PCE price index Oct

27/11/2024 (Wed)

Previous: 2.7% Forecast: 2.8%

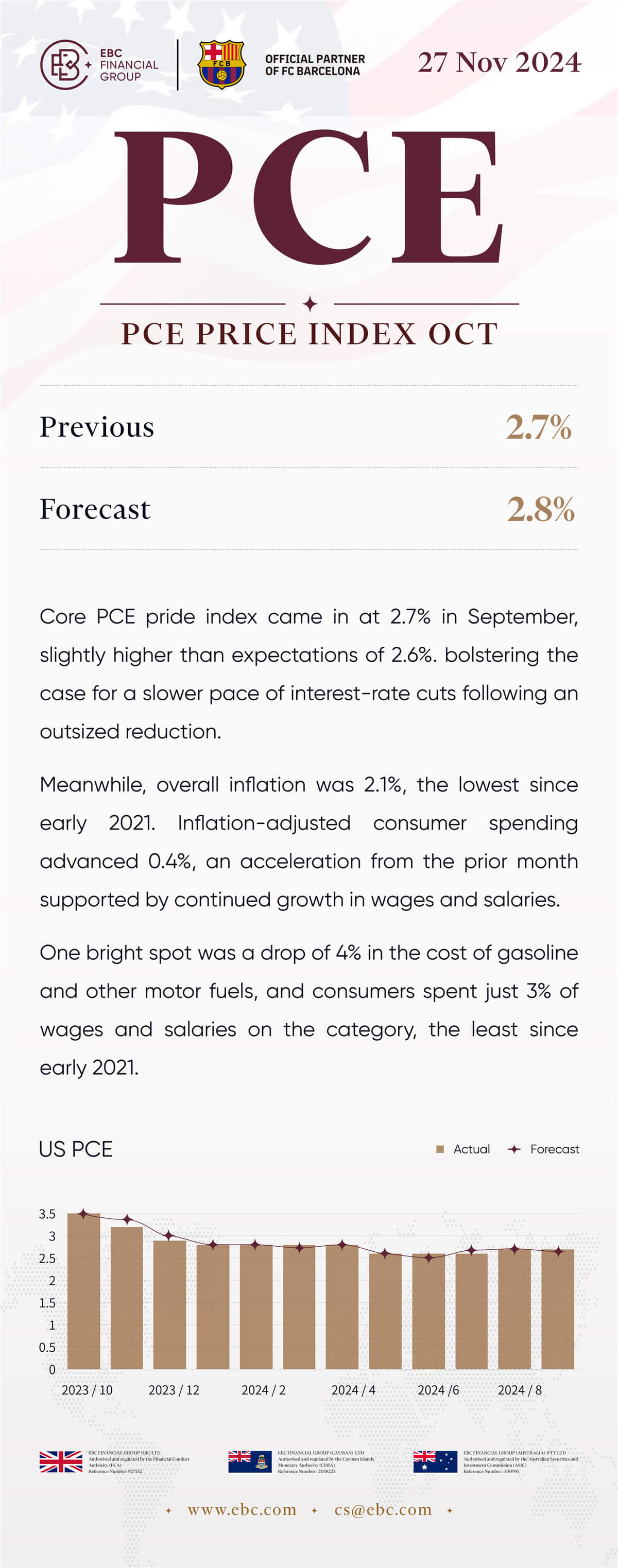

Core PCE pride index came in at 2.7% in September, slightly higher than

expectations of 2.6%. bolstering the case for a slower pace of interest-rate

cuts following an outsized reduction.

Meanwhile, overall inflation was 2.1%, the lowest since early 2021.

Inflation-adjusted consumer spending advanced 0.4%, an acceleration from the

prior month supported by continued growth in wages and salaries.

One bright spot was a drop of 4% in the cost of gasoline and other motor

fuels, and consumers spent just 3% of wages and salaries on the category, the

least since early 2021.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.