US stocks retreated on Tuesday amid warnings that markets might have been

overly optimistic about rate cuts. Treasury yields climbed to its highest level

since mid-Dec.

Nasdaq CEO Adena Friedman said in Davos that while “there are a lot of

signals that would say that there should be rate [cuts] as we go through the

year … if I were the Fed, I would be a little concerned about starting too

early.”

Fourth-quarter earnings for S&P 500 companies overall are expected to

have increased 4.4% from a year earlier, LSEG data showed on Friday. They are

expected to rise by 11% in 2024 after increasing just 2.9% in 2023.

About 8% of S&P 500 companies have reported so far, with the majority of

these firms surprising positively. But Wall Street strategists said there is

little reason to cheer as earnings estimates were slashed so much over the past

three months

Significant job cuts in the tech industry at the start of the new year have

flashed more warning signals. With higher interest rates, many employers have

re-oriented to focus on profit rather than revenue growth.

Morgan Stanley chief investment officer Mike Wilson believes fourth quarter

results will be a crucial test of investors' belief that the economy will skirt

recession as inflation comes down — the so-called soft-landing trade.

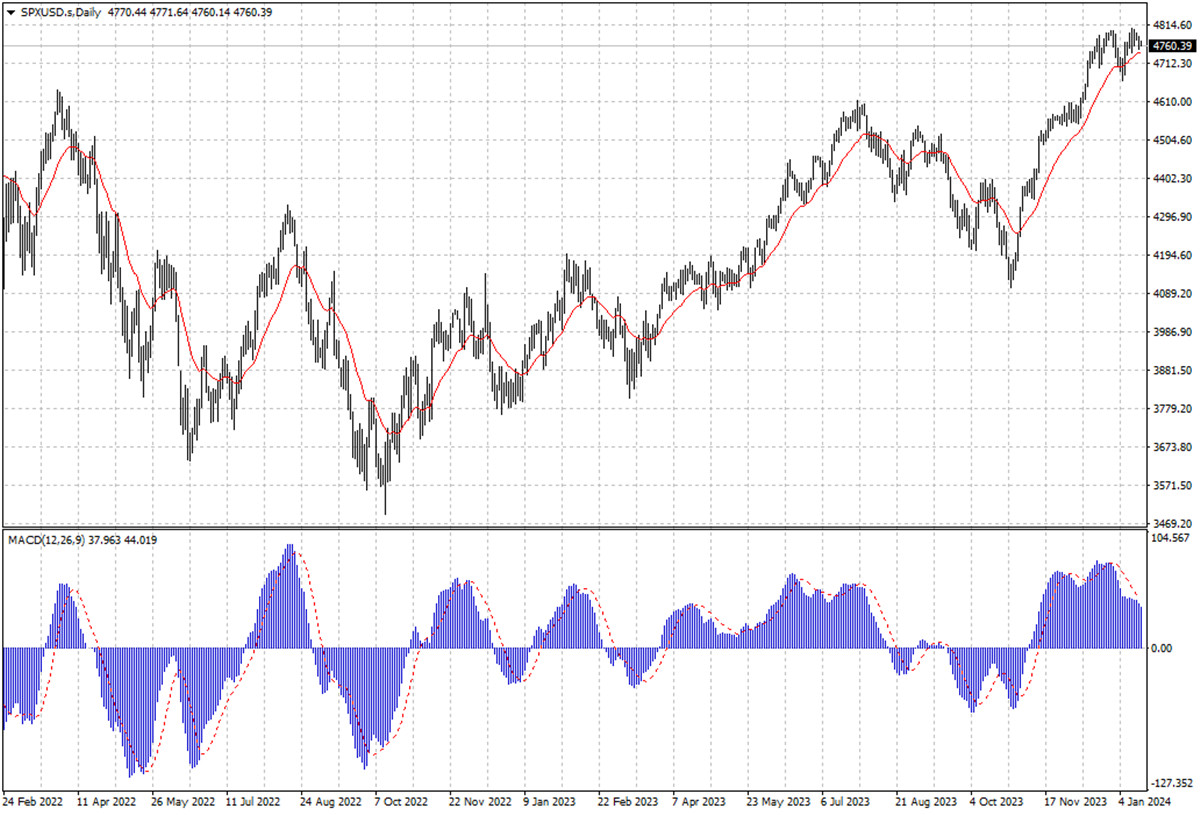

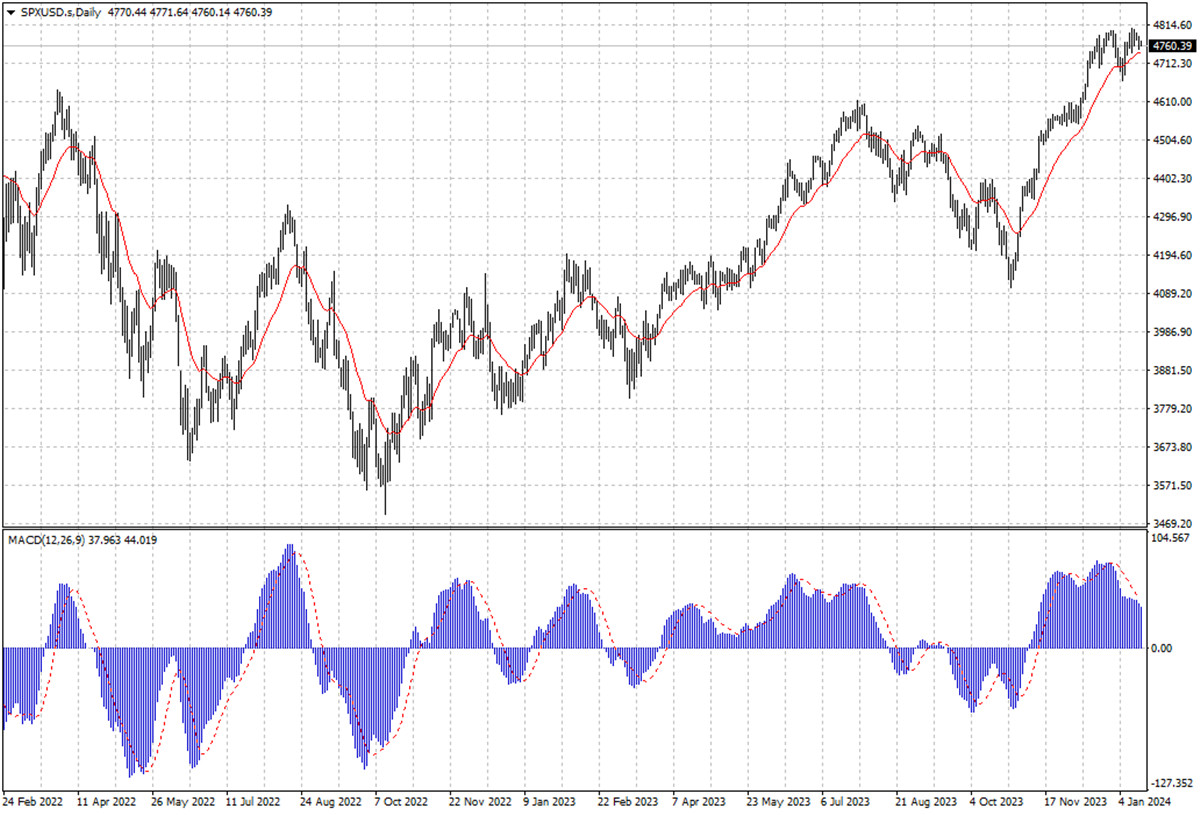

The benchmark index is supported by its 50 EMA with medium-term upward trend

intact. However, MACD diverges negatively against it, which indicates danger of

deeper correction.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.