Gold (XAUUSD) continues to command attention as global markets weigh new trade tensions, shifting US policy, and persistent geopolitical risks. On 5 June 2025, traders are asking: Is the outlook for XAUUSD bullish or bearish?

Let's break down the latest price action, technical signals, and market drivers to help you navigate today's gold market.

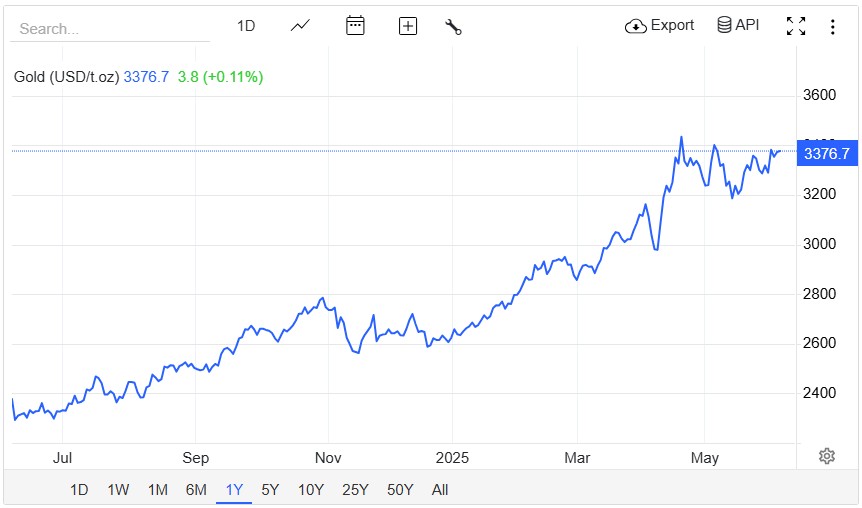

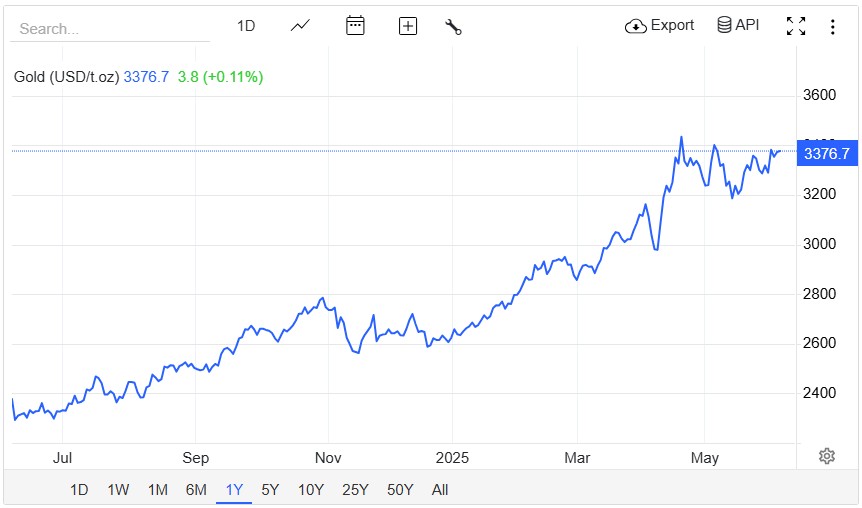

XAUUSD Price Action: Where Are We Now?

Gold futures opened at $3,377.80 per ounce on Wednesday, marking a 0.8% rise from Tuesday's close and continuing a month-long uptrend. Over the past week, gold has gained 2.6%, and over the past month, it's up 4.3%.

As of early 5 June, XAUUSD is trading around $3,358, reflecting a slight pullback from recent highs but still within a strong upward channel.

Key Drivers Shaping Gold's Move

1. US-China Trade Tensions

Fresh tariff threats and ongoing disputes between the US and China have revived gold's safe-haven appeal. President Trump's announcement to double steel and aluminium tariffs has rattled markets, pushing investors toward gold.

2. Geopolitical Risks

Recent escalations in Ukraine and the Middle East have added to global uncertainty, further supporting gold's role as a geopolitical hedge.

3. US Dollar Weakness

The US dollar has softened as traders seek alternative safe-haven currencies. A weaker dollar typically supports gold, which is priced in USD.

4. Upcoming US Jobs Data

The Bureau of Labor Statistics is set to release May jobs data on Friday. A weaker-than-expected report could boost gold further, while a strong report may trigger a pullback.

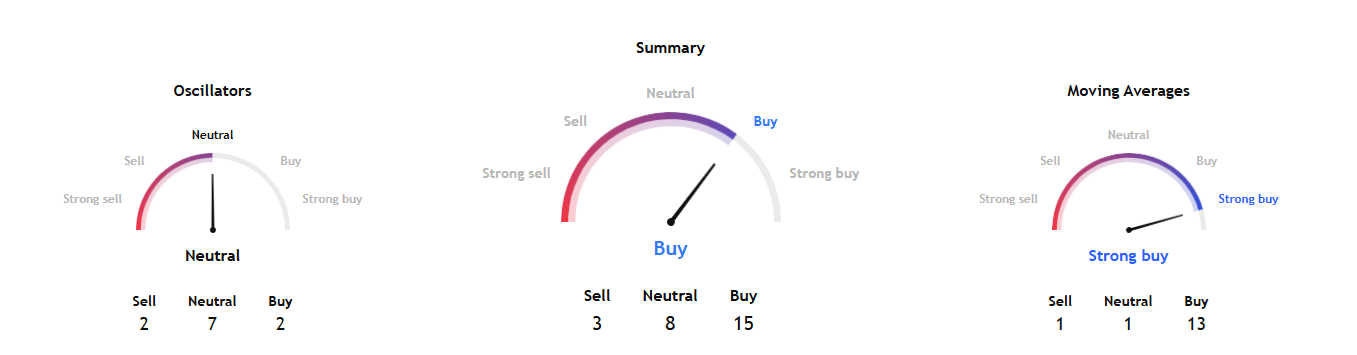

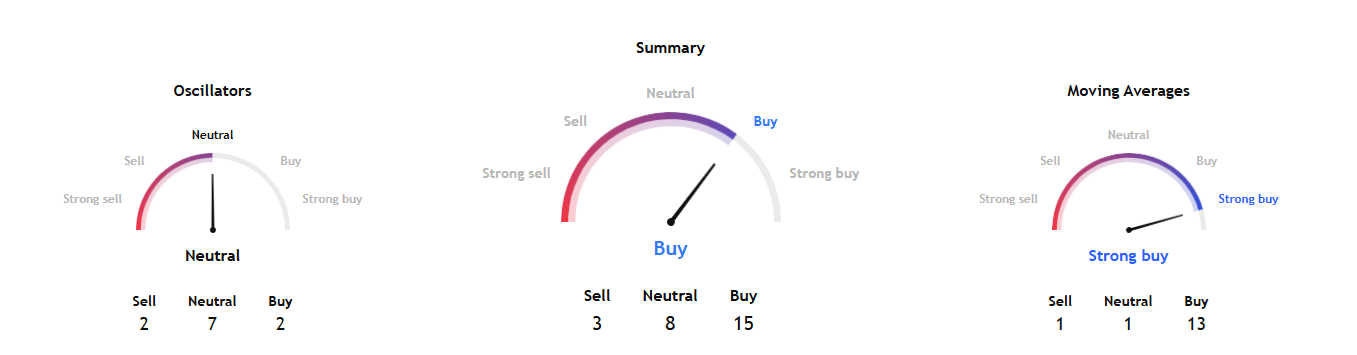

Technical Analysis: Bullish or Bearish?

Short-Term Trend

Moving Averages: Gold is trading above its 20- and 5-day exponential moving averages, indicating short-term bullish control.

RSI: The Relative Strength Index (RSI) on the 4-hour chart sits at 64, signalling moderate bullish momentum but not yet overbought.

Support and Resistance: Immediate support is seen near $3,335, with resistance at $3,366 and $3,392—the latter being a key level to watch for further upside.

Bearish Signals

Correction in Play: XAUUSD is currently moving within a corrective phase and a bearish channel on some intraday timeframes.

RSI and MACD: On the hourly chart, RSI is nearing oversold territory, and the MACD shows bearish momentum, suggesting a possible short-term pullback.

Support Test: A drop below $3,335 could open the door to deeper declines towards $3,315 or even $3,265 if bearish momentum accelerates.

Bullish Signals

Rebound Potential: Technicals indicate that after testing support at $3,335, gold could rebound and continue its uptrend, targeting $3,392 and possibly $3,465 if resistance is broken.

Safe-Haven Demand: Persistent geopolitical and economic risks continue to underpin buying interest, with buyers likely to re-enter on dips.

Weekly Outlook

Analysts expect that, after any short-term correction, the broader uptrend remains intact. The next major upside target is above $3,465, with a potential for new highs if bullish momentum resumes.

Trading Strategies for Today

Bullish Scenario: Watch for a successful rebound from $3,335 support. A break above $3,366–$3,392 with strong volume could signal a fresh leg higher towards $3,440 and beyond.

Bearish Scenario: If gold breaks and closes below $3,315, expect further downside towards $3,265. Short-term traders may look for quick sell opportunities on failed rebounds.

Neutral/Range Trading: If gold consolidates between $3,335 and $3,366, range trading strategies may be effective until a breakout occurs.

Conclusion

On 5 June 2025, XAUUSD presents both bullish and bearish signals. While the broader trend remains upward, short-term corrections and technical pullbacks are possible. Key levels to watch are $3,335 (support) and $3,392 (resistance).

Safe-haven demand and global uncertainty continue to favour gold, but traders should remain alert for volatility around upcoming US economic data and geopolitical headlines.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.