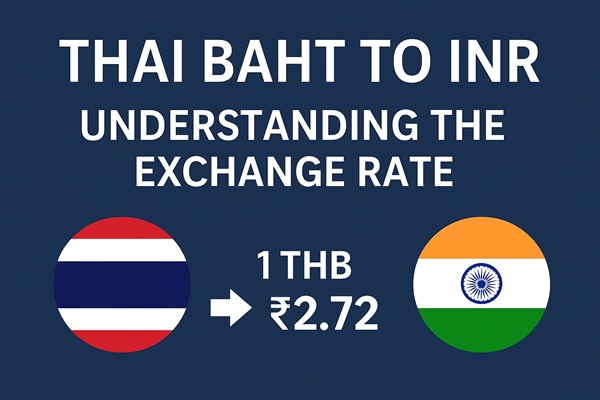

As of September 4. 2025. the exchange rate of Thai Baht to Indian Rupee is approximately:

The exchange rate between the Thai Baht (THB) and the Indian Rupee (INR) is an important reference point for travellers, businesses, and analysts.

For Indian visitors to Thailand, the rate determines how far their budget will go. It influences everything from hotel stays and local transport to shopping and leisure activities.

For businesses and individuals engaged in trade or remittances, fluctuations in THB–INR can directly affect costs, profits, and purchasing power. Monitoring this exchange rate closely therefore helps both groups make better financial decisions.

Current Exchange Rate Overview

Exchange rates are constantly shifting, and even small movements can influence financial outcomes.

Coinbase lists the conversion at approximately 1 THB = ₹2.72.

Wise, using the mid-market benchmark, reports 1 THB = ₹2.724. with a weekly high of 2.735 and a low of 2.702.

In practice, this means ₹10.000 would exchange to about 3.673 Thai Baht, though actual amounts vary depending on service providers and transaction costs.

Historical Performance of THB to INR

Looking at longer-term trends helps contextualise today's values.

Highest: ~₹2.732 on 29 August 2025.

Lowest: ~₹2.474 in early January.

Average: ~₹2.599.

Average rate ~₹2.615. showing gradual appreciation of the Baht against the Rupee.

High: ~₹2.729

Low: ~₹2.617

Average: ~₹2.668

The Thai Baht has demonstrated resilience, recovering from early-year lows and maintaining stability through mid-2025.

Factors Influencing the THB–INR Rate

Several interconnected factors shape the relationship between the Baht and the Rupee:

Faster GDP growth in Thailand or India can tilt the balance in favour of one currency.

Differences in interest rates and inflation influence capital flows and investor confidence.

India imports significant amounts of oil, meaning global crude prices often weigh on the Rupee.

Thailand, on the other hand, benefits from robust tourism and export-oriented industries.

The 1997 Asian Financial Crisis and 2008 Global Financial Crisis both left long-term imprints on the THB–INR relationship.

Geopolitical tensions or natural disasters also cause sudden fluctuations.

Thailand's strong tourism inflows boost demand for the Baht.

Remittance flows between the two countries influence short-term exchange volumes.

Historical Context Behind Thai Baht to Inr

The Thai Baht was formerly pegged to the US dollar, which provided exchange rate stability. While this limited short-term volatility, it made the baht vulnerable to external economic shocks.

Following the Asian Financial Crisis of 1997. Thailand transitioned to a floating exchange rate. This allowed market forces—such as capital flows, trade balances, and investor sentiment—to play a more direct role in determining the currency's value.

The Indian Rupee underwent a similar shift in the early 1990s, moving from a controlled exchange rate system to a managed float. This exposed the rupee to global market dynamics and increased the influence of domestic economic indicators, including GDP growth, inflation, and trade performance.

These historical transitions are highly relevant to the current THB–INR rate. Both currencies now respond to key determinants such as macroeconomic performance, interest rate differentials, tourism and trade flows, and global risk sentiment.

Understanding this evolution provides essential context for the present-day dynamics of the THB–INR pair. It explains why short-term fluctuations occur and how long-term trends are shaped by both domestic and international factors.

Thai Baht to Inr at a Glance

| Section |

Key Points |

| Introduction |

THB to INR crucial for travellers, remittances, and trade. Current rate ~₹2.72. |

| Current Rate |

Coinbase: 2.72; Wise: 2.724. Weekly range 2.702–2.735. |

| Historical Trends |

2025 high: 2.732; low: 2.474; avg: 2.599. Six-month avg: 2.615. |

| Influencing Factors |

Economic growth, inflation, trade, oil prices, tourism, global crises. |

| Rate Sources |

Real-time: Coinbase, Wise. Historical: ExchangeRates.org.uk, MarketWatch. |

| Applications |

Travel budgeting, remittances, trade planning, forex trading. |

| FAQs |

Covers current rate, annual trends, reasons for fluctuation, and trusted sources. |

Frequently Asked Questions

1. What is the prevailing THB–INR rate?

The mid-market rate is approximately ₹2.73 per baht as of September 2025.

2. How volatile has the rate been recently?

The weekly trading range has remained narrow at ₹2.703–₹2.735. indicating limited short-term volatility.

3. Which platforms provide the most accurate rates?

Wise and XE are reliable for mid-market rates. For applied customer rates including fees, Revolut and BookMyForex provide real-time transaction values.

4. Why do reported rates differ between platforms?

Variations are due to differences in whether rates reflect mid-market benchmarks, include service fees, or are updated in real time versus periodically.

Conclusion

The Thai Baht to Indian Rupee exchange rate plays a crucial role for travellers, businesses, and investors alike. With the THB currently valued at around ₹2.72. both short-term fluctuations and long-term trends matter. Economic conditions, tourism flows, and global financial markets all exert influence, making vigilance essential.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.