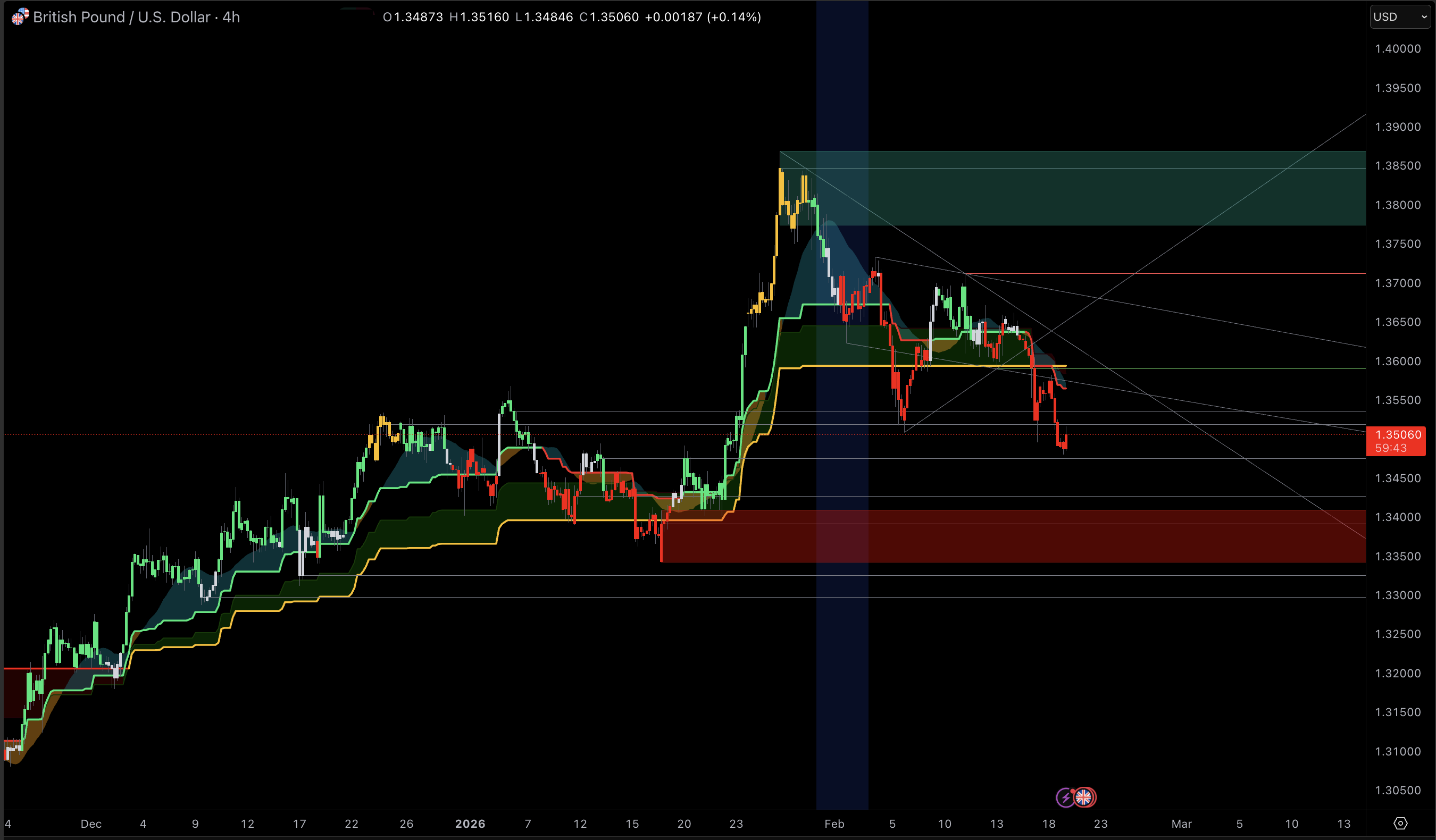

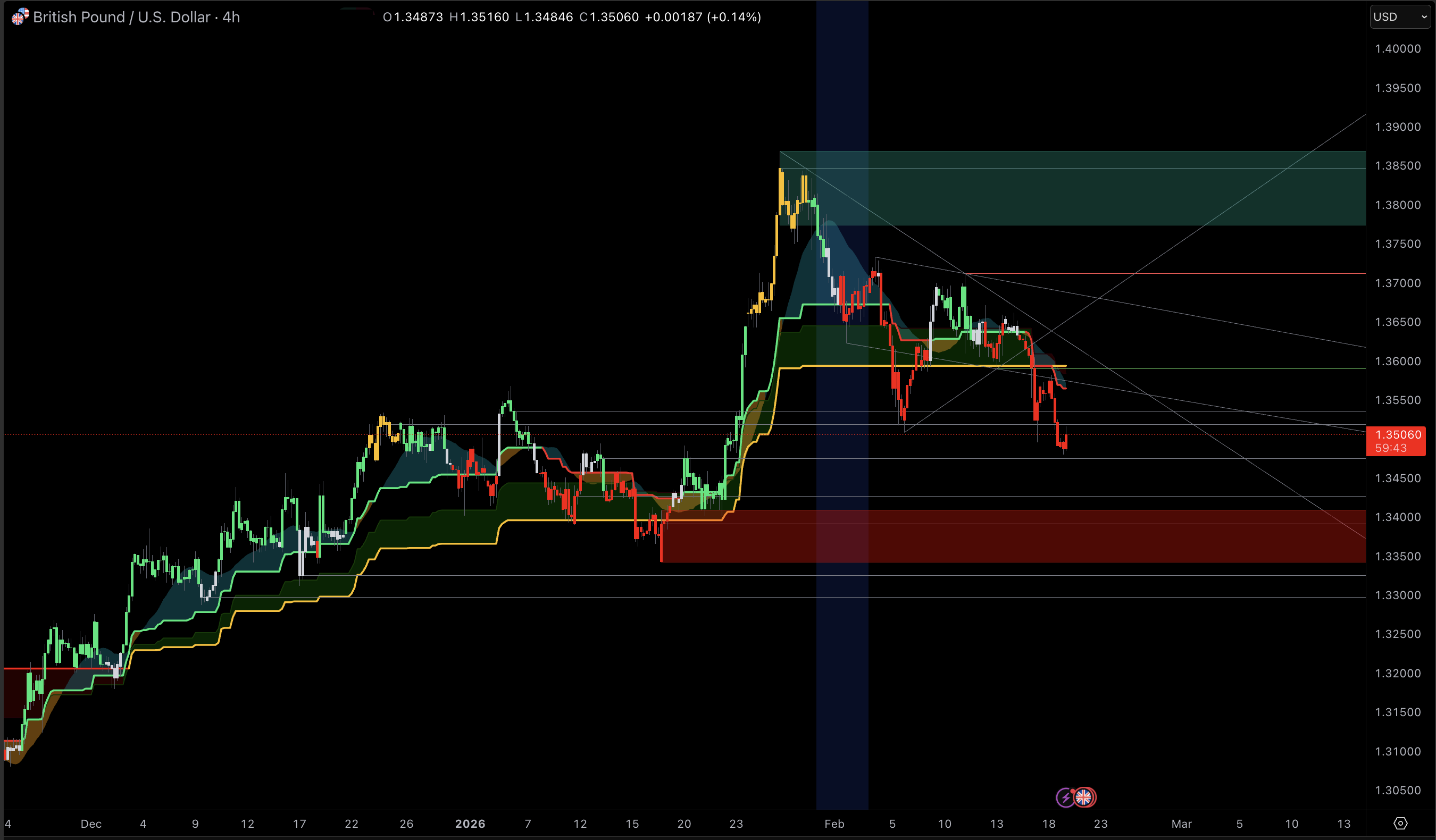

In February 2026, GBPUSD has retraced from its late-January peak near $1.38 to the key $1.35 level. This move reflects a repricing of rate-cut expectations and a reset in momentum following January’s rally, rather than a collapse in sterling.

This pullback is significant because it occurs in a technically important area where various trading strategies converge. With UK disinflation accelerating and the Bank of England divided on easing, the market views rebounds as conditional rather than guaranteed.

GBPUSD February 2026 Market Table

Metric |

Level |

Why It Matters |

| Spot (Feb 19) |

$1.3512 |

Current reference point for the pullback zone. |

| Day’s Range (Feb 19) |

$1.3481–$1.3514 |

Defines immediate liquidity pockets and stop clusters. |

| 2026 High |

$1.3824 (Jan 28) |

January blow-off high that anchored February’s retracement. |

| 2026 Low |

$1.3381 (Jan 15) |

The nearest structural low that bulls must defend on a breakdown. |

| 52-Week Range |

$1.2558–$1.3869 |

Confirms February weakness is a correction inside a larger range. |

| Bank Of England Bank Rate |

3.75% (5–4 Hold) |

A narrowly divided committee increases sensitivity to UK data surprises. |

| Federal Funds Target Range |

3.5%–3.75% (Jan Hold) |

Keeps the carry backdrop restrictive for GBPUSD unless Fed easing resumes. |

| UK CPI (Jan) |

3.0% y/y |

Faster disinflation lifts the odds of earlier BoE cuts. |

| US CPI (Jan) |

2.4% y/y |

Reinforces the Fed’s “wait for clearer disinflation” posture. |

| UK Unemployment Rate (Oct–Dec) |

5.2% |

Cooling labor conditions add policy pressure on the BoE. |

| Daily RSI (14) |

45.486 |

Momentum is soft, but not washed out or panic-like. |

| Daily MA50 / MA200 |

$1.3541 / $1.3617 |

Price below both signals a corrective phase on the daily chart. |

| Next BoE Decision |

Mar 19, 2026 |

A major catalyst for repricing the UK-US rate path. |

Why GBPUSD Is Pulling Back In February 2026

The February retreat has a clear macro spine: UK disinflation and softer activity data are pushing the market toward earlier Bank of England easing, while the Federal Reserve is signaling patience rather than urgency. The BoE kept Bank Rate at 3.75% on February 5, but the 5-4 split is the detail that matters because it validates a live debate about cutting as soon as the next meeting.

UK CPI slowed to 3.0% year over year in January, down from 3.4% in December, which steepens the “policy normalization” narrative. At the same time, unemployment rose to 5.2% in the three months to December, pointing to slack building, which the BoE watches most closely for in domestically driven inflation persistence.

On the US side, January CPI at 2.4% keeps inflation above target but trending in the right direction, giving policymakers cover to hold rates steady while they watch whether services inflation fully cools. The net effect is simple: the market is increasingly comfortable pricing BoE cuts before Fed cuts, and that expectation tends to cap GBPUSD rallies until price action proves otherwise.

GBPUSD Technical Structure Across Time Frames

Weekly Context: Uptrend Fatigue, Not A Trend Break

GBPUSD’s 52-week range of $1.2558 to $1.3869 frames February’s weakness as a retracement inside a larger recovery that began well before 2026. Even so, the proximity to the upper end of the range matters because late-stage rallies often become vulnerable to sharp, orderly pullbacks when positioning is crowded, and rate expectations shift.

Daily Chart: The Pullback Is Testing A High-Value Support Band

In January, GBPUSD reached a 2026 high near $1.3824 and a low near $1.3381, providing a clear range for retracement analysis. The 50% retracement is around $1.3603, and the 78.6% retracement is near $1.3476, placing the current market at a key support zone. This alignment makes $1.35 a critical level rather than just a round number.

Momentum indicators support the view of a correction. The daily RSI near 45.5 is neutral to slightly weak, indicating controlled selling rather than panic. More importantly, GBPUSD is trading below the MA50 ($1.3541) and MA200 ($1.3617), so rallies toward these averages may attract systematic sellers until the pair closes above them.

Tactical Levels

Support Zones

$1.3500–$1.3480: Current compression area and recent intraday floor.

$1.3475–$1.3473: Deep retracement and nearby pivot structure, often a last defense before stops accelerate.

$1.3381: January low, a clean invalidation level for the February dip thesis.

Resistance Zones

$1.3541: MA50, first “trend repair” hurdle.

$1.3603–$1.3617: 50% retracement region and MA200 overlap, a classic supply zone in pullbacks.

$1.3655–$1.3720: A higher retracement band that would signal the pullback is ending, not extending.

Trade Setups For Trading The February 2026 Pullback

The market presents two scenarios: if $1.35 holds, GBPUSD may mean revert upward toward moving-average resistance. If $1.35 fails, the January low is likely to be tested.

Setup 1: Buy the Hold Above $1.3480 With Confirmation

A valid long position requires evidence that sellers cannot break the $1.3480–$1.3500 support. The clearest confirmation is a daily close above the MA50 near $1.3541, which would shift short-term trend signals from selling rallies to buying pullbacks.

Targets: $1.3603–$1.3617 first, then $1.3655.

Risk Line: A sustained break below roughly $1.3470 shifts odds toward a retest of $1.3381.

Setup 2: Sell The Breakdown Below $1.3470 Toward $1.3381

If GBPUSD breaks the deep support band and fails to quickly recover to $1.35, the market often shifts from range trading to a stop-driven decline. In this scenario, $1.3381 is the likely target, as it marks the 2026 low and a previous inflection point.

Targets: $1.3381 first, then watch for follow-through only if macro pricing turns sharply more USD-supportive.

Is GBPUSD A Buy Or Sell

On the daily chart, GBPUSD is Sell-to-Neutral as it trades below the MA50 and MA200, and momentum indicators are not yet oversold enough to prompt systematic buying. In this environment, patience is advisable; waiting for confirmation helps avoid entering during a continued retracement.

On the weekly and medium-term outlook, GBPUSD favors a Buy-On-Dips approach, provided $1.3381 holds and the BoE does not accelerate easing beyond market expectations. (Exchange Rates UK) The pair must reclaim $1.3617 to reestablish a stronger bullish structure.

Frequently Asked Questions About GBPUSD

What Is The Most Important Support For GBPUSD Right Now?

The immediate support band is $1.3500–$1.3480. A sustained break below that area increases the probability of a move toward $1.3381, the 2026 low, where longer-term buyers are more likely to defend.

What Resistance Must Bulls Clear To End The Pullback?

The first technical hurdle is the MA50 near $1.3541. A stronger confirmation comes from reclaiming the MA200 near $1.3617, which would indicate that the pullback is likely complete rather than ongoing.

Why Does UK Inflation Matter So Much For GBPUSD In February 2026?

UK CPI at 3.0% and falling strengthens the case for earlier BoE cuts. Earlier UK easing relative to the Fed typically narrows the rate differential that supports sterling, making GBPUSD rallies harder to sustain without fresh catalysts.

How Does US Inflation Feed Into The Dollar Side Of The Pair?

US CPI at 2.4% supports the Fed’s “hold and evaluate” stance. When the market expects U.S. rates to remain restrictive for longer, the dollar tends to find a floor through carry and yield support, especially against currencies that have already seen earlier rate cuts.

What Upcoming Event Could Reset GBPUSD Direction Quickly?

The March 19 Bank of England decision is a high-impact catalyst because it can validate or reject the market’s near-term easing expectations. A dovish surprise can extend the pullback, while a cautious hold can support a rebound.

Conclusion

GBPUSD’s February 2026 pullback is a technically orderly retracement driven by changing rate expectations, rather than a sudden loss of confidence in sterling. The market is consolidating around $1.35 due to its alignment with key retracement levels, round-number significance, and ongoing BoE policy discussions.

Traders gain an advantage by recognizing this division. If GBPUSD holds above the $1.3480–$1.3500 base, rebounds can target moving-average resistance through controlled mean reversion. If it falls below, downside risk increases toward $1.3381, where the broader trend will be tested.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.