George Soros is a Hungarian-American financier, philanthropist, and political activist renowned for his transformative influence on global financial markets and civil society. He is most famously known for the 1992 Black Wednesday currency crisis, where he earned $1 billion by shorting the British pound.

Beyond finance, George Soros has contributed more than $32 billion through his Open Society Foundations to support democracy, human rights, and education worldwide. This article examines George Soros's early life, career, investment philosophy, philanthropic initiatives, political influence, and enduring legacy.

Early Life and Intellectual Formation of George Soros

George Soros was born György Schwartz on 12 August 1930 in Budapest, Hungary. His Jewish family survived the Nazi occupation by adopting false identities and frequently relocating.

In 1947. George Soros moved to London, where he pursued studies at the London School of Economics (LSE). At LSE, he studied under philosopher Karl Popper, whose concept of the "open society" profoundly influenced Soros's worldview and guided his later philanthropic work.

Career and Investment Innovations of George Soros

1. Early Career and the Creation of Quantum Fund

George Soros began his financial career in London and New York, working for various merchant banks. In 1969. he founded his first hedge fund, Double Eagle, which evolved into Soros Fund Management.

His investment philosophy focused on identifying market inefficiencies and capitalising on them through aggressive and informed strategies.

2. Notable Trades and Market Strategies

George Soros's reputation as a formidable investor was cemented through several high-profile trades:

1992 Black Wednesday:

George Soros shorted the British pound, predicting the UK would exit the European Exchange Rate Mechanism. The trade yielded approximately $1 billion in profit.

Asian Financial Crisis:

Anticipating currency devaluations, George Soros profited by shorting the Thai baht.

Japanese Yen:

George Soros invested in Japanese equities while taking positions in the yen to capitalise on its fluctuations.

Selected Notable Trades of George Soros

| Year |

Event |

Strategy |

Estimated Profit |

| 1992 |

Black Wednesday |

Shorted GBP |

$1 billion |

| 1997 |

Asian Financial Crisis |

Shorted Thai baht |

$200 million+ |

| 1980s |

Japanese Yen & equities |

Diversified currency/equity positions |

$100 million+ |

George Soros and the Theory of Reflexivity

George Soros developed the theory of reflexivity, which posits that market participants' perceptions influence market fundamentals, creating feedback loops that can distort prices. This concept challenges the Efficient Market Hypothesis by suggesting markets are not always rational.

George Soros applied reflexivity to predict and capitalise on market trends, providing a philosophical foundation for his trading strategies.

Philanthropy and Open Society Foundations Led by George Soros

1. Establishment and Mission

In 1993. George Soros founded the Open Society Foundations (OSF) to promote democracy, governance reforms, and human rights. The foundation's philosophy reflects Karl Popper's open society principles, advocating for freedom, transparency, and accountability.

2. Major Initiatives

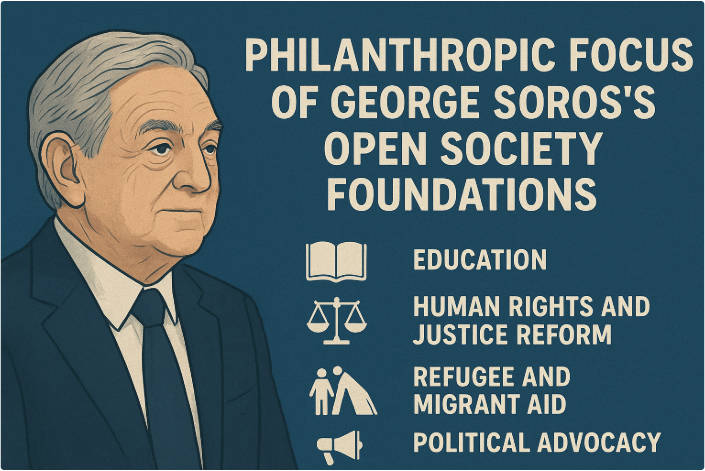

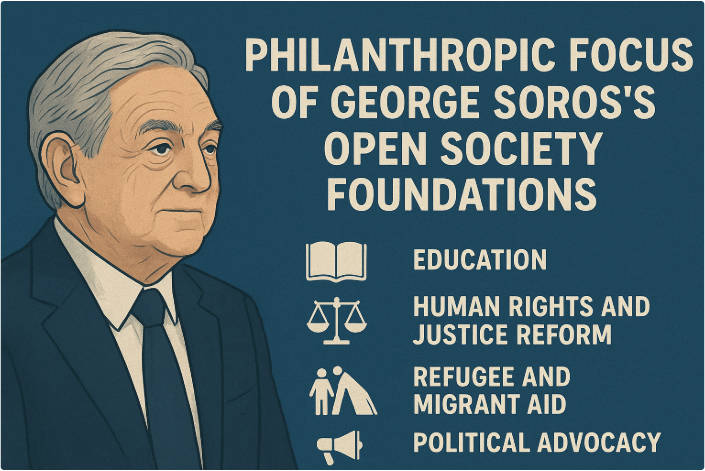

George Soros has directed his philanthropic efforts towards:

Education: Scholarships and support for higher education institutions in Eastern Europe.

Human Rights and Justice Reform: Programmes promoting legal reform and the rule of law.

Refugee and Migrant Aid: Support for displaced communities worldwide.

Political Advocacy: Funding progressive movements and promoting democratic policies.

Philanthropic Focus of George Soros's Open Society Foundations

| Area |

Key Initiatives |

Geographic Reach |

| Education |

Scholarships, academic institutions |

Eastern Europe, US, Global |

| Human Rights |

Legal reform, civil rights programmes |

Global |

| Refugee Aid |

Migrant support, resettlement projects |

Europe, US, Africa |

| Political Advocacy |

Democracy and governance programmes |

Global |

Political Influence and Strategic Engagement of George Soros

George Soros has been a major supporter of progressive political movements globally. His funding has influenced criminal justice reform, refugee policy, and democracy promotion.

Despite his philanthropic work, George Soros has faced significant criticism from conservative and nationalist groups, often accused of influencing political outcomes through his wealth.

Recognition and Legacy of George Soros

1. Awards and Honours

In January 2025. George Soros received the Presidential Medal of Freedom in recognition of his contributions to democracy, human rights, and open society initiatives.

2. Publications

George Soros's books have shaped both financial and socio-political thought:

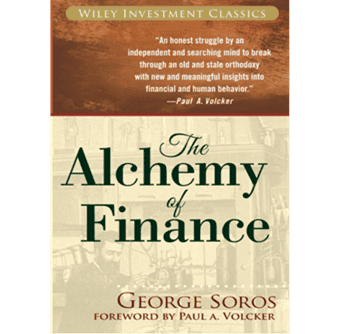

The Alchemy of Finance (1987): Introduces reflexivity and market theory.

The New Paradigm for Financial Markets (2008): Analyses global financial crises.

Open Society: Reforming Global Capitalism (2000): Advocates open societies and governance reforms.

3. Enduring Impact

George Soros's influence extends beyond financial markets into philanthropy, governance, and political thought. His work has shaped modern investing strategies, guided global humanitarian initiatives, and inspired discussions on democracy and civil society worldwide.

Conclusion

George Soros exemplifies the combination of financial insight, philosophical reflection, and social responsibility.

Through his innovative investment strategies, commitment to open societies, and political engagement, George Soros has left an indelible mark on the financial world and global civil society.

Frequently Asked Questions

1. Who is George Soros?

George Soros is a Hungarian-American financier, philanthropist, and political activist, best known for his hedge fund management, major market trades, and the Open Society Foundations.

2. What is George Soros famous for in finance?

He is most famous for shorting the British pound in 1992 during Black Wednesday, earning approximately $1 billion, and for pioneering the theory of market reflexivity.

3. What is the theory of reflexivity?

Reflexivity is Soros's concept that market participants' perceptions can influence fundamentals, creating feedback loops that can distort prices and challenge the Efficient Market Hypothesis.

4. What is the Open Society Foundations?

Founded by Soros in 1993. the Open Society Foundations support democracy, human rights, education, and governance reforms worldwide.

5. How much has George Soros contributed to philanthropy?

George Soros has donated over $32 billion through his Open Society Foundations to support civil society, education, and human rights initiatives.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.