluctuations.

The ETF's response to interest rate cycles highlights its role as a stabilising instrument. For instance, during the post-2008 low-interest-rate environment, LQD generated attractive returns, benefiting from both declining yields and the relative safety of investment-grade debt. Conversely, periods of rising rates, such as the late 2016–2018 Fed tightening cycle, led to modest price volatility but continued income generation.

Risk Profile and Market Sensitivities

Despite its reputation as a lower-risk fixed-income vehicle, LQD carries several risks that investors should consider:

Interest Rate Risk: As a medium- to long-term bond ETF, LQD is sensitive to changes in interest rates. Rising rates typically reduce the market value of bonds, potentially impacting short-term returns.

Credit Risk: Although focused on investment-grade bonds, LQD remains exposed to the possibility of issuer defaults, particularly during economic downturns. Diversification mitigates, but does not eliminate, this risk.

Liquidity Risk: While the ETF itself is highly liquid, some underlying corporate bonds, especially in smaller issuances, may be less easily tradable, potentially affecting pricing during market stress.

Sector Concentration: LQD is moderately concentrated in certain sectors such as financials and industrials. Sector-specific downturns can influence overall performance.

Understanding these risks is crucial for aligning LQD with an investor's risk tolerance and broader portfolio objectives.

Investor Suitability and Portfolio Applications

LQD is particularly suited for investors seeking regular income, moderate growth, and exposure to the corporate bond market without the complexities of direct bond ownership. Typical investor profiles include:

Income-focused investors: Individuals seeking steady interest payments as part of a broader income strategy.

Diversification seekers: Equity-heavy portfolios benefit from LQD's relatively low correlation with stocks, providing stability during market volatility.

Risk-conscious investors: Those prioritising capital preservation over high returns find LQD an appealing alternative to high-yield bonds or equities.

LQD can also serve as a tactical allocation in multi-asset portfolios, used to hedge equity risk, adjust duration exposure, or enhance income generation. Its liquid, ETF structure allows for flexibility not typically available in individual bond holdings.

Comparisons and Alternatives in the Corporate Bond ETF Space

Within the investment-grade bond ETF universe, LQD is frequently compared with alternatives such as:

Vanguard Long-Term Corporate Bond ETF (VCLT): Offers longer-duration exposure with slightly higher interest rate sensitivity.

SPDR Portfolio Investment Grade Corporate Bond ETF (SPAB): Typically lower expense ratio, focusing on a broad selection of U.S. investment-grade bonds.

High-yield ETFs (e.g., HYG, JNK): Offer higher yields but with increased credit risk and volatility, suitable for more aggressive investors.

Compared to Treasury-focused ETFs, LQD provides higher yields at the cost of marginally greater credit risk. Its relative strength lies in balancing income, quality, and liquidity, making it a core holding for conservative and income-oriented investors alike.

Conclusion

The iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) stands out as a versatile, high-quality fixed-income instrument. Its combination of investment-grade corporate exposure, steady income, and broad diversification makes it a compelling option for income-seeking and risk-conscious investors. While interest rate and credit risks persist, the ETF's track record, liquidity, and alignment with market indices position it as a foundational component in many modern portfolios, bridging the gap between direct bond investments and equity market participation.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.