The canadian dollar (CAD) to US dollar (USD) exchange rate is a closely watched pair in the global FX market. In 2025, traders face a landscape shaped by shifting central bank policies, trade tensions, and commodity price swings.

Whether you're an active trader or a market observer, understanding the factors influencing CAD to USD and the latest forecasts can help you navigate volatility and spot opportunities. Here's what to watch in the FX market this year.

Recent Performance and Current Levels

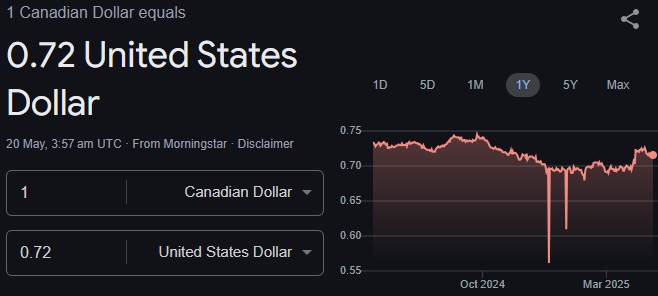

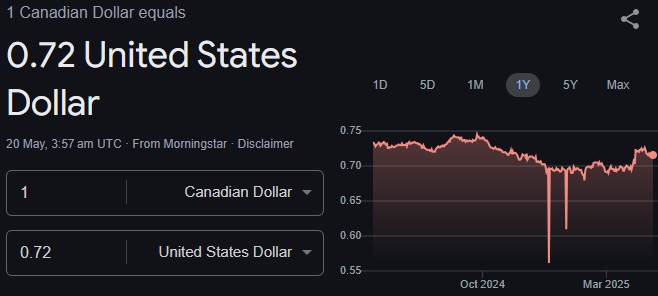

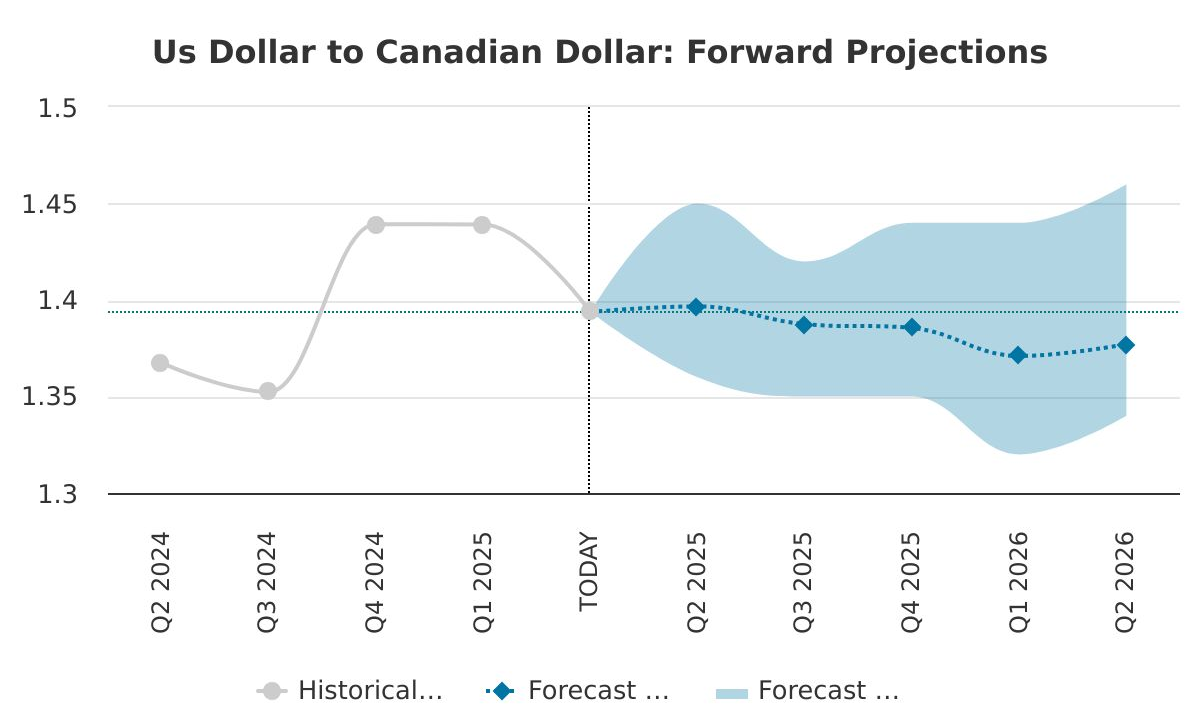

The CAD has experienced significant volatility against the USD over the past year. After starting 2024 at around 1.33, the Canadian dollar weakened sharply, hitting a two-decade low of 1.44 per US dollar by the end of the year. Early 2025 saw further pressure, with rates reaching as high as 1.46 in February before rebounding to the 1.40–1.42 range by May.

Historical data shows that, as of April 30, 2025, 1 CAD was worth approximately 0.7156 USD, and by mid-May, it had strengthened slightly to around 0.7190 USD.

Key Drivers Shaping the CAD to USD Outlook

1. Diverging Central Bank Policies

The Bank of Canada (BoC) has been easing monetary policy, cutting rates to support a sluggish domestic economy. In contrast, the US Federal Reserve has taken a more cautious approach, with markets anticipating fewer rate cuts in 2025 than previously expected. This policy divergence widens the interest rate differential, typically putting downward pressure on the Canadian dollar.

2. Trade Tensions and Tariff Risks

The return of US tariffs on Canadian goods under the Trump administration has weighed heavily on the loonie. The threat of further tariffs or escalation in trade disputes remains a key risk factor. Analysts suggest that if tariffs persist or escalate, the CAD could weaken towards 1.45 or even 1.50 against the USD by year-end. However, any resolution or easing of trade tensions could provide relief and support a CAD rebound.

3. Commodity Prices

Canada's economy is closely tied to commodity exports, especially oil. Fluctuations in global oil prices can have a direct impact on the CAD. Lower oil prices in early 2025 contributed to the currency's weakness, while any recovery in energy markets could help the loonie regain ground.

4. Economic Growth and Labour Market

A high unemployment rate and economic slack have made the BoC more dovish, while the US economy, though slowing, remains relatively resilient. Any surprises in GDP growth, inflation, or labour market data on either side of the border can trigger sharp moves in the CAD/USD pair.

5. Global Risk Sentiment

Broader market volatility, risk-off sentiment, and capital flows into or out of North America also play a role. In times of global uncertainty, the USD tends to benefit as a safe-haven currency, which can further pressure the CAD.

Analyst Forecasts for CAD to USD in 2025

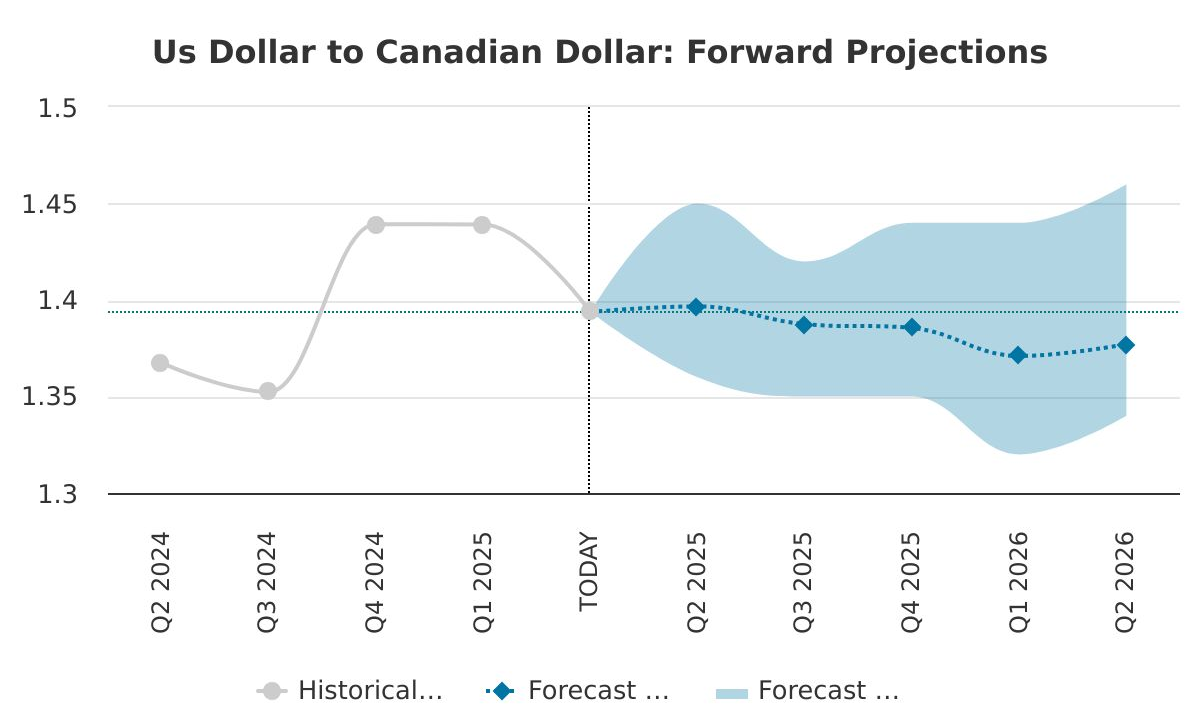

Morningstar reports a wide range of projections for the loonie, from 1.30 to 1.50 per USD, reflecting the high degree of uncertainty in the outlook.

LongForecast suggests the USD to CAD pair could trade between 1.40 and 1.46 through the first half of 2025, with a potential move to 1.45–1.50 if tariffs escalate.

What Should Traders Watch?

Central bank meetings and policy statements from the BoC and Fed

US and Canadian economic data (GDP, inflation, jobs)

Trade policy announcements and tariff developments

Oil and commodity price trends

Levels of market volatility and global risk sentiment

Final Thoughts

The CAD to USD forecast for 2025 is shaped by central bank divergence, trade risks, commodity prices, and shifting economic fundamentals. With analysts projecting a volatile range and potential for further swings, traders should stay alert to policy changes, economic data, and global headlines.

Monitoring these drivers will be key to navigating the FX market and making informed decisions in the months ahead.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.