The Thai baht (THB) to US dollar (USD) exchange rate has been a focal point for investors, travellers, and businesses in 2025. With global trade tensions, shifting US policy, and regional economic uncertainty, the baht's value against the dollar has seen notable changes.

This article explores the top trends, key rate movements, and expert forecasts for the baht to USD in 2025, helping you understand what's behind the numbers and what to expect for the remainder of the year.

Baht to USD: Rate Changes in 2025

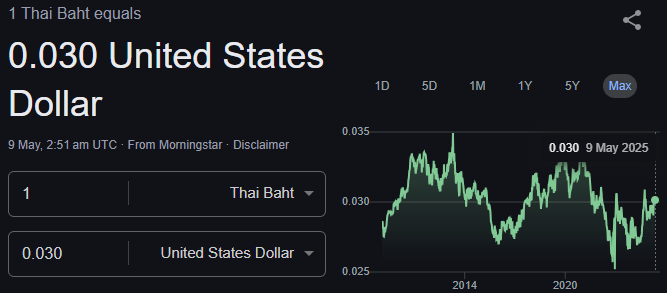

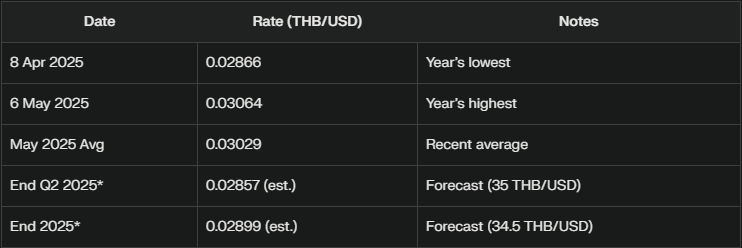

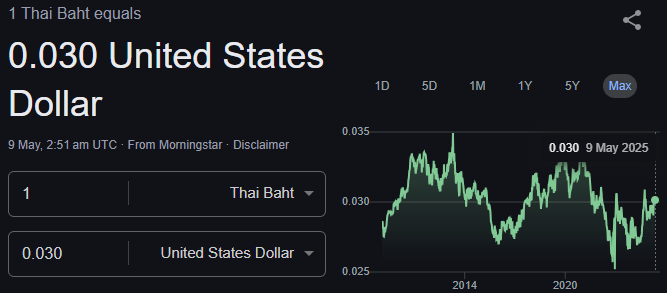

So far in 2025, the Thai baht has shown surprising strength against the US dollar. As of early May, the baht is up by approximately 4% against the dollar compared to the start of the year. The exchange rate reached its highest point of 0.03064 USD per baht on 6 May 2025, while the lowest was 0.02866 USD on 8 April 2025.

Key figures for 2025 so far:

Highest rate: 1 THB = 0.03064 USD (6 May 2025)

Lowest rate: 1 THB = 0.02866 USD (8 April 2025)

Average rate: 1 THB = 0.02956 USD

Year-to-date change: Baht up 3.94%–5.15% vs. USD, depending on the source

This means the baht has appreciated against the dollar for much of the year, bucking many expert forecasts made at the start of 2025.

What's Driving the Baht's Performance?

1. Global Trade Tensions and US Tariffs

A major factor shaping the baht's movements has been the escalation of US tariffs on aluminium and steel imports, which were raised in February 2025. These tariffs, along with broader US-China trade tensions, were widely expected to weaken the baht by making Thai exports less competitive and dampening investor sentiment.

2. Regional Economic Pressures

China's economic slowdown has weighed on regional currencies, including the baht, by curbing investment and trade flows. However, thailand's recovering tourism sector has provided some support, offsetting external pressures and helping the baht regain ground.

3. Domestic Factors and Monetary Policy

Thailand's political and economic landscape remains uncertain, but the Bank of Thailand has kept its policy rate steady at 2.25% in 2025, aiming to balance inflation and growth. Political stability and policy clarity are crucial for currency confidence, and any changes could quickly impact the baht's value.

4. US Federal Reserve and Dollar Strength

The US Federal Reserve's decision to delay rate cuts in response to global uncertainty has kept the dollar relatively strong, but the baht's resilience suggests that local and regional factors are currently outweighing US monetary policy in driving the exchange rate.

Expert Forecasts for the Baht in 2025

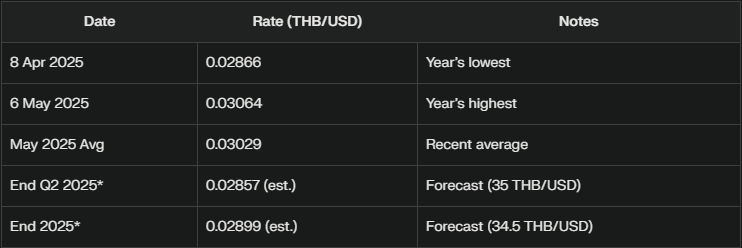

Despite the baht's recent gains, many analysts expect it to weaken against the dollar as the year progresses. Standard Chartered Bank (Thai) forecasts the baht will dip to around 35 per USD by mid-2025, driven by ongoing trade tensions.

However, the bank also predicts a rebound to 34.50 per USD by year-end, as some of the current volatility subsides and Thailand's economic fundamentals stabilise.

Trading Economics models suggest the baht could trade at 33.42 per USD by the end of the current quarter, reflecting a more optimistic view.

Volatility and What to Watch

Analysts agree that the baht is likely to remain one of the most volatile Asian currencies in 2025. Key factors to watch include:

Further developments in US trade policy and tariffs

Economic data from China and the US

Changes in Thai tourism and export performance

Domestic political stability and Bank of Thailand policy decisions

Final Thoughts

The baht to USD exchange rate in 2025 has defied some expectations, with the baht gaining ground against the dollar in the first half of the year. However, ongoing trade tensions, regional economic pressures, and domestic factors are likely to keep the currency volatile.

Most experts expect some weakening of the baht by mid-year, with a possible rebound towards the end of 2025. For anyone dealing with Thai baht or US dollars, staying informed about these trends will be key to making sound decisions in the months ahead.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.