US stocks rebounded on Tuesday as hints at the de-escalation of trade

tensions brought buyers in from the sidelines. A broad rally boosted all three

major stock indexes by more than 2.5%.

The market jumped further in extended trade after Trump said he has no plans

to fire Fed Chair Jerome Powell, stepping back from his recent rhetoric against

the central bank chief.

Trump also told reporters he would be very nice in negotiations with China,

and that tariffs on imports from the country would fall significantly following

a deal, but not to zero.

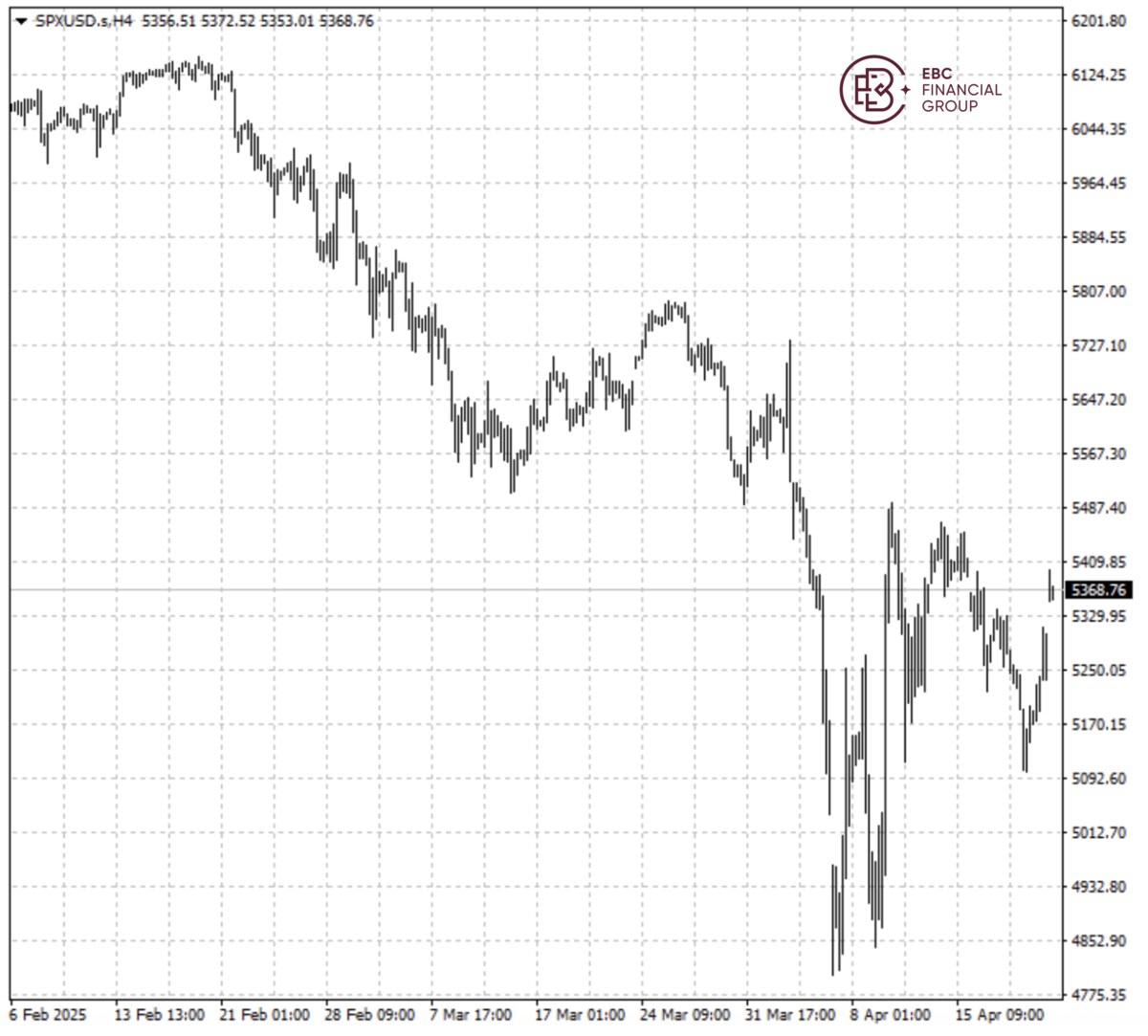

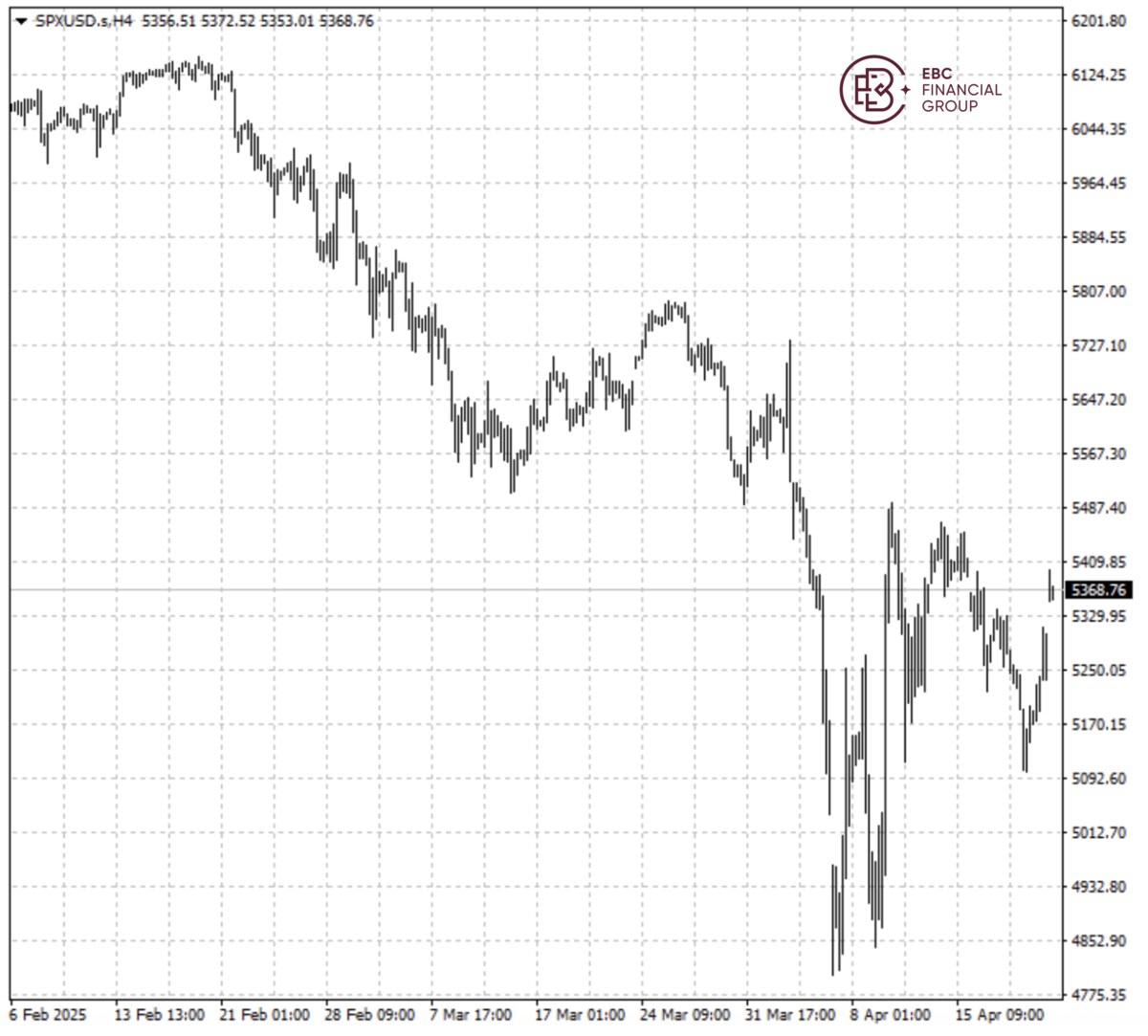

After being battered for weeks by Washington, the S&P 500 closed nearly

14% below its record closing high reached in February. IMF has slashed its

forecasts for US GDP growth to 1.8% in 2025.

Adding to optimism, 82 of the companies in the S&P 500 have reported and

73% among them beat expectations, according to LSEG. Tesla jumped 5% in

after-hours trading though its results widely missed the mark.

The company said plans for new affordable vehicles are on track for start of

production in the first half of 2025 and that it still expects Robotaxi volume

production starting in 2026.

The S&P 500 has been trading in a range since early this month. So the

basic scenario is that it will retest the resistance around 5,500 before a

retreat.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.