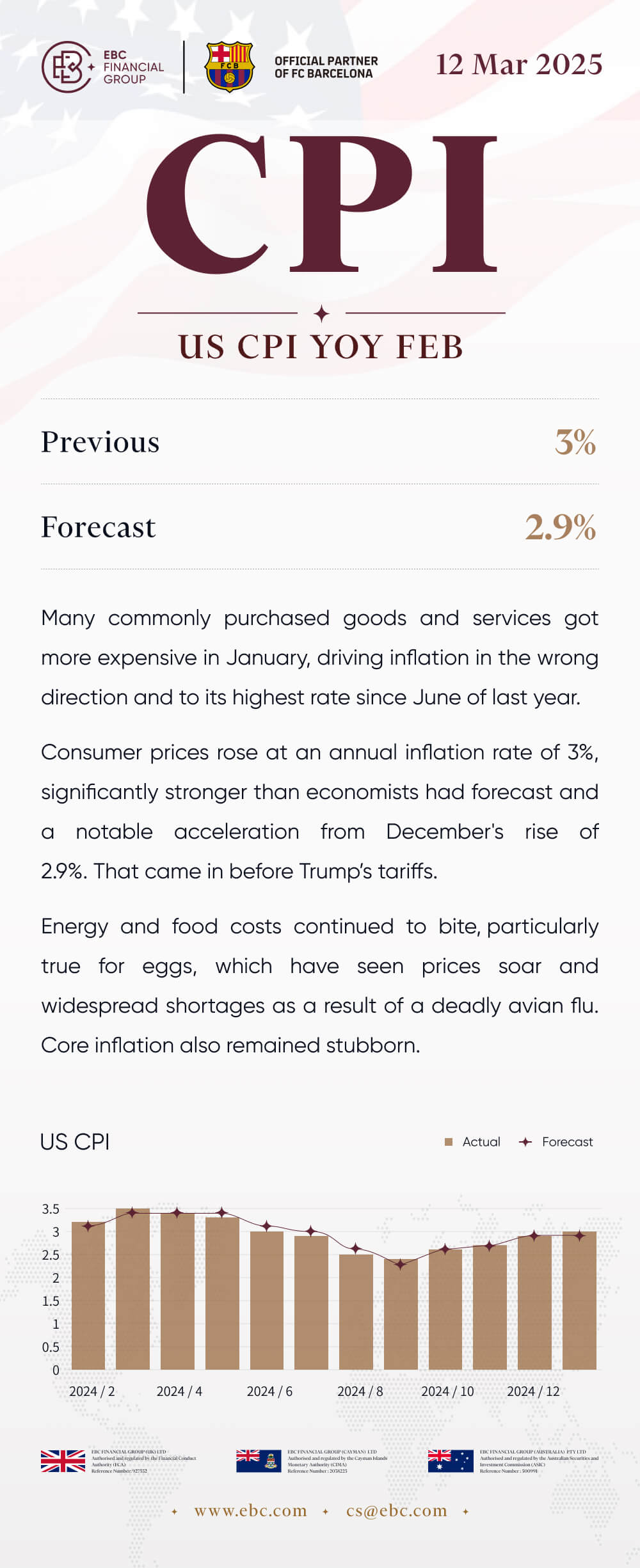

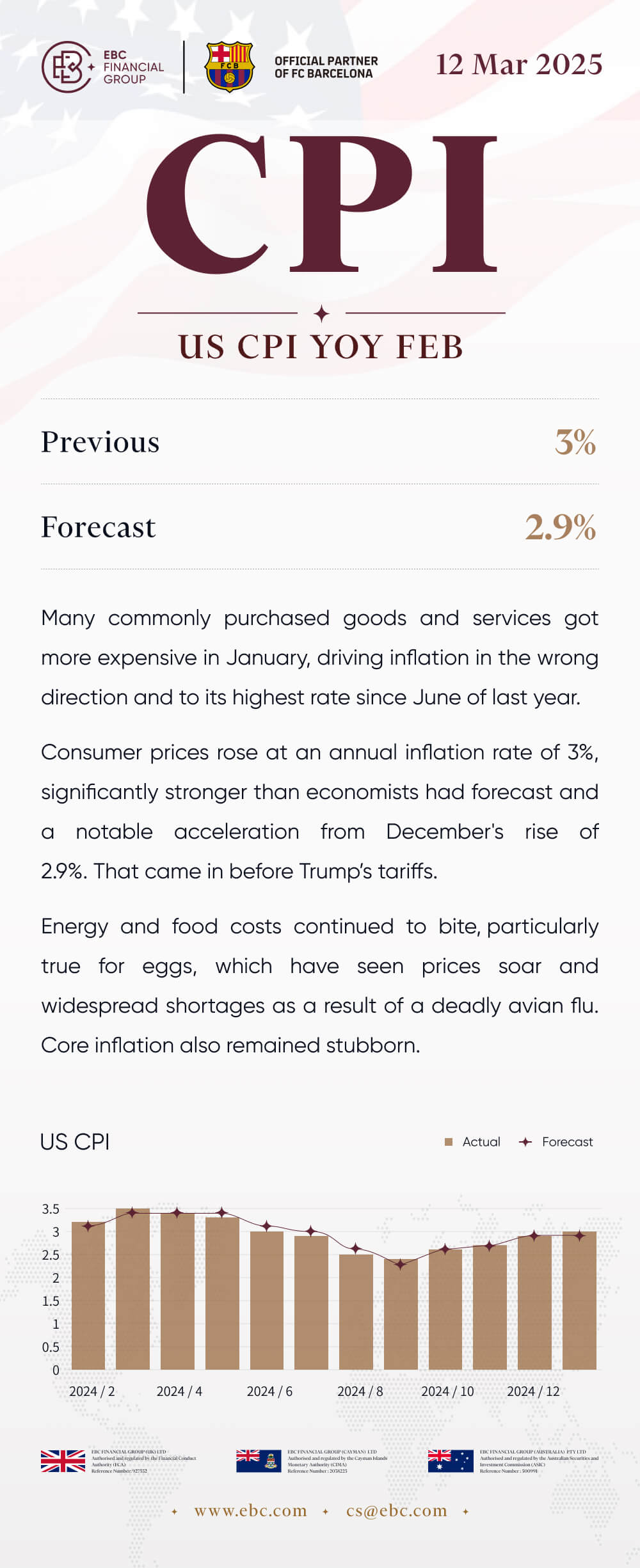

US CPI Feb

12/3/2025 (Wed)

Previous: 3% Forecast: 2.9%

Many commonly purchased goods and services got more expensive in January,

driving inflation in the wrong direction and to its highest rate since June of

last year.

Consumer prices rose at an annual inflation rate of 3%, significantly

stronger than economists had forecast and a notable acceleration from December's

rise of 2.9%. That came in before Trump's tariffs.

Energy and food costs continued to bite, particularly true for eggs, which

have seen prices soar and widespread shortages as a result of a deadly avian

flu. Core inflation also remained stubborn.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.