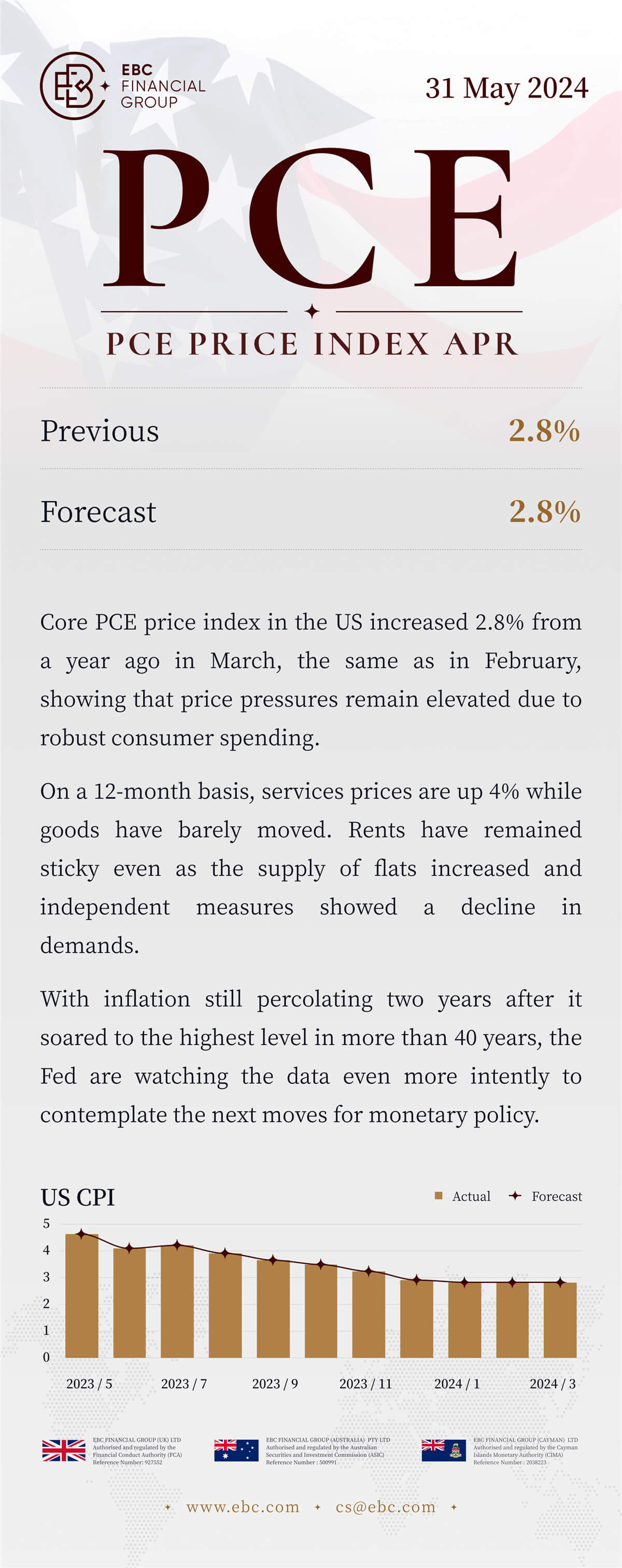

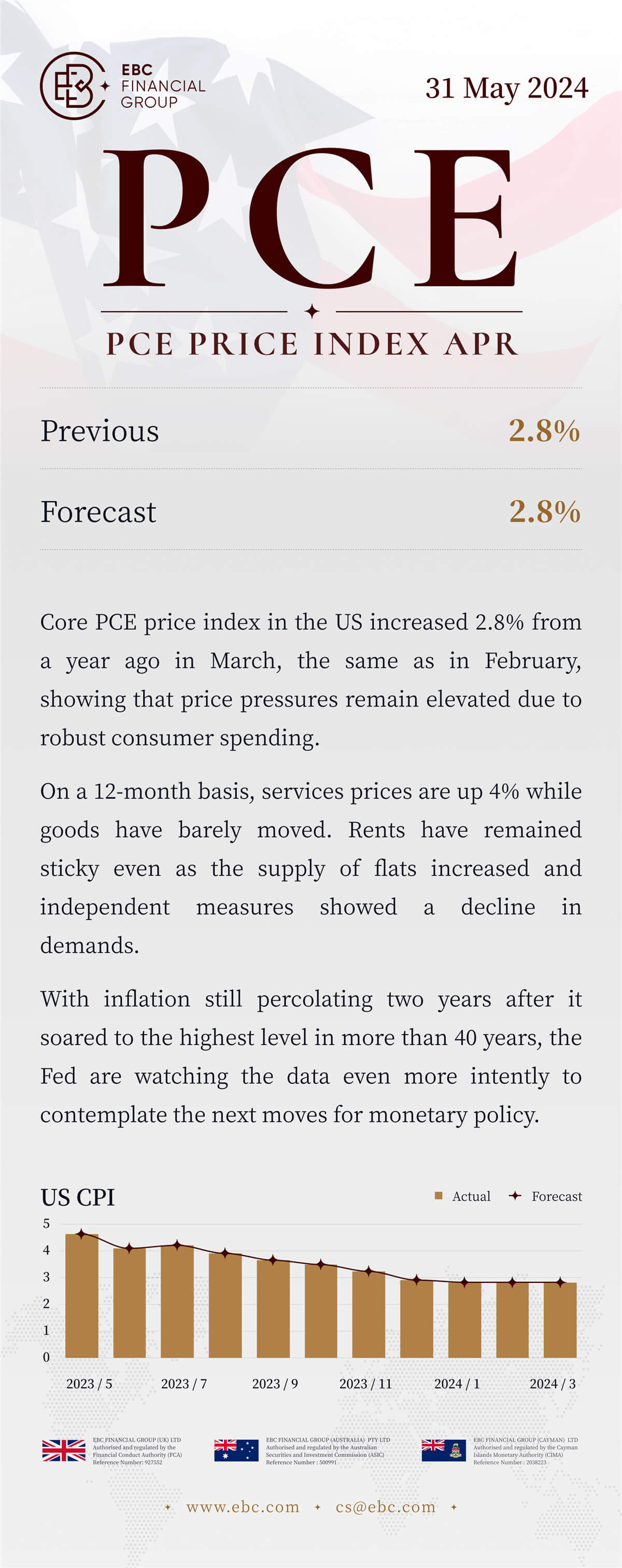

PCE Price Index April

31/5/2024 (Fri)

Previous: 2.8% Forecast: 2.8%

Core PCE price index in the US increased 2.8% from a year ago in March, the

same as in February, showing that price pressures remain elevated due to robust

consumer spending.

On a 12-month basis, services prices are up 4% while goods have barely moved.

Rents have remained sticky even as the supply of flats increased and independent

measures showed a decline in demands.

With inflation still percolating two years after it soared to the highest

level in more than 40 years, the Fed are watching the data even more intently to

contemplate the next moves for monetary policy.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.