The iShares Core S&P Small-Cap ETF (IJR) has long been a favourite among traders and investors looking for efficient, low-cost exposure to US small-cap stocks.

In 2025, IJR stands out even more for its combination of value, growth potential, and portfolio resilience. Here are seven key reasons why now may be the right time to consider adding IJR to your trading or investment strategy.

7 Reasons to Buy the IJR ETF

1. Attractive Valuation Compared to Large Caps

IJR currently trades at a significant discount to large-cap benchmarks like the S&P 500, with a price-to-earnings (P/E) ratio of around 17.3 as of June 2025. This lower valuation means investors are paying less for each dollar of earnings, offering greater upside potential, especially if small caps rebound as economic conditions improve.

2. Exposure to US Economic Growth

Small-cap companies are often more sensitive to domestic economic trends. As the US economy shows signs of stabilisation and growth in 2025, small caps are well-positioned to benefit from increased consumer spending, business investment, and potential interest rate cuts. IJR's portfolio is designed to capture this upside by tracking the S&P SmallCap 600 Index.

3. Diversification Across Sectors and Stocks

IJR holds over 600 stocks, providing instant diversification across a broad range of sectors, including industrials, technology, healthcare, and consumer cyclical. This reduces the risk associated with individual company performance and helps smooth returns during periods of market volatility.

4. Strong Long-Term Performance

Despite recent volatility, IJR has delivered impressive long-term returns. Over the past 10 years, it has produced an annualised return of about 7.5–9.1%, outperforming many peers and providing a solid foundation for long-term growth. Its cumulative return since inception in 2000 is over 770%.

5. Low Expense Ratio

With an expense ratio of just 0.06%, IJR is one of the most cost-effective ways to gain exposure to US small caps. Lower costs mean more of your investment returns stay in your pocket, which is especially important for long-term traders and investors.

6. Focus on Profitable Companies

Unlike some small-cap ETFs that include unprofitable firms, IJR screens for profitability, ensuring its holdings are financially sound. This approach helps avoid value traps and supports more stable performance, even during challenging market conditions.

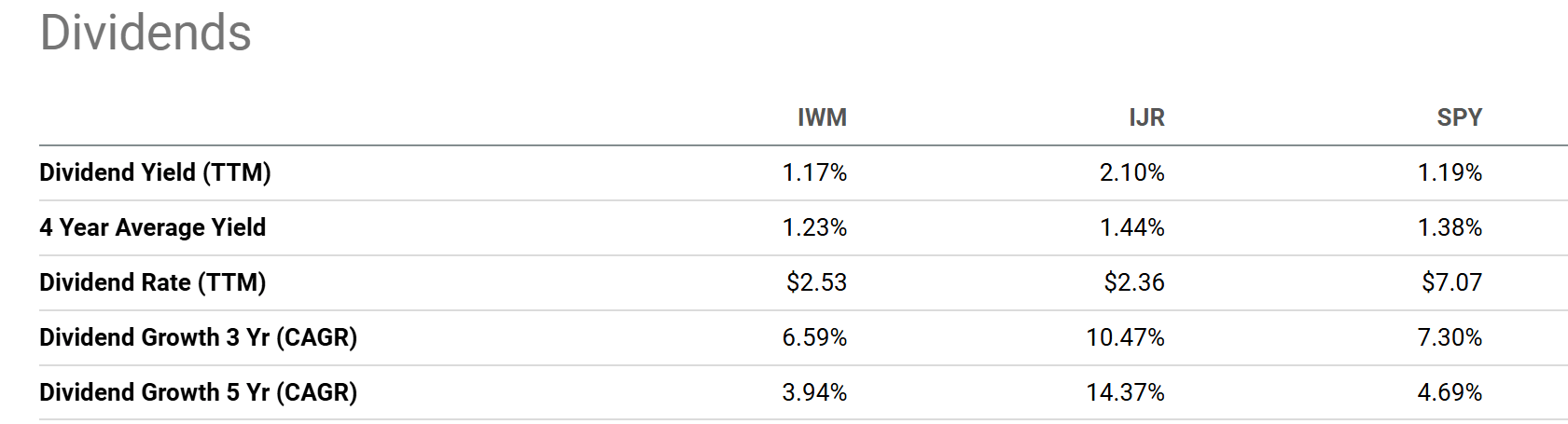

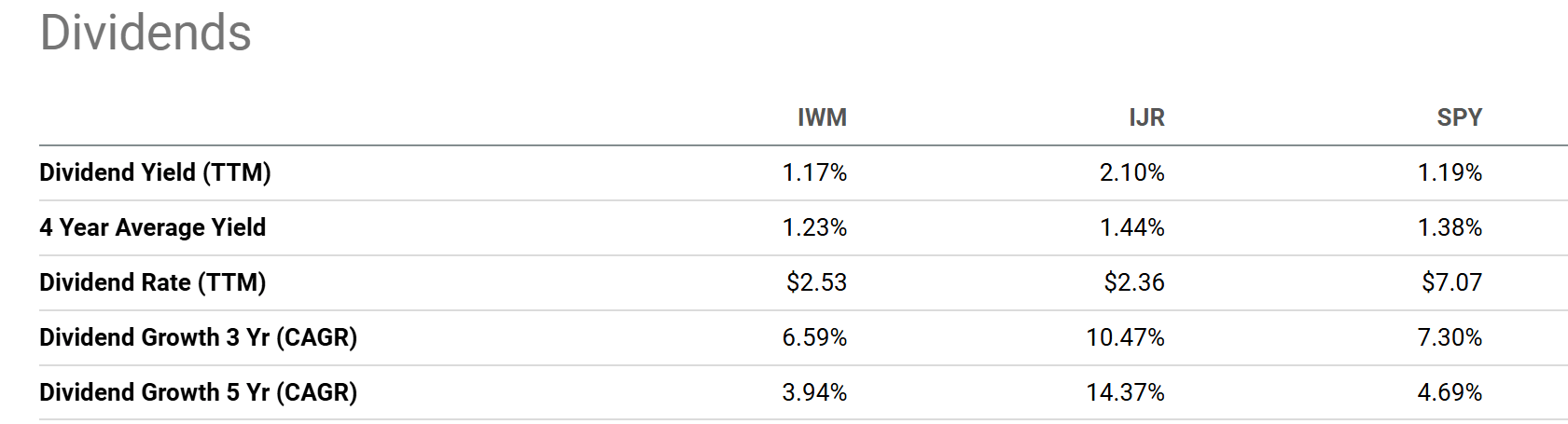

7. Attractive Dividend Yield

IJR offers a dividend yield of around 2.2% as of June 2025, higher than the S&P 500's yield. This provides an additional income stream for investors and can help cushion returns during periods of market uncertainty.

Conclusion

IJR stands out as a compelling choice for traders and investors seeking growth, value, and diversification in 2025. With its attractive valuation, broad sector exposure, strong long-term performance, and low fees, IJR is well-positioned to benefit from a potential small-cap resurgence as economic conditions improve. Its focus on profitable companies and a healthy dividend yield further enhance its appeal.

As always, ensure IJR fits your investment goals and risk tolerance before adding it to your portfolio.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.