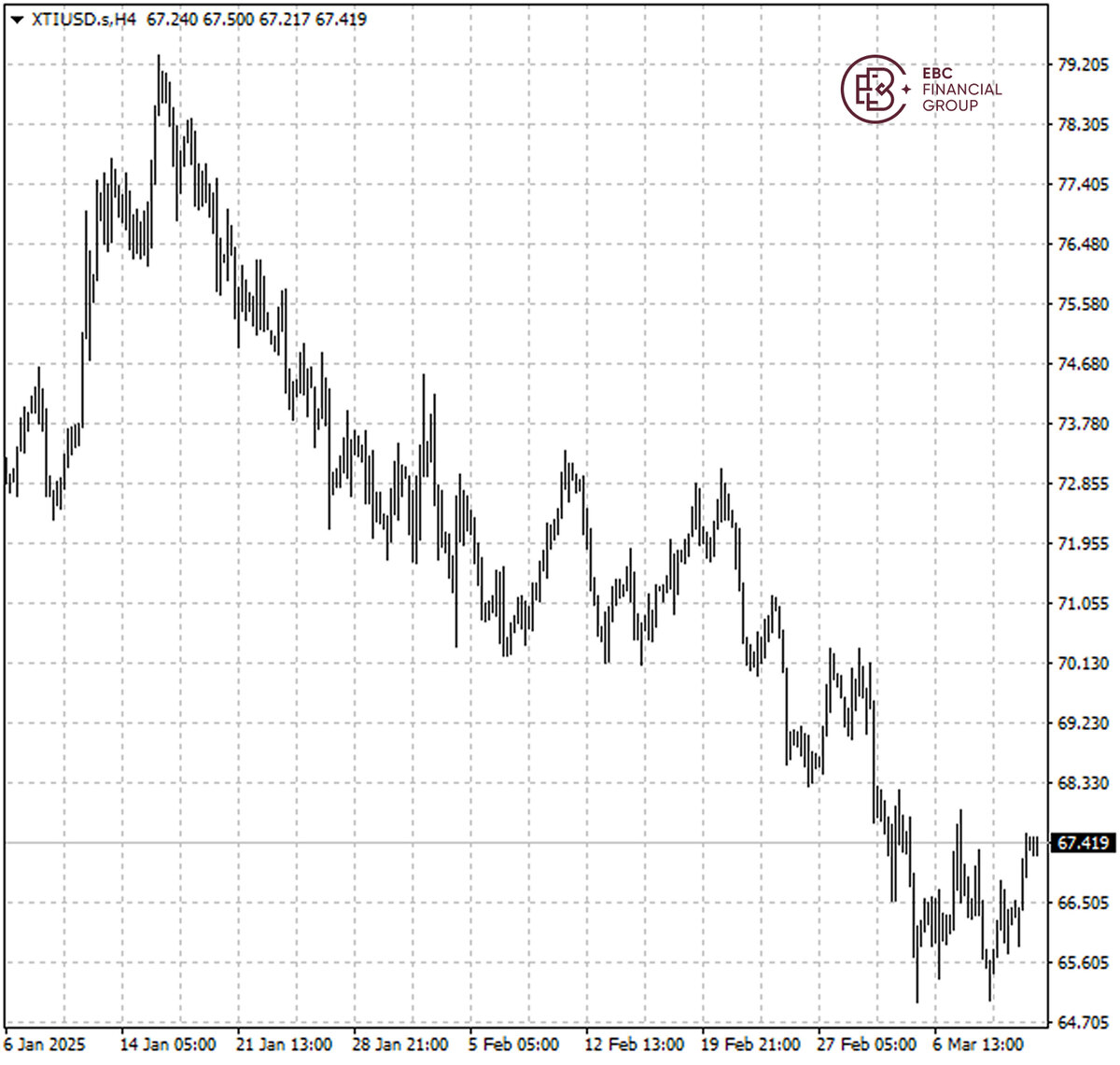

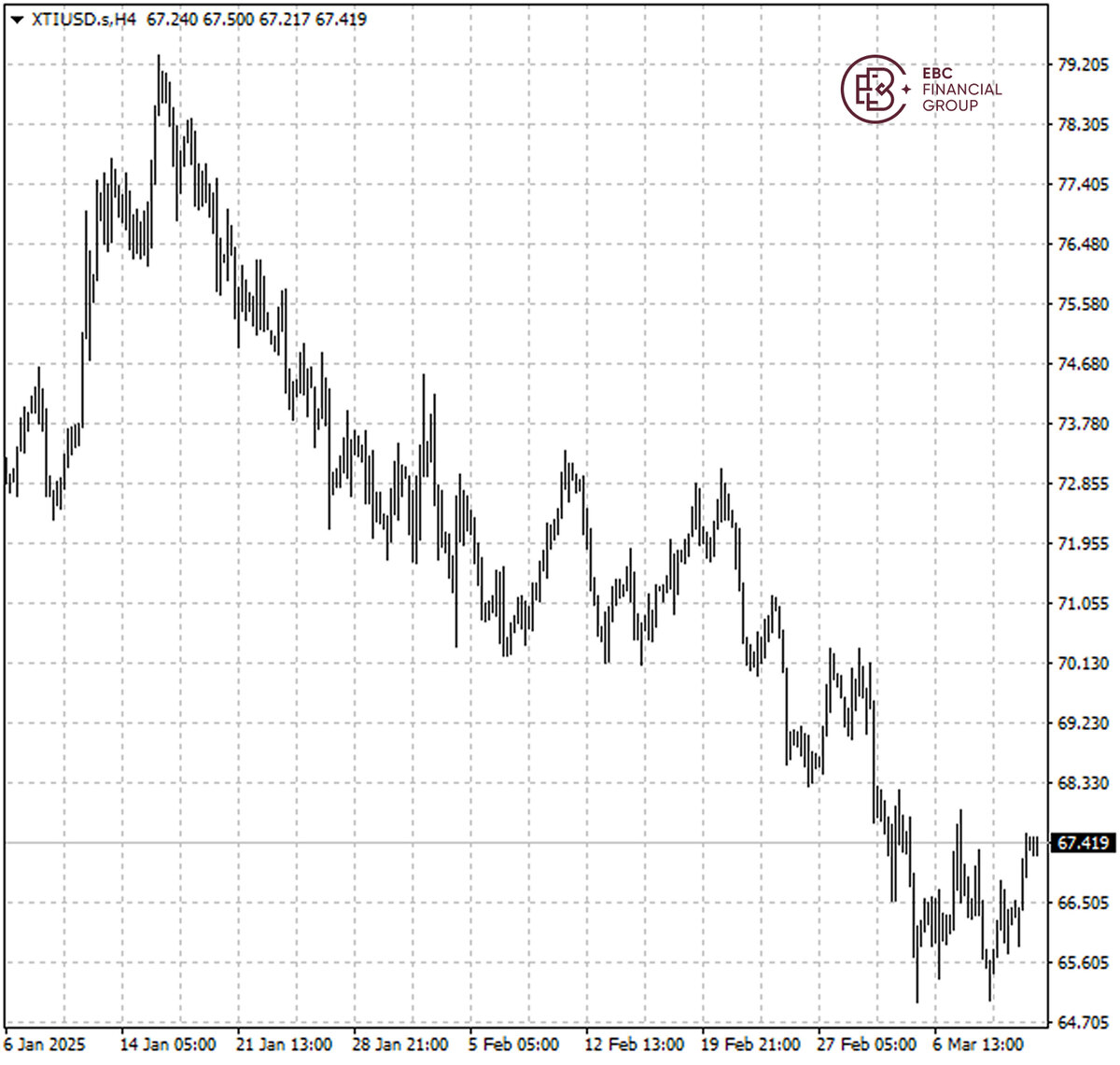

Oil prices eased on Thursday after surging the day on the positive sentiment

from a sizable draw in US gasoline stocks. Traders have slashed bullish bets on

crude oil, with WTI net long positions at a 15-year low in February.

Cooler inflation last month leaves the door open for the Fed to resume

cutting interest rates by mid-year, but the central bank remains worried that

tariffs could rekindle price pressures.

US crude stockpiles rose by 1.4 million barrels in the latest week, EIA data

showed, less than the 2 million-barrel rise analysts had expected. Gasoline

inventories also fell more than expected.

Canada could impose non-tariff measures such as restricting its oil exports

to the US or levying export duties on products if the trade dispute escalates,

the country's energy minister Jonathan Wilkinson said on Tuesday.

Trump threatened on Wednesday to escalate a global trade war with further

tariffs on EU goods. His unpredictability has rattled investors, consumers and

business confidence and raised recession fears.

OPEC's monthly report showed OPEC+ raised output in February by 363,000

barrels per day, though the group kept its forecasts for relatively strong

growth in global oil demand in 2025.

WTI crude has recently digested its heavy losses with the initial resistance

around $68. A break above the level could lead the price to $70.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.