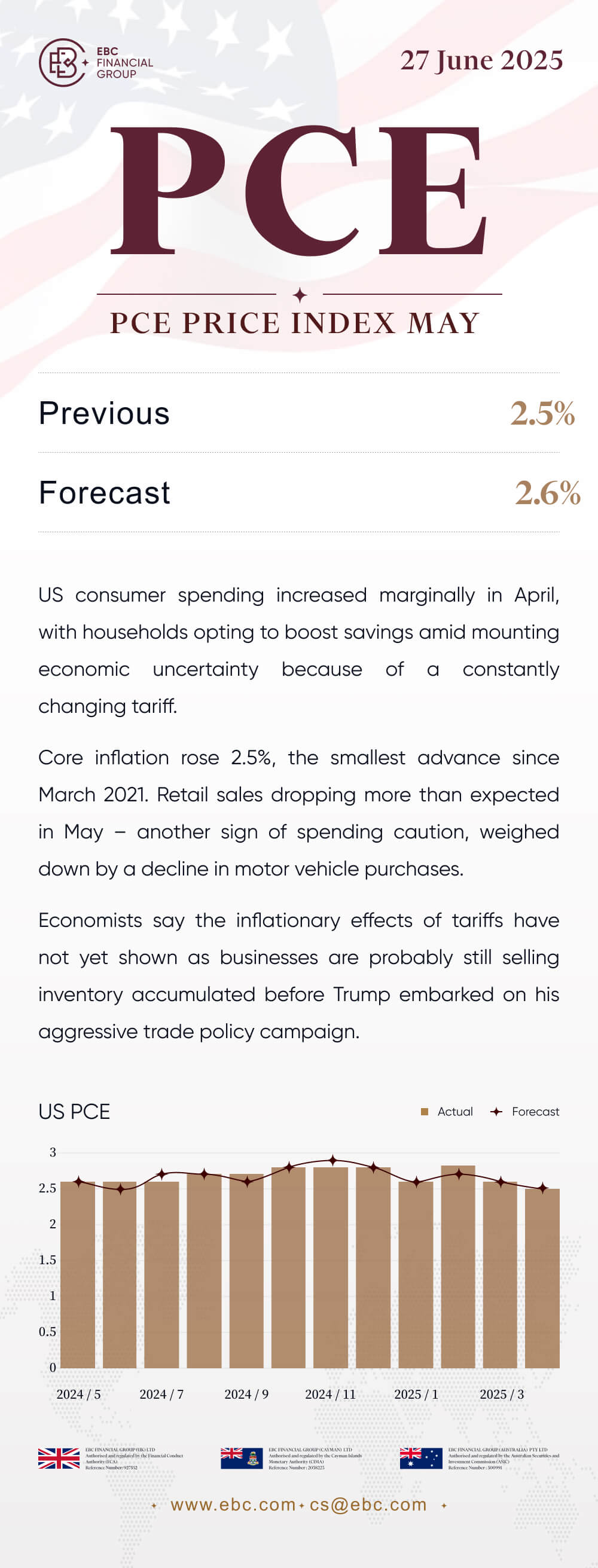

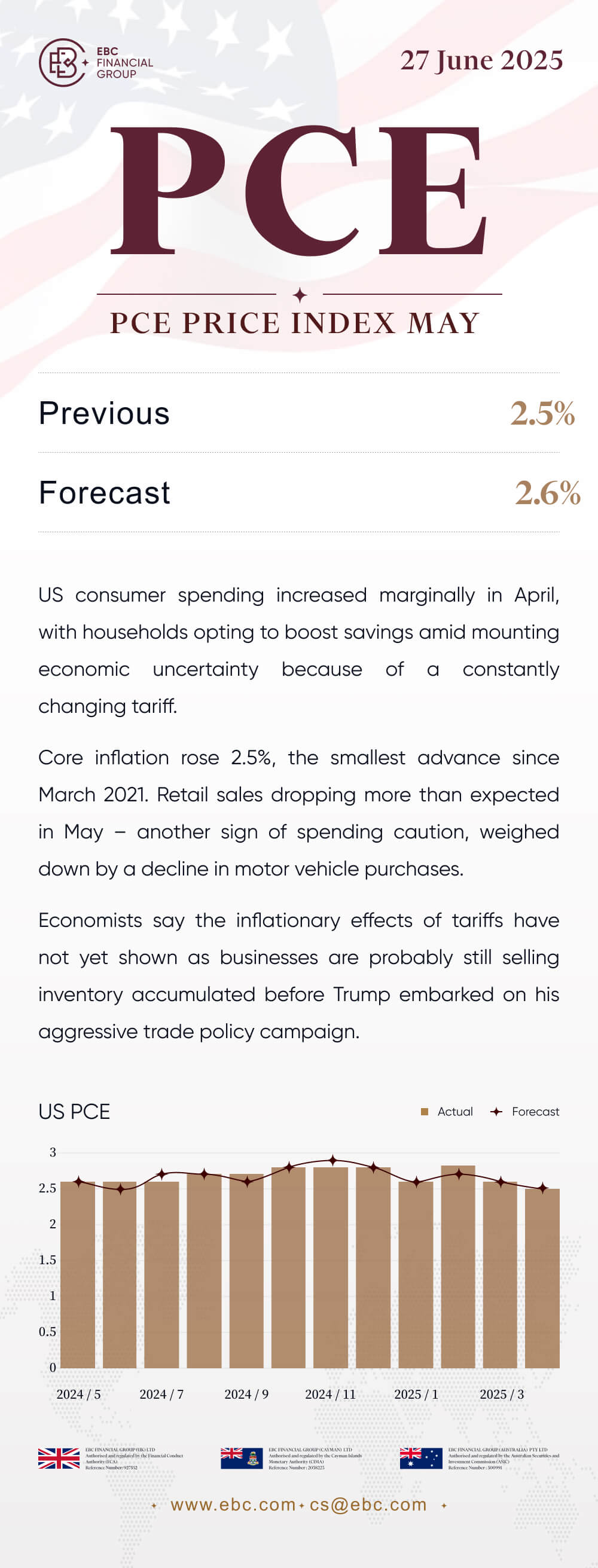

PCE price index May

27/6/2025 (Fri)

Previous: 2.5% Forecast: 2.6%

US consumer spending increased marginally in April, with households opting to

boost savings amid mounting economic uncertainty because of a constantly

changing tariff.

Core inflation rose 2.5%, the smallest advance since March 2021. Retail sales

dropping more than expected in May – another sign of spending caution, weighed

down by a decline in motor vehicle purchases.

Economists say the inflationary effects of tariffs have not yet shown as

businesses are probably still selling inventory accumulated before Trump

embarked on his aggressive trade policy campaign.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.