Trading volume price difference analysis is a technical analysis method that

uses observations of trading volume and price changes in the market to determine

market trends and forces. Trading volume refers to the trading volume completed

by an exchange within a certain period of time, usually represented by a bar

chart; price refers to the transaction price of the exchange at the same time,

usually represented by a line chart or a K line chart.

The analysis of trading volume price differences mainly includes the

following aspects:

1. Changes in trading volume: Trading volume is an important indicator that

reflects the trading sentiment and behavior of market participants. When trading

volume increases, it usually means that the emotions of market participants are

changing, and it is necessary to pay attention to the market trend.

2. Price changes: Price reflects the relationship between market supply and

demand, and the rise and fall of price reflect the trend and strength of the

market. The market trend can be judged based on the rise and fall of prices.

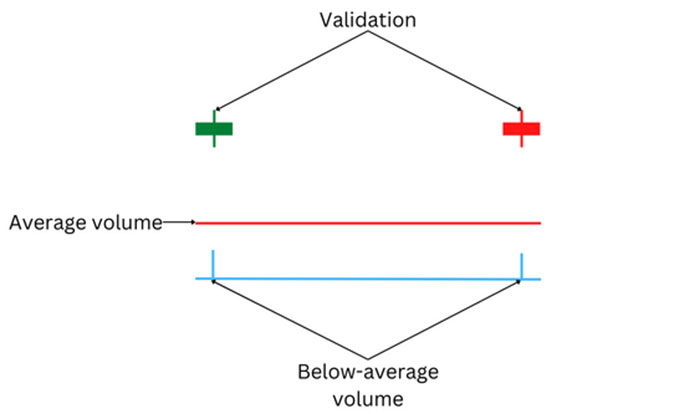

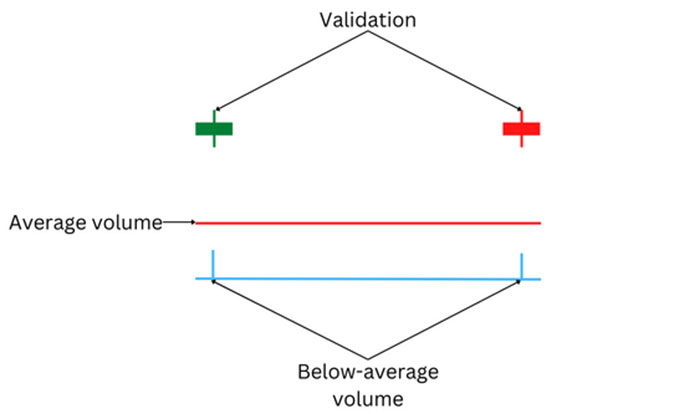

3. Compare changes in trading volume and price: Changes in trading volume and

price are usually interrelated. When the price rises and the trading volume

increases, it indicates that the market's bulls are strong; when the price drops

and the trading volume increases, it indicates that the market's bears have

strong strength. In addition, the strength of the market can also be observed by

calculating the difference between trading volume and price.

Trading volume and price difference analysis is a method of predicting market

trends by observing changes in trading volume and prices. Here are some basic

methods for analyzing trading volume and price differences:

Firstly, observe the changes in trading volume and prices. If the price rises

and the trading volume also increases, it indicates that the market has strong

bullish forces and can be considered for buying. On the contrary, if the price

drops and the trading volume increases, it indicates that the market has strong

short-selling power and can be considered for sale.

Secondly, the current level of market activity can be determined by comparing

current trading volume with historical average trading volume. If the current

trading volume is much higher than the historical average trading volume, it

indicates that the market is very active and there may be important market

events or news that need to be handled with caution. On the contrary, if the

current trading volume is lower than the historical average trading volume, it

indicates that the market is relatively calm and some more conservative trading

strategies can be considered.

Finally, the strength of the market can be observed by calculating the

difference between trading volume and price. If the trading volume increases but

the price does not rise with it, then market forces may be shifting and close

attention needs to be paid. On the contrary, if the trading volume increases and

the price is also rising, it indicates that the market has strong bullish forces

and can be considered for buying.

In short, the analysis of trading volume price differences requires a

combination of multiple factors to make judgments, requires caution, and

requires continuous learning and practice.