China's A50 gained more than 1% on Wednesday as offered on the latest signs

of progress in US-China trade talks, while more detail of what was decided and

whether it would stick for long remain to be seen.

Both sides said on Tuesday they had agreed on a framework to put their trade

truce back on track and remove China's export restrictions on rare earths. That

allays fears of China's further slowdown.

The country's consumer prices fell for a fourth consecutive month in May, as

Beijing's stimulus measures appear insufficient to boost domestic consumption.

Price wars in the car industry have bolstered the trend.

Eyes will be on the l Lujiazui forum due later this month, where top

financial regulators will deliver keynote speeches. Government officials said

last month that major financial policies will be revealed then.

Residential sales continued to fall in May. An often overlooked pool of funds

worth 10.9 trillion yuan could be utilised to salvage its housing sector,

offering an alternative to bank mortgages.

The World Bank slashed its global growth forecast for 2025 by four-tenths of

a percentage point to 2.3%, saying higher tariffs and heightened uncertainty

posed a "significant headwind" for nearly all economies.

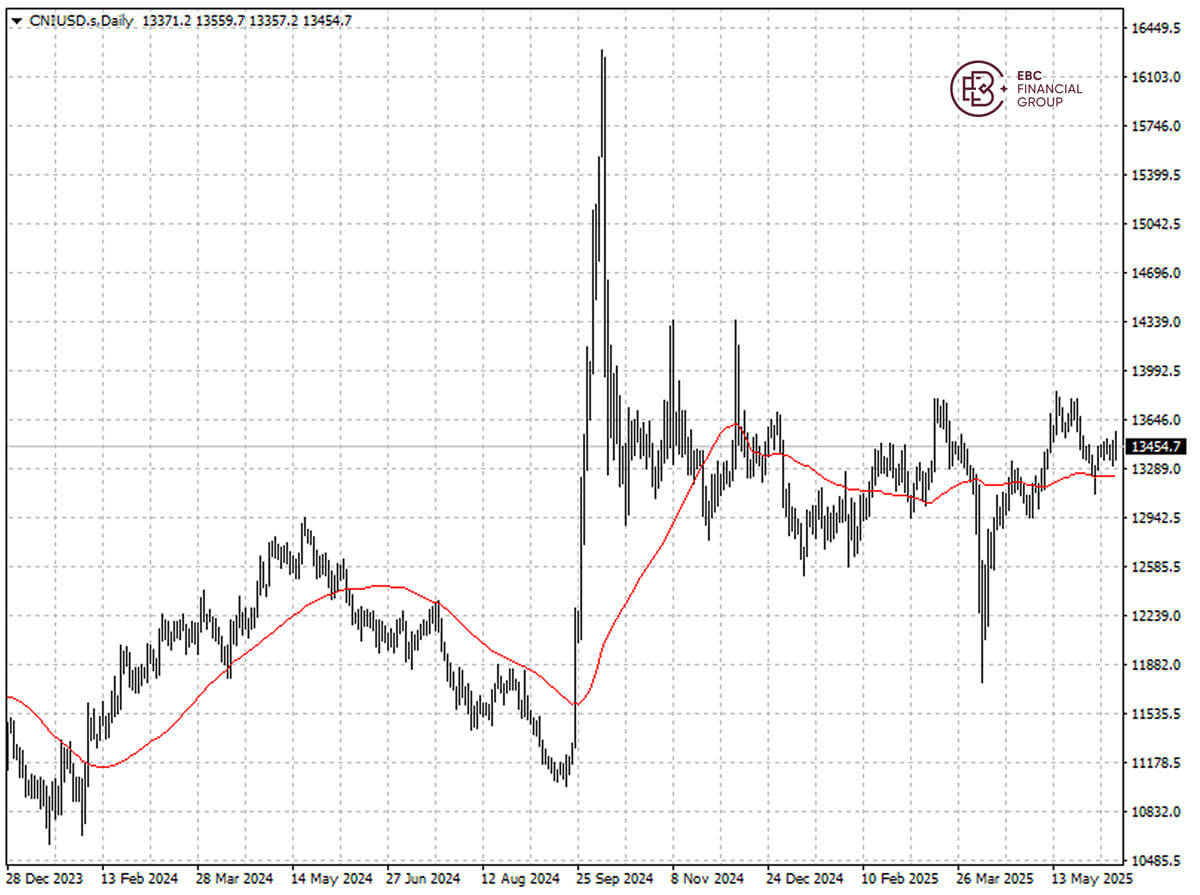

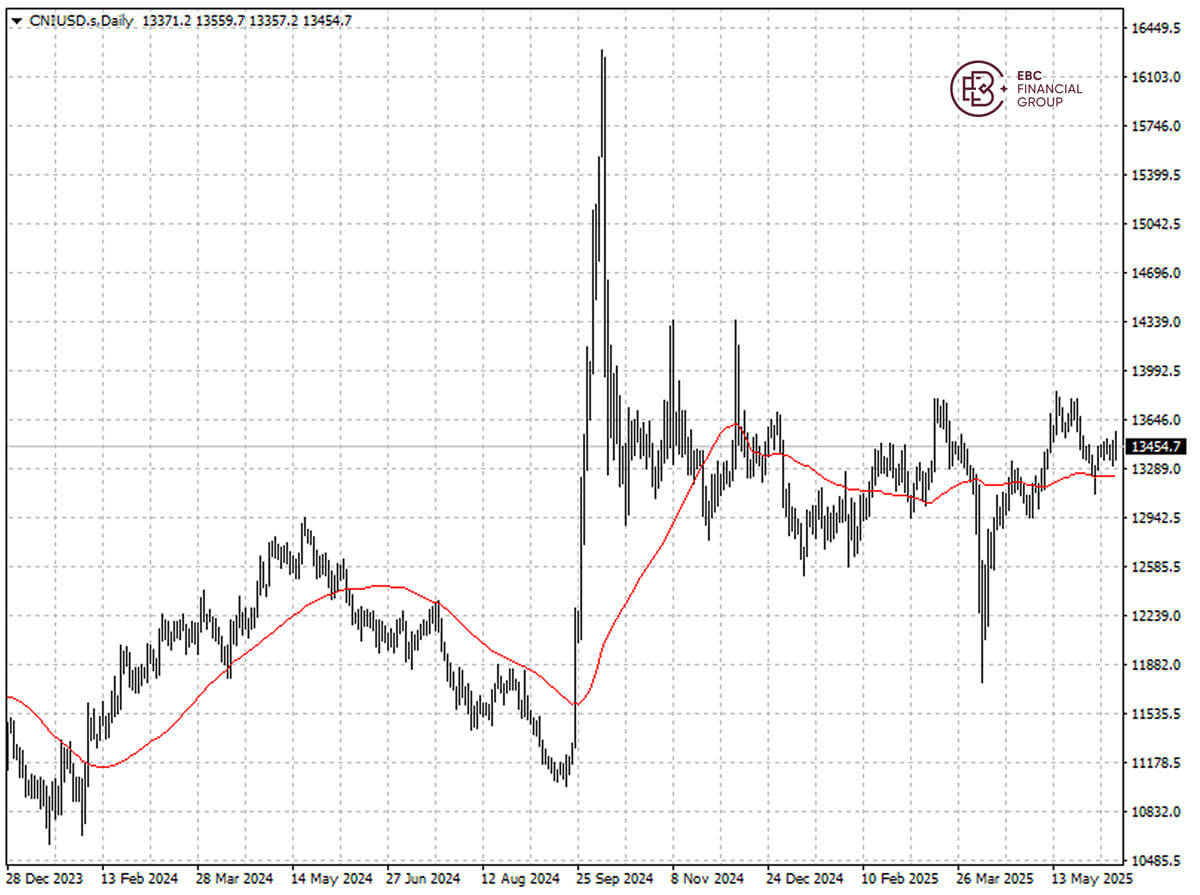

The A50 index stays comfortably above 50 SMA and the volatility has been

muted this month. We expect it to retest the support around 13,300 if the

consolidation goes on.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.