EBC Forex Snapshot, 22 May 2024

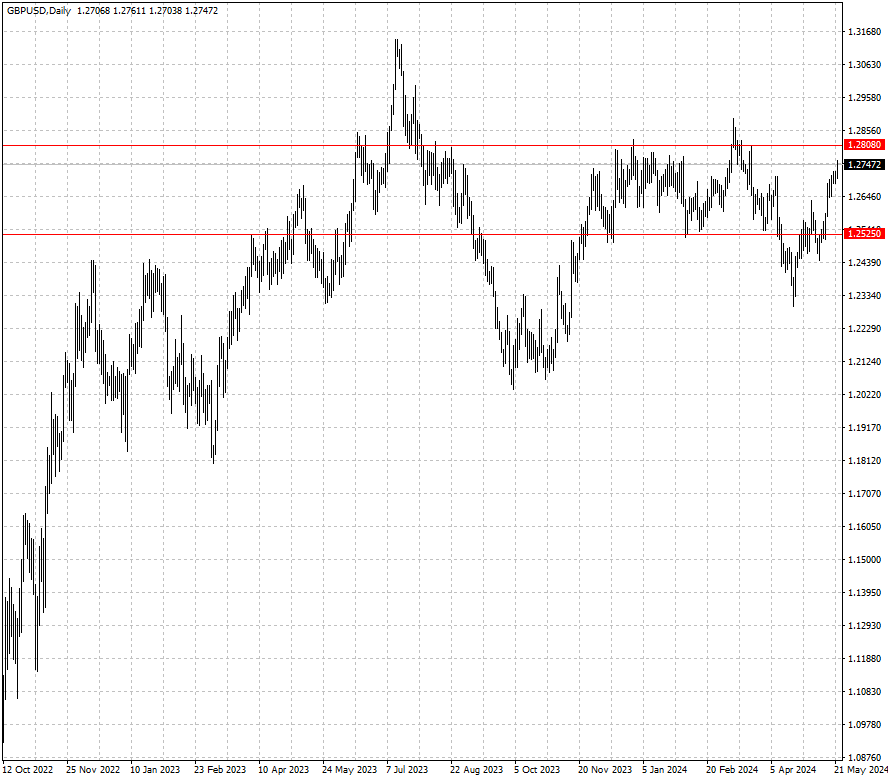

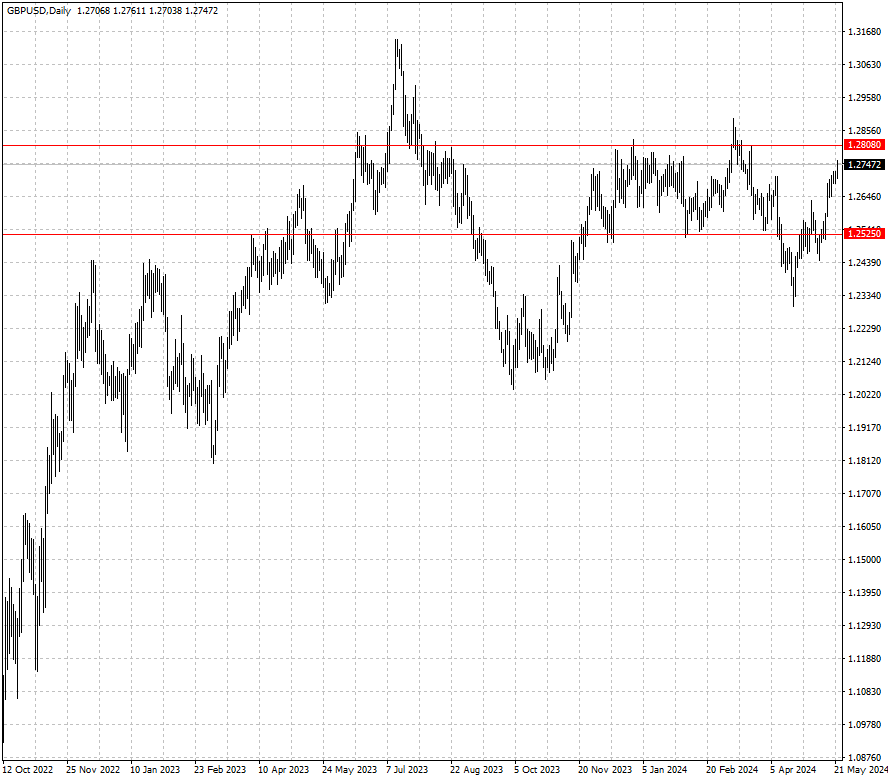

With little to drive the market in terms of economic data this week, most

major currencies continued to move in a tight range on Wednesday. The pound

jumped after data showed hotter-than-expected UK inflation.

British consumer prices rose by 2.3% in annual terms in April compared to the

forecast for 2.1%. The figure close to the target leaves the chances of a June

rate cut by unchanged at around 50%.

That positions the ECB as the next major central bank most likely to start

bringing down rates, as its policymakers continue to suggest it would take a

major shock to prevent a June cut.

Citibank vs. HSBC Currency Pair Data Comparison

|

Citi (as of 13 May) |

HSBC (as of 22 May) |

|

support |

resistance |

support |

resistance |

| EUR/USD |

1.0601 |

1.0885 |

1.0720 |

1.0941 |

| GBP/USD |

1.2300 |

1.2709 |

1.2525 |

1.2808 |

| USD/CHF |

0.8999 |

0.9244 |

0.9007 |

0.9194 |

| AUD/USD |

0.6443 |

0.6668 |

0.6547 |

0.6748 |

| USD/CAD |

1.3478 |

1.3846 |

1.3572 |

1.3747 |

| USD/JPY |

152.12 |

157.68 |

153.08 |

157.98 |

The green numbers in the table indicate that the data has increased compared with the previous time; the red numbers indicate that the data has decreased compared with the previous time; and the black numbers indicate that the data has remained unchanged.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.