Money management improves trading success by controlling risk, protecting capital, and ensuring losses are limited while allowing profits to grow.

Effective money management is one of the most critical skills a trader can develop.

This guide explores money management in trading in detail, outlining core principles, advanced techniques, psychological factors, and practical steps for implementation.

Highlights

Money management is essential for controlling risk and protecting trading capital.

Limiting risk per trade (1–2%) prevents large losses and preserves accounts.

Position sizing, stop-losses, and risk-to-reward ratios guide disciplined trading.

Advanced techniques like diversification, hedging, and the Kelly Criterion optimise growth.

Psychological discipline and adherence to a money management plan ensure long-term profitability.

I. Understanding Money Management in Trading

1) What Money Management Really Means

Money management in trading refers to the set of rules and techniques traders use to control risk, protect capital, and optimise returns. It is not merely about limiting losses; it involves systematic planning to ensure that profitable trades outweigh losses over the long term.

2) Why Money Management Beats Strategy Alone

Even the most effective trading strategy will fail without sound money management. A trader who wins 60% of trades can still lose money if their losing trades are large relative to their winning trades.

Conversely, disciplined money management ensures that losses are small, allowing a trader to survive through drawdowns and capitalise on profitable opportunities.

3) Common Misconceptions About Trading Capital

Many new traders believe that a larger account or higher leverage guarantees success. In reality, it is possible to lose a substantial sum very quickly without strict rules. Money management ensures that traders can trade sustainably, regardless of account size.

II. Core Principles of Effective Money Management

1) Risk Per Trade: Protecting Your Hard-Earned Capital

A fundamental principle is to risk only a small fraction of the total account per trade. The common rule is 1–2% per trade.

For example, with an account of £10.000. risking 2% means a maximum loss of £200 per trade. This approach prevents a few losses from significantly depleting capital and allows the trader to remain active in the market.

2) Position Sizing: Tailoring Trade Sizes to Your Account

Position sizing refers to the number of units of an asset a trader purchases.

Fixed position sizing uses a constant percentage of the account for each trade, while dynamic sizing adjusts based on factors such as volatility, market conditions, or confidence in the trade.

Correct position sizing ensures that risk aligns with account size and market behaviour.

3) Stop-Loss Placement: The Safety Net Every Trader Needs

Stop-loss orders automatically close a trade at a predetermined level to prevent excessive losses.

Technical stop-losses are placed based on chart levels, such as support or resistance, whereas psychological stop-losses are based on risk tolerance. Both are essential to preserve capital and prevent emotional decision-making.

4) Risk-to-Reward Ratio: Ensuring Trades Are Worth the Risk

The risk-to-reward ratio compares potential loss against potential profit.

A minimum ratio of 1:2 is recommended, meaning the potential gain should be at least twice the potential loss.

Evaluating this ratio before entering a trade ensures that even if some trades fail, profitable trades can compensate and produce net gains.

5) Leverage Management: Amplifying Gains Without Destroying Capital

Leverage allows traders to control a larger position with a smaller amount of capital. While it can magnify gains, it also magnifies losses.

Effective leverage management involves using only a portion of available leverage and ensuring that stop-losses are applied to protect the account.

III. Advanced Money Management Techniques

1) Fixed Ratio and Scaling: Growing Your Account Strategically

Fixed ratio money management increases trade size incrementally as account balance grows. This method allows traders to scale up gradually, benefiting from profits without taking excessive risks.

2) The Kelly Criterion: Mathematics of Optimal Betting

The Kelly Criterion is a formula used to calculate the ideal fraction of capital to risk per trade to maximise long-term growth. It balances the probability of winning against the potential reward, ensuring trades are sized efficiently.

3) Diversification and Correlation Management

Diversification spreads capital across different assets to reduce risk. Understanding correlations between assets prevents unintended concentration, which can increase risk if multiple trades move in the same adverse direction.

4) Hedging Strategies: Protecting Your Portfolio from Market Shocks

Hedging involves opening positions that offset potential losses in other trades. Common techniques include using options, inverse ETFs, or currency pairs to mitigate exposure. While not always necessary, hedging can provide protection during volatile markets.

5) Averaging Up vs. Averaging Down: When Adding to Positions Works

Averaging up means adding to profitable positions to maximise gains, whereas averaging down involves adding to losing positions, which is riskier. Traders should use averaging up cautiously and avoid averaging down unless part of a well-defined strategy.

IV. Crafting a Personalised Money Management Plan

1) Assessing Your Risk Tolerance and Trading Goals

Every trader has a unique risk tolerance and objective. Beginners may prefer low-risk trades with smaller gains, while experienced traders may accept higher risk for larger returns. Defining these factors helps in designing a suitable plan.

2) Creating a Trade Entry and Exit Framework

Pre-defining rules for entering and exiting trades ensures consistency. Criteria should include entry signals, position size, stop-loss levels, and profit targets.

3) Journaling and Monitoring Performance

Recording every trade in detail—entry and exit points, size, outcome, and notes—helps identify patterns and improve discipline. Regular review ensures adherence to the plan and highlights areas for adjustment.

4) Continuous Adjustment: Evolving Your Plan with Experience

Markets evolve, and so should your money management. Traders must periodically review performance, adjust risk levels, and refine strategies to accommodate changes in market conditions or personal goals.

V. Psychological Factors in Money Management

1) The Role of Discipline and Emotional Control

Discipline is critical in enforcing money management rules. Impulsive trades, chasing losses, or deviating from the plan can erode capital quickly.

2) Overcoming Fear and Greed

Fear can prevent traders from entering profitable trades, while greed can lead to over-leveraging or holding losing trades too long. Techniques such as pre-defined trade rules and controlled position sizing help mitigate these emotions.

3) Building Confidence Without Overconfidence

Confidence is built through practice and consistent application of rules. Overconfidence, however, can result in excessive risk-taking. Balancing confidence with caution is key to long-term success.

VI. Practical Tools and Resources

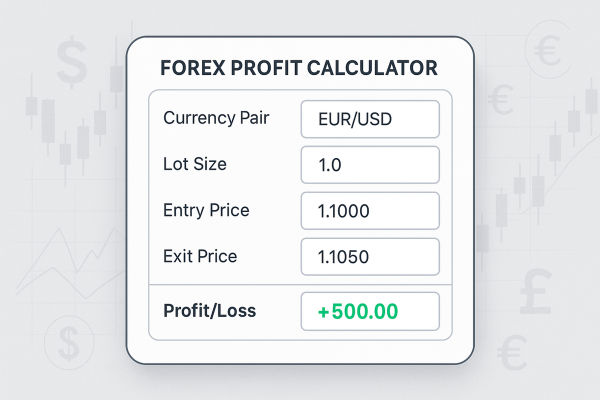

1) Risk Calculators and Trade Sizers

Modern trading platforms offer tools that calculate position size and risk per trade automatically. These tools help enforce discipline and ensure trades are consistent with the plan.

2) Demo Accounts and Backtesting Platforms

Demo accounts allow traders to practice money management strategies without risking real capital. Backtesting historical data provides insight into the effectiveness of strategies and risk controls.

3) Alerts and Automation for Discipline

Stop-loss and take-profit orders, combined with alerts and automation, ensure that rules are applied consistently, even in volatile or fast-moving markets.

Common Money Management Techniques

| Technique |

Purpose |

When to Use |

| Fixed Ratio |

Gradually increases position size |

Growing profitable accounts |

| Kelly Criterion |

Calculates optimal risk per trade |

Advanced risk management |

| Stop-Loss Orders |

Limits potential losses |

Every trade |

| Diversification |

Reduces risk across assets |

Multiple trades or portfolios |

| Hedging |

Protects portfolio from market shocks |

Volatile or uncertain markets |

Frequently Asked Questions (FAQ)

Q1: How much should I risk per trade?

Risking 1–2% of your account per trade is a commonly recommended practice. This ensures losses remain manageable, even during a losing streak.

Q2: What risk-to-reward ratio should I aim for?

A minimum of 1:2 is recommended, but traders may adjust this based on market conditions and personal strategy.

Q3: How can I use leverage without blowing my account?

Use low leverage, combine it with strict stop-loss levels, and avoid overexposing your capital.

Q4: How do I recover after a losing streak?

Stick to your money management rules, reduce trade sizes temporarily, and avoid impulsive trades. Review your strategy and learn from each loss.

Conclusion

Money management is the foundation of successful trading. Developing a personal money management plan, adhering to rules, and continuously reviewing performance will significantly increase the chances of long-term profitability. Remember, in trading, preserving capital is often more important than chasing quick gains.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.