The US dollar wallowed near a five-month trough against the euro and other

major peers on Tuesday as investors grappled with the potential economic impact

of growing global trade tensions.

The dollar found little support from a Commerce Department report on Monday

that showed retail sales rebounded moderately in February, after a revised 1.2%

decline in January.

Asset managers pumped up bullish euro positions to a five-month high, while

hedge funds pared bets on the currency's weakness. That underscore a global

rethink on the euro's trajectory.

German conservative leader Friedrich Merz last week reached an agreement with

the Green Party on a debt-funded spending package for defense and

infrastructure, ahead of a crunch vote in parliament.

The ECB will lower borrowing costs two more times, according to analysts

surveyed by Bloomberg who no longer expect interest rates to go below 2%.

Back-to-back cuts are seen as likely in April and June.

Survey respondents expect the euro-zone economy to gain momentum, predicting

growth of 0.9%, 1.2% and 1.5% in the next three years — broadly in line with the

ECB's own projections.

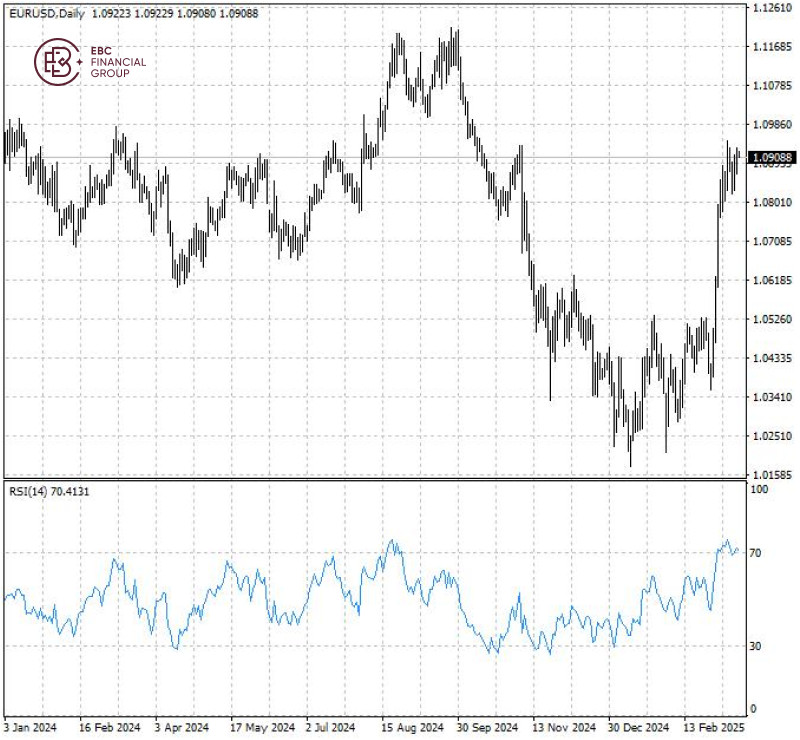

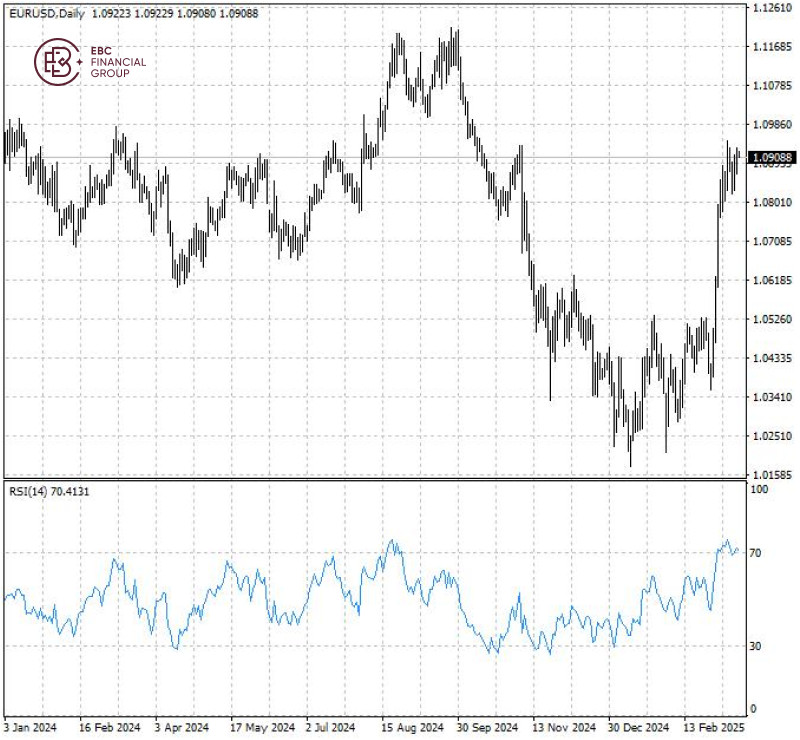

The single currency is trading near the resistance at 1.0930. This, coupled

with RSI over 70, signals an immediate treat though it could have more room to

run in the longer term.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.