The Hang Seng Tech Index has rapidly become a focal point for traders looking to tap into the growing technology sector in China. As part of the broader Hang Seng Index, it serves as a benchmark for the performance of the technology companies listed in Hong Kong, providing a clear snapshot of how China's digital economy is evolving. But for those who aren't familiar with this index, it might seem a bit overwhelming.

The Role of the Hang Seng Tech Index in the Chinese Market

To start, let's understand what the Hang Seng Tech Index actually represents. Introduced in 2020. it's designed to track the largest and most influential technology companies in Hong Kong. This includes the likes of Tencent, Alibaba, and Meituan — names that are not only household staples in China but also major players on the global tech stage. The index includes a variety of companies, from internet services and e-commerce giants to cloud computing and semiconductor firms. Essentially, it provides a barometer of China's fast-evolving digital landscape.

As China's economy continues to shift from traditional manufacturing to technology and services, this index offers traders a way to capture the growth of its high-tech sector. Given the growing reliance on technology in both daily life and business operations, the Hang Seng Tech Index has garnered increasing interest as a way to invest in this transformation.

Key Companies in the Hang Seng Tech Index

The Hang Seng Tech Index includes some of the biggest names in the Chinese tech space, which makes it an appealing option for those looking to invest in the sector's future. Tencent and Alibaba are at the top of the list, dominating not just in China but across the globe. Tencent, known for its messaging app WeChat and its stake in a variety of video games, is one of the most valuable companies in the world. Similarly, Alibaba's reach spans e-commerce, cloud computing, and digital payments, making it a heavyweight in global markets.

Other notable companies in the index include Meituan, which has transformed how people in China order food and services online, and Xiaomi, a leader in smartphones and smart devices. These companies are often referred to as China's answer to Silicon Valley giants like Google, Amazon, and Facebook, and they offer a diversified mix of opportunities within the tech space.

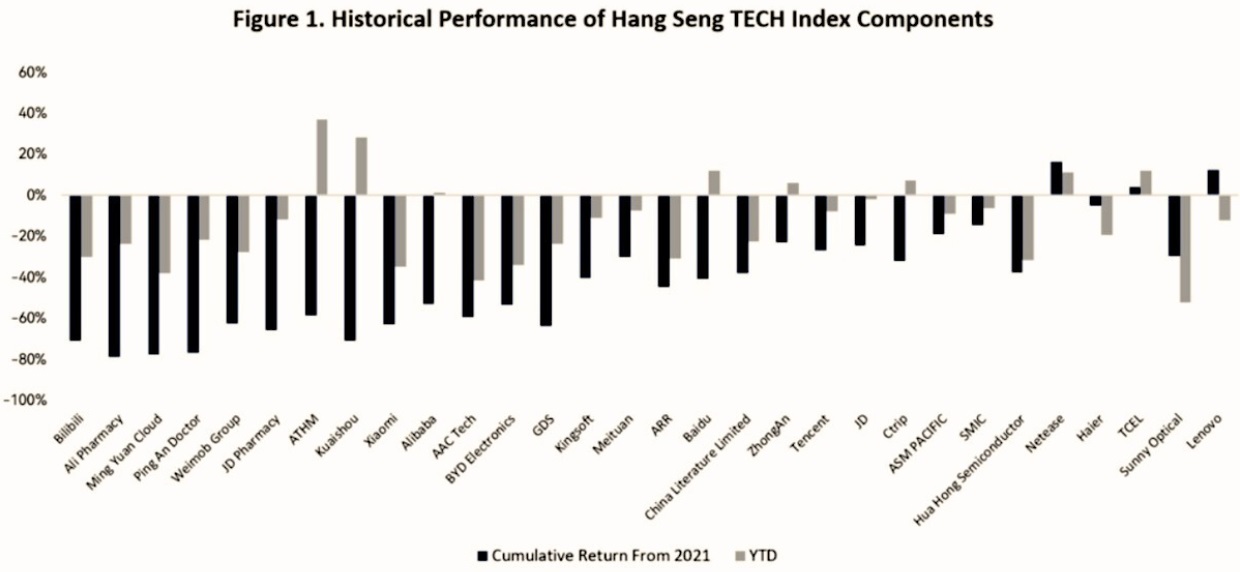

But while these companies are impressive, the index is made up of 30 stocks in total, offering a broader view of the technology sector beyond just the largest firms. This diversity is key for traders who want exposure to the rising stars of China's digital economy, especially as newer tech companies continue to grow.

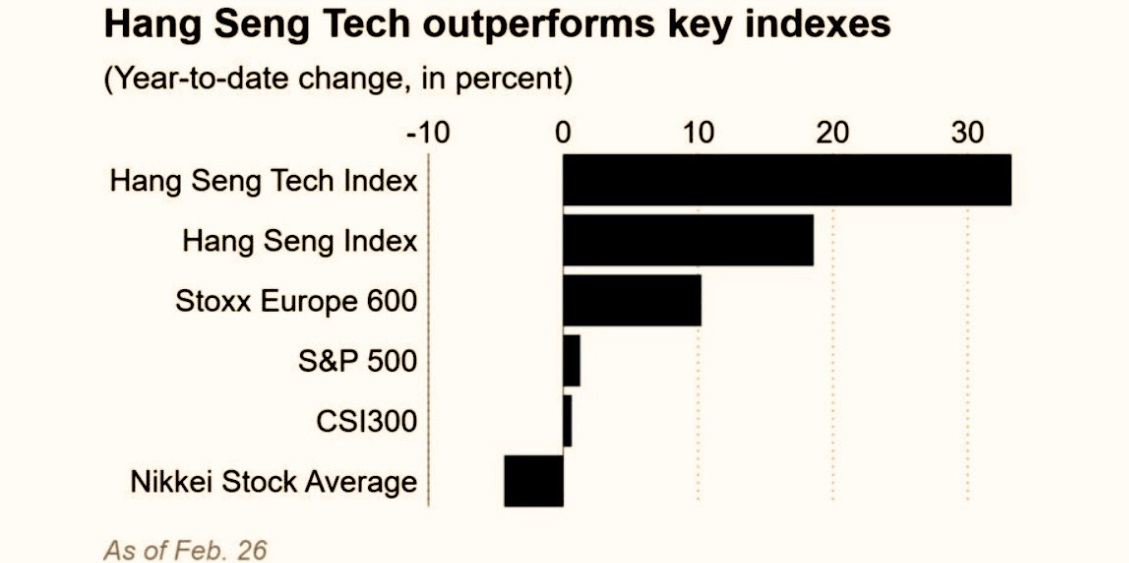

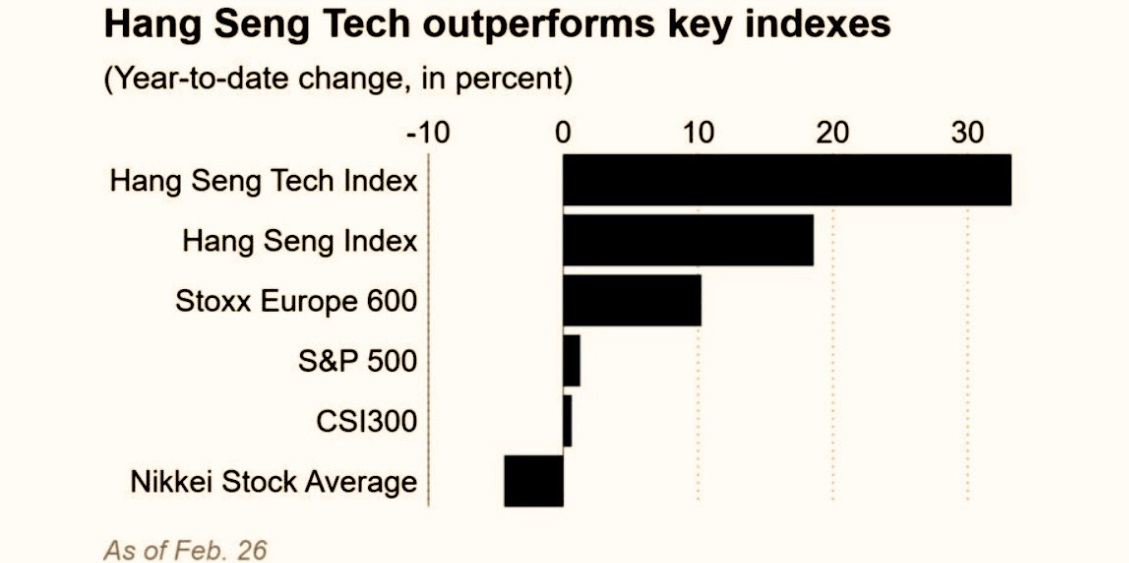

Why Global Traders Are Watching the Hang Seng Tech Index

The Hang Seng Tech Index isn't just important for Chinese traders; it has also caught the attention of global market players. China is the world's second-largest economy, and its tech sector is expanding rapidly, despite some regulatory hurdles. For traders looking to diversify their portfolios or gain exposure to emerging markets, the Hang Seng Tech Index provides a way to access a crucial segment of China's economy. The rise of e-commerce, cloud computing, artificial intelligence, and other cutting-edge technologies are all factors driving the demand for tech stocks.

One reason why the Hang Seng Tech Index is particularly attractive is its potential for long-term growth. While China's economic growth has slowed slightly in recent years, its tech sector continues to expand at a rapid pace, driven by consumer demand, government support, and a rising middle class. The Hang Seng Tech Index, therefore, offers a way for traders to capture this growth while also benefiting from the globalisation of Chinese technology.

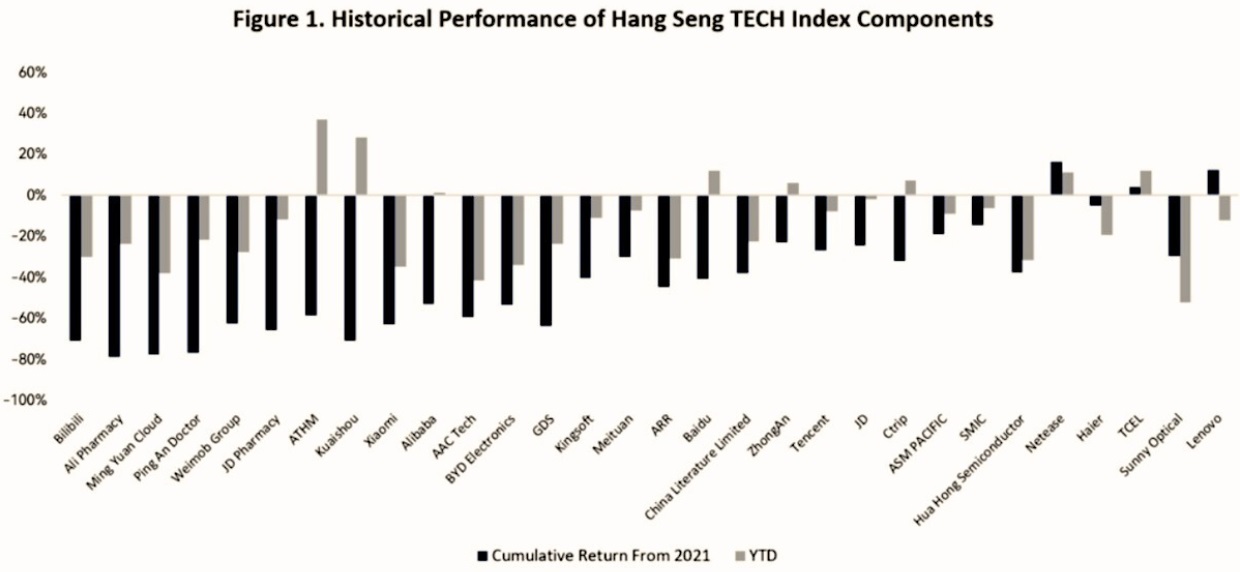

However, investing in Chinese tech stocks isn't without its risks. For one, Chinese companies face regulatory challenges, particularly in terms of data privacy and anti-competitive practices. This can lead to volatility in Stock Prices, as seen with the crackdown on tech giants in 2021. However, for those who are prepared to weather the occasional turbulence, the potential rewards can be substantial.

How to Invest in the Hang Seng Tech Index

Investing in the Hang Seng Tech Index can be done in several ways, depending on your investment style and preferences. One of the most straightforward ways is to purchase exchange-traded funds (ETFs) that track the performance of the index. ETFs offer a cost-effective way to gain exposure to the entire index, providing diversification across all 30 stocks without needing to pick individual winners.

Another option is to buy individual stocks that are part of the Hang Seng Tech Index. For example, if you believe that a company like Tencent or Alibaba has significant growth potential, you could invest directly in their shares. However, this approach requires more research and a deeper understanding of the companies involved, as well as the broader market dynamics.

For those who want to take a more active approach, trading Hang Seng Tech Index futures or options may be appealing. These products allow traders to speculate on the future performance of the index, but they also come with a higher level of risk and complexity. It's important to have a solid understanding of futures and options trading before venturing into this territory.

The Future of the Hang Seng Tech Index

Looking ahead, the Hang Seng Tech Index seems set to play an even more pivotal role in the global tech landscape. As China continues to develop its tech capabilities, it is expected that the companies in the index will benefit from government policies aimed at fostering innovation. Moreover, China's push for self-reliance in critical technologies like semiconductors and artificial intelligence is likely to support the growth of the companies that make up the index.

While the regulatory environment in China remains a risk factor, the government has shown a willingness to support its tech sector in the long term. This includes investing in research and development, as well as promoting international collaboration. With these factors in play, the Hang Seng Tech Index offers traders a unique opportunity to gain exposure to the rapidly changing landscape of one of the world's most dynamic economies.

Conclusion

In summary, the Hang Seng Tech Index offers traders a window into the heart of China's tech industry. With a diverse mix of companies, including household names like Tencent and Alibaba, the index provides an exciting opportunity for those looking to tap into China's growing digital economy. While it comes with risks — especially around regulation — the long-term growth potential of the tech sector in China is undeniable. For anyone looking to invest in one of the world's most dynamic markets, the Hang Seng Tech Index should definitely be on your radar.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.