In finance, liquidity refers to how quickly and easily something can be converted into cash without affecting its market value.

So, what are liquid assets? They are assets that can be turned into cash quickly, with minimal price impact. Liquid assets form the backbone of day-to-day financial operations, whether in personal budgeting, corporate cash flow, or investment portfolios.

What Are Liquid Assets?

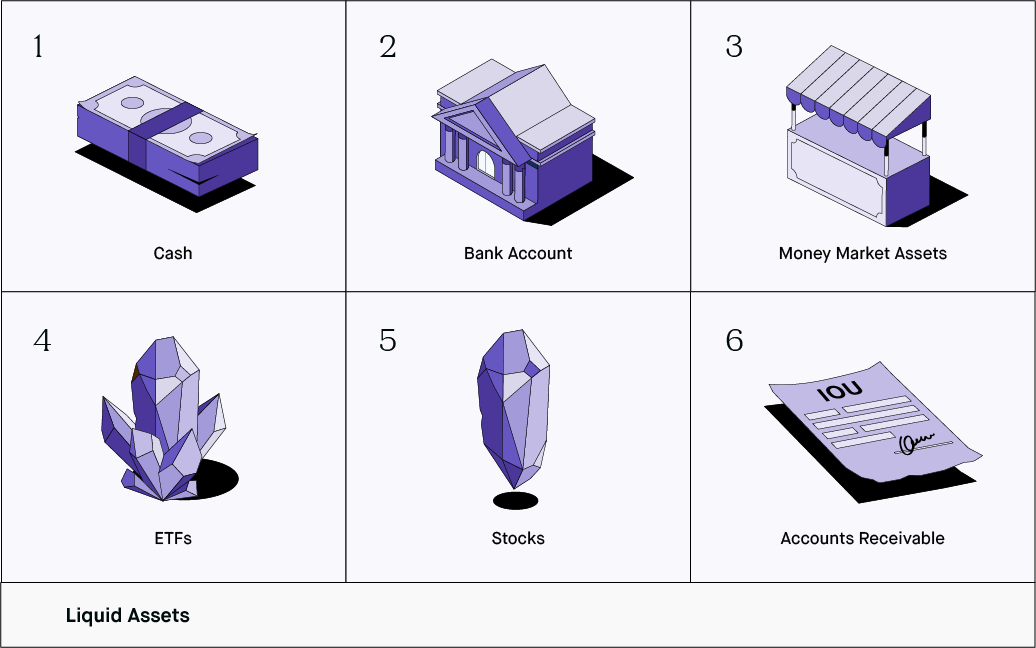

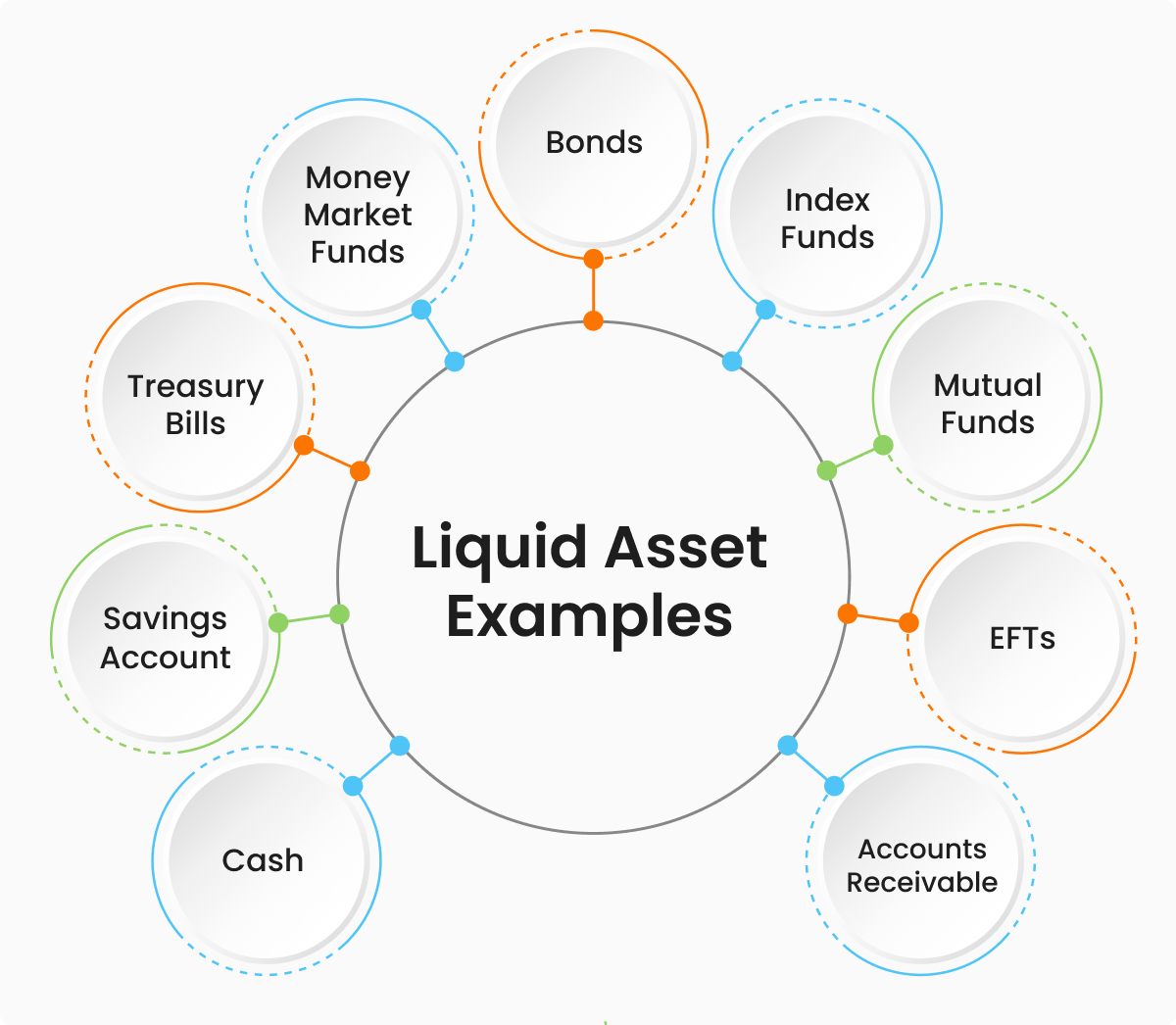

Cash is the most obvious example. It is already in its most usable form and ready to meet any obligation. However, many other financial instruments also qualify as liquid assets, such as funds held in current accounts, money market instruments, and publicly traded stocks or bonds.

Understanding what are liquid assets and how they work is essential for assessing financial health, making sound investment decisions, and ensuring resilience in times of financial pressure.

Why Liquid Assets Matter

If you're asking what are liquid assets and why they are important, consider this: liquidity provides flexibility. In emergencies, the ability to access cash quickly without selling at a loss is crucial. This is especially relevant in personal finance, where liquid assets help cover sudden expenses, such as medical bills or unexpected repairs.

For businesses, liquid assets ensure that obligations such as payroll, rent, and supplier payments are met on time. Firms with a healthy balance of liquid assets are often seen as more financially stable and less vulnerable to market shocks or revenue dips.

When evaluating a person's or company's financial strength, liquid assets are often considered alongside liabilities. A high level of liquidity provides reassurance that financial commitments can be handled smoothly, even if income is disrupted temporarily.

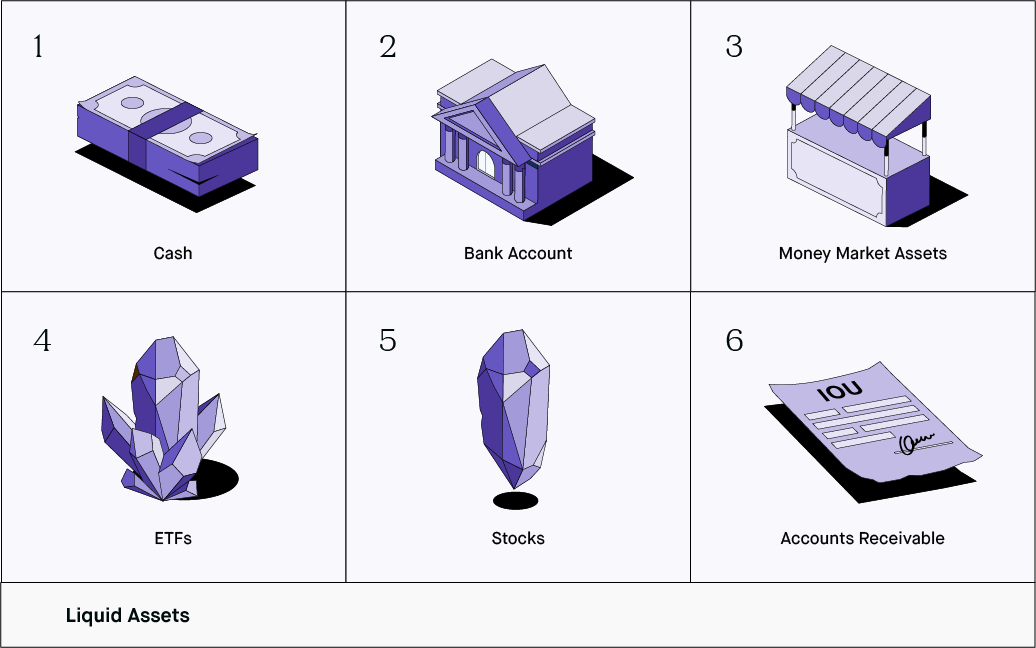

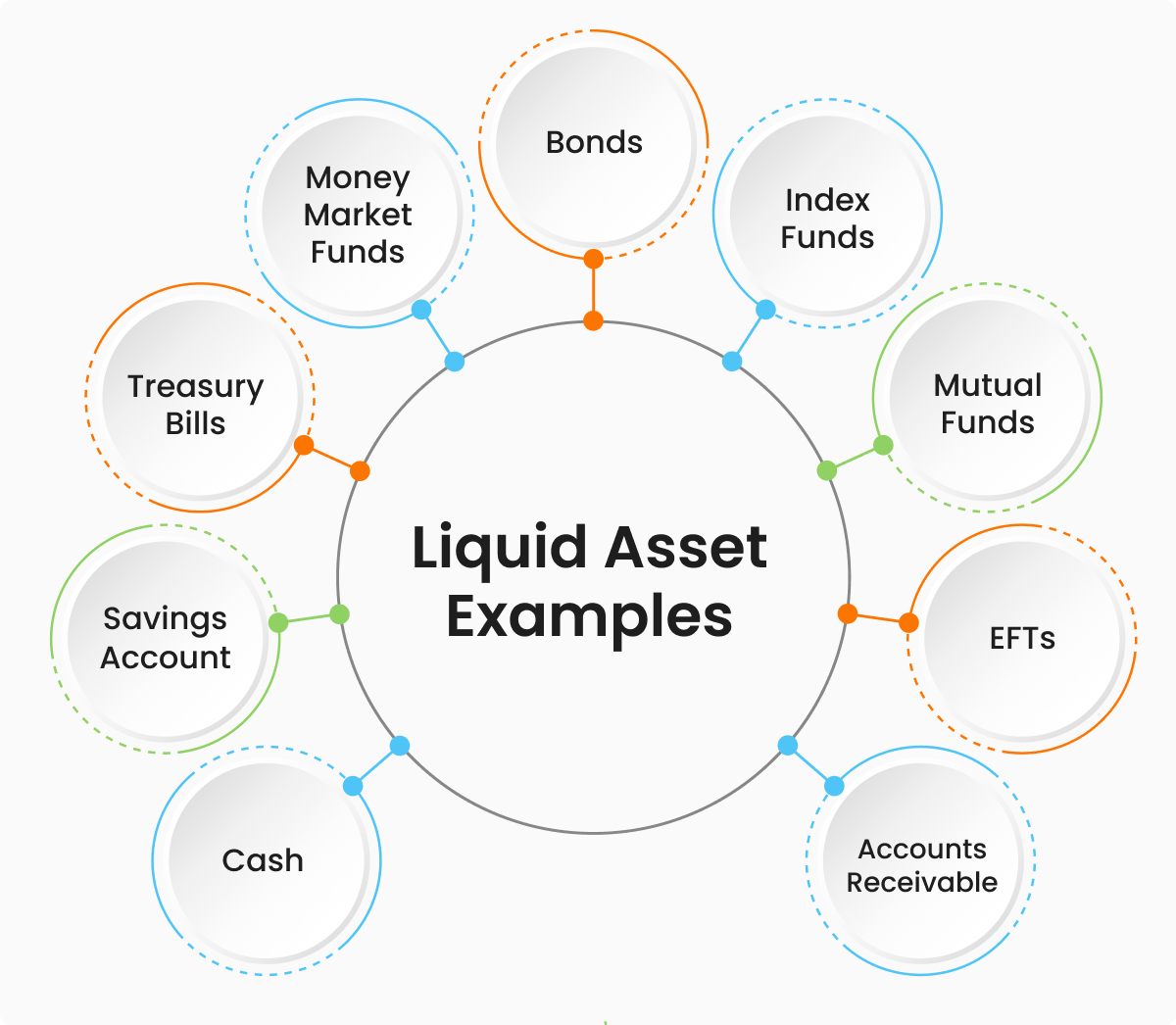

Examples of Liquid Assets

To fully understand what are liquid assets, it's useful to look at specific examples. Apart from cash, assets like savings held in bank accounts, short-term government bonds, and marketable securities such as listed company shares all count as liquid.

The common factor is that these assets are easily sellable and widely accepted. A government bond, for instance, can be sold quickly with minimal price fluctuation. In contrast, property, though valuable, is not considered liquid because it takes time to sell and often requires negotiation or intermediary steps.

Even within the category of financial investments, not all are liquid. Shares in small private firms or niche mutual funds may be difficult to sell swiftly. So when considering what are liquid assets, the key characteristics are speed, accessibility, and minimal loss of value.

Liquid Assets vs Non-Liquid Assets

A clearer understanding of what are liquid assets can be gained by comparing them to their opposite — non-liquid or illiquid assets. These include real estate, vehicles, collectibles, and equipment. While these may hold substantial value, they can take weeks or months to convert into usable funds.

Illiquid assets are typically harder to price quickly. Their sale might involve taxes, fees, paperwork, or market downturns, all of which reduce the speed and certainty of access to cash.

This distinction is especially important in investment planning. A balanced portfolio typically includes both types. Liquid assets offer quick access to cash and stability, while illiquid assets often provide longer-term growth potential or income. Knowing how much liquidity is appropriate depends on your personal or business risk tolerance and spending needs.

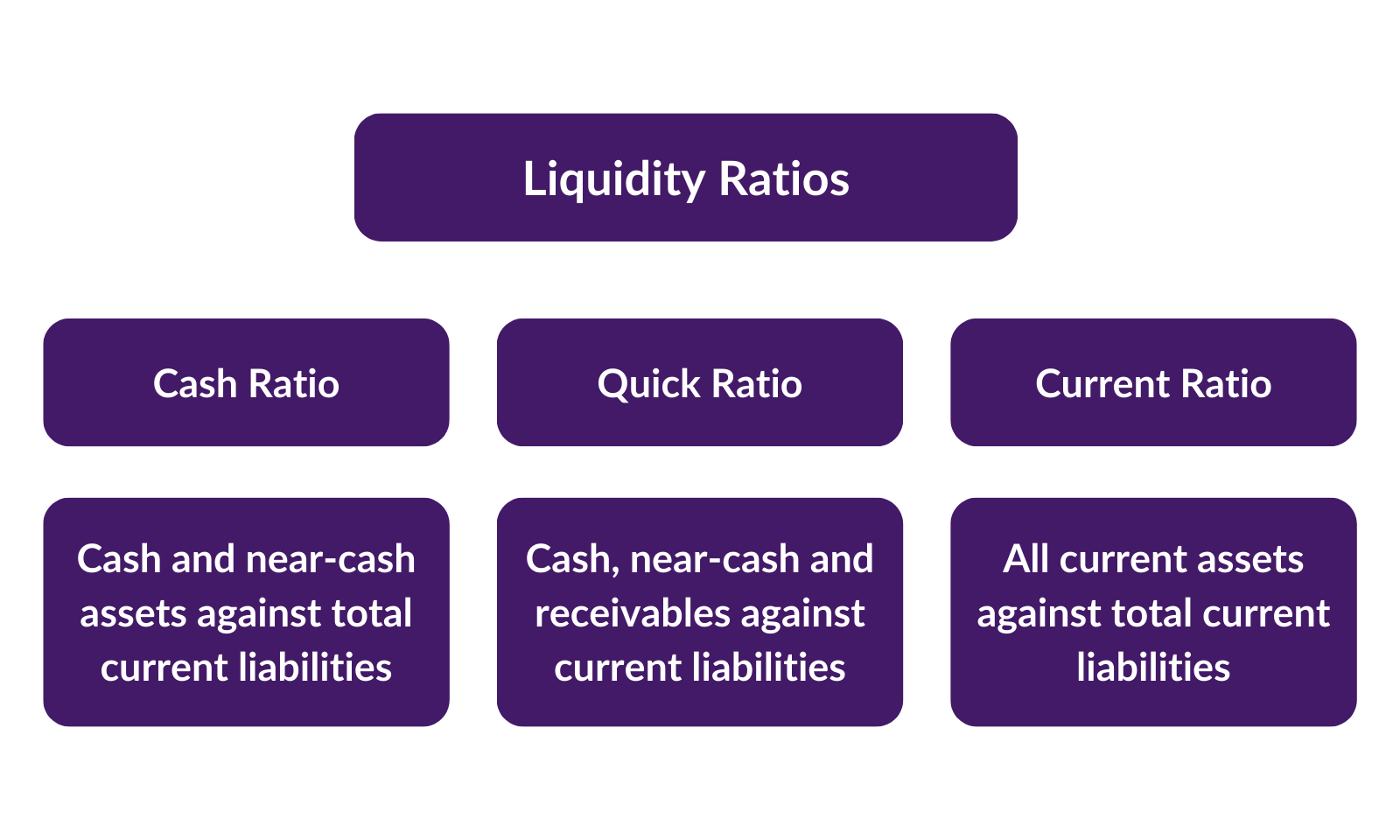

Liquidity Ratios and Financial Health

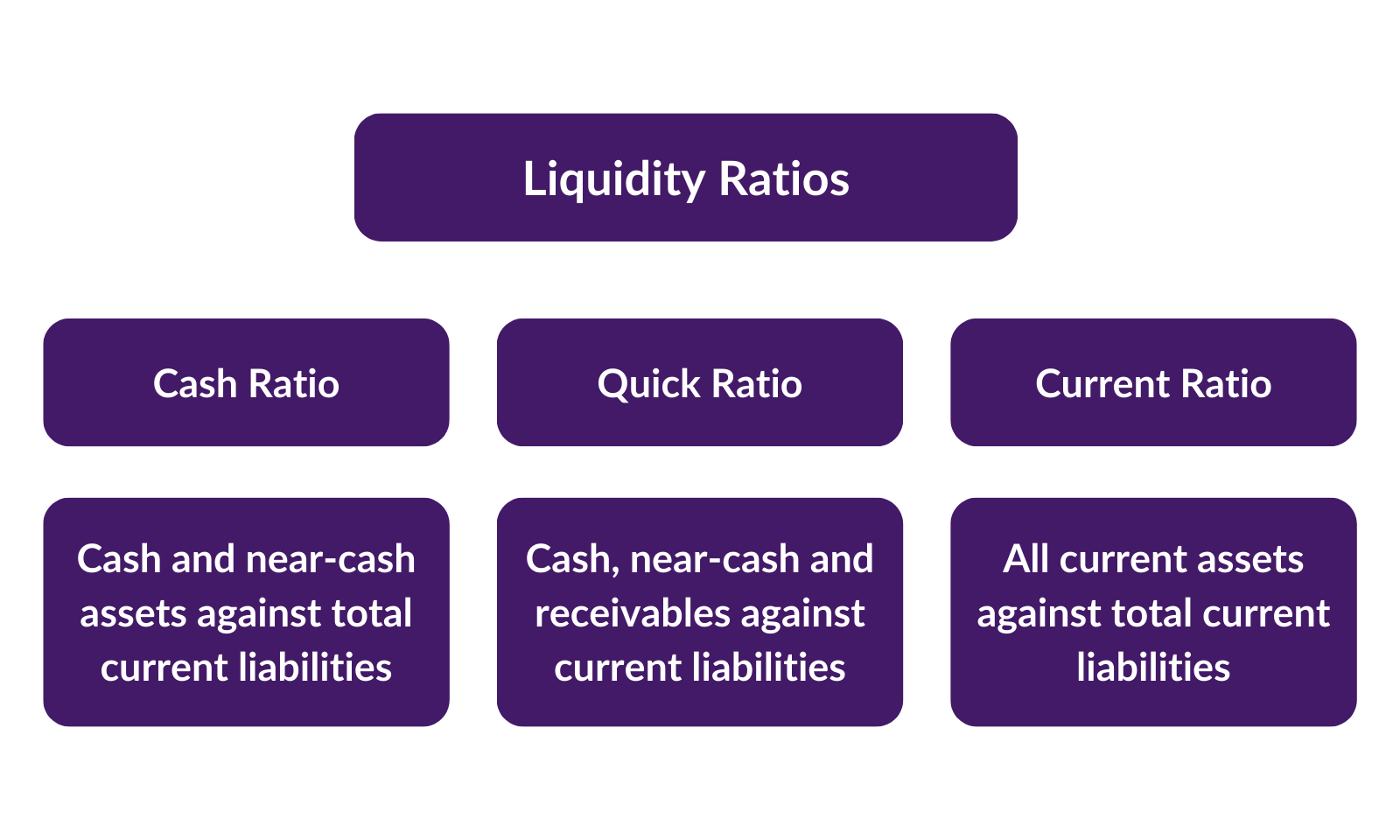

When professionals ask what are liquid assets, they often look at liquidity ratios. These financial metrics assess how well a person or business can meet short-term obligations using only their liquid assets.

Common examples include the current ratio and quick ratio. These formulas compare a firm's liquid assets to its short-term liabilities. A ratio above 1 is generally seen as healthy, meaning there are more liquid assets than short-term debts.

Such ratios are used by banks, investors, and analysts to judge creditworthiness or investment viability. A company may have large amounts of inventory or property, but if it lacks liquid assets, it may struggle to operate effectively in the short term.

Understanding what are liquid assets is essential in interpreting these metrics accurately and making informed financial decisions.

Managing Liquid Assets Wisely

Once you understand what are liquid assets, the next step is managing them well. Keeping too much cash may mean missing out on higher returns, while having too little liquidity can leave you exposed in a crisis. The key is balance.

Many individuals and businesses maintain an emergency fund made up entirely of liquid assets. For individuals, this might cover three to six months of expenses. For companies, the amount will depend on operating costs and revenue predictability.

Holding a combination of savings, short-term investments, and accessible financial products allows for both stability and modest growth. Strategic liquidity management helps meet obligations, seize new opportunities, and avoid distress selling during downturns.

Final Thoughts

So, what are liquid assets? They are the financial tools that offer immediate access to value. Cash, marketable securities, and other short-term investments all fall into this category, and their presence is a strong indicator of financial strength.

Whether you are managing personal finances or running a business, understanding what are liquid assets can help you plan more effectively. Liquidity brings security, agility, and peace of mind in a changing financial environment. The better you manage your liquid assets, the more control you'll have over your financial journey.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.