The NFP full form stands for Non-Farm Payrolls, a key economic indicator used by traders, analysts, and central banks to understand employment trends in the United States. Released monthly by the US Bureau of Labor Statistics, the report covers employment figures in non-agricultural sectors, offering deep insights into economic health.

For forex traders, the NFP full form holds massive importance, as it frequently triggers sharp moves in currency markets. Below, we break down what makes this data point so significant through five simple but crucial points.

Explaining NFP Full Form in 5 Points

1. What Is the NFP Full Form and Why Is It Called That?

The NFP full form refers to Non-Farm Payrolls, which essentially measures the number of jobs added or lost in the US economy during the previous month, excluding agricultural workers, private household employees, non-profit organisations, and government workers. The exclusion of these sectors is intentional. Agricultural jobs, for example, are seasonal and often too volatile to provide consistent economic signals. By focusing on more stable sectors, the NFP delivers a clearer picture of underlying employment trends.

For traders, understanding the NFP full form is not just about knowing the literal words behind the abbreviation. It's about recognising its relevance in predicting interest rate decisions, gauging inflation pressure, and responding swiftly to short-term market volatility.

2. How the NFP Impacts Forex Markets

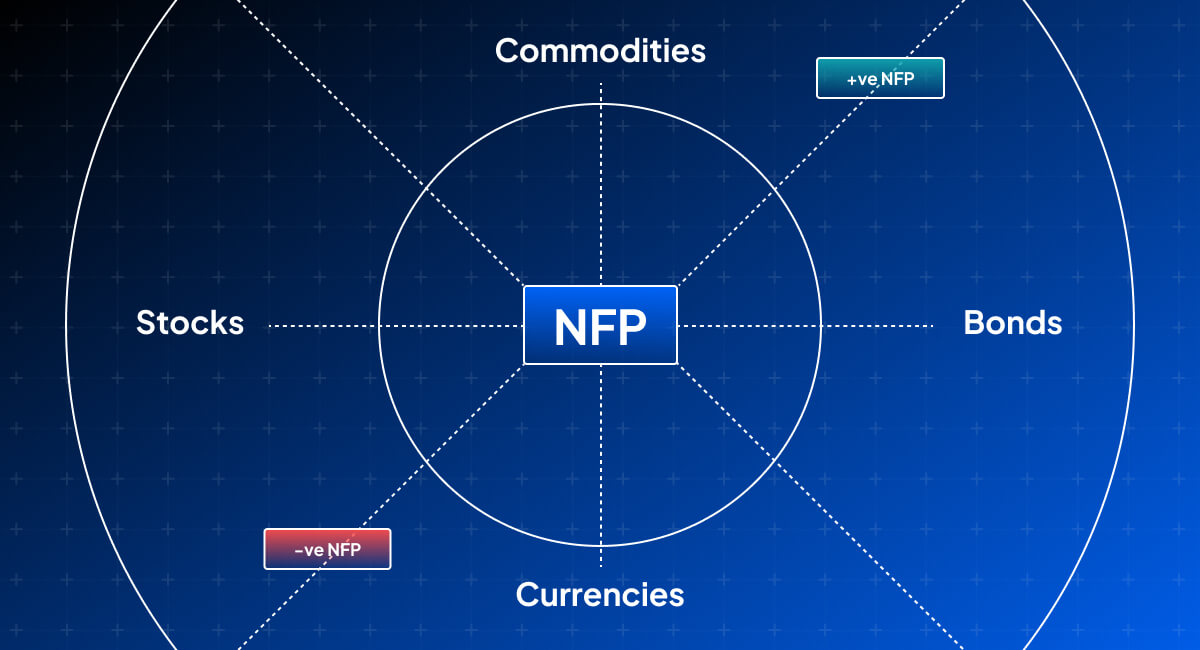

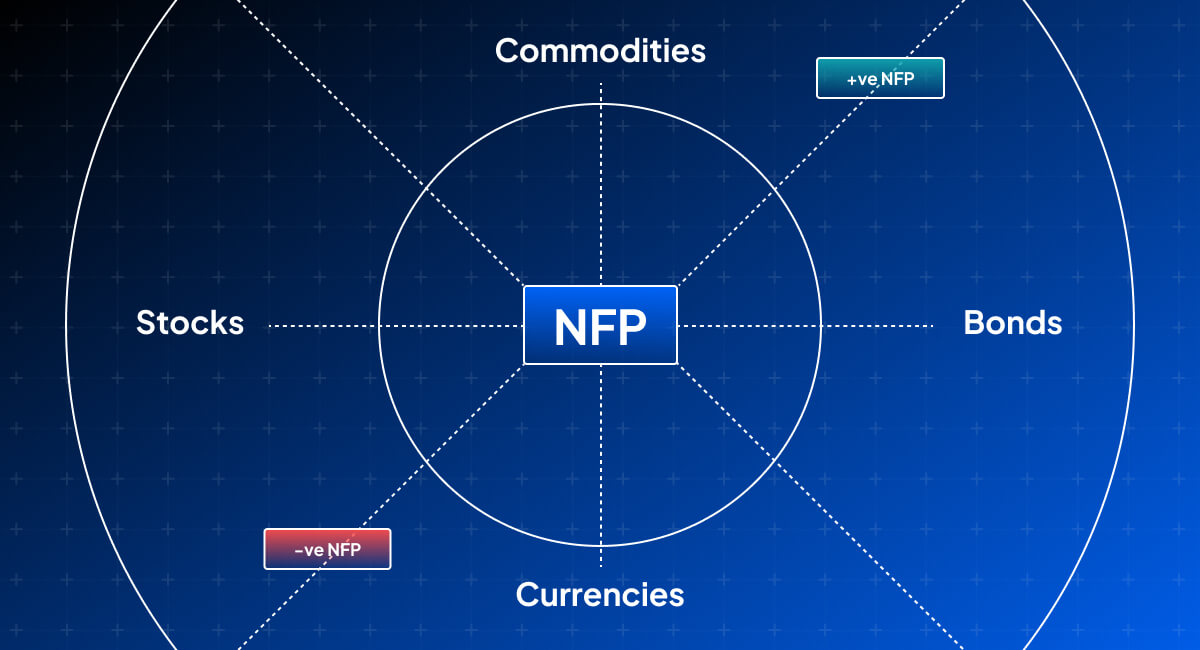

The forex market is often most reactive to macroeconomic releases, and the NFP tops the list. Why? Because the US dollar is the world's primary reserve currency, and employment strength directly affects the Federal Reserve's monetary policy.

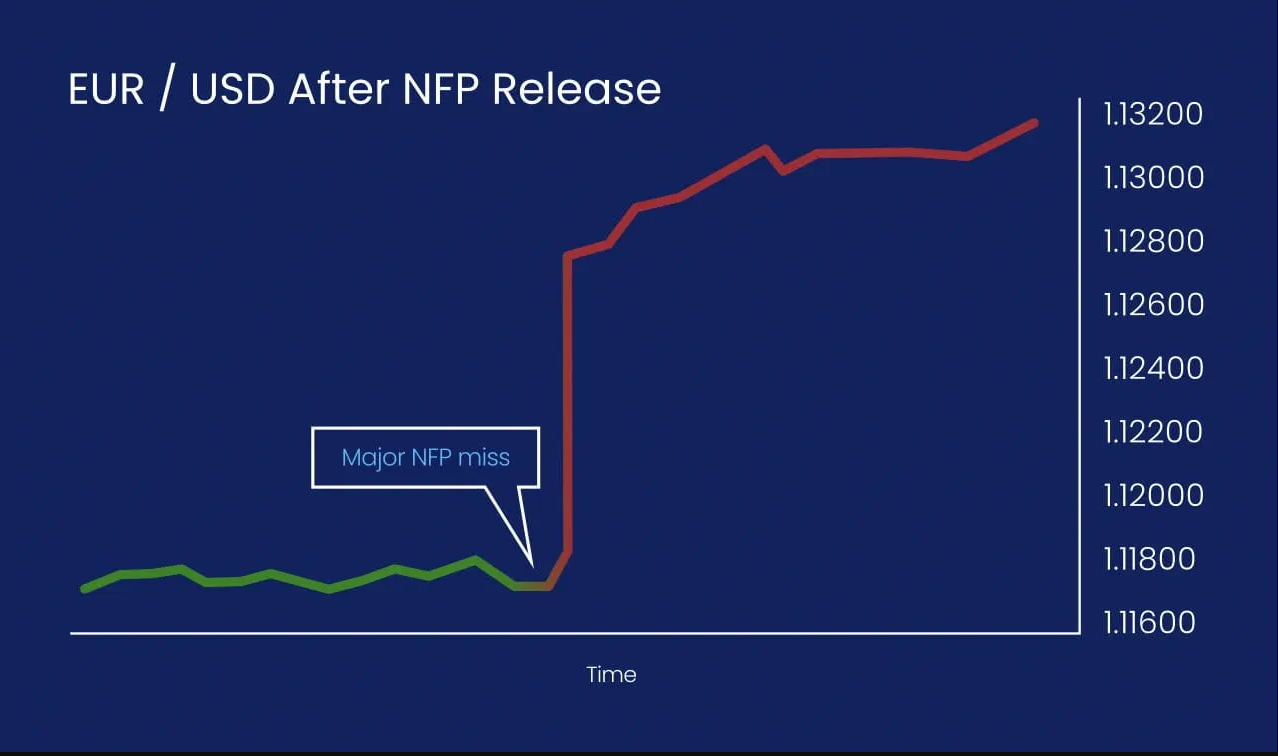

A strong NFP report may signal robust economic activity, increasing the chances of interest rate hikes, which usually strengthens the dollar. On the other hand, a disappointing NFP number can lead to USD weakness as traders speculate on possible rate cuts or economic softening.

If you are a forex trader and are not familiar with the NFP, you could be blindsided by a market that moves hundreds of pips within minutes. This is why many professional traders either close positions or set tight stop losses ahead of the NFP release.

3. When and Where the NFP Gets Released

The NFP is usually released on the first Friday of each month at 8:30 a.m. Eastern Time. The report is published by the US Bureau of Labor Statistics on their official website and is also widely disseminated across financial news outlets and trading platforms.

Most economic calendars will mark this release in advance, allowing traders to prepare accordingly. The data includes not just job numbers but also unemployment rates and average hourly earnings, which add depth to the NFP analysis. Still, it is the Non-Farm Payroll number that captures the most immediate market attention. Anyone involved in financial trading needs to know the NFP and when it is scheduled, as it can create both opportunities and risks within seconds of its release.

4. Analysing the Figures Behind the NFP

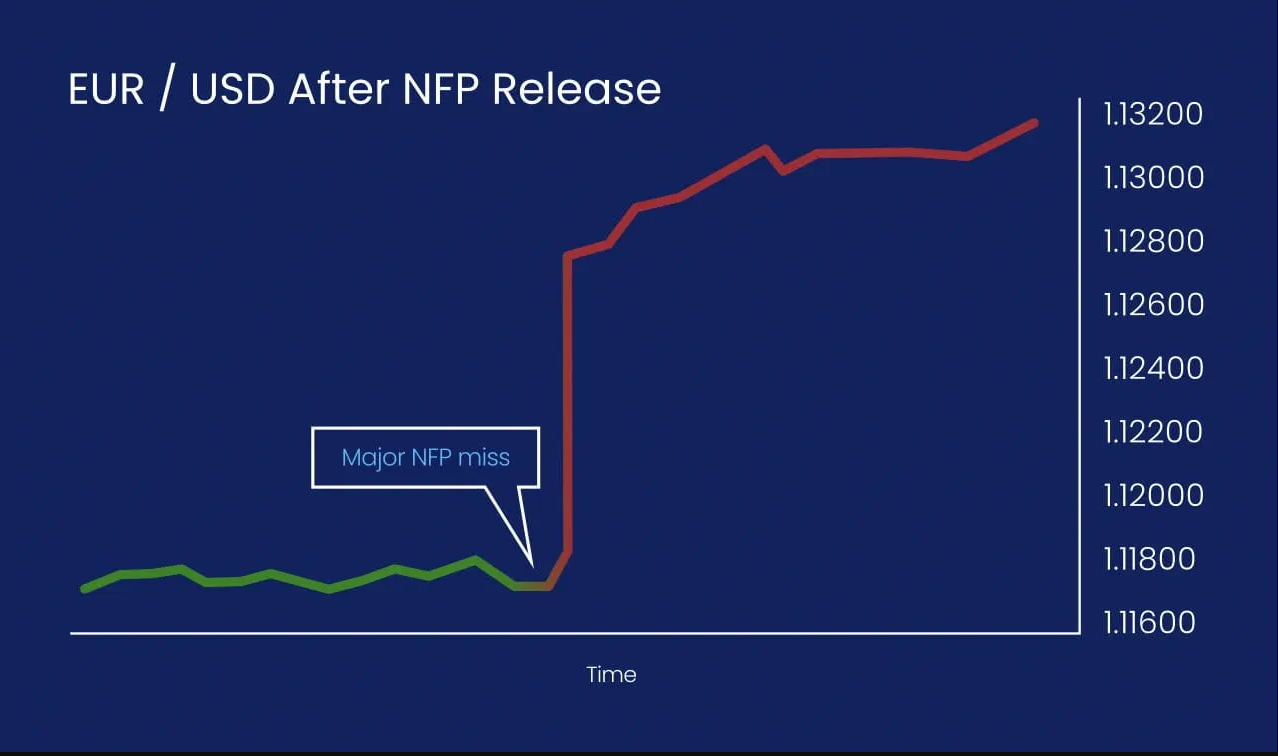

Once you understand the NFP full form, the next step is interpreting the numbers effectively. The report will state the change in total non-farm employment for the previous month. For example, a print of +200,000 means 200,000 jobs were added, which is typically considered positive for the economy.

However, market interpretation isn't always straightforward. A number that is better or worse than expectations often has a stronger impact than the absolute figure. If the consensus forecast was 150,000 and the NFP shows 100,000, markets may react negatively, despite the fact that it is still job growth. This is where context and understanding the NFP within broader market sentiment is critical.

Revisions also play a role. The previous month's data can be revised up or down, which might influence how traders view the current report. A seasoned trader doesn't just focus on the headline number but evaluates all components of the report.

5. How Beginners Can Trade Around the NFP

New traders often underestimate the volatility surrounding the NFP release. The price action can be erratic and liquidity can vanish in seconds. For this reason, trading around the NFP should be approached with caution.

Here are some tips for beginners:

Avoid opening new positions right before the release. The market could spike in either direction.

If you want to trade the NFP, do so with small position sizes.

Use pending orders to catch breakouts, but always protect them with stop-losses.

Wait for the initial volatility to settle before entering a position, as a clearer trend often follows the first 15 minutes.

Most importantly, understand that the NFP is not just a headline — it's a reflection of broader economic forces that move the world's largest economy and its currency. Patience, preparation, and risk control are essential when engaging with NFP-related strategies.

Final Thoughts

Understanding the NFP full form is a fundamental skill for anyone serious about trading forex. It may seem like a small piece of jargon at first, but its implications reach into some of the most critical aspects of global finance. From guiding central bank policy to shaking up the forex markets within seconds, the Non-Farm Payrolls report holds more weight than its simple name suggests.

As a trader, whether beginner or experienced, being aware of the NFP and how it fits into your broader strategy could be the difference between smart positioning and unnecessary losses. Use economic calendars, keep an eye on expectations, and always trade with a clear risk management plan in mind when the NFP date rolls around.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.