The australian dollar gained after weekend talks between the US and China

announced a "trade deal". While details of the deal are still unclear, any

de-escalation in the ongoing trade war could bring relief.

Trump indicated Friday ahead of key trade talks that he was willing to lower

tariffs on China to 80%, but that level may still be higher than what investors

and business leaders were hoping for.

A priority on US agenda is securing the removal of China's export

restrictions on rare earths used to make magnets as a range of industries face

disruption, people familiar with the preparations for the talks said.

According to Bloomberg Economics calculations, the existing tariffs on China

and the rest of the world have lifted the US's average tariff rate by more than

20 percentage points to 23%.

A fragile ceasefire was holding between India and pakistan on Sunday, after

hours of overnight fighting between the nuclear-armed neighbours, as Trump said

he will work to provide a solution regarding Kashmir.

Meanwhile Ukrainian President Zelenskiy said he was ready to meet Russian

leader Putin in Turkey on Thursday for direct talks, the first since early

months of the 2022 invasion.

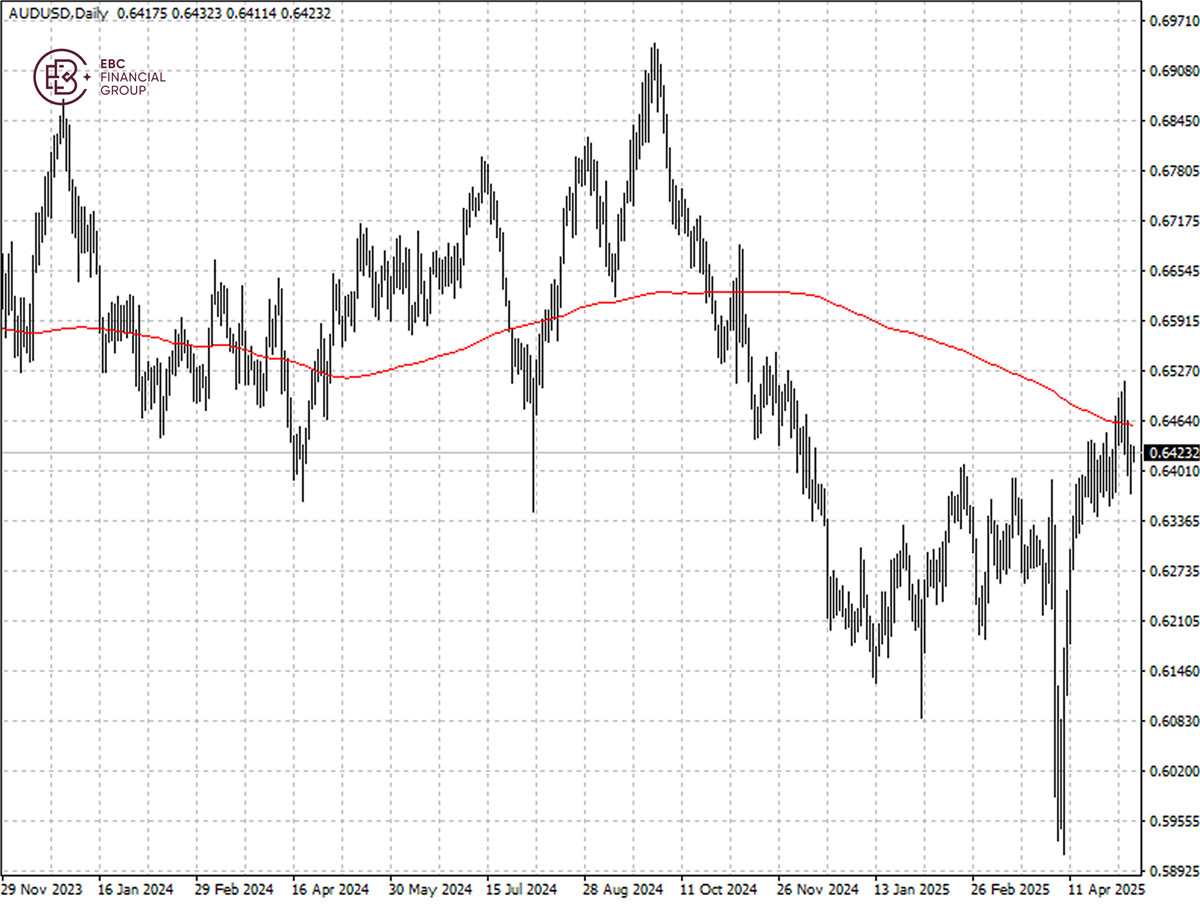

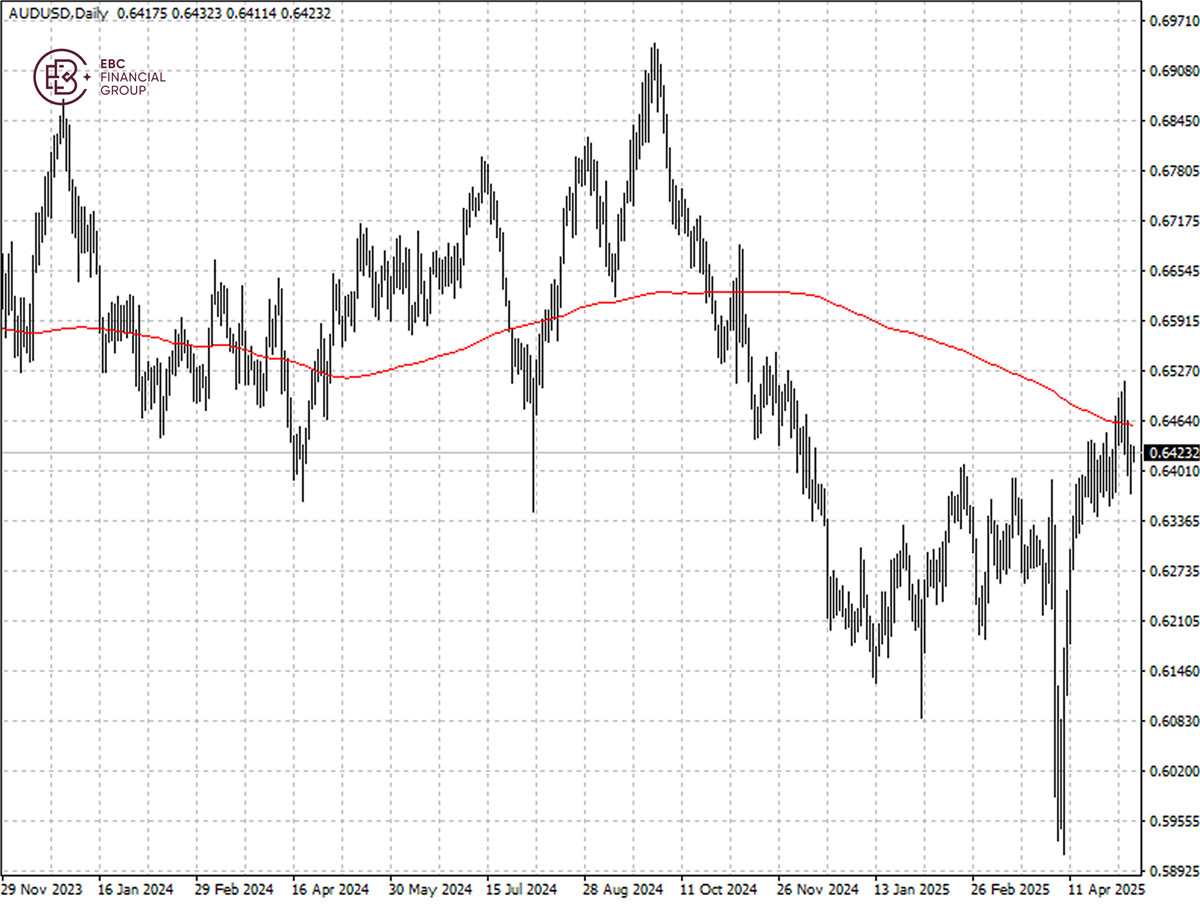

The Aussie dollar has fallen below 200 SMA and reverted to its previous

trading range As such the risk is skewed towards the downside in the near term

with support around 0.6350.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.