Many beginner traders often struggle with margin requirements, risking too much or too little without realising how it affects their positions. This is where a Forex Margin Calculator becomes an essential tool.

A forex margin calculator helps traders determine the required margin for a specific trade, based on factors like account balance, lot size, leverage, and currency pair.

In simple terms, a margin calculator tells you how much money you need to open and maintain a trading position. By using it correctly, traders can avoid margin calls, manage risk more effectively, and trade with confidence.

What Is a Forex Margin Calculator?

As mentioned above, a Forex Margin Calculator is a trading instrument that instantly calculates the amount of margin required to open and maintain a position.

It removes the need for manual calculations and ensures you always know your margin requirements before executing a trade.

It takes into account:

At EBC Financial Group, traders can use an advanced Forex Margin Calculator to plan trades effectively. This tool provides accurate margin requirements tailored to your account currency, trade size, and leverage.

By integrating margin calculation into your trading routine, you minimise risk and trade with greater confidence.

How Does a Forex Margin Calculator Work?

As highlighted, EBC's calculator is designed for both beginners and professional traders, ensuring transparency and accuracy in every trade.

Let's break it down with a practical example.

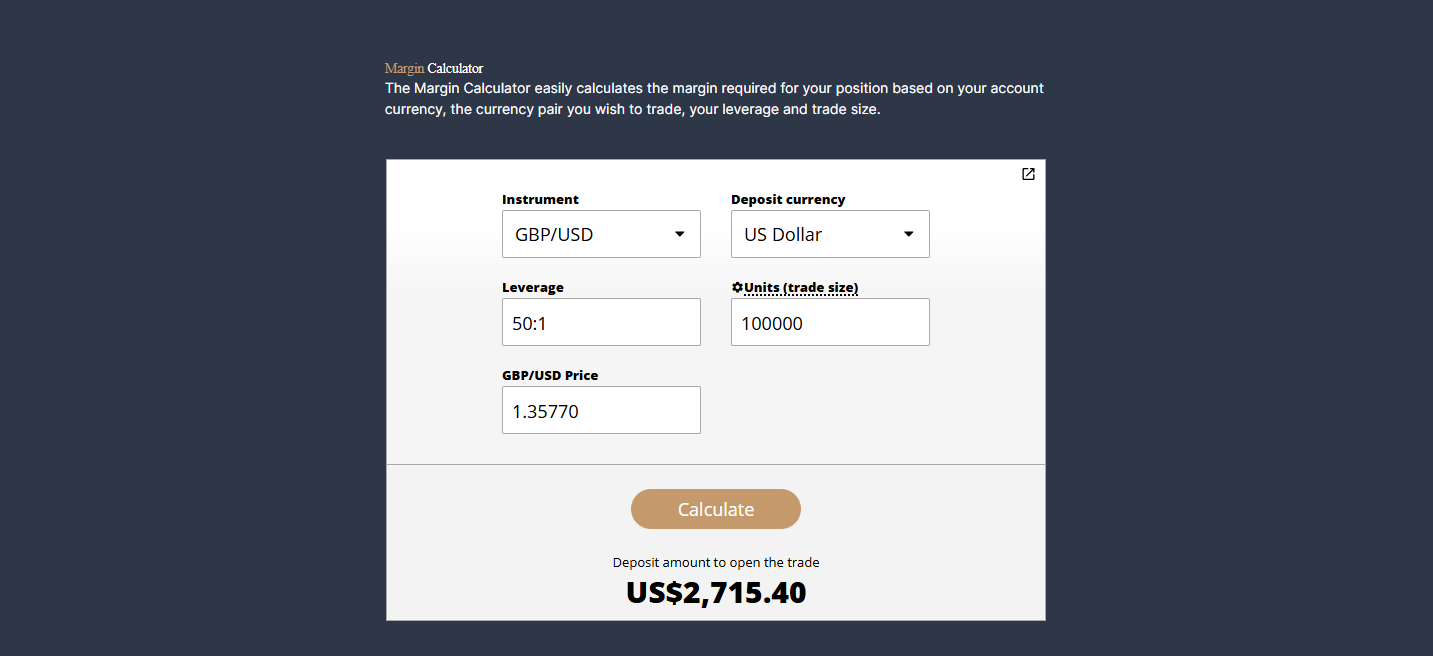

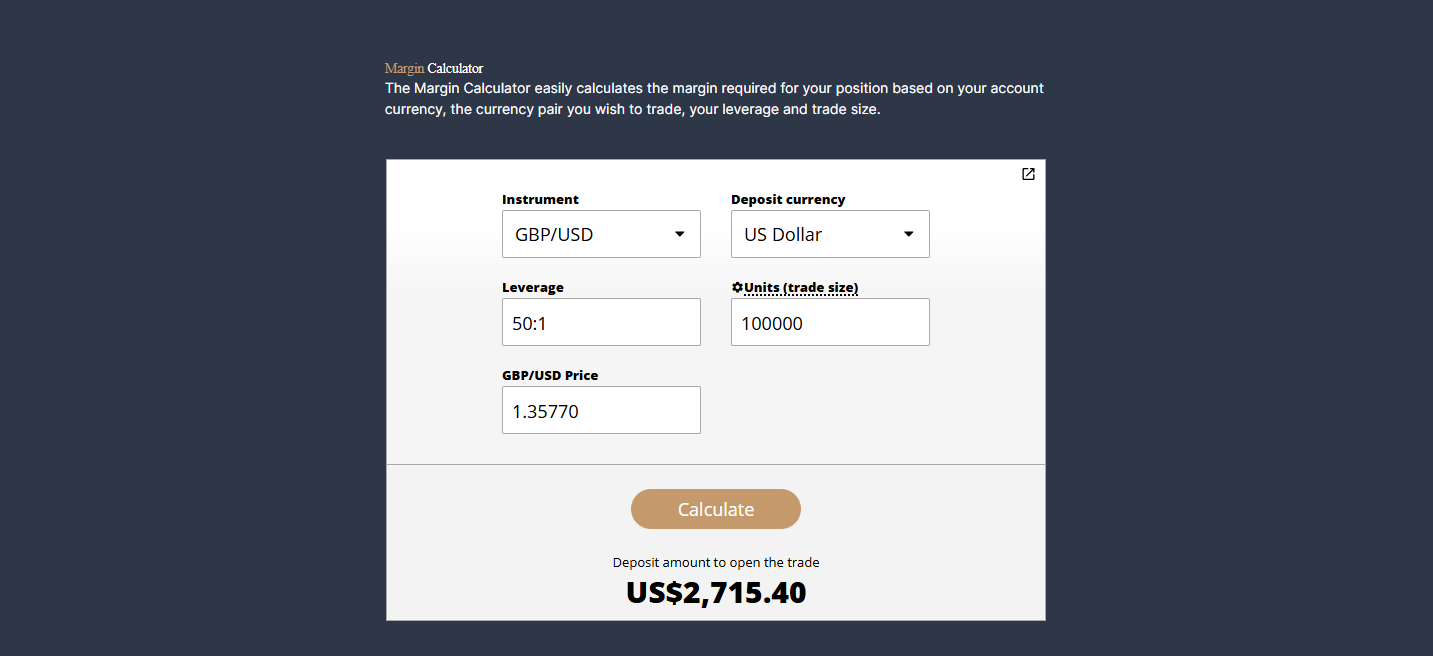

Imagine you aim to trade 1 lot (100,000 units) of GBP/USD using 1:50 leverage.

Contract Size: 100,000 Units

Leverage Ratio: 1:50

GBP/USD Price: 1.35770

Required Margin: (Contract Size ÷ Leverage) x Current Exchange Rates= (100,000 ÷ 50) x 1.35770 = 2,000 GBP

This means you need 2,715.40 GBP in your margin account to open the position.

A forex margin calculator does this instantly. Instead of manually crunching numbers, you can enter your trade details, and the tool provides accurate results.

Additional Examples: Margin Calculation for Different Scenarios

Let's explore some scenarios to gain insight into how margin requirements fluctuate.

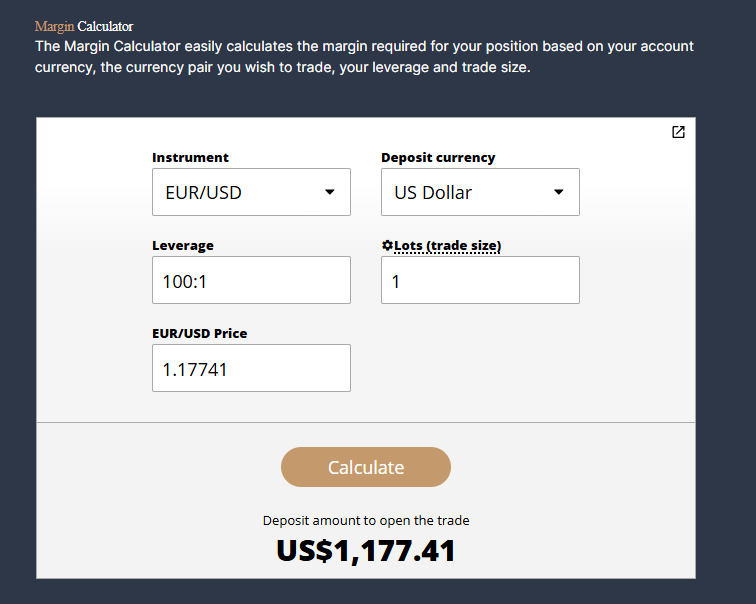

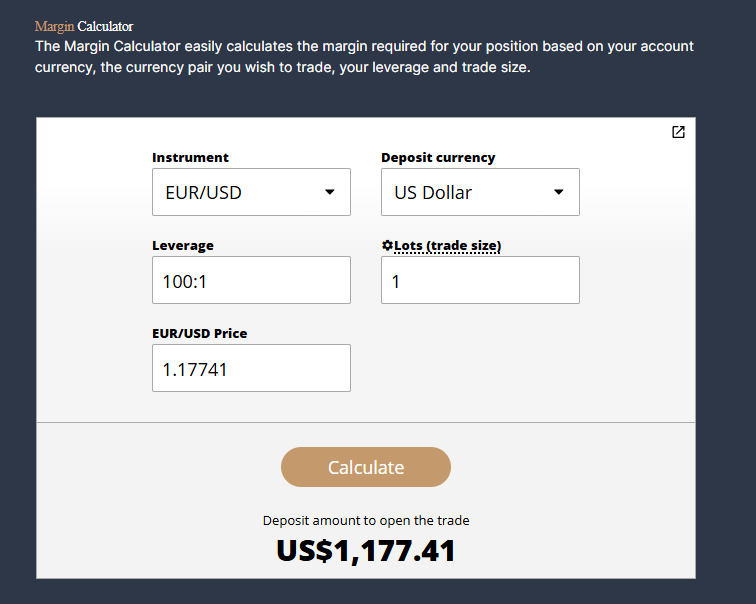

Example: EUR/USD Trade

Account Currency: USD

Position Size: 1 Lot (100,000 units)

Leverage: 1:100

EUR/USD Price == 1.17741

Required Margin = (100,000 ÷ 100) x 1.17741 = 1,177.41 USD

As you can see, the margin requirement depends on the lot size, leverage, and exchange rate. A calculator simplifies these variations instantly.

Importance of Leverage in Margin Calculations

Leverage directly influences margin requirements:

For instance:

At 1:100 leverage, 1 lot of EUR/USD requires 1,000 USD.

At 1:20 leverage, the same trade requires 5,000 USD.

While higher leverage makes trading more accessible, it also increases risk exposure.

Advantages and Risks of Using a Forex Margin Calculator

| Advantages |

Risks |

| Accurate margin calculations |

May give traders a false sense of security if used without risk management |

| Helps avoid margin calls |

Cannot predict market volatility |

| Saves time and effort |

Over-reliance may cause traders to neglect manual calculations |

| Useful for multi-trade planning |

Different brokers may have slightly different margin requirements |

Margin Calculator vs Other Trading Tools

A forex margin calculator is often used alongside:

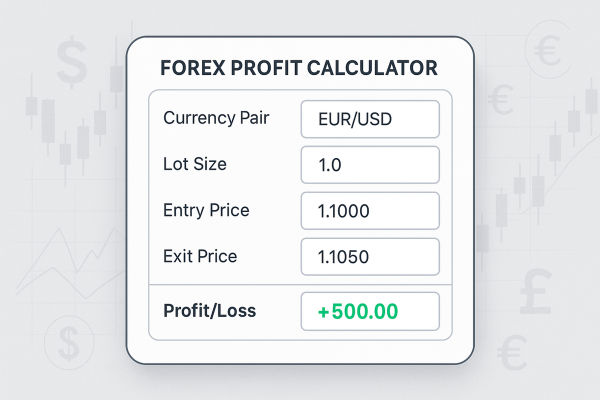

Pip Calculator: To determine the value of each pip movement.

Profit Calculator: To estimate potential gains or losses.

Position Size Calculator: To find the right lot size based on risk tolerance.

Together, these tools provided by EBC help traders create a strong risk management strategy.

Practical Tips for Margin Management

1) Avoid Over-Leveraging

Using excessive leverage without proper risk management often leads to margin calls.

2) Do Not Ignore Currency Conversions

If your account currency differs from the base currency of the pair, you must account for exchange rates.

3) Remember to Check for Free Margin

Traders sometimes forget to check the available free margin before opening multiple positions.

4) Do Not Assume All Brokers Have the Same Rules

Margin requirements may vary between brokers, so it's essential to verify the specific conditions.

Additionally:

Always calculate the margin before entering a trade.

Keep a free margin above 50% of your balance to avoid margin calls.

Use a position size calculator along with the margin calculator.

Start with smaller trades until you fully understand margin mechanics.

Avoid trading during extreme volatility if you're heavily leveraged.

Frequently Asked Questions

1. What Is a Forex Margin Calculator?

A Forex Margin Calculator is a trading tool that helps traders determine the required margin to open and hold a forex position based on lot size, leverage, and currency pair.

2. Why Should I Use a Forex Margin Calculator?

Using a Forex Margin Calculator ensures accurate margin requirements, prevents over-leveraging, and helps avoid margin calls by planning trades with better risk management.

3. Does Leverage Affect the Margin Calculated?

Yes. Higher leverage reduces the margin required, while lower leverage increases it. The calculator displays the precise amount needed according to your selected leverage ratio.

4. Is a Forex Margin Calculator Useful for Beginners?

Absolutely. Beginners often struggle with manual margin calculations, so a calculator helps them trade safely and understand risk exposure.

Conclusion

In conclusion, a Forex Margin Calculator is one of the most useful tools for traders in 2025. It offers insight into the margin required for each trade, enabling you to strategise wisely, control leverage, and steer clear of unnecessary risks.

With brokers like EBC Financial Group offering reliable and user-friendly calculators, beginners and experienced traders can execute smarter, safer, and more profitable trades.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.