Choppy Market Definition And Trading Fit

A choppy market is a non‑trending, range‑bound phase where price oscillates between support and resistance, often snapping back after brief pushes beyond those levels.

Such phases produce frequent false breakouts and whipsaws, making trend‑following tactics less effective unless adapted to sideways conditions.

It is worth trading when approached as range or mean‑reversion with defined levels, modest size, and clear invalidation; otherwise, waiting for momentum can preserve capital and focus.

Why Choppy Markets Matter

Chop is common between trends and can quietly erode performance through repeated small losses, slippage, and commissions, especially if breakouts are chased without confirmation.

Handled well, chop can reward patient traders who buy near support and sell near resistance, using tools aligned to sideways regimes rather than pure trend filters.

In range conditions, volatility bands and oscillators can help frame entries and exits, but stops must sit outside obvious levels to avoid noise‑driven exits.

As conditions shift, traders can demand stronger confirmation to treat a move as a genuine range break, or revert to neutrality until evidence builds.

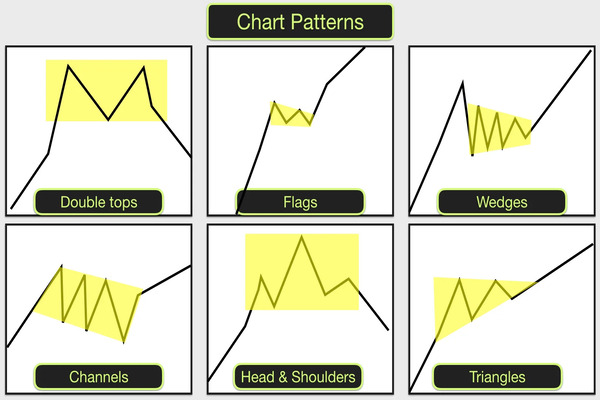

How To Identify A Choppy Market

-

Price repeatedly fails to hold breaks beyond a well‑observed trading range, snapping back into prior bounds within a few bars or sessions.

-

Frequent whipsaws at or just beyond range edges indicate a lack of directional conviction and poor follow‑through.

-

Volatility bands, for example Bollinger Bands, tend to contain price, with moves toward outer bands reverting rather than extending.

Moving averages appear flat and clustered, reflecting the absence of sustained directional bias across recent bars.

Choppy Market Range Setup And $ Example

-

Map the range clearly. Plan to buy near support and sell near resistance, with stops placed beyond the banded structure to avoid trivial noise hits.

-

Prefer liquid instruments and avoid chasing initial breaks. Require confirmation, such as closes outside the range with volume, to treat a breakout as valid.

Keep size modest and targets realistic. Range trades typically aim for smaller, repeatable pay‑offs within the band.

Practical example: With a $10,000 account, a stock ranges between $48 and $52. A plan buys $48.30 with a stop at $47.80, risking $0.50 per share, and targets $51.70. This aligns entries and exits to the range rather than chasing breaks.

This approach seeks positive expectancy by buying near support and selling near resistance while placing the stop beyond the range to reduce random taps.

Choppy Market Costs, Slippage, And Discipline

-

Failed breakouts and frequent reversals increase slippage and fees. High‑friction execution can turn small edges negative in chop.

-

Spreads can widen during indecisive phases or around micro‑events. Prioritise liquid names and time entries when depth is better.

Discipline matters. Only take trades at or near levels with clear invalidation. Standing aside during messy patches protects capital and confidence.

Choppy Market Mistakes And Fixes

| Mistake |

Impact in Chop |

Fix |

Implementation Tip |

| Chasing initial breakouts in chop |

Higher failure rates and whipsaws when breakouts lack follow-through |

Require confirmation, such as closes outside the range and supportive volume, before acting |

Use a two-bar close rule or a minimum volume expansion threshold to validate breaks |

| Stops just beyond obvious levels |

Noise clips positions before the range reasserts, lowering expectancy |

Place stops beyond the banded structure and reduce position size to keep risk constant |

Anchor stops outside volatility bands or beyond recent swing extremes; size to the wider stop |

| Using trend-only indicators in chop |

Multiple false signals and overtrading in non-trending regimes |

Favour oscillators or volatility bands and mean-reversion setups aligned to ranges |

Combine RSI or Bollinger cues with level-based entries; avoid pure moving average cross systems in sideways markets |

| Over-trading mid-range noise |

Low reward-to-risk and excess fees from entries far from edges |

Only act near support or resistance with predefined invalidation; skip the middle |

Add a no-trade zone in the middle 40 to 60 percent of the range to enforce selection |

Related Terms (Choppy Market)

-

Sideways Market: A period with no clear uptrend or downtrend, often overlapping with choppy conditions in practice.

-

Trading Range: The bounded area between recurring support and resistance used for buy‑low, sell‑high tactics in chop.

-

Whipsaw: A sharp reversal that quickly invalidates a fresh position, common when markets lack directional commitment.

Bollinger Bands: Volatility bands that help locate potential overbought or oversold zones and frame mean‑reversion trades in ranges.

Pro Takeaway For Choppy Markets

Professionals codify a chop mode. Trade the range by default, demand confirmation for breakouts, for example repeated closes and volume expansion, and rotate back to trend playbooks only after robust evidence of directional change.

They right‑size positions, prefer high‑liquidity instruments, and measure slippage. If friction rises or evidence weakens, they step aside and preserve dry powder for cleaner conditions.

Conclusion

A choppy market is worth trading when the strategy fits the regime. Use range rules at the edges, clear invalidation, and patience. Otherwise, waiting for trend is often the better trade.

Treat chop as its own environment. Define the range, confirm breaks, embrace mean reversion where appropriate, and do not hesitate to stand aside when conditions are messy.