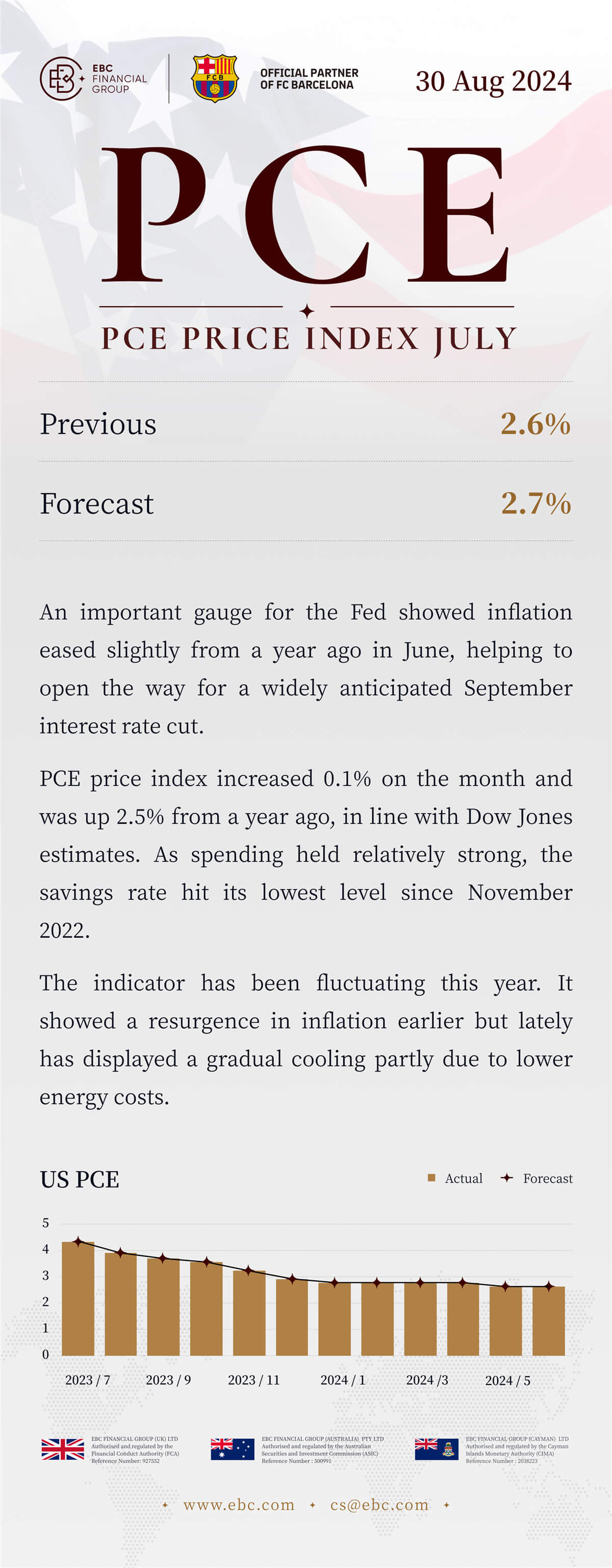

PCE Price Index Jul

30/8/2024 (Fri)

Previous: 2.6% Forecast: 2.7%

An important gauge for the Fed showed inflation eased slightly from a year

ago in June, helping to open the way for a widely anticipated September interest

rate cut.

PCE price index increased 0.1% on the month and was up 2.5% from a year ago,

in line with Dow Jones estimates. As spending held relatively strong, the

savings rate hit its lowest level since November 2022.

The indicator has been fluctuating this year. It showed a resurgence in

inflation earlier but lately has displayed a gradual cooling partly due to lower

energy costs.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.