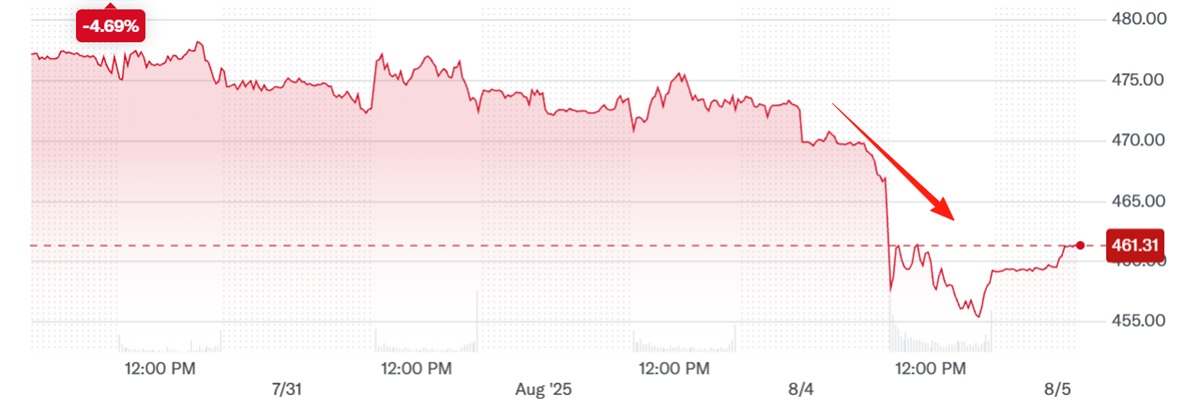

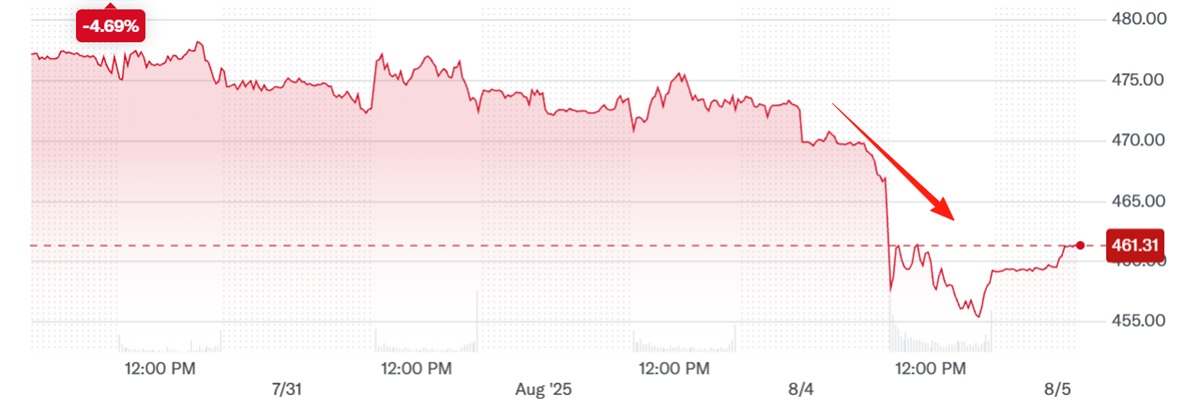

The recent retirement of Warren Buffett has marked the end of an era—not just for Berkshire Hathaway, but for the investment world at large. Yet as the company adjusts to life without the Oracle of Omaha at the helm, the challenges it faces are becoming more apparent. Berkshire Hathaway stock has already dropped 12% since Buffett's May departure, and the latest earnings report suggests there may be further turbulence ahead.

Q2 Results Fall Short of Expectations

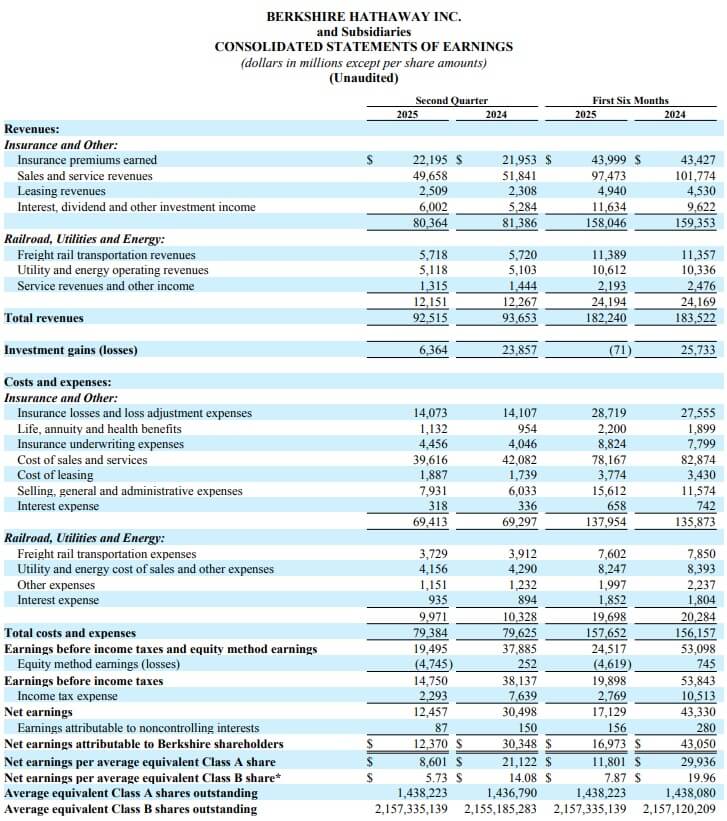

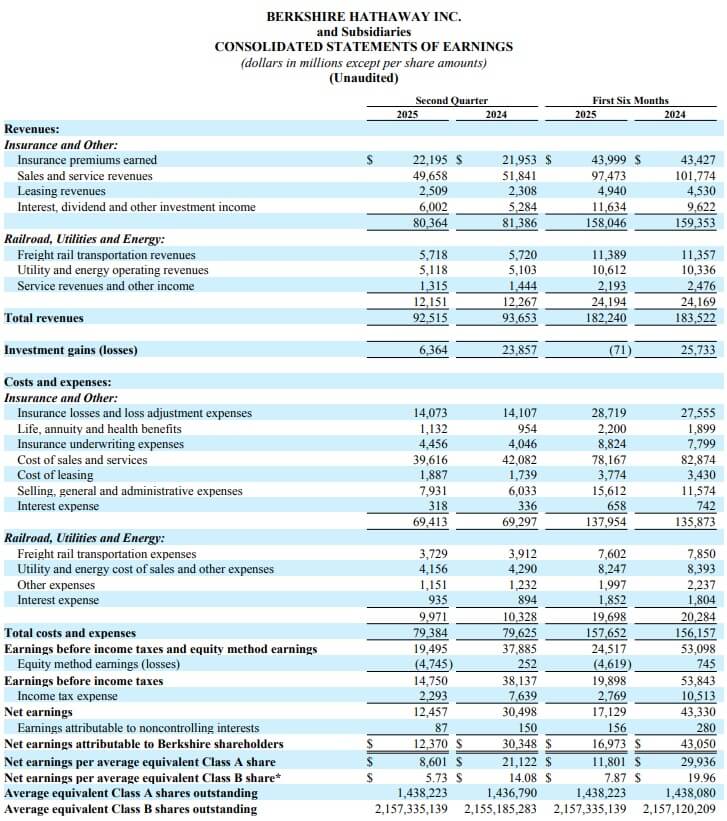

On 2 August 2025. Berkshire Hathaway released its second-quarter financial results. The figures disappointed investors across the board. Revenue came in at $92.52 billion, down 1.2% year-on-year, while net profit plunged 59% to $12.37 billion. Both metrics fell short of analyst expectations.

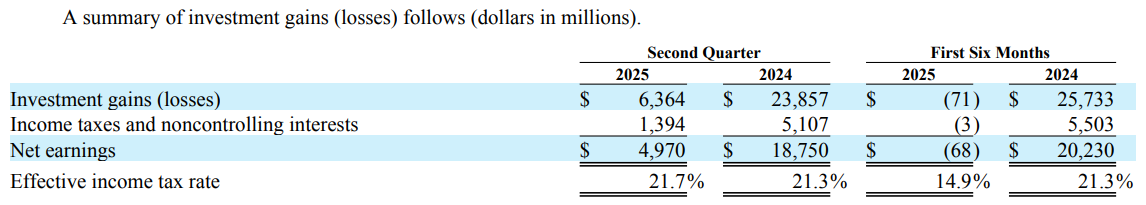

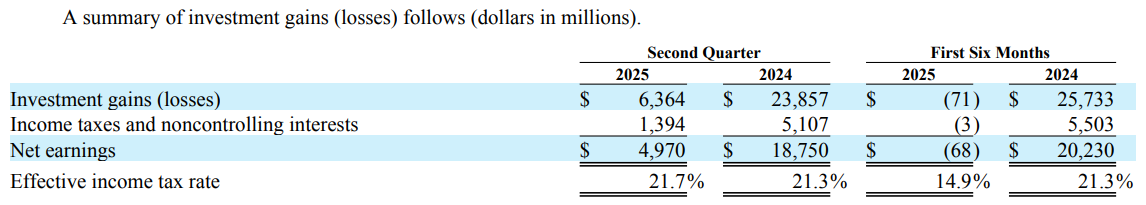

Despite posting investment gains of $6.36 billion during the quarter, the company reported a net loss of $71 million for the first half of the year. A significant portion of this came from a $3.8 billion impairment related to its investment in Kraft Heinz—a clear sign that not all of Berkshire's bets are ageing well.

Of further note, the company has now been a net seller of equities for 11 consecutive quarters. Most recently, it liquidated roughly $1.2 billion worth of shares in VeriSign. This cautious stance has raised eyebrows among investors wondering whether Berkshire is struggling to find compelling opportunities in today's market.

The End of the Buffett Premium?

Much of Berkshire Hathaway stock's long-standing strength has come from what many dubbed the "Buffett premium"—the confidence investors placed in Warren Buffett's steady hand, long-term vision, and unrivalled market instincts. But now, with Buffett stepping down, that premium appears to be evaporating.

Investors are also concerned about the company's current lack of aggressive investment activity. Berkshire has not repurchased any of its own shares so far this year, which some analysts interpret as a sign that management no longer sees the stock as undervalued. The company's core insurance business is facing headwinds as well, with underwriting profits down nearly 12%, and there are growing concerns that the property and casualty insurance cycle has peaked.

Meanwhile, the firm's massive $344 billion cash pile—once seen as a war chest for strategic acquisitions—is fuelling speculation that Berkshire is struggling to find suitable targets. This lack of clear growth direction, combined with margin pressure and limited buybacks, has effectively removed any near-term catalysts for a stock rebound.

Shifting Market Dynamics

Adding to the pressure is a broader rotation within the market. Defensive stocks like Berkshire Hathaway are falling out of favour as investors chase growth in technology and other high-beta sectors. With Berkshire's top holdings still rooted in legacy names such as Apple, American Express, Coca-Cola, and Chevron, some question whether its portfolio is well-positioned for the next cycle of market leadership.

Despite the downturn, it's important not to write off Berkshire Hathaway stock entirely. The firm remains financially robust, with a diversified business model and a long track record of weathering economic cycles. But the coming quarters will be crucial in demonstrating whether it can evolve successfully in a post-Buffett world.

Conclusion

Berkshire Hathaway stock is entering a new chapter—one marked by transition, uncertainty, and increased scrutiny. Without the guiding force of Warren Buffett, the company must prove that its investment philosophy, leadership, and operational strength can stand on their own.

For investors, the road ahead may be bumpier than in decades past. But as with any period of change, it could also offer opportunities—for those who believe that Berkshire's legacy is strong enough to endure even without its legendary founder at the helm.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.