Fiat money plays a central role in the global economy. Unlike gold or other tangible assets, its value is not backed by a physical commodity but rather by the trust and authority of the government that issues it.

Thus, the value of fiat money can fluctuate, sometimes significantly, due to a range of economic, political, and psychological factors.

In this comprehensive guide, we'll explain factors that affect the value of fiat money, how these shifts impact economies and investors, and what you can do to protect your wealth during currency volatility.

What Is Fiat Money?

Fiat money is a government-issued currency that has no intrinsic value and is not backed by a physical commodity such as gold or silver. Its value derives solely from the trust that individuals and institutions place in the issuing government.

Examples of fiat currencies include:

The U.S. Dollar (USD)

Euro (EUR)

Japanese Yen (JPY)

Indian Rupee (INR)

British Pound (GBP)

Fiat currency dominates global financial systems because it provides governments the flexibility to manage economies and implement monetary policy.

How Fiat Money Differs from Commodity Money

| Type |

Definition |

Example |

| Fiat Money |

Currency not backed by a physical good; value from trust |

U.S. Dollar |

| Commodity Money |

Currency backed by a physical commodity |

Gold Standard |

| Representative |

Paper money backed by reserves of a commodity |

Gold certificates |

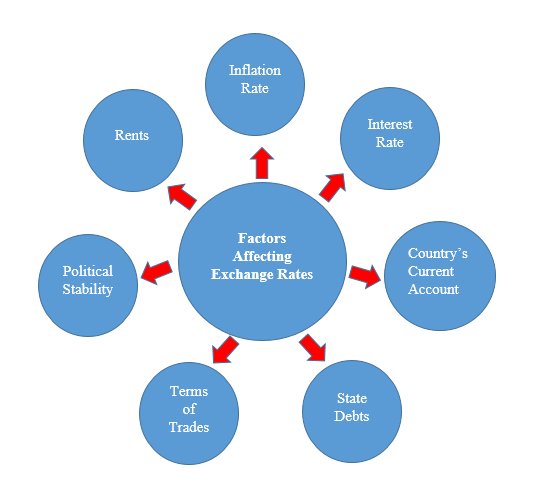

What Might Cause a Change in the Value of Fiat Money? 10 Factors

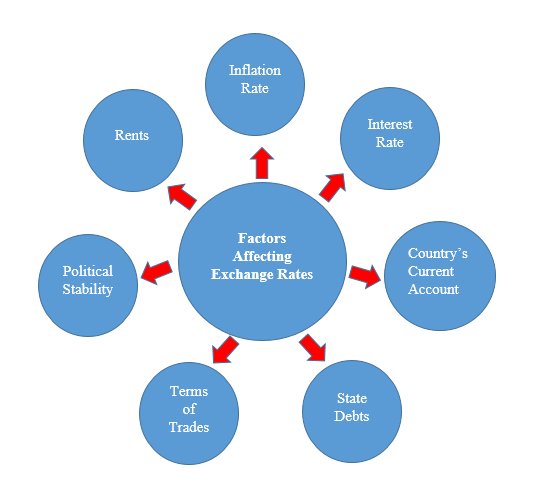

1. Central Bank Monetary Policy

Central banks like the Federal Reserve (Fed), European Central Bank (ECB), and Reserve Bank of India (RBI) control money supply and influence currency value through monetary policy tools:

Example: When the Fed increases the money supply, it can reduce the dollar's purchasing power.

2. Inflation and Deflation

Inflation erodes the purchasing power of fiat currency, while deflation increases it.

Example: In countries like Venezuela or Zimbabwe, hyperinflation caused the value of their currencies to collapse.

3. Interest Rates

Interest rates directly impact currency value because they affect capital flows:

Example: If the U.S. raises interest rates while Japan keeps them low, the dollar often strengthens against the yen.

4. Government Debt and Fiscal Policy

A country with high national debt is perceived as riskier, which can:

Reduce investor confidence

This leads to higher inflation expectations

Pressure central banks to print more money

Fiscal deficits (when spending > revenue) can also lead to devaluation.

Example: In times of high government borrowing, the market may devalue a country's currency in anticipation of future economic stress.

5. Supply and Demand

Like any asset, the supply and demand dynamics of a currency can shift its value:

Factors such as imports, exports, remittances, and investment inflows influence this balance.

6. Political Stability and Confidence

Investors avoid countries with political unrest, corruption, or uncertainty. A stable government that enforces contracts and supports economic growth increases investor confidence.

Events that reduce confidence:

Example: Brexit created significant volatility in the British Pound due to uncertainty about trade and governance.

7. Trade Balances and Current Account Deficits

If a country focuses on importing than exporting, it creates a current account deficit, which can weaken its currency.

Example: Countries heavily reliant on oil imports may see currency weakness when oil prices rise.

8. Foreign Exchange Markets

The FX market, where currencies are traded, is highly liquid and speculative. Market sentiment, news releases, and institutional activity can drive price swings.

Currency pairs are affected by both local and international events.

Day traders and hedge funds move billions, influencing short-term value.

9. Speculation and Investor Sentiment

If traders believe a currency will weaken due to future inflation, rate cuts, or poor GDP growth, they may sell it in anticipation, pushing its value down.

Example: A rumour about potential sanctions or war can lead to speculative shorting of a country's currency.

10. Global Economic Conditions

A recession or financial crisis—whether local or global—can impact currency value. Investors often move to "safe haven" currencies like the U.S. Dollar or Swiss francs during turmoil.

Booming economy: Stronger currency

Recession: A weaker currency

Risk-off environment: Boosts demand for safe assets

Real-World Examples

1. The 2008 Global Financial Crisis

The U.S. printed trillions through quantitative easing, temporarily weakening the dollar. However, due to global panic, the dollar remained a safe haven.

2. Venezuela's Hyperinflation

Due to mismanagement, excessive money printing, and falling oil revenues, the Venezuelan bolívar lost almost all of its value.

3. Brexit and the British Pound

When the UK voted to leave the EU in 2016, GBP fell nearly 10% in a single day, triggered by uncertainty and fear of economic consequences.

4. Turkish Lira Collapse

Political interference in monetary policy and high inflation drop the Turkish significantly in value between 2020 and 2023.

How Currency Devaluation Affects Investors

For Investors:

Foreign investors lose returns when converting profits back into stronger currencies.

Stocks and bonds denominated in the local currency may drop in value.

Gold may hedge against devaluation.

How to Hedge Against Fiat Currency Risk

There are several ways to protect your portfolio from the risks of fiat currency devaluation:

1. Diversify into Foreign Currencies

Hold a mix of currencies to offset risk from local currency decline.

2. Invest in Commodities

Gold, silver, oil, and agricultural commodities often maintain value when fiat money weakens.

3. Buy Inflation-Protected Securities

TIPS (Treasury Inflation-Protected Securities) are designed to rise with inflation.

4. Use Forex Hedging Strategies

Tools such as currency futures, options, and swaps can lock in exchange rates.

Conclusion

In conclusion, fiat currencies are crucial to modern economies, but their value is far from fixed. Central banks, inflation, debt levels, global trade, and market sentiment all shape the strength of a currency.

As fiat volatility grows in the 2020s, understanding these factors will improve your financial literacy, as hedging strategies will be more crucial than ever.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.