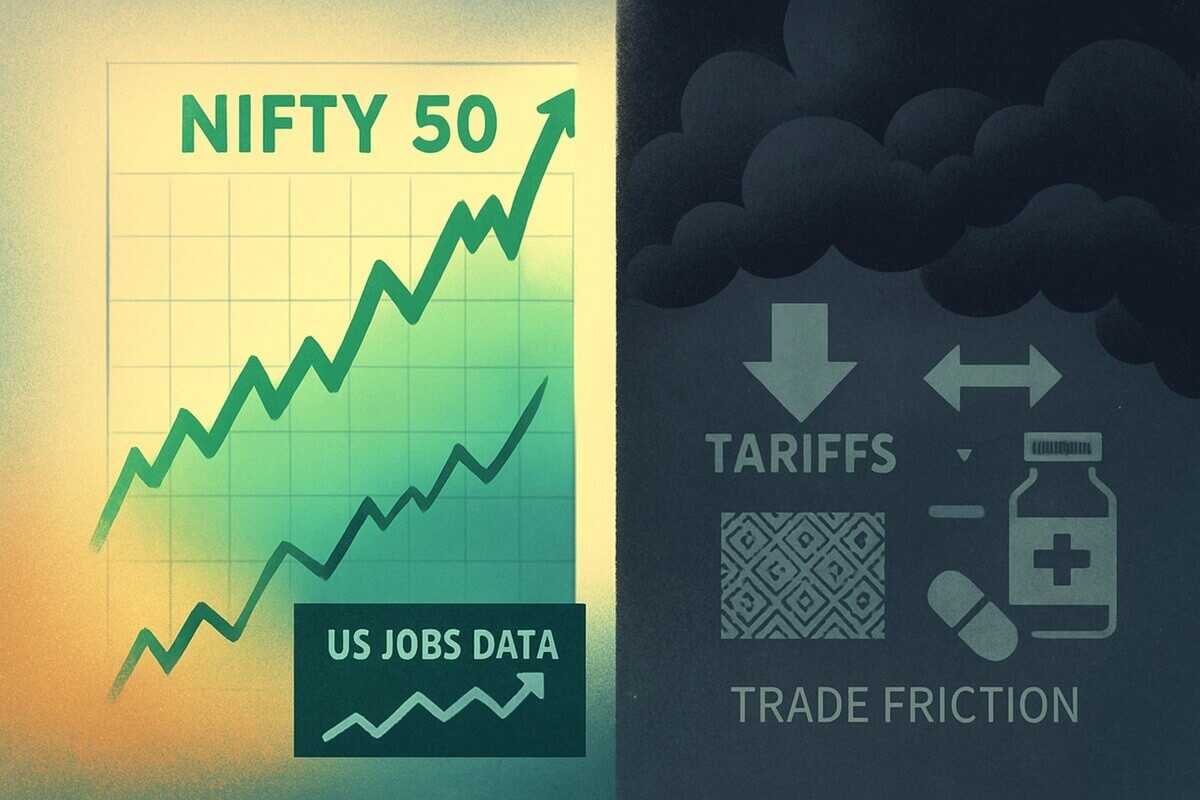

After enduring five consecutive weeks of losses, the Nifty 50 — India's flagship equity index — has finally shown signs of resilience. On Monday, 4th August 2025. it edged up by 0.3% to reclaim the 24.500 level, offering a momentary sigh of relief to investors navigating a storm of uncertainty. While this modest rebound sparked renewed interest on Dalal Street, broader sentiment remains fragile, clouded by escalating trade tensions, mixed earnings results, and shifting expectations around U.S. monetary policy.

The question now is not whether the bounce happened, but whether it is sustainable — or merely a pause before the next downward move.

A Snapshot of the Nifty 50

The Nifty 50 is more than just a number on a screen — it's the pulse of India's equity market. Representing the 50 most liquid and financially sound companies listed on the National Stock Exchange (NSE), the index cuts across a diverse range of sectors, including financials, information technology, consumer goods, energy, and healthcare.

Functioning as a bellwether for the Indian economy, the Nifty 50 is a benchmark for institutional investors, asset managers, and global funds looking to tap into the Indian growth story. Its composition is reviewed semi-annually, ensuring that it reflects the changing dynamics of the economy and corporate India.

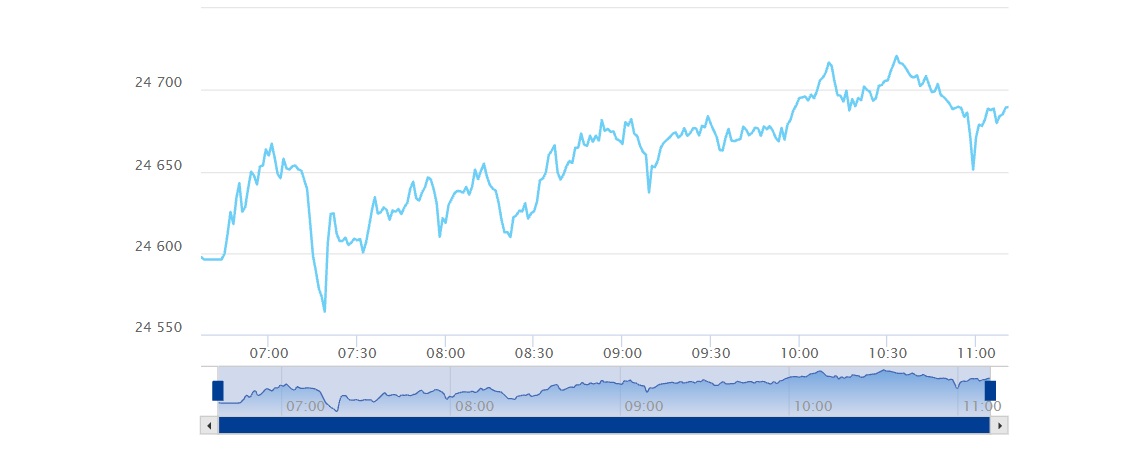

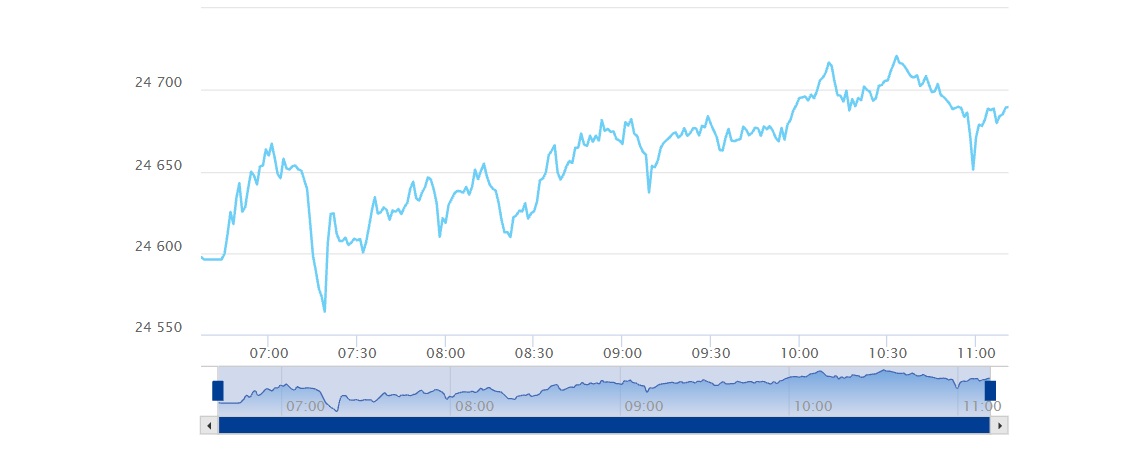

Market Movement: A Measured Rebound

On the trading session of 4th August 2025. the Nifty 50 rose by 0.3%, opening at 24.588. while the Sensex gained over 105 points to trade around 80.721. This marked the first positive weekly start in over a month. The trigger? Softer-than-expected U.S. jobs data, which lifted hopes that the Federal Reserve may pivot to a rate cut in September. This prospect, in turn, revived global risk appetite — albeit cautiously.

However, optimism was tempered by the re-emergence of global trade friction. Former President Donald Trump's newly announced 25% tariffs on Indian-manufactured goods have spooked investors and rattled export-dependent sectors, such as textiles, pharmaceuticals, and chemicals. This development also raises the spectre of retaliatory measures and potential disruption in trade flows.

Earnings Season Disappoints

Beyond geopolitics, corporate earnings have failed to provide much cheer. Q1 results from several blue-chip companies in the information technology and metals sectors have underwhelmed, missing analyst expectations and dragging overall sentiment. Cost pressures, muted demand growth, and margin squeezes have all played a part in the downbeat performance.

The lack of broad-based earnings momentum has led many investors to adopt a "wait-and-watch" approach, particularly with several key companies yet to report. For the Nifty 50 to build on its recent gains, corporate India will need to show more resilience and deliver tangible signs of earnings recovery.

Foreign Outflows and Currency Pressure

Adding to the complexity is the recent trend of foreign portfolio investor (FPI) outflows. Spooked by global uncertainty and looking to hedge risks, overseas investors have been pulling capital out of Indian equities over the past month. The rupee, already under pressure from a rising dollar and trade disruptions, has depreciated, raising imported inflation concerns.

However, some analysts argue that these outflows could reverse quickly if the Fed indeed cuts rates — making emerging markets more attractive relative to U.S. assets.

The Long-Term Perspective: SIP and Discipline

While near-term volatility remains high, seasoned investors continue to stress the importance of staying invested in quality companies. A case in point: a monthly SIP (Systematic Investment Plan) of ₹10.000 in the Nifty 50 over the past five years would today be worth over ₹8.6 lakh — a testament to the power of compounding and consistency.

Historically, the Nifty 50 has weathered multiple storms — from global financial crises to pandemics — and still delivered strong long-term returns. The current environment, while tense, is no different in its cyclical nature.

Conclusion

The Nifty 50's modest rebound offers investors a much-needed reprieve, but it's far too early to declare victory. With Trump-era tariffs back on the table, corporate earnings delivering mixed signals, and uncertainty over the Fed's policy path, volatility may remain the norm in the weeks ahead.

Yet, for investors with a long horizon and a focus on fundamentals, these periods of instability often prove to be opportunities in disguise. As the dust settles and global factors evolve, India's structural growth story — underpinned by demographics, consumption, and digital innovation — is likely to reassert itself.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.