In 2025, gold remains a safe haven asset, valued for its ability to hedge inflation, volatility, and currency weakness.

As global uncertainty persists and gold crosses the $4,200 per ounce mark in 2025, demand for gold exchange-traded funds (ETFs) stock has surged.

Gold ETFs stock provide direct exposure to gold prices without the burden of owning or storing physical bullion. They are liquid, transparent, and efficient, ideal for both institutional and retail investors seeking defensive allocation.

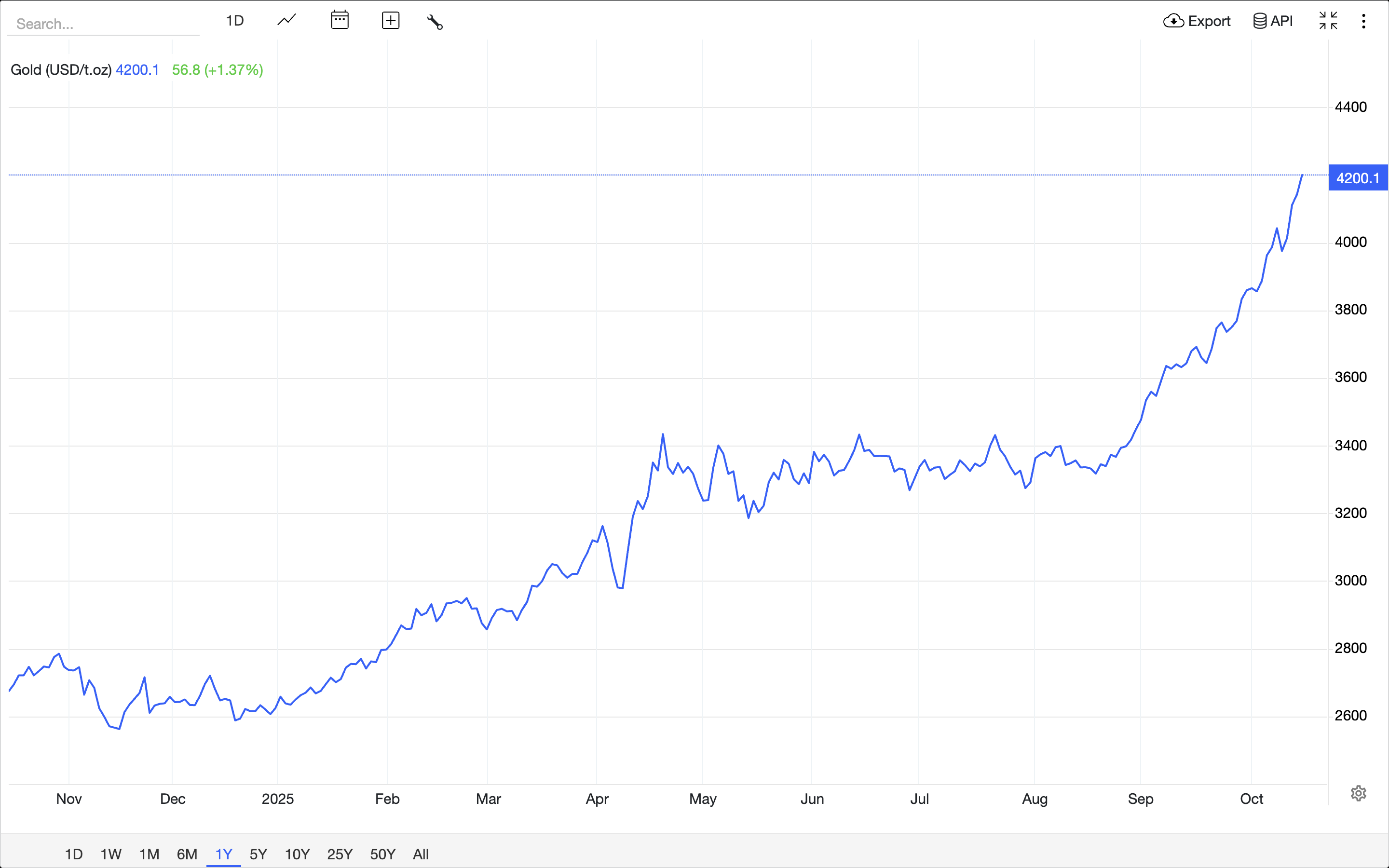

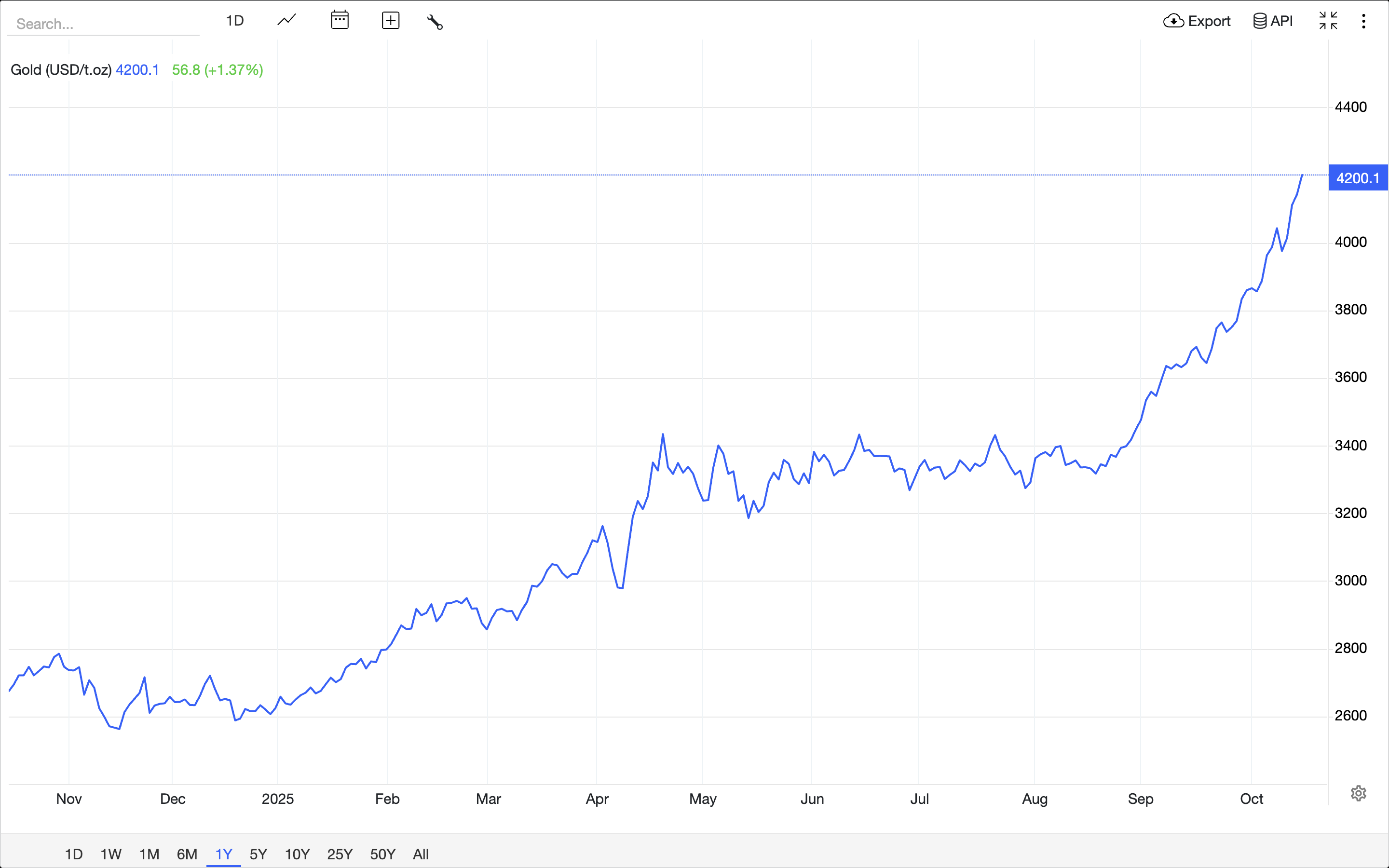

Current Gold Spot Price

The current gold spot price in 2025 serves as the benchmark for valuing gold ETF stock and reflects real-time shifts in global supply, demand, and investor sentiment.

Why Invest in Gold ETFs Stock in 2025

Several factors are reinforcing gold’s position as a high-priority asset to invest in this year:

Record Prices: Gold recently broke the $4,200 per ounce barrier, hitting new all-time highs on rate cut expectations and safe-haven demand.

Strong Year-to-Date Gains: Gold is up over 50% YTD, driven by macro pressures and rising investor flows.

Equity Volatility: With global equity indices under pressure, many investors are reallocating capital toward gold ETFs as a hedge.

Central Bank Demand: Central banks continue to buy gold, adding institutional support and credibility.

Top Gold ETFs Stock to Buy in 2025 And Why

From low-cost physical gold funds to high-potential mining ETFs, these are the gold ETF stock picks defining 2025’s strongest opportunities for investors.

| ETF Name |

2025 Return (approx.) |

Expense Ratio |

Highlights / Notes |

| Franklin Responsibly Sourced Gold ETF (FGDL) |

~44% |

0.15% |

Reported as top performer in recent reviews. |

| iShares Gold Trust Micro (IAUM) |

~43–48% |

0.09% |

Cited for lowest fees and strong performance. |

| Goldman Sachs Physical Gold ETF (AAAU) |

~43–44% |

0.18% |

Offers direct physical gold backing; consistent with prior data. |

| GraniteShares Gold Shares (BAR) |

~43–44% |

0.17% |

Strong liquidity and transparent structure. |

| VanEck Gold Miners ETF (GDX) |

30–35%+ |

0.51% |

Mining stocks have outperformed bullion in 2025. |

| SPDR Gold Shares (GLD) |

~13–16% (YTD) |

0.40% |

Still among the most liquid gold ETFs. |

| iShares Gold Trust (IAU) |

~13–16% (YTD) |

0.25% |

Low cost vs GLD; good for long-term exposure. |

| Axis Gold ETF (India) |

~25–28% |

(varies) |

Strong Indian market performance; data from mid-2025. |

| ICICI Prudential Gold ETF (India) |

~25–32% |

(varies) |

Historically solid in the Indian gold space. |

How to Choose the Best Gold ETF Stock

Fees: Lower expense ratios improve net returns.

Liquidity: Large ETFs like GLD and IAU offer tighter spreads and easy trading.

Type of Exposure: Choose between physical gold ETFs or gold mining ETF stocks like GDX.

Diversification: Indian ETFs add cross-border exposure for global investors.

Transparency: Verify fund custody, sourcing, and storage disclosures.

The Hidden Costs of Gold ETFs: What to Watch For

While gold ETFs are efficient and accessible, they aren’t cost-free. The expense ratio which is a small annual fee deducted from returns covers management and storage, but it can quietly eat into long-term gains.

Even a 0.40% fee compounds over years, reducing total performance compared to lower-cost alternatives.

Another overlooked factor is the bid-ask spread, the small difference between buying and selling prices on the market. Wider spreads mean higher trading costs, especially for less-liquid funds.

Finally, investors should understand tracking errors such as the gap between an ETF’s performance and the actual price of gold. It can occur due to management costs or imperfect replication.

For serious investors though, these small gaps matter, as choosing funds with low fees, tight spreads, and strong liquidity ensures gold exposure remains as pure and cost-effective as possible.

Future of Gold Investing: Beyond ETFs

Gold investing is evolving beyond traditional ETFs. Digital platforms now offer tokenized gold, where each token represents ownership of real, vaulted bullion that can be traded instantly online.

This bridges the gap between physical gold and digital finance, improving liquidity and accessibility for smaller investors.

Fractional ownership is also growing, allowing investors to buy tiny portions of gold-backed assets rather than full bars or coins.

Combined with blockchain verification and transparent custody records, these innovations are making gold investment faster, more secure, and globally accessible, marking the next phase of how investors hold and trade gold.

EBC Options: Gold CFD & Gold ETF CFD

For investors seeking more flexibility, EBC offers Gold CFD and Gold ETF CFD trading options. These contracts allow leveraged exposure to gold prices or ETFs without owning the underlying asset.

Gold CFD: Track real-time gold prices and trade with leverage for potentially higher returns.

Gold ETF CFD: Gain exposure to top-performing gold ETFs while avoiding the complexities of physical custody.

These instruments can complement traditional ETF investments, providing more trading opportunities and short-term strategies for active investors.

Frequently Asked Questions

1. Are gold ETFs still a good investment in 2025?

Yes. With gold trading above $4,200 per ounce in 2025 and equities facing pressure, gold ETFs remain one of the most effective hedges against inflation, volatility, and currency weakness.

2. What’s the difference between a gold ETF and a gold mining ETF?

A gold ETF tracks the price of physical bullion, while a gold mining ETF invests in shares of gold-producing companies. Mining ETFs can offer higher upside when gold prices rise but are generally more volatile.

3. How much should I allocate to gold ETFs in my portfolio?

Financial analysts typically suggest 5–10% exposure to gold ETFs as part of a diversified portfolio, balancing growth assets with defensive holdings.

4. Are gold ETFs safe?

Gold ETFs are regulated financial products backed by physical gold or equity holdings. They offer secure custody, transparent holdings, and daily liquidity, making them safer than storing physical gold yourself.

Final Thoughts: Gold Still Holds Its Shine

In 2025, gold ETFs stock continues to offer a safe and profitable route for investors navigating inflation and economic instability.

Leading funds such as FGDL, IAUM, AAAU, BAR, and GDX remain among the best gold ETFs for diversified portfolios.

Whether you prefer direct gold exposure or leveraged returns from mining stocks, today’s gold ETF options provide the flexibility to match any investment strategy no matter defensive or growth-oriented.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.