The ASX200 flirted with its record high on Friday, trading at more than 18

times future earnings - a roughly 11% premium to its average valuation over the

last decade.

Corporate Australia will release half-year earnings next week. While modest

growth is expected, traders will scrutinise whether profits justify stretched

valuations.

A miss to expectations threatens to tip companies off their high valuations.

Financial stocks are primed for decent earnings growth as they benefit from high

interest rates, UBS analysts said.

Aussie banks will see a "relatively benign reporting season" characterised by

stable margins and solid credit growth, Citi analysts said. Elsewhere weakness

in resources firms continues to be a drag on the market.

While analysts see value in the sector after a dismal performance last year,

weak Chinese commodities demand and higher operating costs remain upsetting.

BHP has put takeover plans for the London-listed Anglo American on ice,

according to people close to the company. Anglo's copper assets are the

rationale behind the bid as iron ore boom is fading.

Woodside Energy warned Australia faces an "acute" challenge in keeping its

position as one of the world's leading energy suppliers in the face of Trump's

push to increase fossil fuel output.

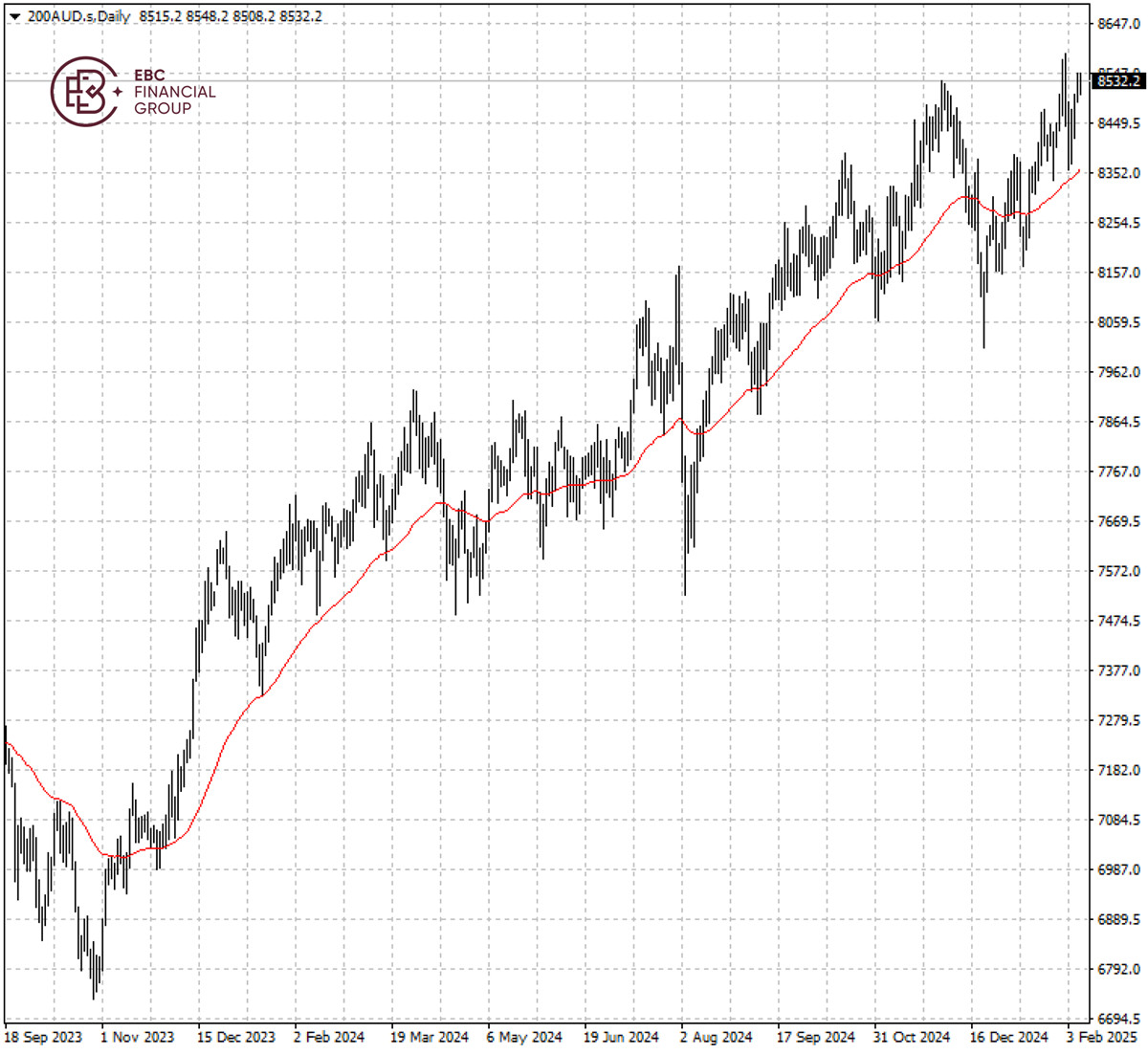

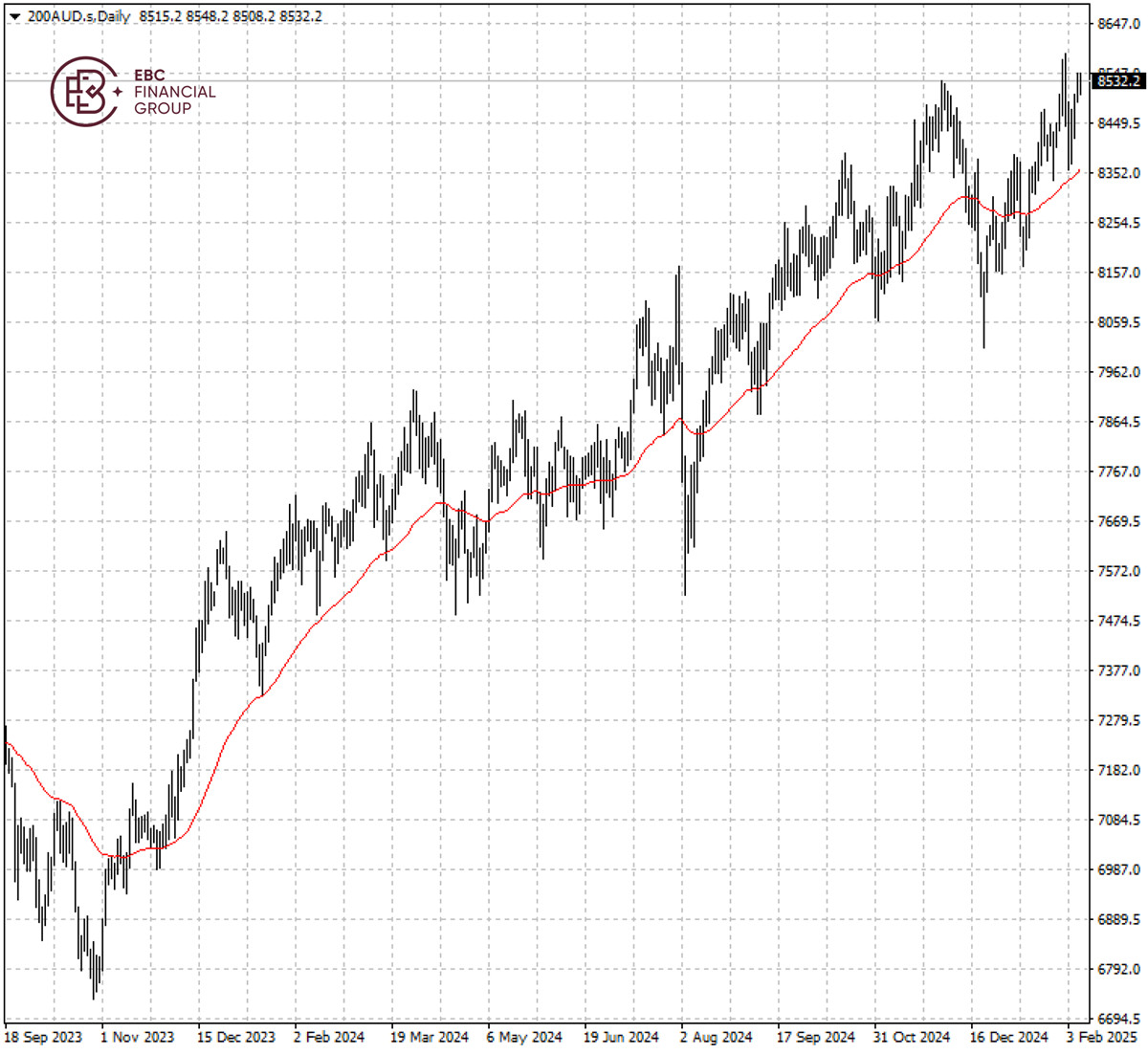

The benchmark stock index stayed bullish above 50 SMA. The resistance lies

around 8,550, a break of which is needed to break the record.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.