In the foreign exchange (FX) market, swap points—sometimes referred to as forward points—represent the difference between the forward exchange rate and the spot rate of a currency pair. Rather than being an arbitrary figure, swap points emerge from the underlying interest rate differential between two currencies. They serve as a key adjustment mechanism in the pricing of forward contracts and foreign exchange swaps.

Put simply, swap points are the incremental additions or subtractions made to a spot exchange rate to derive a forward rate, ensuring that the forward market reflects not only current exchange levels but also the financial cost of holding currencies over time.

Terminology & Context in FX Markets

In market practice, the terms swap points, forward points, and FX points are often used interchangeably. They are quoted in pips or fractions of a pip, and their application extends across forward contracts, hedging operations, and overnight rollovers in margin-based trading.

Swap points are central to the mechanics of FX swaps, where one currency is exchanged for another with a simultaneous agreement to reverse the trade at a future date. The inclusion of swap points ensures that the forward rate properly accounts for the interest rate conditions of the two currencies involved.

For treasurers, investors, and traders alike, understanding swap points is critical because they determine the effective cost—or benefit—of rolling positions or hedging exposure beyond the spot settlement date.

Mathematical Foundation & Interest Differentials

The valuation of swap points rests firmly on the principle of covered interest rate parity. According to this theory, the forward rate between two currencies must reflect the interest rate differential between them in order to prevent arbitrage opportunities.

The formula is typically expressed as:

Where:

F = Forward exchange rate

S = Spot exchange rate

r_d = Domestic interest rate

r_f = Foreign interest rate

T = Time (in years) until forward maturity

This approximation holds when the product of foreign interest rate and time is small, which is generally the case for short-dated forwards. The essence is clear: if domestic rates exceed foreign rates, the forward price must adjust upward (producing positive swap points) to offset the cost advantage of holding domestic currency, and vice versa.

Purpose in Currency Swaps & Forwards

Swap points are not arbitrary market adjustments—they are the price mechanism that ensures fairness and equilibrium in forward exchange contracts. Their purpose is twofold:

Compensation for Interest Rate Differentials: Since different currencies accrue interest at different rates, swap points adjust the forward rate so that it mirrors these disparities.

Alignment of Spot and Forward Markets: Without swap points, forward contracts could systematically favour one side of the market, creating arbitrage opportunities.

In practice, this means that swap points prevent distortions and ensure that hedgers and speculators transact at rates consistent with prevailing interest environments.

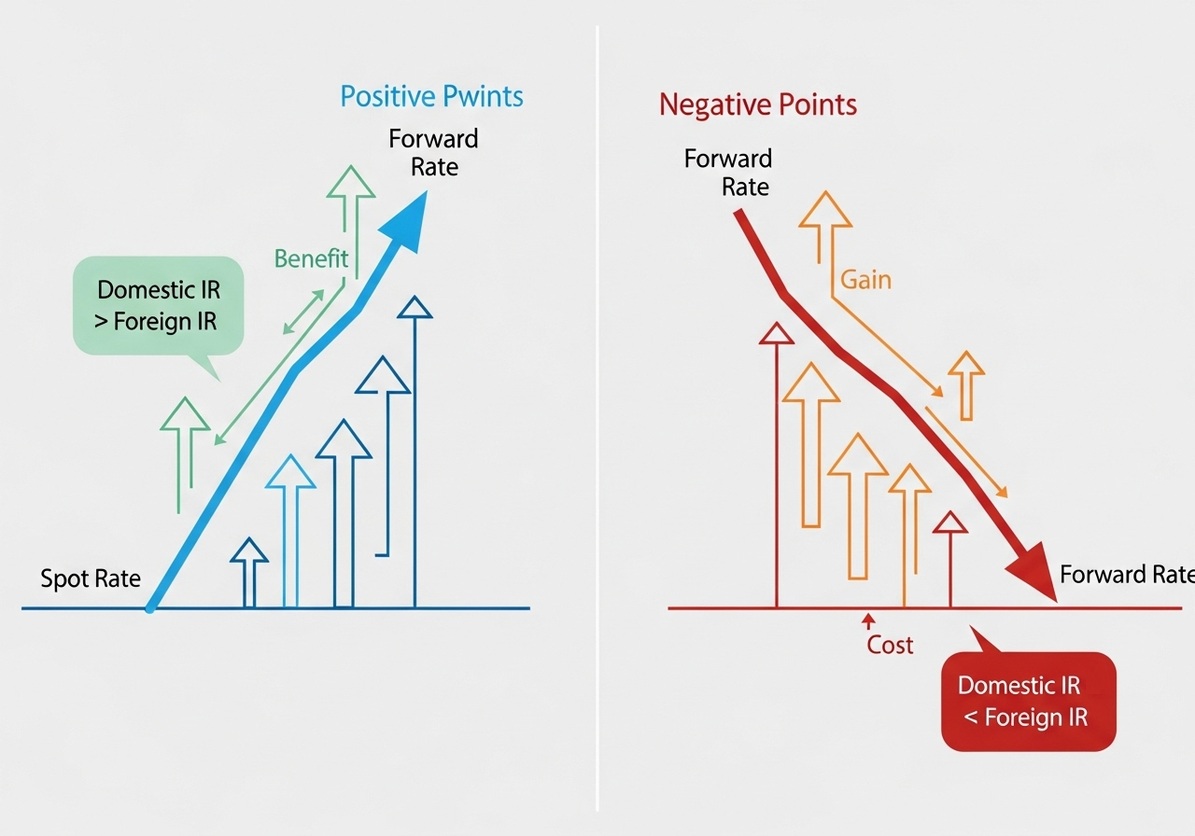

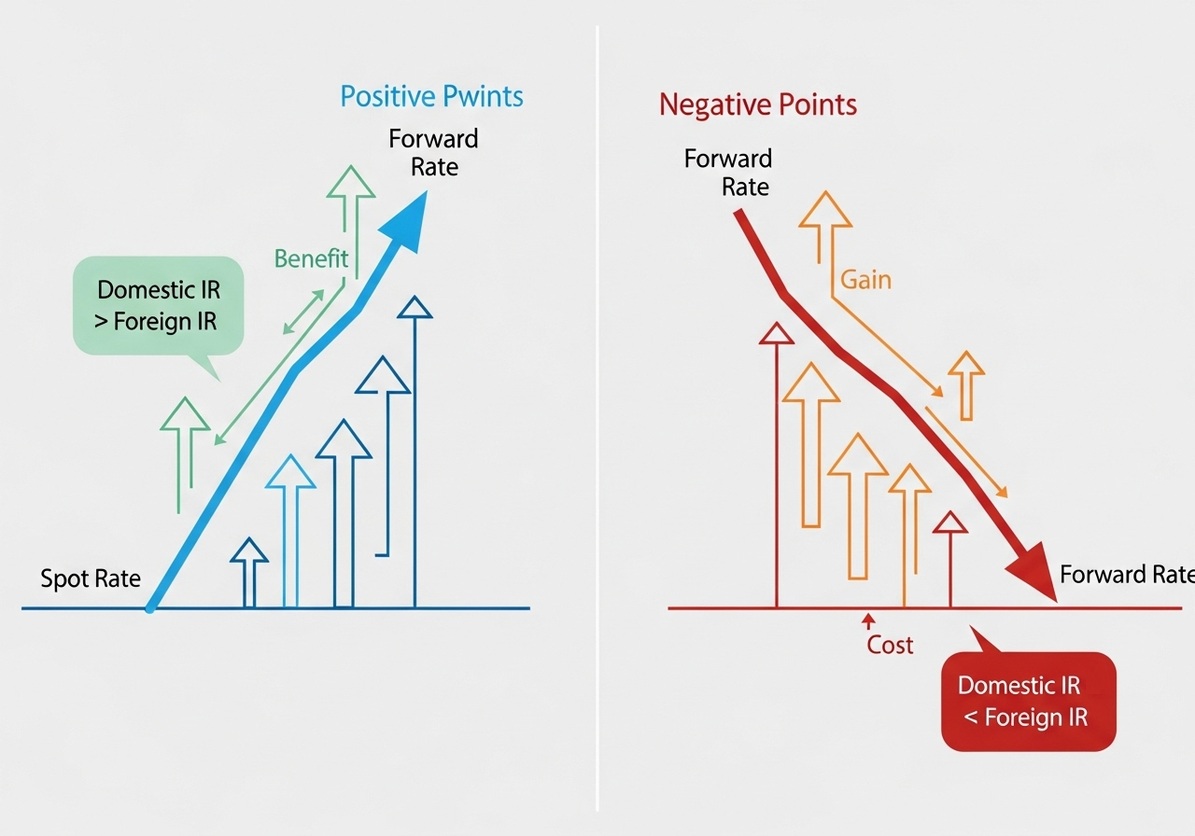

Positive vs. Negative Swap Points

One of the most important distinctions for market participants is whether swap points are positive or negative.

Positive swap points occur when the domestic interest rate is higher than the foreign interest rate. This results in the forward rate being above the spot rate. Traders or investors rolling into the forward will effectively earn from the rate differential.

Negative swap points arise when the domestic interest rate is lower than the foreign interest rate. In such cases, the forward rate is set below the spot rate, meaning that the rollover or forward contract carries a cost.

For example, if an investor holds a position in a higher-yielding currency against a lower-yielding one, they may benefit from positive swap points—a cornerstone of the so-called carry trade strategy. Conversely, exposure in the opposite direction can create a drag on returns due to negative swap points.

Practical Impact on Traders & Hedgers

Swap points have profound implications for both traders and corporate hedgers.

For traders, swap points determine the daily cost or income of holding leveraged FX positions overnight. A position in a higher-yielding currency may generate swap income, while the reverse could lead to swap charges. Awareness of these dynamics is essential when designing medium- or long-term trading strategies.

For hedgers, swap points are crucial when rolling forward exposures. A corporation seeking to hedge receivables or payables denominated in foreign currency must account for swap points in the forward contracts they enter. These adjustments directly affect the final settlement price and, ultimately, cash flows.

Beyond these direct financial consequences, swap points reflect broader macroeconomic realities, such as interest rate policies of central banks and market expectations of monetary conditions. For this reason, traders often monitor changes in swap point levels as indirect signals of shifts in global liquidity and monetary policy trends.

Conclusion

Swap points, while often quoted as a simple numerical adjustment, embody the complex interplay between currency values, interest rate differentials, and time. They are a cornerstone of the FX forward and swap markets, ensuring that forward pricing remains consistent with underlying financial fundamentals.

For traders, swap points represent either a cost or an opportunity, shaping the profitability of positions held beyond the spot horizon. For hedgers, they are an indispensable part of managing currency risk in a fair and efficient manner. Ultimately, a solid grasp of swap points is indispensable for anyone operating in the interconnected world of global finance.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.