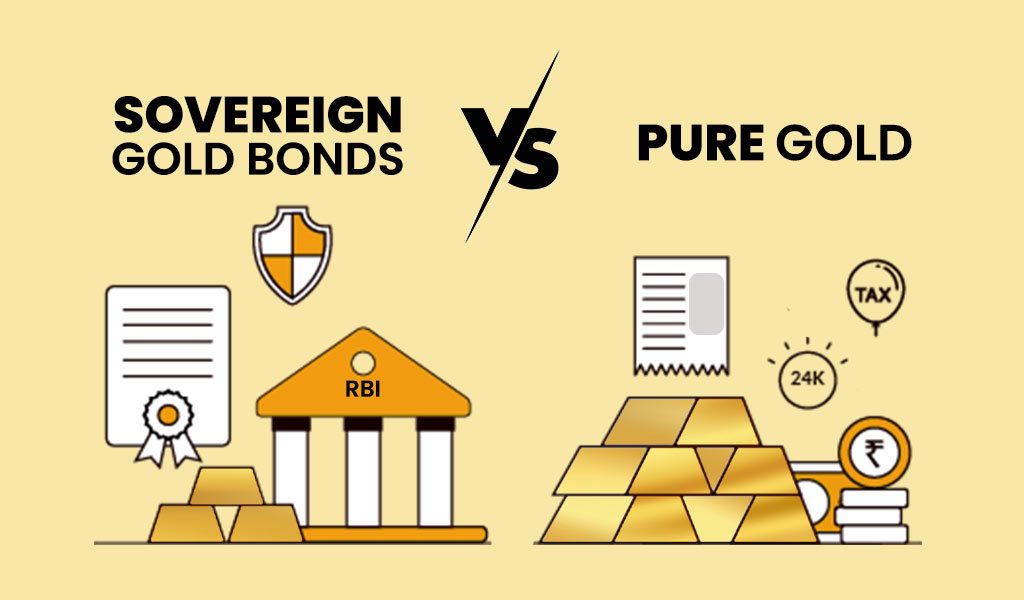

Investing in gold has long been considered a safe haven during economic uncertainties. Among the various methods to invest in gold, Sovereign Gold Bonds (SGBs) have emerged as a popular choice for investors seeking security and returns.

This article explores what gold bonds are, their benefits and drawbacks, how to invest in them, and expert opinions on whether they are a suitable investment for you.

What Is Gold Bond?

Gold bonds are government-issued securities that represent a specific quantity of gold. Instead of purchasing physical gold, investors buy these bonds, which are denominated in grams of gold.

The most notable example is the Sovereign Gold Bond (SGB) scheme introduced by the Government of India, where the Reserve Bank of India (RBI) issues bonds on behalf of the government.

Gold Bonds vs Gold Stocks vs Gold ETFs

| Feature |

Gold Bonds (SGBs) |

Gold Stocks (Mining Companies) |

Gold ETFs |

| Definition |

Government-issued bonds backed by gold |

Shares of companies involved in gold mining |

Exchange-traded funds tracking gold prices |

| Returns |

Fixed interest (2.5% p.a.) + gold price appreciation |

Capital gains + possible dividends |

Gold price appreciation (no interest or dividend) |

| Risk Level |

Low (backed by government) |

High (company and market risk) |

Moderate (subject to market price volatility) |

| Liquidity |

Tradable on exchange after lock-in; moderate liquidity |

Highly liquid (stock market) |

Highly liquid (traded like stocks) |

| Physical Gold Involved |

No |

No |

No |

| Taxation |

No capital gains tax on redemption (individuals); interest taxable |

Capital gains tax applicable |

Capital gains tax on selling units |

| Minimum Investment |

1 gram of gold (approx. cost of 1 gram) |

Cost of 1 share |

Cost of 1 unit (usually 1 gram of gold) |

| Ownership Structure |

Bond, no ownership of gold or company |

Equity in a mining company |

Units in a fund holding gold |

| Price Tracking |

Based on gold price |

Based on business performance + gold price |

Directly tracks market gold prices |

| Best For |

Long-term conservative investors |

Aggressive investors seeking high returns |

Short to medium-term investors seeking liquidity + gold exposure |

| Storage/Security Issues |

None |

None |

None |

| Volatility |

Low to moderate |

High |

Moderate |

How Do Sovereign Gold Bonds Work?

When you invest in an SGB, you are essentially lending money to the government, which, in turn, promises to pay you the equivalent value of gold at maturity, along with periodic interest payments. Key features include:

Denomination: Issued in multiples of one gram of gold.

Tenure: Eight years with an exit option after the fifth year.

Interest Rate: Fixed rate of 2.5% per annum, payable semi-annually.

Redemption: At maturity, investors receive the prevailing market value of gold.

Tax Benefits: Capital gains tax arising on redemption of SGBs to an individual is exempted.

Step-by-Step Guide to Invest in Sovereign Gold Bonds

Step 1: Check Eligibility

Ensure you are eligible to invest. Indian residents, including individuals, Hindu Undivided Families (HUFs), trusts, universities, and charitable institutions, can invest.

Step 2: Choose a Platform or Channel

You can invest through:

Scheduled commercial banks (except Small Finance Banks & Payment Banks)

Stock Holding Corporation of India Ltd (SHCIL)

Designated post offices

Recognised stock exchanges (NSE/BSE)

Online platforms of banks and brokers (like Zerodha, HDFC, ICICI, SBI)

Step 3: Track the Issuance Calendar

The RBI issues Savings Government Bonds (SGBs) in various series throughout the financial year. Keep track of the issuance dates by checking official announcements from the RBI or notifications from the bank.

Step 4: Complete the Application

You'll need to:

Fill in the application form online or at a bank/post office

Provide KYC documents (PAN card, Aadhaar, etc.)

Mention demat details (if applicable)

Step 5: Make Payment

Pay for the gold bonds using:

Step 6: Receive Allotment

After processing, you will receive:

Step 7: Hold or Trade

Expert Opinions on Gold Bonds

1. Reserve Bank of India (RBI)

RBI's View:

The RBI, which issues Sovereign Gold Bonds, promotes them as a safer and more productive alternative to physical gold. According to official communications, these bonds help reduce the country's gold imports while allowing investors to earn a 2.5% annual interest over and above any capital appreciation.

Key Point:

The RBI highlights the dual advantages of tracking gold prices and fixed income in volatile or high-inflation environments.

2. Morningstar India – Investment Analyst Commentary

Expert Insight:

"Gold Bonds serve long-term investors well, especially those who want to hedge against inflation without the risk and cost of storing physical gold. The tax exemption on capital gains at maturity is a standout feature," said Rajat Jain, Financial Analyst, Morningstar India.

Key Point:

Ideal for conservative investors who want predictable, government-backed returns.

3. Motilal Oswal Financial Services

Research Note (2025):

Analysts at Motilal Oswal describe SGBs as "one of the most efficient Gold Investment instruments" due to:

Tax benefits (no LTCG tax if held to maturity)

Better returns than physical gold

Government backing, reducing credit risk

Key Point:

They recommend gold bonds as a core gold holding in diversified portfolios.

4. ET Wealth Panel – Economic Times

Panel View (March 2025):

The ET Wealth's investment panel highlighted SGBs as the most cost-effective and transparent way to hold gold. Compared to jewellery or coins, SGBs eliminate making charges and storage hassles.

Key Point:

They advise retail investors to use SGBs for wealth preservation over a 5–10 year horizon.

5. Zerodha Varsity – Market Educator Platform

Commentary by Market Educator Karthik Rangappa:

Sovereign Gold Bonds (SGBs) are significantly more stable than gold futures or gold mining stocks in terms of risk-reward. Although they do not provide immediate liquidity, they are among the best long-term wealth-building strategies.

Key Point:

Good for disciplined investors not requiring short-term access to capital.

Benefits and Risks to Know

Advantanges

1. Safety and Security

Unlike physical gold, SGBs eliminate risks associated with storage and theft. They are held in digital or paper form, ensuring ease of management.

2. Regular Income

The 2.5% annual interest provides a steady income stream, which physical gold investments do not offer.

3. Tax Efficiency

Interest earned is taxable, but capital gains at maturity are exempt for individual investors, making it a tax-efficient investment.

4. Liquidity

SGBs are tradable on stock exchanges, allowing exit before maturity.

5. Collateral for Loans

These bonds can be used as collateral for loans, adding to their utility.

Disadvantanges

1. Market Risk

The value of SGBs is linked to the market price of gold, which can fluctuate, leading to potential capital loss if prices fall.

2. Interest Rate Risk

The fixed interest rate may be less attractive if market interest rates rise significantly.

3. Liquidity Constraints

While SGBs are tradable, their liquidity may be lower than that of other financial instruments, which could impact investors selling them.

Conclusion

In conclusion, Sovereign Gold Bonds present a compelling investment avenue for those looking to gain exposure to gold without the hassles of physical storage. With the added benefits of regular interest income, tax efficiency, and government backing, they are a prudent choice for long-term investors seeking portfolio diversification.

However, potential investors should assess their financial goals, risk tolerance, and investment horizon before committing funds to SGBs.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.