The concept of starting to trade often brings to mind the image of young investors, quick reflexes, and decades ahead to master the craft. Yet, the question lingers for many: is there truly a “right age” to begin, and does starting later put you at a disadvantage? The reality, backed by data and experience, is that the best time to start trading is when you are prepared—mentally, financially, and strategically—regardless of your age.

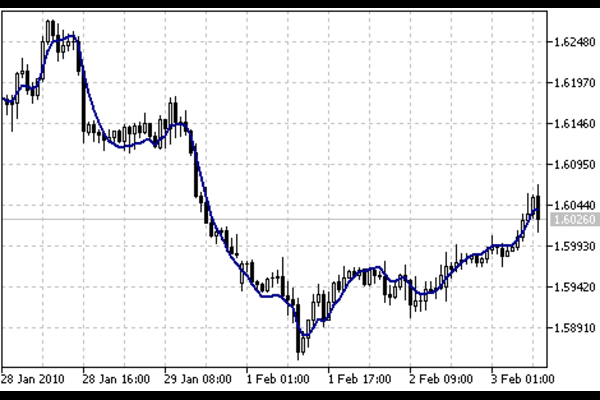

Across global markets, trading has become more accessible than ever before. Online platforms, real-time analytics, and educational resources have democratised access for traders in their 20s, 40s, or even 60s. What determines success is not the number of candles on your birthday cake but your ability to adapt, learn, and manage risk. Whether you start trading as a fresh graduate or as a retiree seeking to grow your savings, the playing field can be level with the right approach.

Why People Hesitate to Start Trading Later in Life

One of the biggest barriers for late starters is the fear of time running out. Older individuals may feel pressured to achieve results faster, especially if they are aiming to supplement retirement income. This urgency can lead to higher risk-taking, which, without a proper strategy, increases the likelihood of loss. On the flip side, many late starters bring with them a wealth of discipline, patience, and financial stability—traits that often give them an edge over younger, more impulsive traders.

Another hesitation is technological fluency. While younger generations may adapt quickly to new trading apps and charting tools, older traders sometimes fear the learning curve. However, modern trading platforms are designed to be user-friendly, and many offer simulated environments where you can practise without risking real capital. The key is to view technology as an enabler rather than a barrier when you start trading.

Data on Age and Trading Performance

Market data suggests that performance is not strongly correlated with age but rather with experience, consistency, and adherence to a plan. A trader in their 50s who begins with disciplined risk management may outperform a younger counterpart who trades emotionally. The most common factor among consistently profitable traders—regardless of when they start trading—is that they treat trading as a skill to be developed, not a gamble to be won.

Interestingly, a large percentage of professional traders only became profitable after several years of experience. This suggests that even those who start trading early still need to go through the same learning curve as late starters. Age can sometimes shorten the emotional recovery period after losses, as older traders may be more pragmatic about setbacks and less likely to chase losses.

Advantages of Starting Trading at Any Age

When you start trading young, your biggest advantage is time—time to compound profits, recover from mistakes, and gradually scale your portfolio. You can afford to take a few wrong turns and still have decades to refine your approach. For those starting later, the advantage often lies in resources and maturity. You might have more capital to allocate, a more defined risk tolerance, and a sharper sense of financial priorities.

In both cases, the market rewards preparation. Before you start trading, it’s important to decide on your objectives: Are you aiming for long-term growth, short-term gains, or diversification of your income sources? The clearer your goals, the easier it becomes to choose the right markets, strategies, and position sizes.

Key Principles That Apply to All Traders

No matter your age, the principles of successful trading remain constant. Risk management should always take precedence over profit targets. Emotional discipline is essential; the market often tests your patience and resolve. Continuous education—through market analysis, economic news, and strategy refinement—ensures that you remain adaptable in ever-changing conditions.

When you start trading, keep in mind that consistency is more important than speed. Many new traders burn out or blow their accounts because they focus on maximising profits quickly instead of building a sustainable system. Whether you’re 25 or 65, treating trading as a business rather than a one-off event dramatically improves your odds of success.

The Psychological Factor

Psychology plays a critical role in how traders perform. Younger traders may have a higher tolerance for risk but also a greater susceptibility to overconfidence. Older traders, on the other hand, may be more risk-averse but better at sticking to a plan. The act of starting trading at any stage in life requires a balance between optimism and caution. Recognising your own psychological tendencies can help you create strategies that fit your personality and goals.

Looking Ahead: Trends That Favour Late Starters

The global trading landscape is evolving in ways that make it easier than ever to start trading later in life. The rise of fractional investing allows you to begin with smaller capital. Access to round-the-clock markets like forex means that trading can fit around your existing commitments. Automated tools and algorithmic trading options can help reduce the workload and remove emotional decision-making from the process.

Furthermore, the abundance of free and paid educational content means you can gain the equivalent of years of trading knowledge in a fraction of the time, provided you apply it diligently. For those willing to invest in learning, these tools can accelerate the journey from beginner to competent trader.

Final Thoughts

The belief that you’ve “missed your chance” is one of the most damaging myths in trading. The truth is that the best time to start trading is when you are financially stable enough to handle potential losses, emotionally prepared to manage market stress, and committed to ongoing learning. Age may influence your approach, but it does not dictate your potential for success.

Whether you are in your 20s with decades ahead or in your 50s seeking a new financial challenge, the market offers opportunities for those who approach it strategically. The moment you decide to start trading with clear goals, disciplined risk management, and a willingness to learn, you have already taken the most important step.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.