The Swiss franc was largely unchanged on Wednesday despite of improving US

consumer inflation. Longer-term, the more protectionist stance of the United

States is expected to keep hurting the greenback.

Swiss inflation could enter negative territory in the coming months, but this

will not necessarily trigger a reaction by the SNB, Chairman Martin Schlegel

said on Tuesday.

Swiss inflation eased to 0% in April, the lowest reading for four years.

Therefore, markets currently price in a 75% probability the central bank will

cut the rate 25 bps at its next meeting in June.

Signs of economic weakness also points to the necessity of loosening. Swiss

exports to the US plummeted in April, showing the fallout from President Trump's

tariff policy.

Foreign sales, adjusted for seasonal swings, declined 36% from March,

according to official data. That come after two months of robust export numbers

as exporters were frontloading shipments.

US Treasury Secretary Bessent has said that Switzerland is "at the front of

the queue" for a trade deal. The country initially was hit with 31% tariffs

before Trump announced the suspension of many of his levies.

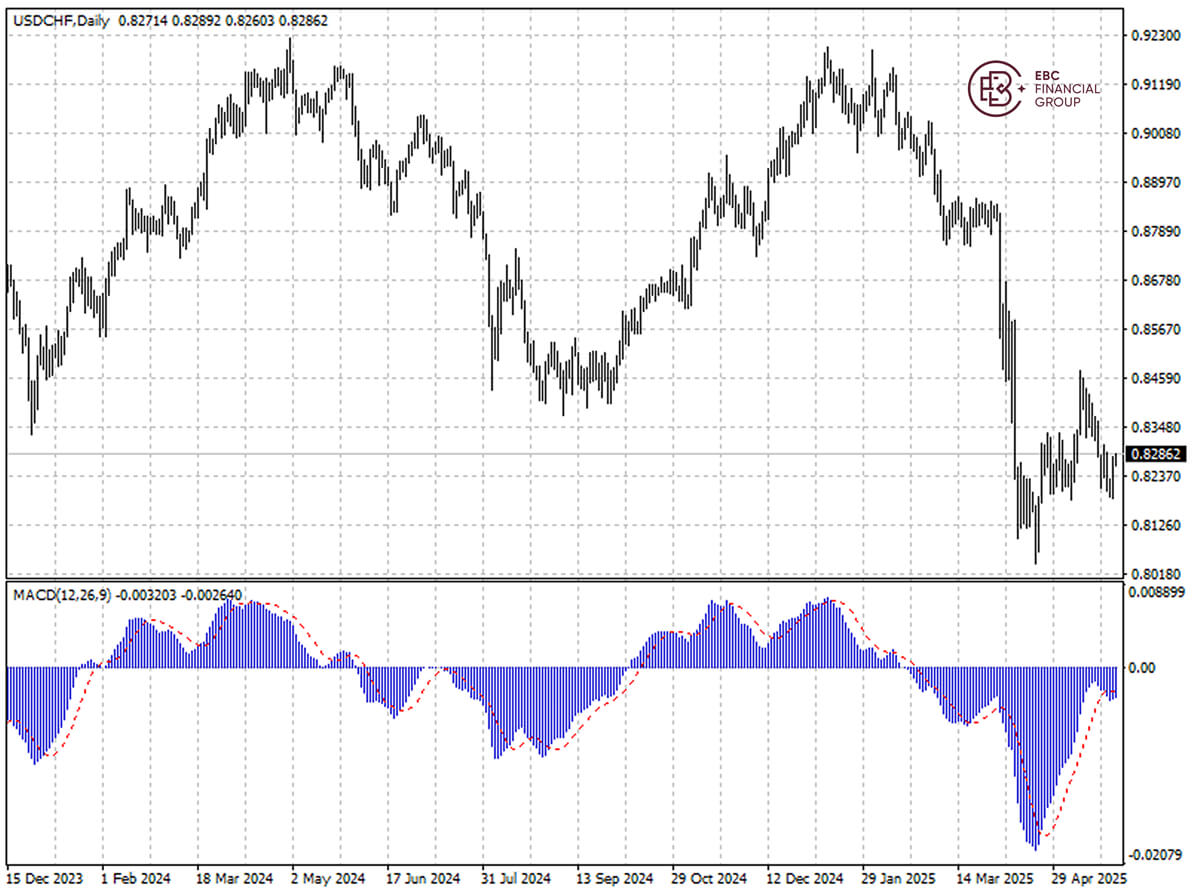

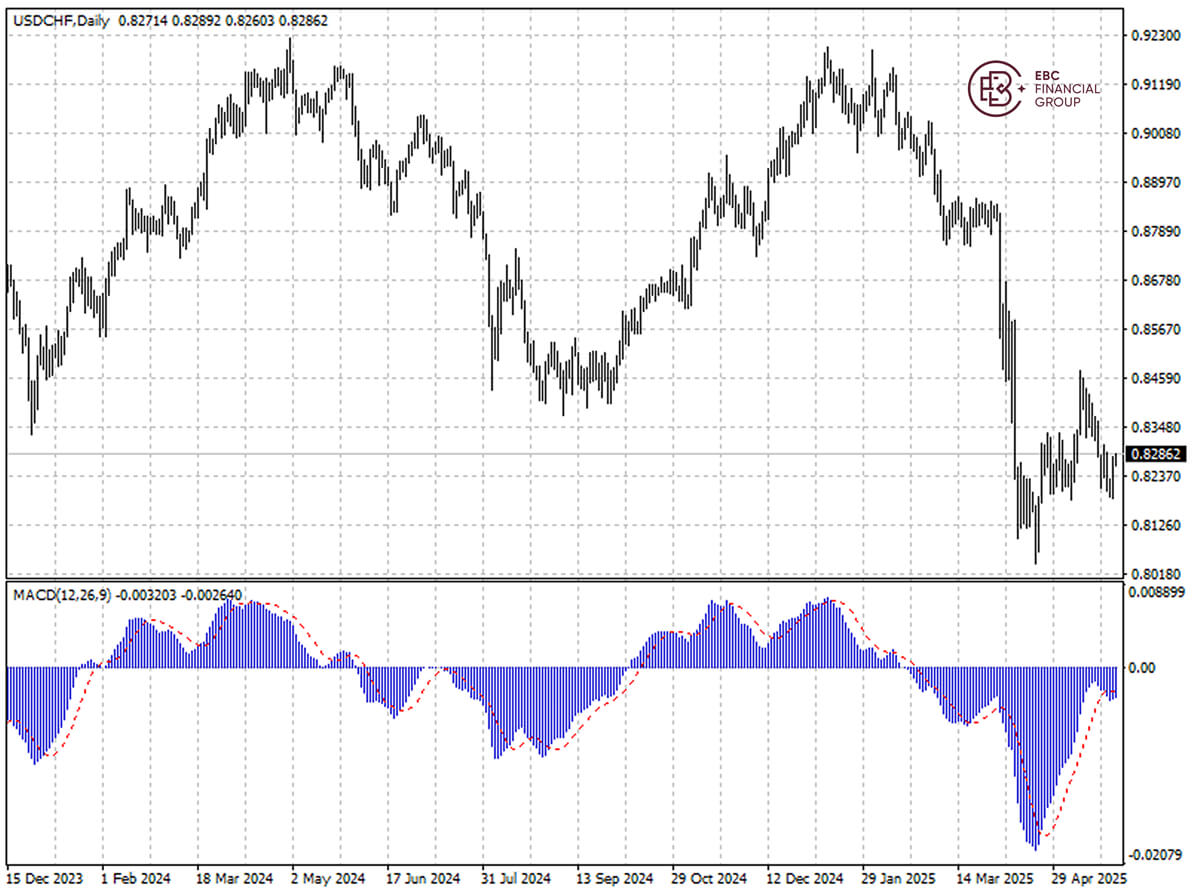

The Swiss franc has consolidated its recent gains, and a bearish MACD

divergence suggests there are upside risks ahead. The resistance could lie

around 0.8250 per dollar.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.