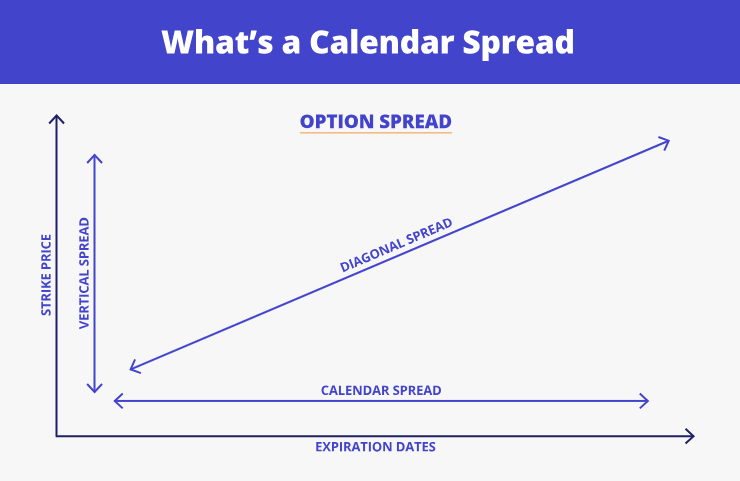

The calendar spread is a widely used options strategy that allows traders to benefit from differences in time value between two contracts. It involves buying and selling options with the same strike price but different expiration dates, making it a time-based strategy rather than a directional one.

This strategy is typically employed when the trader expects the price of the underlying asset to remain relatively stable in the short term but anticipates changes in volatility or value further out. Because of this, the calendar spread can work well in low-volatility environments or ahead of expected market-moving events.

How a Calendar Spread Works

A calendar spread is constructed using either call options or put options. Both contracts share the same strike price but have different expiration dates. The most common setup includes:

The value of the spread is driven by time decay, with the short-term option losing value more rapidly. As the front-month option approaches expiry, traders hope it expires worthless while the long-term option retains value or even appreciates.

For example, if a stock is trading at £200, a trader might buy a call option with a 60-day expiry and sell one with a 30-day expiry, both with a £200 strike. If the stock stays around that price, the short-term option expires, and the long-term option may still have potential.

Why Use a Calendar Spread?

Traders use the calendar spread strategy for a variety of reasons, particularly when they expect the price of an asset to remain near a certain level in the near term. Key advantages include:

Time decay benefit: The short-term option decays faster than the long-term one.

Low capital requirement: It's often cheaper than purchasing a standalone long-term option.

Defined risk: The maximum loss is limited to the net debit paid for the spread.

Volatility potential: Can benefit from an increase in implied volatility over time.

By taking advantage of these factors, traders can build a position that allows for a high probability of profit with clearly defined downside.

Risks of the Calendar Spread Strategy

Despite its many advantages, the calendar spread carries specific risks that traders must understand:

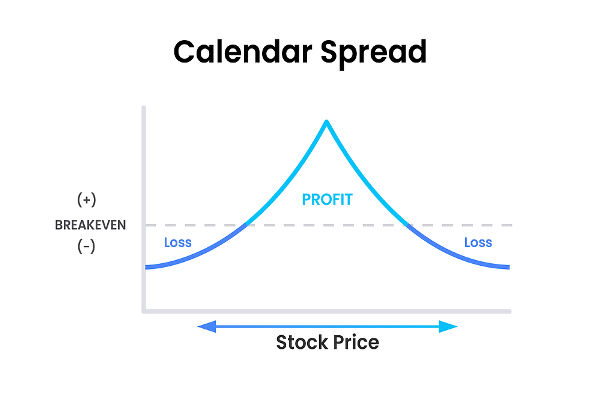

Price movement risk: Large moves in the underlying asset's price can negatively affect the spread.

Volatility decline: A drop in implied volatility can reduce the value of the longer-dated option.

Early assignment risk: If using American-style options, the short leg may be assigned early.

Narrow profit zone: Profits tend to be concentrated around the strike price, requiring precise forecasting.

Understanding these risks is essential before executing a calendar spread in a live market.

When to Use a Calendar Spread

The calendar spread is best used in markets where the trader expects the underlying asset to remain close to a specific price level through the near-term expiration date. Ideal conditions include:

Neutral or mild directional bias: Best for sideways markets.

Low implied volatility: Especially when a rise is expected in the future.

Event-based trading: Ahead of earnings reports, policy decisions, or macroeconomic releases.

These setups allow traders to position themselves for maximum time decay benefit and potential volatility gains.

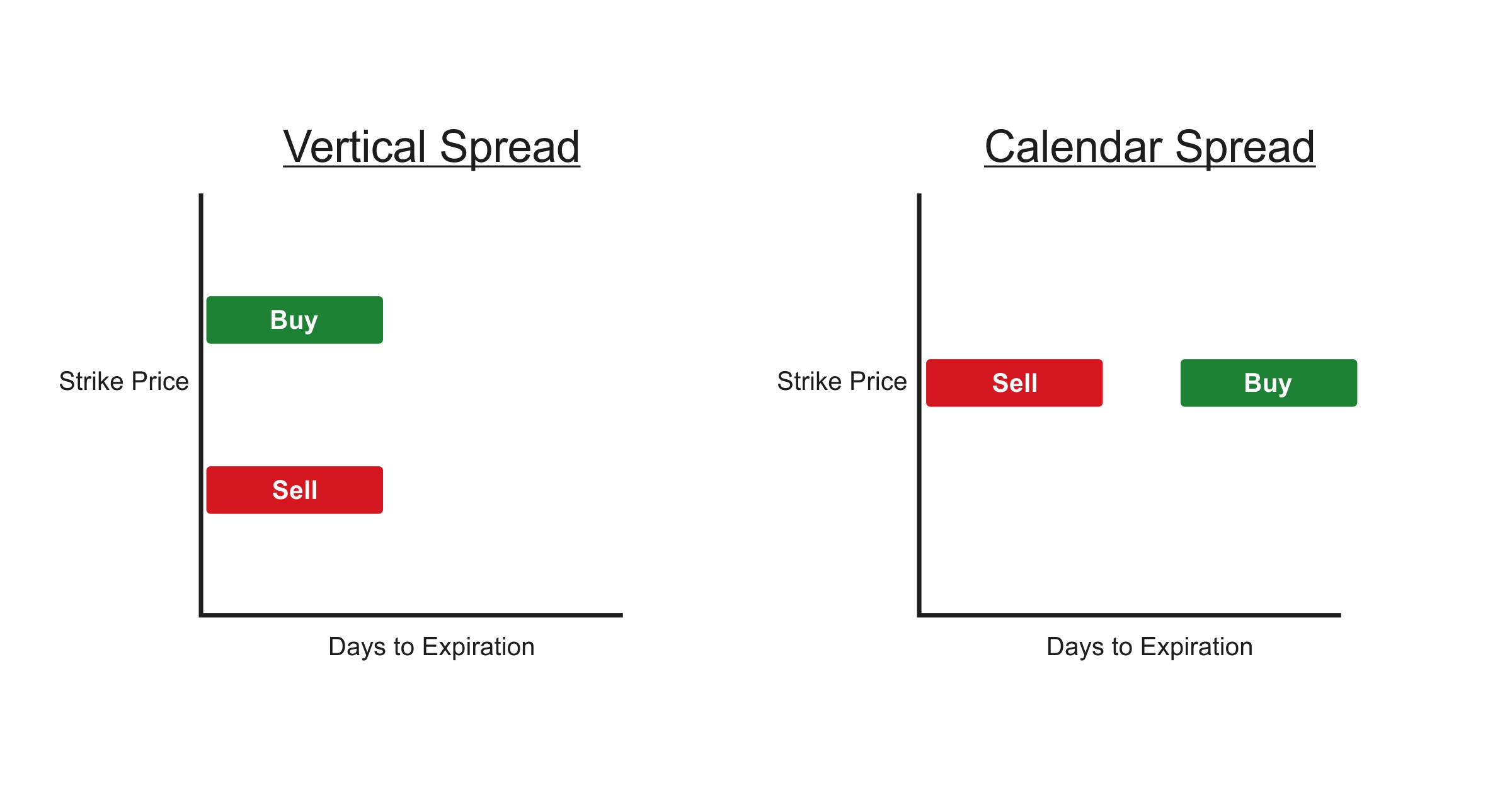

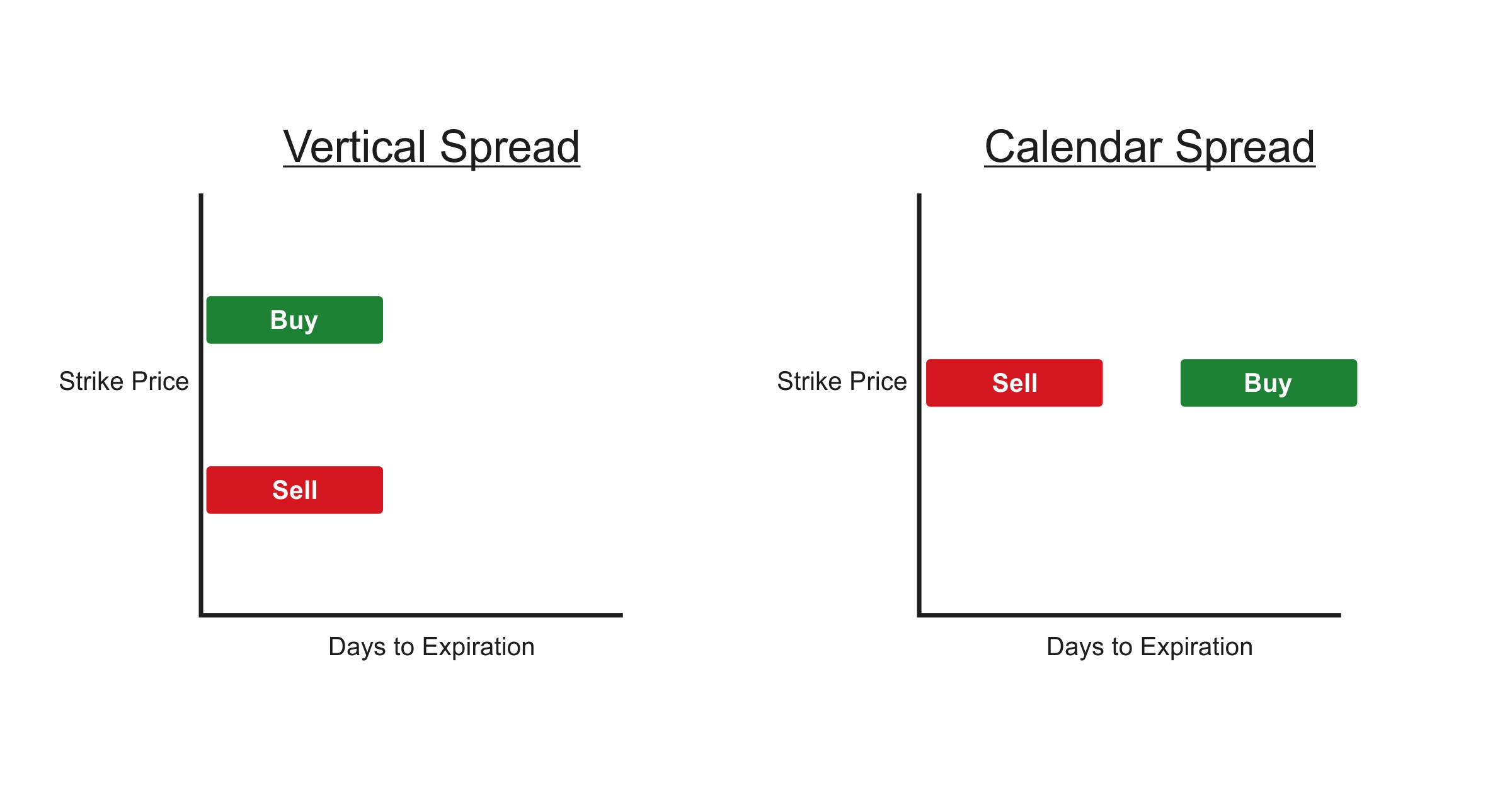

Calendar Spread vs Vertical Spread

It's easy to confuse a calendar spread with other popular options strategies, particularly vertical spreads. Here is how they compare:

Feature Calendar Spread Vertical Spread

Expiration Dates Different (short and long term) Same for both options

Strike Prices Same Different (typically offset by £5–£10)

Best Market Condition Sideways with volatility increase Trending markets

Cost Typically low Can be higher depending on strikes

Risk/Reward Profile Defined and based on time/volatility Defined and based on price movement

The calendar spread excels when precise price movement is not expected, but time and volatility are the main plays.

How to Set Up a Calendar Spread

Here's a simple step-by-step guide to placing a calendar spread:

Choose the underlying asset: Stocks, ETFs, or indices are commonly used.

Identify the strike price: Select the price where you expect the asset to hover.

Select expiration dates: Sell a near-term option and buy a longer-term one at the same strike.

Enter the position: Execute as a single order to lock in your net debit.

Monitor and adjust: Be prepared to roll or close depending on price movement or volatility shifts.

Using this structured approach helps traders avoid execution errors and manage risk effectively.

Real Example of a Calendar Spread

Let's consider a trader looking at a stock currently priced at £120. They believe the price will remain near this level for the next 30 days but may move after earnings in 60 days.

Sell a 30-day £120 call for £2

Buy a 60-day £120 call for £4

Net cost (maximum risk): £2

If the stock remains near £120 in 30 days, the sold call expires worthless, and the longer-term call may increase in value due to rising implied volatility. The trader can then close or adjust the position.

This simple setup demonstrates how the calendar spread works in real market conditions.

Tips for Trading Calendar Spreads Like a Pro

If you want to master the calendar spread, follow these practical tips:

Start with Liquid Assets: Stick to options with tight bid-ask spreads and high volume.

Use analytics tools: Monitor implied volatility and historical price ranges.

Avoid earnings week (for some trades): Unless you're specifically trading the event.

Adjust based on price movement: Consider rolling the short leg if the market moves significantly.

Exit before expiry if needed: Avoid assignment risk by managing the position actively.

These techniques can help refine your execution and increase the odds of success.

Final Thoughts

The calendar spread offers traders a way to benefit from time decay and volatility shifts without needing a strong directional market view. It provides flexibility, defined risk, and strategic entry points around key dates or low-volatility periods.

However, it requires accurate timing, a good grasp of option pricing, and active management. Traders willing to invest the time to understand the strategy can find the calendar spread to be a powerful addition to their toolkit.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.